Ultra Portable Internet Devices Market Size

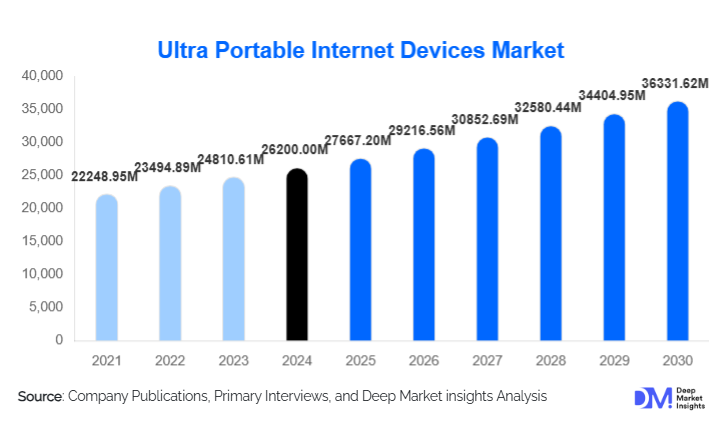

According to Deep Market Insights, the global ultra-portable internet devices market size was valued at USD 26,200.00 million in 2024 and is projected to grow from USD 27,667.20 million in 2025 to reach USD 36,331.62 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). The market growth is driven by the rising adoption of remote and hybrid work models, increasing demand for lightweight and always-connected computing devices, and rapid advancements in battery efficiency, low-power processors, and 5G connectivity.

Key Market Insights

- Ultra-portable internet devices are increasingly replacing traditional laptops for mobile professionals, students, and field workers due to enhanced portability and cloud-based workflows.

- Mid-range devices (USD 300–700) dominate global demand, offering a balance between performance, mobility, and affordability.

- Asia-Pacific leads the global market, supported by large-scale digitalization initiatives, education device programs, and local manufacturing ecosystems.

- 5G-enabled UPIDs represent the fastest-growing connectivity segment, driven by enterprise mobility and real-time data access requirements.

- Education and enterprise end users are the fastest-expanding segments, benefiting from digital classrooms and mobile workforce digitization.

- Online direct-to-consumer channels account for the largest share, reflecting the shift toward e-commerce and OEM-led digital sales models.

What are the latest trends in the Ultra Portable Internet Devices market?

Integration of 5G and Always-On Connectivity

The adoption of 5G-enabled ultra-portable internet devices is accelerating, enabling seamless cloud access, real-time collaboration, and low-latency applications. Enterprises are increasingly deploying these devices for logistics, healthcare, utilities, and remote operations where uninterrupted connectivity is critical. This trend is reshaping device design priorities, with manufacturers focusing on integrated modems, antenna optimization, and power-efficient connectivity solutions.

Shift Toward ARM-Based and AI-Optimized Devices

Manufacturers are increasingly adopting ARM-based architectures to improve battery life and thermal efficiency. Coupled with on-device AI capabilities, UPIDs are now supporting intelligent power management, voice recognition, predictive maintenance, and enhanced security. This trend is expanding the use of ultra-portable devices beyond basic browsing into productivity and analytics-driven applications.

What are the key drivers in the Ultra Portable Internet Devices market?

Expansion of Remote and Hybrid Work Models

The widespread adoption of remote and hybrid work has created sustained demand for lightweight, mobile computing solutions. Ultra-portable internet devices allow professionals to remain productive across locations, supporting cloud-based collaboration tools, video conferencing, and enterprise applications.

Growth of Digital Education and E-Learning

Governments and educational institutions are deploying ultra-portable devices for digital classrooms, remote learning, and student connectivity programs. Their affordability, portability, and long battery life make them well-suited for large-scale education deployments, particularly in emerging economies.

What are the restraints for the global market?

Price Sensitivity in Developing Regions

While demand is strong, high upfront costs for premium UPIDs limit adoption in price-sensitive markets. Budget constraints in education and public-sector procurement can delay large-scale rollouts, requiring manufacturers to optimize cost structures.

Overlap with Tablets and Lightweight Laptops

The functional convergence of tablets, laptops, and ultra-portable internet devices creates category overlap, which can confuse consumers and slow purchasing decisions. Clear differentiation in performance and use cases remains a challenge.

What are the key opportunities in the Ultra Portable Internet Devices industry?

Enterprise Mobility and Field Workforce Digitalization

Industries such as logistics, oil & gas, utilities, and healthcare are increasingly digitizing field operations. Rugged and secure ultra-portable internet devices tailored for harsh environments present significant growth opportunities for manufacturers.

Government-Led Digital Inclusion Programs

National initiatives focused on broadband access, smart cities, and digital governance are driving bulk procurement of ultra-portable devices. Localized manufacturing aligned with programs such as Make in India and Made in China 2025 further strengthens market potential.

Device Type Insights

Mini laptops and netbooks account for the largest share of the ultra-portable internet devices (UPID) market, representing approximately 28% of global revenue in 2024. Their leadership is driven by a combination of productivity-oriented design, physical keyboards, full desktop operating system compatibility, and familiarity among enterprise and education users. These devices are widely adopted in professional environments that require document processing, multitasking, and secure access to enterprise applications, making them the preferred choice for remote workers and students alike.

Handheld internet tablets represent one of the fastest-growing device categories, particularly within the education, content consumption, and entry-level consumer segments. Growth is supported by touchscreen interfaces, lightweight form factors, app-based ecosystems, and competitive pricing. Tablets are increasingly deployed in large-scale government education programs and digital classrooms, especially in emerging economies.

Operating System Insights

Windows-based ultra-portable internet devices dominate the market with an estimated 41% share in 2024. This leadership is primarily driven by enterprise software compatibility, strong cybersecurity frameworks, and seamless integration with corporate IT ecosystems. Windows-based UPIDs are widely preferred by businesses, government agencies, and educational institutions that rely on productivity suites, legacy software, and centralized device management.

Android-based ultra-portable devices are expanding rapidly in the consumer, education, and entry-level enterprise segments. Their growth is fueled by lower hardware costs, a vast application ecosystem, and ease of customization. Android devices are particularly popular in large-scale digital inclusion programs and emerging markets where affordability and app-based usage dominate purchasing decisions. Linux-based operating systems remain a niche but strategically important segment, primarily adopted in industrial automation, government, defense, and cybersecurity-sensitive applications. Their open-source flexibility, enhanced control, and lower licensing costs make them suitable for customized deployments and specialized operational environments.

Connectivity Insights

Wi-Fi-only ultra-portable internet devices continue to dominate global shipment volumes due to their cost-effectiveness and suitability for indoor, campus-based, and residential use cases. These devices are widely used in educational institutions, homes, and offices where a stable Wi-Fi infrastructure is readily available.

However, devices offering Wi-Fi plus 5G connectivity represent the fastest-growing connectivity segment, accounting for nearly 24% of global market revenue in 2024. Growth is driven by rising demand for always-on connectivity, enterprise mobility, real-time cloud access, and remote field operations. Sectors such as logistics, healthcare, utilities, and smart infrastructure increasingly require devices that function reliably beyond traditional Wi-Fi networks, accelerating 5G UPID adoption.

End-Use Insights

Consumer and personal use remains the largest end-use segment, contributing approximately 38% of global demand. This dominance is supported by growing demand for portable devices for browsing, streaming, casual productivity, and remote communication. Increasing adoption among students, freelancers, and digital nomads continues to sustain volume growth. Education is the fastest-growing end-use segment, driven by government-led digital learning initiatives, device-based curricula, and hybrid education models. Ultra-portable devices are increasingly deployed for online learning, assessments, and collaborative classroom environments, particularly in Asia-Pacific, Latin America, and parts of Africa.

Enterprise and industrial end users are steadily increasing the adoption of ultra-portable devices for field service management, asset tracking, real-time reporting, and secure communications. Demand for rugged and secure UPIDs is particularly strong in defense, manufacturing, energy, and transportation sectors.

Distribution Channel Insights

Online direct-to-consumer (D2C) channels account for approximately 46% of global sales, making them the dominant distribution channel in the UPID market. Growth is driven by OEM-operated e-commerce platforms, transparent pricing, wider product selection, and the increasing preference for online purchasing among both consumers and small businesses.

Enterprise and government procurement channels play a critical role in the market, particularly for large-volume contracts in education, defense, and public-sector digitalization projects. These channels often involve customized device specifications, long-term service agreements, and security compliance requirements. Offline retail channels remain relevant in emerging markets, where physical product demonstrations, financing options, and localized sales support influence purchasing decisions.

| By Device Type | By Operating System | By Connectivity | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global ultra-portable internet devices market with an estimated 36% share in 2024. Regional growth is driven by large-scale digital education programs, rapid enterprise digitization, expanding manufacturing ecosystems, and rising internet penetration. China remains the largest market due to domestic production capabilities and enterprise demand, while India is the fastest-growing country, supported by government-led digital inclusion initiatives, affordable device manufacturing, and increasing adoption in education and small businesses. Japan and South Korea contribute through demand for premium and enterprise-grade devices.

North America

North America accounts for approximately 29% of global revenue, led by the United States. Growth in this region is driven by high enterprise IT spending, widespread remote and hybrid work adoption, defense modernization programs, and early uptake of 5G-enabled devices. Strong purchasing power and demand for premium, high-performance UPIDs continue to support market maturity and innovation-led upgrades.

Europe

Europe represents around 21% of the global market, with Germany, the U.K., and France as key contributors. Regional growth is supported by enterprise mobility programs, sustainability-focused procurement policies, and increasing investments in digital public services. European organizations emphasize energy-efficient devices, long product lifecycles, and secure data management, driving demand for premium and enterprise-grade UPIDs.

Latin America

Latin America holds nearly 8% of the global market share, with Brazil and Mexico leading regional demand. Growth is driven by education digitization initiatives, expanding broadband infrastructure, and increasing adoption of mobile computing in small and medium-sized enterprises. While price sensitivity remains a challenge, improving connectivity and government-supported digital programs are gradually expanding market penetration.

Middle East & Africa

The Middle East & Africa region accounts for approximately 6% of global demand. Growth is supported by smart city projects, government digitization strategies, defense investments, and enterprise mobility initiatives, particularly in the UAE and Saudi Arabia. In Africa, rising adoption in education, healthcare, and public services, combined with improving internet access, is gradually strengthening demand for affordable and rugged ultra-portable internet devices.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ultra-Portable Internet Devices Market

- Apple Inc.

- Samsung Electronics

- Lenovo Group

- Microsoft Corporation

- HP Inc.

- Dell Technologies

- ASUS

- Acer Inc.

- Huawei Technologies

- Panasonic Corporation

- Getac Holdings

- Zebra Technologies

- Fujitsu Limited

- Sony Corporation

- LG Electronics