Trekking Poles Market Size

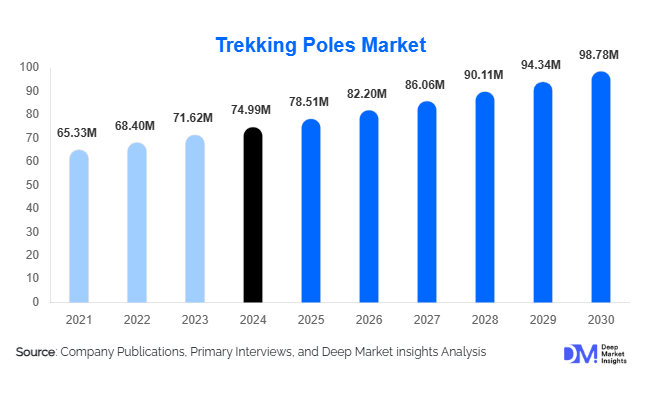

According to Deep Market Insights, the global trekking poles market size was valued at USD 74.99 million in 2024 and is projected to grow from USD 78.51 million in 2025 to reach USD 98.78 million by 2030, expanding at a CAGR of 4.7% during the forecast period (2025–2030). The trekking poles market growth is primarily driven by the rising participation in outdoor recreational activities, increasing health and wellness awareness among aging populations, and continuous innovation in lightweight materials and ergonomic designs.

Key Market Insights

- Recreational hiking and trekking dominate demand, accounting for over half of global trekking pole consumption in 2024.

- Adjustable and foldable trekking poles drive product adoption, thanks to their versatility across terrains and user groups.

- North America is the largest regional market, supported by a strong outdoor culture and high spending on premium gear.

- Asia-Pacific is the fastest-growing region, fueled by rising adventure tourism and expanding middle-class participation in outdoor sports.

- Carbon fiber poles are the fastest-growing segment of the materials market, gaining traction among trail runners and professional mountaineers.

- E-commerce channels are expanding rapidly, reshaping brand reach and direct-to-consumer sales strategies.

What are the latest trends in the trekking poles market?

Lightweight and Foldable Pole Designs

One of the most prominent trends in the trekking poles market is the shift toward lightweight, compact, and foldable designs. Manufacturers are increasingly introducing Z-fold and hybrid telescopic poles that can be easily packed into backpacks, appealing to trail runners, fast-packers, and international travelers. Carbon fiber and composite materials are being widely adopted to reduce weight without compromising strength, enhancing endurance and comfort for long-distance users. This trend is particularly strong in premium product categories, where consumers are willing to pay higher prices for portability and performance.

Sustainability and Eco-Friendly Materials

Sustainability is becoming an important differentiator in trekking pole manufacturing. Brands are incorporating recycled aluminum, bio-based grip materials, and low-impact production processes to align with environmentally conscious consumer preferences. Eco-labeling and durability-focused designs that extend product life cycles are gaining importance, especially in Europe and North America. This trend is also influencing purchasing decisions among younger outdoor enthusiasts who prioritize responsible consumption alongside performance.

What are the key drivers in the trekking poles market?

Growth in Outdoor Recreation and Adventure Tourism

The global rise in outdoor recreation, including hiking, trekking, and trail running, is a key driver of trekking poles demand. Increased visitation to national parks, long-distance trails, and mountainous regions has expanded the consumer base for trekking equipment. Adventure tourism initiatives supported by governments in regions such as Asia-Pacific and Latin America are further accelerating adoption, particularly among first-time users.

Health, Fitness, and Aging Population Benefits

Trekking poles are increasingly recognized for their health benefits, including reduced joint strain, improved balance, and enhanced posture. These benefits have driven adoption among older adults, rehabilitation users, and fitness-focused consumers. As aging populations grow in regions such as Europe and Japan, trekking poles are gaining acceptance beyond traditional adventure sports, supporting steady market expansion.

What are the restraints for the global market?

Price Sensitivity and Low-Cost Competition

Price sensitivity remains a key restraint, particularly in emerging markets where low-cost, unbranded trekking poles compete aggressively with established brands. This commoditization pressures profit margins and limits premium product penetration in price-conscious regions.

Seasonal and Weather-Dependent Demand

Trekking pole sales are highly seasonal, influenced by weather patterns and tourism cycles. Demand fluctuations create inventory management challenges for manufacturers and retailers, potentially impacting revenue stability.

What are the key opportunities in the trekking poles market?

Expansion in Emerging Markets

Asia-Pacific and Latin America present strong growth opportunities as domestic adventure tourism rises and outdoor lifestyles gain popularity. Localization of pricing, product features, and distribution can help manufacturers capture significant untapped demand in countries such as China, India, and Chile.

New Use Cases Beyond Traditional Hiking

Emerging applications such as trail running, ski touring, military training, and rehabilitation therapy are creating new demand streams. Institutional adoption by defense forces, rescue teams, and healthcare providers offers long-term, stable revenue opportunities beyond consumer retail.

Product Type Insights

Dual-pole trekking systems dominate the market, accounting for approximately 68% of global revenue in 2024, due to superior balance and load distribution. Single poles are primarily used in trail running and urban fitness applications. Adjustable telescopic poles lead within product designs, representing nearly 60% of demand, as they offer versatility for varying terrains and user heights. Foldable Z-poles are the fastest-growing sub-segment, driven by portability requirements among endurance athletes.

Material Insights

Aluminum trekking poles hold the largest share at around 52% of the 2024 market, supported by durability, affordability, and suitability for beginners. Carbon fiber poles are growing at a faster pace, particularly in premium and professional segments, due to their lightweight properties and vibration-damping. Hybrid composite poles serve a niche segment seeking a balance between cost and performance.

Distribution Channel Insights

Offline retail channels, including specialty outdoor stores and sports chains, account for approximately 58% of global sales, benefiting from product trials and expert guidance. However, online channels are growing faster, supported by brand-owned websites and e-commerce platforms that offer wider product ranges, competitive pricing, and global reach. Direct-to-consumer strategies are increasingly important for premium brands.

End-Use Insights

Recreational hiking and trekking represent the largest end-use segment, contributing about 55% of total market demand in 2024. Professional mountaineering and alpine climbing form a high-value niche, while trail running is the fastest-growing application. Ski touring and snow sports drive seasonal demand in Europe and North America, while military and tactical training applications are emerging as stable institutional segments.

| By Product Type | By Material Type | By Adjustability | By End-Use Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the trekking poles market with approximately 34% share in 2024, driven by strong participation in outdoor sports and high consumer spending on premium equipment. The U.S. is the largest contributor, supported by extensive trail networks and national park tourism.

Europe

Europe accounts for nearly 29% of global demand, led by Germany, France, Italy, and Nordic countries. Strong hiking culture, aging populations, and preference for sustainable products support steady market growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR exceeding 8%, driven by China, Japan, India, and South Korea. Government-backed adventure tourism initiatives and rising disposable incomes are accelerating adoption.

Latin America

Latin America represents a smaller but expanding market, led by Chile, Argentina, and Brazil. Growth is supported by trekking tourism in mountainous regions and increasing participation in endurance sports.

Middle East & Africa

The Middle East and Africa account for a modest share, with demand driven by adventure tourism hubs, military training applications, and growing outdoor recreation interest in South Africa and the UAE.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Trekking Poles Market

- Black Diamond Equipment

- LEKI

- Komperdell

- MSR

- Cascade Designs

- Decathlon

- Salomon

- The North Face

- Helinox

- Mountainsmith

- Fizan

- Gipron

- Montbell

- TSL Outdoor

- K2 Sports

Recent Developments

- In 2024, several leading manufacturers expanded their carbon fiber trekking pole portfolios to cater to the growing trail running and ultralight backpacking segments.

- In early 2025, outdoor brands increased direct-to-consumer investments, enhancing online customization tools and sustainability-focused product lines.

- In 2025, multiple European manufacturers announced the use of recycled aluminum and bio-based grips to align with tightening environmental regulations.