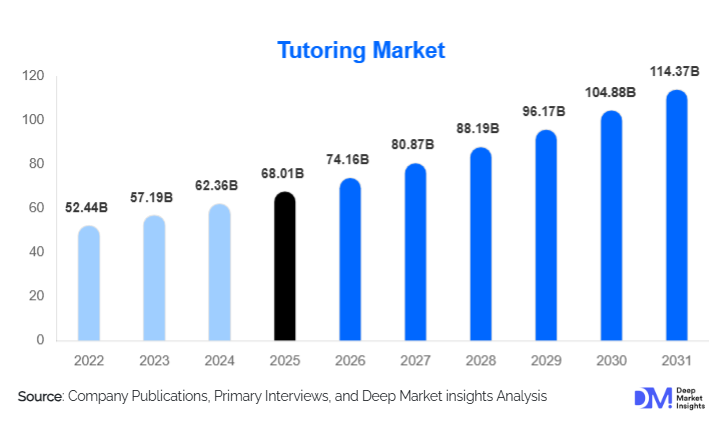

Tutoring Market Size

According to Deep Market Insights, the global tutoring market size was valued at USD 68.01 billion in 2025 and is projected to grow from USD 74.16 billion in 2026 to reach USD 114.37 billion by 2031, expanding at a CAGR of 9.05% during the forecast period (2026–2031). The tutoring market growth is driven by rising academic competition, increasing adoption of online and AI-enabled learning platforms, growing demand for test preparation, and the rapid expansion of lifelong learning and workforce upskilling initiatives across both developed and emerging economies.

Key Market Insights

- Online tutoring is rapidly transforming the education ecosystem, driven by scalability, cost efficiency, and global access to qualified educators.

- STEM-focused tutoring dominates demand, supported by a strong emphasis on mathematics, science, and coding skills across K–12 and higher education.

- Asia-Pacific leads the global market, fueled by exam-oriented education systems in China and India.

- North America remains a high-value market, driven by test preparation, homeschooling support, and adult upskilling.

- Subscription-based tutoring models are gaining traction, offering predictable revenues and higher learner retention.

- AI, adaptive learning, and data analytics are reshaping personalized tutoring and improving learning outcomes.

What are the latest trends in the tutoring market?

AI-Enabled Personalized Learning

Artificial intelligence is becoming a core component of modern tutoring platforms. AI-powered diagnostics, adaptive assessments, and personalized learning pathways are enabling platforms to tailor instruction based on individual learner performance, pace, and knowledge gaps. This trend is particularly strong in online tutoring and test preparation, where performance tracking and outcome-based learning are critical. AI tutors, automated doubt-solving tools, and predictive analytics are reducing dependency on human tutors while improving scalability and margins for providers.

Rapid Shift Toward Online and Hybrid Tutoring

The tutoring market is witnessing a sustained shift from traditional offline models toward online and hybrid formats. Live one-on-one sessions, small group classes, and recorded modules are increasingly delivered through digital platforms. Hybrid tutoring models, combining online instruction with periodic in-person support, are gaining popularity in urban and semi-urban regions. This trend is expanding access to high-quality tutoring in underserved geographies and lowering overall costs for learners.

What are the key drivers in the tutoring market?

Rising Academic Competition and Exam Pressure

Increasing competition for school placements, university admissions, and professional certifications is a major driver of tutoring demand globally. In regions such as Asia-Pacific, exam-oriented education systems have made tutoring an essential component of academic success. Test preparation and subject-specific tutoring continue to generate repeat demand across multiple academic years.

Growth of Lifelong Learning and Workforce Upskilling

Rapid technological change and automation are driving demand for continuous skill development. Adult learners and working professionals are increasingly investing in tutoring for coding, data analytics, language proficiency, and professional certifications. Corporate-sponsored tutoring and workforce training programs are emerging as high-growth segments, particularly in developed economies.

What are the restraints for the global market?

Pricing Sensitivity in Emerging Markets

Despite strong demand, affordability remains a challenge in price-sensitive regions such as parts of Asia, Africa, and Latin America. High-quality tutoring services often remain inaccessible to lower-income households, limiting monetization potential and slowing market penetration for premium offerings.

Quality Standardization and Tutor Availability

The rapid expansion of online tutoring has created challenges in maintaining consistent teaching quality. Recruiting, training, and retaining qualified tutors—especially for advanced STEM subjects and languages—remains a key operational constraint for many platforms.

What are the key opportunities in the tutoring industry?

Expansion in Emerging Markets

Emerging economies such as India, Southeast Asia, Africa, and Latin America present significant growth opportunities due to large student populations, rising internet penetration, and increasing household spending on education. Localized content, vernacular language tutoring, and mobile-first platforms are expected to unlock substantial new demand.

Corporate and B2B Tutoring Solutions

The growing focus on employee reskilling is creating opportunities for tutoring providers to expand into the corporate training segment. B2B tutoring offers higher contract values, longer customer lifecycles, and lower churn compared to traditional B2C models, making it an attractive growth avenue.

Delivery Mode Insights

Online tutoring accounts for approximately 46% of the global tutoring market in 2024, making it the leading delivery mode. Its growth is primarily driven by scalability, flexible scheduling, and significantly lower operating costs compared to traditional methods. Platforms leveraging AI, adaptive learning, and interactive digital tools are accelerating the adoption of online tutoring, especially in STEM and language subjects, where outcome tracking is highly valued. Offline tutoring, including home tutoring and learning centers, continues to hold a significant share due to the trust parents and students place in in-person guidance, particularly in exam-centric regions with high-stakes academic pressure. Hybrid models, which combine the convenience of online platforms with periodic in-person engagement, are gaining traction as they cater to both traditional learning expectations and modern digital preferences. The flexibility, reduced geographic barriers, and ability to offer personalized instruction across hybrid and online models are expected to continue fueling growth over the forecast period.

Academic Level Insights

Secondary education tutoring represents the largest academic segment, accounting for nearly 34% of total market revenue in 2024. Its leadership is driven by curriculum complexity, competitive exam pressure, and the need for focused guidance in middle and high school education. Test preparation tutoring closely follows, particularly for college entrance exams, professional certifications, and competitive assessments. Meanwhile, adult and lifelong learning is the fastest-growing segment, supported by demand for professional certifications, upskilling programs, and corporate-sponsored learning initiatives. Growth in this segment is further catalyzed by digital adoption, flexible scheduling, and increasing recognition of the need for continuous skill enhancement in a rapidly evolving job market.

Subject Type Insights

STEM tutoring dominates the global market with an estimated 41% share in 2024, driven by high demand for mathematics, science, and coding education. Parents and institutions increasingly value STEM learning due to its direct correlation with academic success, career prospects, and technological competency. Language tutoring is the second-largest segment, benefiting from globalization, cross-border education, and workforce mobility, with English, Mandarin, and other widely spoken languages being in the highest demand. Commerce, humanities, and skill-based tutoring, including soft skills and vocational training, form a growing niche, particularly within adult learning and corporate upskilling. The shift toward multidisciplinary skill acquisition and the rise of employability-focused learning are further enhancing the growth potential of these segments.

End-Use Insights

Individual learners account for approximately 72% of total tutoring market demand in 2024, primarily driven by parental spending in K–12 education and self-funded adult learners seeking professional development. Educational institutions are increasingly integrating tutoring services to complement classroom instruction, particularly in test preparation and remedial programs, representing a growing B2B segment. Corporate and workforce tutoring is the fastest-growing end-use segment, fueled by organizational upskilling, reskilling programs, and professional development initiatives. Enterprises are increasingly partnering with tutoring providers to implement training programs in digital literacy, coding, and language proficiency, offering longer-term contracts and higher revenue per learner. The convergence of B2C and B2B adoption, combined with digital learning platforms, continues to create opportunities for scalable and profitable market expansion.

| By Delivery Mode | By Academic Level | By Subject Type | By End User | By Pricing Model |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global tutoring market with around 42% share in 2024. China and India are the largest contributors, supported by large student populations, high parental investment in education, and intense competitive exam pressures. Drivers of regional growth include rising internet penetration, widespread smartphone adoption, and the proliferation of online tutoring platforms that provide access to quality educators in both urban and rural areas. Japan and South Korea contribute a steady demand for test preparation, STEM, and language tutoring, driven by highly competitive academic systems and government emphasis on digital learning. Regional growth is further supported by public and private investments in edtech infrastructure and the growing middle-class disposable income that enables subscription-based learning models.

North America

North America accounts for approximately 26% of the global market, led by the United States. The growth drivers in this region include high adoption of online tutoring platforms, increasing homeschooling trends, and rising demand for adult learning and professional certifications. Test preparation, particularly for SAT, GRE, and professional licensure exams, continues to drive sustained demand. Corporate tutoring programs and workforce development initiatives are increasingly contributing to revenue growth. The presence of major edtech platforms and technological integration, including AI and data analytics in personalized learning, supports premium services and higher average revenue per user, further bolstering regional growth.

Europe

Europe holds nearly 18% market share, with the U.K., Germany, and France as key contributors. Language tutoring, STEM education, and professional development courses are the primary growth drivers. Demand is bolstered by high-quality education standards, widespread internet penetration, and increasing adoption of online learning platforms in schools and universities. Governments’ focus on lifelong learning policies, as well as corporate upskilling initiatives across finance, technology, and healthcare sectors, further enhances market expansion. Cultural emphasis on multilingual proficiency and employability skills also drives demand for private and corporate tutoring services.

Latin America

Latin America represents about 6% of global demand, led by Brazil and Mexico. Regional growth is primarily fueled by increasing digital adoption, rising awareness of the benefits of supplementary education, and growing investment in edtech platforms. Urbanization, a rising middle class, and government education reforms are key drivers, particularly in providing access to quality tutoring in regions where traditional educational infrastructure may be uneven. Cross-border online tutoring is also expanding, offering international curriculum support and language learning services.

Middle East & Africa

The Middle East & Africa accounts for roughly 8% of the global market, with the UAE, Saudi Arabia, and South Africa leading demand. Drivers include government education reforms, digital learning initiatives, and rapidly growing youth populations. Rising investment in edtech infrastructure, coupled with increasing demand for private tutoring to supplement national curricula, is fueling growth. In addition, multinational corporations operating in the region are creating a growing need for workforce tutoring, language training, and professional certification programs. Regional expansion is also supported by cultural emphasis on academic achievement and rising household disposable incomes.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|