Ventilation Fan Market Size

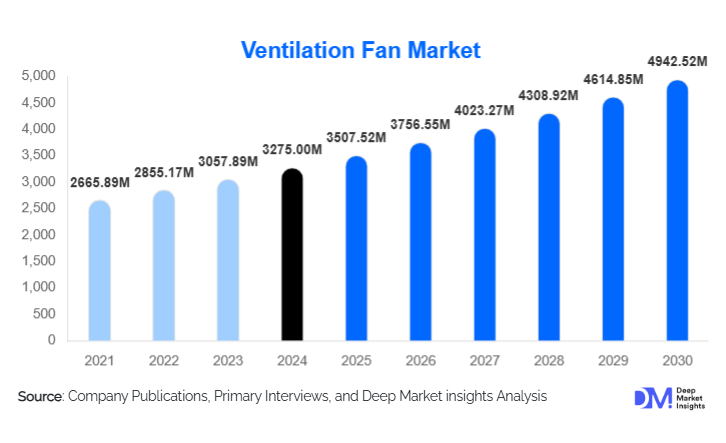

According to Deep Market Insights, the global ventilation fan market size was valued at USD 3275 million in 2024 and is projected to grow from USD 3507.52 million in 2025 to reach USD 4942.52 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is primarily driven by tightening indoor air quality regulations, rapid urban construction and retrofits, expansion of industrial and cleanroom ventilation needs, and accelerating adoption of energy-efficient and smart ventilation systems across residential, commercial, and industrial environments.

Key Market Insights

- Stringent indoor air quality (IAQ) and occupational safety regulations are driving market growth, compelling buildings and factories to upgrade to compliant mechanical ventilation systems.

- Axial and centrifugal fans dominate the market, collectively accounting for over half of the global revenue share due to their wide applicability and performance efficiency.

- Asia Pacific leads the global market with approximately 38–40% share in 2024, fueled by urbanization, industrial growth, and infrastructure expansion.

- Industrial and commercial end users contribute the highest revenue share, driven by cleanroom standards, hygiene compliance, and ventilation safety regulations.

- Energy-efficient and green-building-compliant fans are gaining strong traction, aligned with global sustainability and energy-saving initiatives.

- Offline channels account for around 65% of global sales, although digital and e-commerce platforms continue to grow rapidly.

What are the latest trends in the ventilation fan market?

Smart and IoT-Integrated Ventilation Systems

Integration of ventilation fans with smart building ecosystems is a major trend. Manufacturers are launching fans embedded with sensors, variable speed drives, and connectivity options that allow control via mobile apps or building management systems. These smart fans can automatically modulate airflow based on humidity, indoor pollutant levels, and occupancy, optimizing both energy consumption and air quality. Additionally, predictive maintenance and remote monitoring via cloud platforms are becoming standard features, particularly in commercial and industrial ventilation deployments.

Energy-Efficient, Low-Noise, and Green-Building-Compliant Fans

The global shift toward net-zero energy buildings is propelling demand for high-efficiency, low-noise ventilation solutions. Modern fan designs incorporate EC motors, advanced aerodynamic blades, and optimized housing to reduce energy use and sound emissions. Compliance with international certifications, including ISO, CE, ENERGY STAR, and national green building codes, is becoming a major purchasing factor. In hospitals, schools, laboratories, and commercial complexes, the focus is on quiet, high-performance exhaust and air supply systems that support both comfort and sustainability goals.

What are the key drivers in the ventilation fan market?

Stricter IAQ and Workplace Safety Regulations

Governments worldwide are tightening indoor air quality (IAQ) and workplace safety regulations. Updated building codes now mandate continuous ventilation in public and commercial buildings, especially after heightened health awareness post-pandemic. Industrial facilities handling chemicals, dust, smoke, and heat require specialized exhaust systems to meet safety standards. These regulations are accelerating the adoption of advanced ventilation fan technologies, including high-pressure industrial fans and explosion-proof exhaust systems.

Urbanization, Construction Growth, and Retrofit Demand

The surge in urban infrastructure development across emerging economies has created a large customer base for ventilation systems. Residential towers, office complexes, healthcare facilities, retail spaces, and transportation hubs all require mechanical ventilation installations. In mature economies like the United States, Japan, Canada, and Europe, significant demand arises from retrofits of aging ventilation equipment, aimed at improving energy efficiency, airflow consistency, and compliance with updated regulations.

Industrial Safety, Cleanrooms, and Process Ventilation

Industrial ventilation is crucial for protecting workers and maintaining process integrity. Manufacturing facilities in automotive, electronics, pharmaceuticals, food processing, and chemical industries require precise ventilation solutions for fume extraction, contamination control, and temperature regulation. Cleanrooms, which are critical in semiconductor and biotech manufacturing, use advanced centrifugal and variable-speed fans to maintain airflow purity and pressure stability. These specialized industrial applications are helping drive premium market segments.

What are the restraints for the global market?

Volatile Raw Material Costs and Pricing Pressure

Ventilation fan manufacturing relies heavily on metals such as aluminum, steel, and copper. Fluctuations in raw material prices increase production costs, often squeezing profit margins. Market competition from low-cost regional manufacturers also pressures premium global brands to reduce pricing, making it difficult to maintain margins while investing in innovation and quality enhancements.

Installation Complexity and Maintenance Requirements

While residential fans are relatively easy to install, larger commercial and industrial systems require specialized planning, ducting, engineering, and maintenance. These systems also need periodic servicing of components such as motors, belts, filters, and housings. These requirements can deter adoption, particularly in small businesses, warehouses, and developing markets.

What are the key opportunities in the ventilation fan industry?

Smart Building Integration and Advanced Controls

Ventilation fans that integrate with smart building platforms and IoT infrastructure present high growth potential. As demand grows for connected HVAC systems capable of real-time airflow control, EC-driven, sensor-based ventilation systems will command premium pricing. These connected solutions offer better monitoring, remote diagnostics, and predictive maintenance features, making them ideal for hospitals, industrial plants, airports, and high-rise offices.

Energy-Efficient Retrofits and Green Renovations

There is significant opportunity in renovation and retrofit markets across North America, Europe, and mature Asian economies. Governments are promoting energy-efficient upgrades through incentives, tax credits, and sustainability mandates. Ventilation fan manufacturers can capitalize on this by offering EC motor-based, high-efficiency, low-noise solutions tailored for commercial and institutional retrofits.

Sector-Specific Industrial Ventilation Solutions

Explosion-proof, corrosion-resistant, and high-temperature-resistant ventilation fans for oil and gas, chemicals, mining, marine, and heavy manufacturing present strong niche opportunities. Cleanroom-compatible and contamination-resistant fans designed for pharmaceuticals, biotech, and semiconductor environments are expected to see higher adoption, driven by global expansion in these sectors.

Product Type Insights

Axial fans dominate the global ventilation fan market with approximately 35% share in 2024, due to their high airflow capabilities, compact structure, and cost-effectiveness. These fans are widely used in bathrooms, kitchens, workshops, and commercial ventilation systems. Centrifugal fans follow closely and are favored in HVAC, industrial, and air purification systems due to superior pressure handling. Mixed-flow, cross-flow, and specialized fans serve niche applications, particularly in laboratories, server rooms, and precision-controlled environments.

Application Insights

Commercial and industrial applications contribute over 50% of total market revenue. Commercial spaces such as hospitals, offices, hospitality venues, and retail spaces increasingly prioritize air quality, driving adoption of energy-efficient and low-noise ventilation systems. Industrial deployments focus on process exhaust, fume extraction, cooling, and contaminant filtering. Residential applications remain important for volume growth, particularly in high-rise housing projects, but contribute comparatively lower revenue per unit.

Distribution Channel Insights

Offline distribution accounts for approximately 65% of market share due to the importance of HVAC dealers, building contractors, and engineering firms in specification and installation. However, digital and e-commerce sales are growing rapidly, especially for residential and light-commercial fans. Manufacturers are enhancing digital catalogs, product selectors, and BIM-ready data to support online purchasing and project planning.

Technology and Installation Insights

Energy-efficient EC motor fans and smart fans with integrated filters and sensors are gaining rapid adoption. Demand-based ventilation and variable-speed control technologies are becoming standard for premium projects. Ceiling and wall-mounted fans dominate residential setups, while ducted, inline, and roof-mounted systems are preferred in industrial and commercial environments, particularly where airflow needs to be centralized or distributed across multiple zones.

| Product Type Insights | Application Insights | Distribution Channel Insights | Technology and Installation Insights |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia Pacific

Asia Pacific holds the largest share at approximately 38–40% in 2024. Rapid industrialization, large-scale urban development, growing healthcare infrastructure, and government investment in smart cities drive significant demand. China remains the largest consumer, followed by India, Indonesia, and Vietnam. Local manufacturing strengths also help reduce costs and increase exports from the region.

North America

North America holds around 25% of the global market, driven by strong demand from residential retrofits, commercial renovations, healthcare, data centers, and smart building installations. The U.S. is a major hub for premium-grade, energy-efficient, and smart-connected ventilation products, with high demand from both residential modernization and industrial ventilation upgrades.

Europe

Europe contributes slightly over 20% of global revenue, led by Germany, the UK, France, Italy, and Nordic nations. Strict EU regulations on energy efficiency, acoustics, and indoor air quality support sustained demand for premium ventilation solutions. Adoption of heat recovery and smart HVAC-ventilation integration is particularly advanced in this region.

Latin America

Latin America is an emerging market, driven by industrial expansion and increasing construction in Brazil, Mexico, and Chile. Demand is rising for mid-range fans for commercial, healthcare, and retail projects, although energy efficiency and technology adoption are comparatively slower than in developed regions.

Middle East and Africa

Middle East and Africa is one of the fastest-growing regions due to mega construction projects in Saudi Arabia, the UAE, Qatar, South Africa, and Kenya. Harsh weather conditions, expanding infrastructure, and the need for mechanical cooling in sealed buildings drive consistent demand for ventilation systems.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The global ventilation fan market share is moderately consolidated. Top five players collectively account for around 35–40% of global market revenue. These leading brands dominate high-performance product segments, large-scale installations, and smart ventilation integrations, while regional players serve price-sensitive and niche applications.

Top Manufacturers in the Ventilation Fan Market

- Greenheck Fan Corporation

- Systemair AB

- Delta Electronics, Inc.

- Panasonic Corporation

- Broan-NuTone

- Zehnder Group

- Soler & Palau Ventilation Group

- Vent-Axia

- Twin City Fan & Blower

- Loren Cook Company

- Maico Elektroapparate-Fabrik

- ebm-papst

- Nederman Holding AB

- Vortice

- Kruger Ventilation Industries

Recent Developments

- March 15, 2024 – Greenheck Group announced a major expansion of its manufacturing campus in Knoxville, Tennessee, aimed at increasing production of ventilation and air movement equipment for North American and export markets. The project includes plant enhancements, new product lines, and automation upgrades.

- February 28, 2024 – Panasonic Eco Systems North America introduced upgraded WhisperGreen Select residential ventilation fan models, focusing on quieter operation, better moisture control, and simplified installation for bathrooms, laundry rooms, and enclosed spaces.

- January 10, 2024 – Systemair AB launched its new sustainability labeling initiative to mark energy-efficient ventilation equipment compliant with green building standards, designed to support architects, engineers, and HVAC planners in selecting eco-certified products.