Upholstered Furniture Market Size

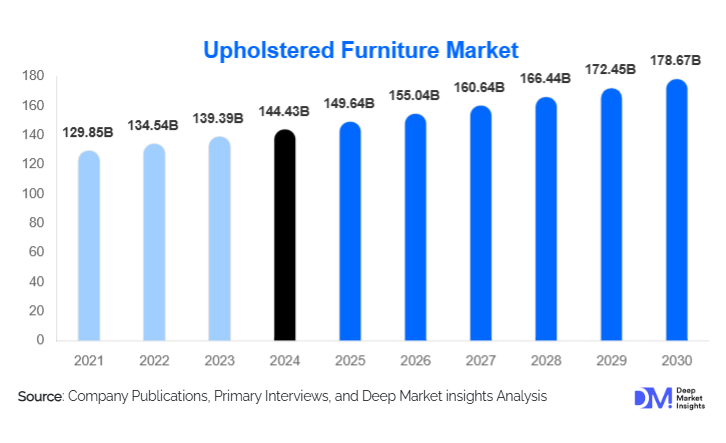

According to Deep Market Insights, the global upholstered furniture market size was valued at USD 144.43 billion in 2024 and is projected to grow from USD 149.64 billion in 2025 to reach USD 178.67 billion by 2030, expanding at a CAGR of 3.61% during the forecast period (2025–2030). The market growth is primarily driven by rising urbanization, increasing disposable incomes, evolving consumer lifestyles, and the growing demand for multifunctional and aesthetically appealing furniture solutions across residential and commercial spaces.

Key Market Insights

- Residential demand dominates the market, fueled by urban housing development, luxury apartments, and increasing consumer preference for ergonomic and multifunctional furniture.

- Commercial segment growth is rising, particularly in hospitality and office spaces, driven by global hotel expansions, co-working spaces, and healthcare infrastructure upgrades.

- Asia-Pacific is emerging as the fastest-growing region, led by China, India, and Southeast Asia, with rising middle-class income and urbanization boosting demand for both mid-range and premium furniture.

- Technological adoption, including smart furniture, IoT-enabled designs, and online retail platforms, is transforming consumer engagement and purchasing behavior globally.

- Sustainable materials and eco-friendly designs are gaining popularity among consumers, creating opportunities for manufacturers to differentiate their offerings.

- North America and Europe remain mature markets, driven by high consumer spending, preference for premium furniture, and strong e-commerce penetration.

What are the latest trends in the upholstered furniture market?

Rise of Multifunctional and Smart Furniture

Furniture manufacturers are increasingly integrating smart features into sofas, recliners, and beds. Adjustable recliners, embedded USB charging ports, and IoT-enabled furniture solutions are appealing to tech-savvy urban consumers. Multifunctional designs such as sofa beds, storage ottomans, and modular sectional sofas are gaining traction, particularly in regions with space constraints, such as APAC. This trend not only enhances convenience but also drives adoption in both residential and commercial segments.

Shift Toward Sustainable and Eco-Friendly Materials

Consumers are prioritizing environmentally responsible furniture, opting for materials such as recycled fabrics, certified wood, low-emission adhesives, and vegan leather alternatives. Sustainable production practices are increasingly being adopted by major players to meet this growing demand. Brands focusing on eco-friendly offerings are able to charge a premium, strengthen brand loyalty, and align with global sustainability goals.

What are the key drivers in the upholstered furniture market?

Urbanization and Rising Disposable Incomes

Rapid urbanization, especially in the Asia-Pacific and Latin America, has led to an increased demand for modern, stylish, and space-efficient furniture. Higher disposable incomes allow consumers to invest in mid-range and premium upholstered furniture, boosting overall market revenue. Residential developments, including apartments, condominiums, and villas, are key drivers for this growth.

E-Commerce Expansion

The rise of online retail platforms has revolutionized the furniture market by offering convenience, customization, and competitive pricing. Consumers increasingly prefer home delivery and flexible returns, enhancing adoption rates. Younger demographics are particularly attracted to digital platforms for purchasing furniture, contributing to faster market penetration.

Growing Preference for Ergonomic and Premium Designs

Awareness about comfort, posture, and aesthetics has driven demand for ergonomic chairs, recliners, and premium sofas. Consumers are increasingly willing to pay a premium for designs that enhance both style and health. This trend is most pronounced in North America and Europe, where ergonomic standards and luxury furniture are widely adopted.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuations in the cost of leather, fabrics, and wood significantly impact manufacturing expenses. Price-sensitive consumers, especially in emerging markets, can limit growth in mid-range and budget segments. Manufacturers must manage supply chains effectively to mitigate the impact of raw material price changes.

Intense Market Competition

The upholstered furniture market is highly competitive with both regional and global players. Smaller manufacturers often face challenges in differentiating their products in terms of quality, design, and brand recognition. Intense competition can limit profitability and increase marketing and innovation costs for market participants.

What are the key opportunities in the upholstered furniture market?

Expansion in Emerging Economies

Emerging markets like India, China, and Southeast Asia offer significant growth potential. Rapid urbanization, growing middle-class income, and the rise of real estate development projects are driving residential and commercial furniture demand. New entrants and existing players can capitalize on local production efficiencies and distribution networks to capture market share.

Integration of Smart and Connected Furniture

The adoption of smart furniture, including adjustable recliners, IoT-enabled desks, and app-controlled storage solutions, presents an opportunity for differentiation. Consumers increasingly seek products that offer convenience, connectivity, and health benefits, creating room for innovative product offerings and higher-margin revenue streams.

Government Initiatives and Infrastructure Spending

Programs like “Make in India” and “Made in China 2025” promote domestic manufacturing and export opportunities. Investments in urban infrastructure, hotels, and co-working spaces increase demand for upholstered furniture. Supportive policies and subsidies provide a favorable environment for both local and international manufacturers to expand operations.

Product Type Insights

Sofas and couches dominate the upholstered furniture market, accounting for approximately 45% share in 2024. This leadership is primarily driven by the growing demand for multifunctional and space-efficient furniture solutions, particularly sectional sofas, recliners, and sofa beds. Urban households, smaller living spaces, and rising work-from-home adoption have accelerated the preference for modular and convertible seating that serves both comfort and utility. Additionally, premiumization trends, such as powered recliners, adjustable headrests, and integrated charging ports, are supporting higher average selling prices within this category.

Fabric upholstery leads the material segment with a commanding 55% market share, supported by its affordability, wide design variety, ease of customization, and improving durability through stain-resistant and performance fabrics. Fabric-based furniture appeals strongly to middle-income households and younger consumers, particularly in Asia-Pacific and Latin America, where cost sensitivity remains high. Leather upholstery continues to grow in premium niches but remains constrained by pricing and maintenance concerns.

Application Insights

Residential applications remain the dominant end-use segment, accounting for approximately 60% of total market revenue in 2024. Demand is driven by rising urban housing developments, apartment living, home renovation activities, and increasing consumer spending on interior aesthetics and comfort. Growth in nuclear families and higher frequency of home upgrades are further strengthening residential demand, especially for sofas, recliners, and upholstered beds.

The commercial segment is expanding steadily, led by hospitality, offices, and healthcare facilities. The hospitality sector, in particular, is growing at a CAGR of 7.2%, supported by new hotel developments, resort expansions, and the refurbishment of existing properties. Hotels and resorts increasingly demand premium, durable, and customized upholstered furniture to enhance guest experience and brand positioning.

Distribution Channel Insights

Online retail continues to gain dominance due to ease of purchase, broader product selection, doorstep delivery, and competitive pricing. E-commerce platforms and direct-to-consumer (D2C) brand websites are enabling customers to personalize furniture dimensions, fabrics, and finishes, significantly improving engagement and purchase confidence. Online penetration is particularly strong among younger demographics and urban consumers in the Asia-Pacific and North America.

Offline channels, including specialty furniture stores, flagship brand outlets, and department stores, remain highly relevant for premium and luxury furniture purchases, where consumers prefer tactile evaluation and design consultation. Omnichannel strategies are becoming increasingly important, with manufacturers integrating physical showrooms with digital tools such as AR visualization and virtual catalogs. Subscription-based furniture services, influencer-driven marketing, and social commerce are emerging as differentiated distribution models, especially in urban and rental-heavy markets.

| By Product Type | By Material Type | By Application | By Distribution Channel | By Price Segment |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 40% of the global upholstered furniture market share in 2024, led by the United States and Canada. Regional growth is driven by high disposable income levels, strong consumer preference for premium and ergonomic furniture, and widespread adoption of e-commerce and omnichannel retail models. Frequent home renovations, replacement demand, and rising investments in hospitality and co-working spaces further support market expansion. Sustainability trends and demand for customized, high-quality furniture are also strengthening premium segment growth in this region.

Europe

Europe accounts for around 25% of the global market, with Germany, France, and the United Kingdom as key demand centers. Growth is fueled by strong design sensibilities, high demand for sustainable and eco-certified furniture, and a well-established premium furniture market. European consumers prioritize durability, craftsmanship, and environmentally responsible materials, supporting demand for high-end and multifunctional upholstered furniture. Renovation of aging housing stock and steady hospitality investments further contribute to regional growth.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by China, India, Southeast Asia, and parts of East Asia. Rapid urbanization, expanding middle-class population, rising disposable incomes, and large-scale residential and commercial construction projects are the primary growth drivers. China alone contributes approximately 20% of the regional market, supported by strong domestic manufacturing capacity and export-oriented production. India and Southeast Asia are witnessing surging demand for mid-range and affordable upholstered furniture, driven by urban housing growth and digital retail adoption.

Middle East & Africa

The Middle East & Africa market is driven by luxury real estate developments, hospitality megaprojects, and rising urban populations. Countries such as the UAE and Saudi Arabia are witnessing strong demand due to large-scale hotel, resort, and residential developments linked to tourism and economic diversification initiatives. South Africa leads demand in Sub-Saharan Africa, supported by urbanization and a growing middle-income population. Intra-regional trade and demand for premium imported furniture continue to rise across the region.

Latin America

Latin America, led by Brazil, Mexico, and Argentina, is experiencing moderate but stable growth. Urban expansion, rising disposable incomes, and increasing preference for modern home interiors are driving demand for mid-range and premium upholstered furniture. Growth is supported by residential construction and a gradual recovery in commercial real estate investments. While price sensitivity remains a challenge, improving digital retail penetration and expanding middle-class consumption are expected to support long-term market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Upholstered Furniture Market

- IKEA

- Ashley Furniture Industries

- La-Z-Boy Inc.

- Natuzzi S.p.A.

- Steelcase Inc.

- Hooker Furniture Corporation

- Restoration Hardware

- Flexsteel Industries

- HNI Corporation

- RH Furniture

- Ashley Manor

- Ethan Allen Interiors

- Boconcept

- KUKA Home

- Duresta