Turf Shoes Market Size

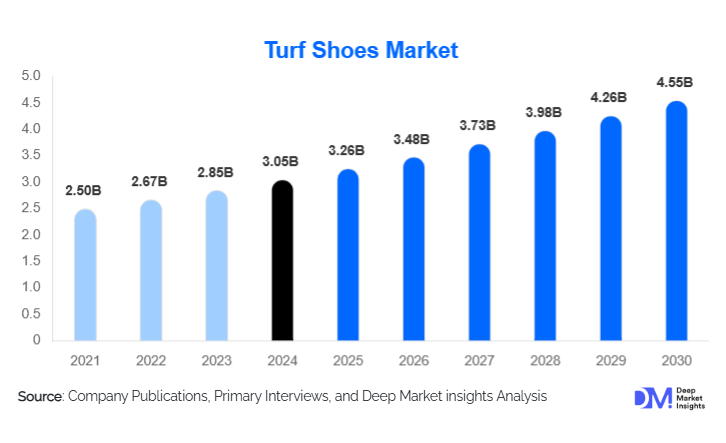

According to Deep Market Insights, the global turf shoes market size was valued at USD 3.05 billion in 2024 and is projected to grow from USD 3.26 billion in 2025 to reach USD 4.55 billion by 2030, expanding at a CAGR of 6.9% during the forecast period (2025–2030). The turf shoes market growth is primarily driven by the rapid expansion of artificial turf sports infrastructure, rising participation in organized sports, and increasing demand for surface-specific athletic footwear that enhances performance and injury prevention.

Key Market Insights

- Football (soccer) remains the dominant application, accounting for nearly half of global turf shoe demand due to the widespread adoption of artificial turf pitches worldwide.

- Mid-range turf shoes (USD 51–100) represent the largest revenue segment, balancing performance features with affordability for amateur and club-level players.

- North America leads global demand, supported by extensive use of turf in baseball, soccer, and multi-sport training facilities.

- Asia-Pacific is the fastest-growing region, driven by school-level sports programs, urbanization, and rising disposable income.

- Sustainability is emerging as a key differentiator, with manufacturers integrating recycled rubber and eco-friendly materials.

- Direct-to-consumer (DTC) channels are gaining traction, improving margins, and strengthening brand-consumer engagement.

What are the latest trends in the turf shoes market?

Expansion of Artificial Turf Infrastructure

The increasing installation of artificial turf across schools, colleges, community sports complexes, and professional training grounds is a defining trend shaping the turf shoes market. Artificial turf enables year-round play, reduces maintenance costs, and supports multi-sport usage, directly increasing demand for specialized turf footwear. Municipal investments and public-private partnerships are accelerating turf adoption, particularly in Asia-Pacific, the Middle East, and Latin America, thereby expanding the addressable consumer base for turf shoes.

Technology-Driven Footwear Innovation

Manufacturers are increasingly focusing on outsole geometry, cushioning systems, and lightweight materials to enhance grip, comfort, and durability on turf surfaces. Advanced rubber compounds, responsive midsoles, and biomechanically optimized designs are becoming standard features, especially in mid-range and premium products. Digital design tools and rapid prototyping are also shortening product development cycles, allowing brands to respond faster to evolving athlete needs.

What are the key drivers in the turf shoes market?

Rising Participation in Organized Sports

Global growth in football, baseball, hockey, and multi-sport training programs is a major driver of turf shoe demand. Youth leagues, amateur clubs, and recreational sports participants collectively represent the largest volume segment, driving frequent replacement cycles and sustained market growth.

Increased Focus on Injury Prevention and Performance

Turf shoes are designed to reduce joint stress and improve traction on artificial surfaces, making them increasingly preferred over traditional cleats. Growing awareness of sports injuries and performance optimization is encouraging athletes to adopt surface-specific footwear, supporting higher average selling prices.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

Despite growing demand, affordability remains a challenge in developing regions. Premium turf shoes are often priced beyond the reach of price-sensitive consumers, limiting penetration outside urban centers and organized sports ecosystems.

Availability of Substitute Footwear

Hybrid and multi-ground shoes can substitute turf shoes in certain applications, creating pricing pressure and limiting differentiation. Brands must clearly communicate performance benefits to sustain demand.

What are the key opportunities in the turf shoes industry?

Growth in Emerging Sports Markets

Asia-Pacific, Africa, and parts of Latin America present significant growth opportunities due to expanding sports participation, government-backed infrastructure investments, and increasing youth engagement. Localized pricing and distribution strategies can unlock substantial volume growth.

Sustainable and Customized Turf Shoes

Customization and sustainability represent high-margin opportunities. Personalized fit, team branding, and eco-friendly materials can differentiate products while aligning with evolving consumer preferences and ESG expectations.

Product Type Insights

Mid-range turf shoes dominate the global market, accounting for approximately 46% of total revenue in 2024, primarily due to their optimal balance between durability, performance, and affordability. This segment benefits from strong adoption among amateur players, club-level athletes, and school sports participants who require reliable turf-specific footwear without the premium price associated with professional-grade products. Manufacturers actively focus on innovation within this category by integrating lightweight cushioning systems, abrasion-resistant rubber outsoles, and improved traction patterns, making mid-range turf shoes the most commercially scalable segment globally.

Premium turf shoes cater to professional and elite athletes, leveraging advanced materials such as engineered mesh uppers, responsive midsoles, and precision outsole geometries designed for maximum grip and energy return. While premium products command higher margins, their volume remains comparatively limited due to price sensitivity. Economy-priced turf shoes serve recreational users and institutional buyers such as schools and academies, particularly in emerging economies, where affordability and durability outweigh advanced performance features. Growth in this segment is driven by rising grassroots sports participation and government-supported school sports programs.

Application Insights

Football (soccer) is the leading application in the turf shoes market, representing approximately 48% of global demand in 2024. This dominance is driven by the widespread installation of artificial turf football pitches, high player participation rates across all age groups, and frequent training schedules that accelerate footwear replacement cycles. Professional leagues, academies, and community-level football programs collectively sustain year-round demand for turf-specific shoes.

Baseball and softball follow as the second-largest application segment, with particularly strong demand in North America, where turf fields are extensively used for training and competitive play. Field hockey and lacrosse contribute to steady demand in Europe and parts of North America, supported by organized school and collegiate sports systems. Cricket-driven demand is expanding across Asia-Pacific and select Middle Eastern markets due to the growing adoption of artificial turf practice pitches. Meanwhile, multi-sport and training turf shoes are gaining popularity globally, fueled by fitness training, agility drills, and cross-functional athletic usage in urban sports facilities.

Distribution Channel Insights

Offline retail channels continue to dominate the turf shoes market, accounting for approximately 58% of global sales in 2024. Specialty sports retailers, brand-exclusive outlets, and multi-brand footwear stores remain critical due to consumers’ preference for physical fit testing, gait assessment, and expert recommendations, particularly for performance-driven footwear. Offline channels are especially important in premium and mid-range segments, where comfort, sizing accuracy, and surface compatibility significantly influence purchase decisions.

However, online distribution channels are expanding rapidly, driven by growing digital adoption, improved last-mile logistics, and aggressive direct-to-consumer (DTC) strategies by leading brands. Brand-owned e-commerce platforms offer wider product assortments, customization options, and competitive pricing, improving margins while strengthening customer engagement. Online marketplaces further enhance product visibility in emerging regions, making digital channels a key growth driver despite offline retail maintaining overall leadership.

End-User Insights

Men constitute the largest end-user segment in the turf shoes market, accounting for approximately 55% of total demand in 2024. This dominance is supported by higher participation rates in organized sports such as football and baseball, stronger representation in amateur and professional leagues, and a greater propensity to purchase mid-range and premium footwear. Frequent training and competition cycles further drive replacement demand within this segment.

Women’s turf shoes represent the fastest-growing end-user segment, supported by increasing female participation in organized sports, rising investment in women’s leagues, and improved product availability tailored specifically to women’s biomechanics. Youth demand is expanding steadily through school sports programs, training academies, and community leagues, where artificial turf is increasingly preferred for safety and durability. Youth-focused turf shoes emphasize affordability, durability, and injury prevention, making this segment strategically important for long-term market expansion.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 32% of the global turf shoes market in 2024, led by the United States. Regional dominance is driven by extensive adoption of artificial turf across baseball, soccer, and multi-sport training facilities, particularly at school, collegiate, and community levels. Strong consumer purchasing power, high awareness of performance footwear, and established sports retail infrastructure support premium and mid-range product demand. Additionally, frequent training schedules and organized leagues contribute to shorter footwear replacement cycles, reinforcing sustained regional growth.

Europe

Europe represents around 24% of global demand, driven primarily by football-centric markets such as Germany, the U.K., France, Spain, and Italy. The region benefits from a deeply embedded football culture, extensive club-level training systems, and growing use of artificial turf to offset climate-related challenges to natural grass. Sustainability regulations and consumer preference for eco-friendly products further influence purchasing decisions, encouraging innovation in recycled materials and low-impact manufacturing processes.

Asia-Pacific

Asia-Pacific holds nearly 28% market share and is the fastest-growing region, expanding at over 8% CAGR. Growth is driven by rapid urbanization, expanding middle-class incomes, and increasing government investment in school and community sports infrastructure. China and India are witnessing rising adoption of artificial turf due to space constraints in urban areas, while Japan and South Korea support demand through structured sports education systems. The region’s large youth population and growing sports participation make it a critical long-term growth engine.

Latin America

Latin America contributes approximately 8% of global demand, led by Brazil and Mexico. Football-driven sports culture, combined with growing investments in artificial turf facilities for training and community use, supports gradual market expansion. Economic recovery trends and rising interest in organized youth sports programs are expected to improve affordability and adoption rates over the forecast period.

Middle East & Africa

The Middle East & Africa region accounts for roughly 8% of the turf shoes market, supported by large-scale sports infrastructure investments, football academies, and favorable climatic conditions that accelerate the adoption of artificial turf over natural grass. Countries such as Saudi Arabia, the UAE, and South Africa are key contributors, driven by government-backed sports development initiatives and international sporting events that stimulate demand for high-performance turf footwear.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|