Trigger Sprayer Market Size

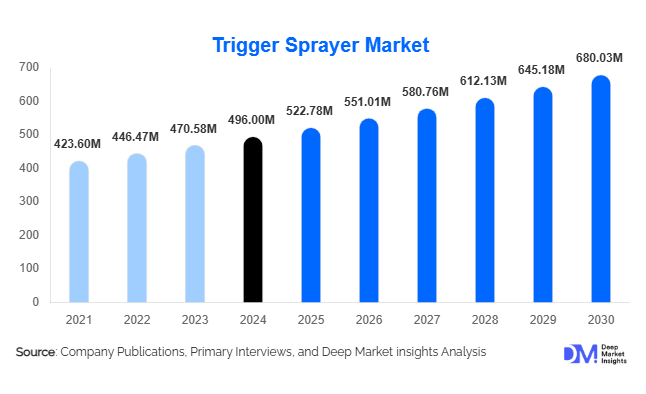

According to Deep Market Insights, the global trigger sprayer market size was valued at USD 496 million in 2024 and is projected to grow from USD 522.78 million in 2025 to reach USD 680.03 million by 2030, expanding at a CAGR of 5.4% during the forecast period (2025–2030). The trigger sprayer market growth is primarily driven by increasing household and personal care product consumption, growing demand for sustainable and eco-friendly packaging, and the expansion of industrial and agricultural applications globally.

Key Market Insights

- Sustainability is reshaping the market, with demand for recyclable, bio-based, and lightweight plastics accelerating adoption across regions.

- Household cleaning and personal care dominate end-use applications, driven by hygiene-conscious consumers and repeat-purchase behavior.

- Asia-Pacific leads in demand and production, with China and India contributing to the largest share of global consumption.

- North America maintains a significant share, driven by hygiene trends, industrial cleaning demand, and premium personal care sprays.

- Emerging e-commerce channels are boosting direct-to-consumer sales, enabling smaller manufacturers and private-label brands to expand globally.

- Technological innovations, including adjustable nozzles, chemical-resistant materials, and ergonomic trigger designs, are enhancing product differentiation.

Latest Market Trends

Sustainability and Eco-friendly Materials

Trigger sprayer manufacturers are increasingly adopting recycled plastics, bio-based polymers, and lightweight designs to reduce environmental impact. Regulatory pressure in Europe and North America and growing consumer preference for sustainable packaging are driving this trend. Brands are marketing refillable or recyclable sprayers to appeal to eco-conscious consumers, while lightweighting reduces shipping costs and carbon footprint, creating both economic and environmental benefits.

Technological Advancements in Nozzle and Trigger Design

Innovations in trigger mechanisms and nozzle technology are creating differentiated products. Adjustable spray patterns, fine-mist and foaming designs, chemical-resistant plastics, and ergonomic triggers enhance usability for various applications, from household cleaners to industrial chemicals. Customized sprayers for personal care and premium cosmetics are emerging, particularly in e-commerce, where leak-proof and durable packaging is highly valued. Automation in production lines is also improving consistency and reducing costs.

Trigger Sprayer Market Drivers

Increasing Household and Personal Care Consumption

Urbanization, busy lifestyles, and rising hygiene awareness are driving household and personal care product sales. Trigger sprayers provide controlled dispensing, convenience, and safety, making them the preferred delivery system. The post-pandemic emphasis on cleanliness has further accelerated adoption in home care and personal care applications.

Expansion into Industrial, Agricultural, and Emerging Applications

Trigger sprayers are increasingly used for industrial cleaning, automotive maintenance, pesticides, fertilizers, and garden care. This diversification expands market potential beyond household and personal care segments. Demand is growing for chemically resistant, durable sprayers and specialized nozzle designs suitable for these applications.

Growth of E-commerce and Emerging Market Penetration

The rise of e-commerce enables direct-to-consumer distribution of trigger sprayers, especially for premium personal care, home care, and specialty sprays. Emerging markets in Asia-Pacific, Latin America, and the Middle East are experiencing rising demand due to urbanization, disposable income growth, and hygiene awareness, creating opportunities for both local and global manufacturers.

Market Restraints

Raw Material Price Volatility

Fluctuations in the price of plastics (PE, PP, PET) affect production costs. Sudden increases can compress margins and lead to higher retail prices, potentially limiting adoption, especially in price-sensitive emerging markets.

Regulatory and Environmental Compliance Costs

Transitioning to bio-based or recycled plastics requires investment in retooling, quality testing, and chemical-resistance verification. Compliance with varying regional regulations (plastic taxes, recycling mandates) can increase costs and slow the adoption of eco-friendly sprayers.

Trigger Sprayer Market Opportunities

Sustainable and Eco-friendly Product Offerings

Rising consumer and regulatory focus on sustainability creates opportunities for recycled, bio-based, and recyclable sprayers. Companies adopting eco-friendly packaging can differentiate themselves, attract major FMCG and personal care clients, and access premium pricing segments.

Customized and Niche Applications

Specialized sprayers for personal care, premium cosmetics, industrial chemicals, agriculture, and gardening provide opportunities for product differentiation. Adjustable nozzles, chemical-resistant plastics, ergonomic triggers, and refillable designs enable companies to serve emerging niches and premium markets.

Expansion via E-commerce and Emerging Markets

Leveraging e-commerce channels allows manufacturers to reach consumers directly, particularly in premium personal care and household cleaning. Emerging markets like India, China, and Southeast Asia offer strong growth potential due to rising disposable incomes, urbanization, and increasing demand for hygiene products.

Product Type Insights

Traditional trigger sprayers remain the dominant product category, accounting for 60–65% of global market value in 2024 (approximately USD 1.3–1.4 billion). Their widespread adoption is driven by their durability, ergonomic use, and adaptability across household cleaning, personal care, automotive, industrial, and agricultural applications. Their low manufacturing cost and compatibility with diverse formulations further reinforce their leadership position.

Fine-mist sprayers, foaming sprayers, and pump sprayers represent smaller yet rapidly growing segments. Growth is propelled by premiumization in personal care (cosmetics, haircare, skincare), rising demand for controlled dosing in industrial chemicals, and the expansion of specialty homecare products such as fabric refreshers and disinfectant sprays. Increasing interest in aesthetic packaging, tactile user experience, and brand differentiation is accelerating adoption in premium categories.

Material Insights

Plastics, primarily PET, PE, and PP, account for 70–80% of total material usage, equivalent to USD 1.5–1.7 billion in 2024. Plastic’s lightweight properties, high chemical resistance, design flexibility, and cost-efficiency make it the preferred manufacturing material for most sprayer types. Growth is amplified by advancements in molding technologies and large-scale production capabilities across Asia.

Demand for bio-based, biodegradable, and recycled plastics is rising significantly, especially in Europe and North America, owing to stringent sustainability regulations, brand commitments to circular economy principles, and consumer preference for eco-friendly packaging. The shift toward PCR (post-consumer recycled) resins is creating opportunities for green product lines within household and personal care segments.

Application Insights

Household and home care cleaning applications lead the market, accounting for 30–35% of total value in 2024 (USD 630–740 million). Growth is driven by rising hygiene awareness, increased adoption of multi-surface and disinfectant sprays, and the expansion of private-label cleaning brands through online channels.

The personal care segment, including hair sprays, body mists, skincare, and fragrances, is expanding due to premiumization, evolving grooming trends, and higher disposable incomes worldwide. Industrial and automotive applications are experiencing strong demand as businesses adopt efficient dispensing systems for chemicals, lubricants, and cleaning agents. Agricultural applications are benefiting from modernization efforts, especially in Asia-Pacific and Africa, where growers are shifting toward handheld crop protection and nutrient application tools.

| By Product Type | By Material | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents 25–30% of the global trigger sprayer market (USD 520–630 million in 2024). Growth is driven by heightened hygiene consciousness, robust demand for industrial and institutional cleaning products, and the popularity of premium personal care sprayers. A highly developed retail ecosystem, spanning supermarkets, specialty stores, and e-commerce, further strengthens product penetration.

Europe

Europe accounts for 20–25% of the global market share (USD 420–530 million in 2024). The region is characterized by stringent sustainability mandates, driving rapid adoption of recyclable, reusable, and bio-based sprayer components. Growth is steady across home care, personal care, and industrial cleaning applications, supported by mature FMCG markets and high consumer environmental awareness.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing market, holding a 35–40% share valued at USD 730–840 million in 2024. Growth is driven by rapid urbanization, rising incomes, and expanding FMCG and e-commerce ecosystems. China is a global manufacturing hub for sprayers, while India and Southeast Asia show strong demand in both consumer and industrial segments. The region also benefits from strong export capabilities.

Latin America

Latin America holds a 5–7% market share (USD 100–150 million in 2024). The region is an emerging growth market fueled by expanding urban populations, rising middle-class spending, and increasing hygiene awareness. Household cleaning and personal care products dominate demand.

Middle East & Africa

The Middle East & Africa region accounts for 3–5% of the global market (USD 65–100 million). Growth is steady, supported by rising disposable incomes, urbanization, and expanding consumer markets. Africa shows strong demand for agricultural and industrial sprayers, while the Middle East favors premium personal care and home care products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Trigger Sprayer Market

- Silgan Holdings

- Berry Global

- Crown Holdings

- RPC Group

- Alpla Werke

- Inteplast Group

- Pactiv Evergreen

- Comar

- Plastipak Packaging

- Amcor

- Pretium Packaging

- Alpha Packaging

- TricorBraun

- GBL Group

- Quadpack

Recent Developments

- In 2025, Berry Global expanded its bio-based trigger sprayer line in Europe, focusing on fully recyclable plastics for household and personal care applications.

- In 2025, Silgan Holdings invested in automated trigger assembly lines in the Asia-Pacific region to meet growing industrial and agricultural demand.

- In 2024, RPC Group launched customizable nozzle designs for personal care and premium cosmetic sprays, enhancing product differentiation in North America and Europe.