Turbo Trainers Market Size

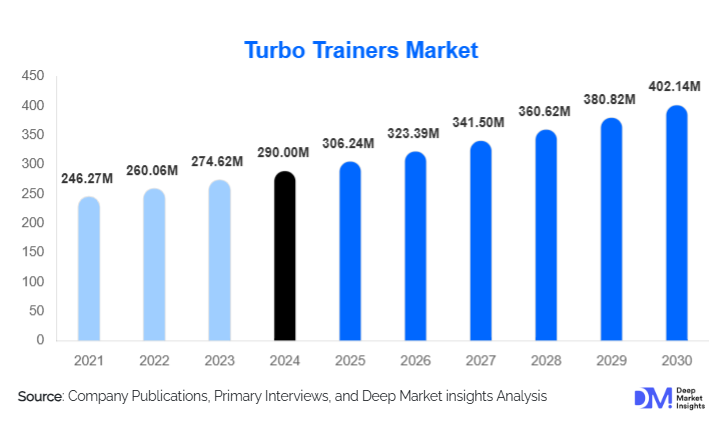

According to Deep Market Insights, the global turbo trainers market size was valued at USD 290.00 million in 2024 and is projected to grow from USD 306.24 million in 2025 to reach USD 402.14 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). The turbo trainers market is witnessing strong momentum driven by the rapid adoption of home fitness solutions, technological advancements in smart indoor cycling systems, and rising participation in cycling, triathlons, and digital fitness platforms worldwide.

Key Market Insights

- Smart trainers dominate global demand, supported by connected fitness ecosystems and the growing popularity of virtual cycling platforms such as Zwift, Rouvy, and TrainerRoad.

- Direct-drive turbo trainers are rapidly gaining share due to superior ride realism, lower noise, and precision power measurement preferred by professional and enthusiast cyclists.

- Online retail channels lead the market, accounting for over half of global sales as consumers increasingly purchase fitness equipment through e-commerce.

- Home/residential usage remains the largest application segment, propelled by hybrid work models and the growth of home-gym installations.

- Asia-Pacific is the fastest-growing regional market, fueled by rising disposable incomes, urbanization, and expanding cycling culture in China, India, and Southeast Asia.

- Technological innovation in smart connectivity, IoT integration, and interactive training content is reshaping product differentiation across brands.

What are the latest trends in the turbo trainers market?

Expansion of Smart & Connected Indoor Cycling Ecosystems

The turbo trainers market is experiencing a major shift toward fully connected fitness environments. Smart trainers equipped with Bluetooth, ANT+, and Wi-Fi integrations now support real-time resistance control, virtual ride simulations, and advanced performance analytics. Platforms such as Zwift and Wahoo RGT have transformed indoor cycling into a social, competitive, and gamified experience, intensifying user engagement. This synergy between hardware and software is driving recurring subscription-based revenue streams and elevating the value proposition for premium direct-drive trainers. Manufacturers are emphasizing firmware updates, app integrations, and ecosystem partnerships to enhance longevity and user satisfaction.

Technological Advancements in Noise Reduction & Ride Feel

New-generation turbo trainers prioritize enhanced road-feel algorithms, precision power measurement, and ultra-quiet operation—major factors influencing consumer purchase decisions. Innovations include adaptive resistance, electromagnetic flywheel simulation, gradient replication up to 20%, and micro-calibration for power accuracy within +/-2%. These upgrades especially appeal to serious cyclists and triathletes who require highly realistic indoor training experiences. Compact foldable designs and improved portability are also emerging trends, widening market access among urban consumers with limited living space.

What are the key drivers in the turbo trainers market?

Surge in Home-Fitness Adoption

Growing awareness of health, wellness, and at-home fitness convenience continues to fuel demand for turbo trainers. Post-pandemic lifestyle shifts and flexible work arrangements have firmly embedded home-gym culture across major regions. Consumers increasingly prefer cardio solutions that offer efficient workouts within small spaces—driving sustained demand for indoor cycling. Turbo trainers, especially smart variants, allow structured training plans, virtual riding, and year-round exercise independent of weather or road safety conditions.

Technological Innovation & Integration With Virtual Training Platforms

The integration of smart technologies—connectivity sensors, automated resistance, mobile apps, and cloud-based performance dashboards—remains a central market driver. Virtual riding ecosystems allow users to train in immersive digital environments, driving significant uptake among competitive cyclists and recreational users alike. Enhanced analytics, group rides, esports competitions, and structured training programs are converting traditional equipment buyers into long-term digital fitness subscribers.

Rising Cycling Participation and Expanding Amateur Athlete Base

The global cycling community continues to expand, with increasing participation in road cycling, triathlons, and endurance events. Amateur athletes rely heavily on turbo trainers for structured indoor training, especially in regions with cold winters or urban areas with limited outdoor cycling infrastructure. The growing popularity of performance-focused fitness and personalized training plans accelerates the adoption of mid-range and premium smart trainers.

What are the restraints for the global market?

High Cost of Premium Smart Trainers

While demand for advanced direct-drive smart trainers is growing, high purchase costs remain a significant barrier for price-sensitive consumers. Premium models often range between USD 700 and USD 1,500, limiting adoption across developing markets. Budget-conscious buyers may instead opt for classic magnetic or roller trainers, slowing revenue expansion in high-margin product categories.

Space & Storage Constraints in Urban Environments

Despite rising home-fitness adoption, limited living space in highly urbanized regions can reduce willingness to invest in larger or heavier turbo trainer setups. Noise concerns, need for mats or riser blocks, and lack of dedicated workout spaces remain obstacles for widespread adoption—particularly in high-density apartment environments.

What are the key opportunities in the turbo trainers industry?

Integration of Advanced Digital Fitness Software Ecosystems

Future product differentiation lies in proprietary digital ecosystems that offer personalized training plans, performance analytics, and real-time virtual coaching. Subscription-driven models allow manufacturers to expand recurring revenue beyond hardware sales. The opportunity also extends to partnerships with existing virtual platforms to enhance user immersion, connectivity, and social engagement within indoor cycling communities.

Expansion into Emerging Markets (Asia-Pacific, LATAM, MEA)

Urban populations in China, India, Brazil, and GCC countries are increasingly adopting home-fitness routines as disposable incomes rise. Affordable smart trainers and localized marketing strategies can unlock substantial new demand pools. Rapid urbanization, limited cycling infrastructure, and growing awareness of lifestyle diseases create ideal conditions for market penetration.

Growth in Commercial Gym, Fitness Studio & Rehabilitation Applications

Commercial adoption of turbo trainers is increasing as gyms introduce connected cycling studios and group training programs. Rehabilitation clinics and corporate wellness centers also recognize the value of low-impact cardiovascular trainers, forming a high-growth B2B opportunity segment. Institutional buyers often purchase in higher volumes, enabling strong revenue visibility for manufacturers.

Product Type Insights

Smart trainers lead the market, accounting for nearly 60% of global revenue in 2024. Their dominance is powered by integration with virtual training platforms, automated resistance, and performance data tracking. Direct-drive smart trainers are especially popular among performance-focused users due to their realistic ride feel and superior accuracy. Mid-range smart trainers continue to gain traction as price-performance balance improves.

Classic magnetic and fluid trainers retain a loyal consumer base among budget-focused and entry-level cyclists. Roller trainers appeal to experienced riders seeking balance and pedaling technique training, though they represent a smaller market share compared to smart trainers.

Application Insights

Home/residential usage represents the largest application segment, capturing nearly 70% of global demand. Growth is driven by rising home-gym installations and the convenience of structured indoor workouts. Professional cyclists and triathletes increasingly rely on turbo trainers for year-round training.

Commercial fitness centers and gyms form a growing application area as connected cycling classes and smart trainer zones gain popularity. Rehabilitation centers and corporate wellness programs are emerging as new high-potential end-use categories, expanding overall market demand.

Distribution Channel Insights

Online retail dominates global sales, contributing over 55% of total market share in 2024. Consumers prefer e-commerce due to wider product availability, competitive pricing, and direct-to-consumer offerings from leading brands. Specialized offline cycling stores remain essential for premium, high-involvement purchases where consumers seek product trials and expert consultation. Gyms and institutional buyers typically acquire products through authorized distributors or direct OEM channels. Social media influencers and virtual cycling communities increasingly influence purchase decisions.

| By Product Type | By Application | By Distribution Channel | By Price Tier |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for 35–40% of global demand in 2024. The U.S. leads adoption with strong cycling participation, a mature home-fitness culture, and widespread acceptance of smart trainers. Canada also shows strong purchasing trends driven by harsh winters, necessitating indoor training options.

Europe

Europe holds a significant share of the turbo trainers market, representing 25–30% of global revenue. Countries such as the U.K., Germany, the Netherlands, Belgium, and Scandinavia exhibit robust demand due to strong cycling culture and seasonal training requirements. European athletes widely use turbo trainers during winter for base-building and power training.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, with demand rising rapidly in China, Japan, South Korea, and India. Urbanization, rising disposable incomes, and emerging interest in endurance sports drive adoption. China leads in volume growth, while India shows rising demand in metro cities as fitness consciousness expands.

Latin America

LATAM demand is gradually increasing, particularly in Brazil, Argentina, and Mexico. A growing fitness community and increasing disposable incomes support market expansion. However, higher import duties and price sensitivity may limit the penetration of premium trainers.

Middle East & Africa

MEA contributes a smaller share but shows accelerating growth, driven by high-income consumers in the UAE, Saudi Arabia, and Qatar. Indoor cycling is gaining popularity in urban centers where climate extremes limit outdoor activity. South Africa shows rising adoption both for fitness and performance cycling.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Turbo Trainers Market

- Wahoo Fitness

- Garmin Ltd. (Tacx)

- Saris (CycleOps)

- Elite SRL

- Kinetic by Kurt

- Minoura Co. Ltd.

- JetBlack Cycling

- Bkool

- Wattbike Ltd.

- Technogym SpA

- 4iiii Innovations

- TrueKinetix

- Life Fitness

- Stages Cycling

- Decathlon (Domyos)

Recent Developments

- In March 2025, Wahoo Fitness released an upgraded direct-drive smart trainer featuring enhanced gradient simulation and automatic calibration to improve real-world training realism.

- In January 2025, Garmin announced new firmware integrations between Tacx trainers and its Edge cycling ecosystem, enabling unified data tracking across indoor and outdoor rides.

- In November 2024, Elite SRL launched a compact foldable trainer aimed at urban users, featuring noise-reduction technology and full app compatibility.