Tree Services Market Size

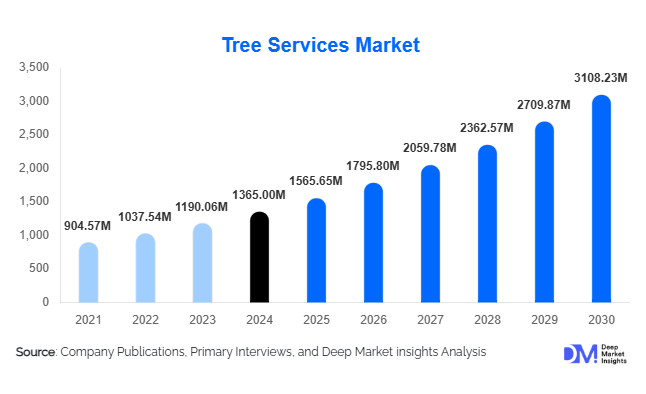

According to Deep Market Insights, the global tree services market size was valued at USD 1,365.00 million in 2024 and is projected to grow from USD 1,565.65 million in 2025 to reach USD 3,108.23 million by 2030, expanding at a CAGR of 14.70% during the forecast period (2025–2030). The market growth is primarily driven by rising urban forestry initiatives, expanded vegetation management requirements in utility infrastructure, and increasing climate-related tree risk incidents that require professional pruning, removal, and maintenance services.

Key Market Insights

- Urban green infrastructure programs are accelerating global demand, with municipalities investing heavily in canopy expansion, tree health, and climate-resilience projects.

- Utility vegetation management (UVM) has become one of the most stable and fastest-growing demand segments, owing to wildfire-prevention regulations and infrastructure modernization.

- North America leads the global market, driven by high residential spending, advanced arboricultural practices, and stringent utility compliance requirements.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, afforestation policies, smart-city projects, and the increasing need for tree maintenance around expanding road and rail networks.

- Digital tools, including drones, GIS mapping, and risk-analysis software, are transforming tree service operations, improving safety, speed, and regulatory compliance.

- Climate-change-induced storms and shifting weather patterns are significantly increasing demand for emergency tree removal and hazard pruning services.

What are the latest trends in the tree services market?

Smart and Data-Driven Arboriculture Expanding Rapidly

Tree services are increasingly integrating digital technologies to streamline operations, improve safety, and enhance the accuracy of tree-risk assessments. Drones are now used for canopy inspection, especially in hard-to-access areas or post-storm evaluations. GIS-based tree inventory systems are helping municipalities and large commercial campuses map, track, and prioritize tree health interventions. AI-enabled analytics can detect early signs of disease or decay, enabling preventive action. Furthermore, software platforms allow service providers to document compliance, deliver real-time monitoring reports, and support long-term urban forest management plans. These advancements are making tree services more sophisticated, measurable, and cost-efficient.

Electrification and Low-Noise Equipment Adoption

Growing environmental regulations and noise-control policies are accelerating the shift toward electric chainsaws, battery-powered trimmers, and hybrid wood chippers. Urban residential areas and municipalities favor quiet, zero-emission maintenance operations, driving companies to adopt cleaner equipment. Improvements in battery life, cutting power, and charging speed have made electric tools viable for professional use. This trend supports sustainability targets, reduces fuel costs, and enhances operator safety by lowering vibration and emissions exposure. Equipment electrification is expected to continue expanding, especially in Europe and North America.

What are the key drivers in the tree services market?

Escalating Climate Risks and Storm-Related Tree Damage

Climate shifts have increased the frequency of high-intensity storms, hurricanes, and extreme wind events globally. This has resulted in rising volumes of fallen trees, broken limbs, and hazardous leaning trees that require emergency removal. Municipalities and insurers now maintain dedicated storm-response budgets, providing year-round demand for professional tree services. With extreme weather events projected to intensify, this driver will continue shaping market growth.

Urbanization and Expansion of Built Infrastructure

Rapid urban development requires continuous tree pruning, hazard mitigation, and landscape management around new housing, commercial centers, and transport corridors. Urban expansion adds millions of new trees annually, increasing long-term maintenance demand. As cities prioritize livability and green space, tree planting and maintenance programs have become essential to urban planning, fueling growth in trimming, pruning, and arboriculture consulting services.

What are the restraints for the global market?

Severe Shortage of Certified Arborists

The industry faces an ongoing deficit of trained and certified arborists, with workforce gaps of 15–20% in major markets. Certification processes, safety training, and specialized skill requirements make recruitment difficult. This limits scalability and increases labor costs, especially during peak storm seasons or large municipal projects.

High Insurance and Equipment Costs

Tree service operations involve significant risks, resulting in high insurance premiums that increase 12–18% annually. Professional equipment, such as bucket trucks, aerial lifts, cranes, and wood chippers, requires substantial upfront investment. These costs act as barriers to entry for small businesses and reduce profit margins for established service providers.

What are the key opportunities in the tree services industry?

Urban Climate-Resilience and Green Infrastructure Programs

Global cities are expanding tree-planting initiatives to manage heat islands, improve air quality, and strengthen climate resilience. Many regions are targeting 20–30% increases in tree canopy coverage by 2030. This creates long-term opportunities in planting, pruning, disease management, and risk consulting. Public-private partnerships are also emerging for community forestry and sustainable landscape management.

Utility Vegetation Management (UVM) Modernization

Utilities worldwide are under pressure to prevent outages and wildfires by maintaining clearances around power lines. This sector represents one of the most recurring, high-value opportunities due to mandatory compliance cycles. Companies investing in LiDAR scanning, drone inspections, and predictive analytics can secure multi-year utility contracts, giving them a competitive advantage and stable revenue streams.

Product Type Insights

Tree trimming and pruning services dominate the market, accounting for approximately 34% of global revenue in 2024. Regular trimming is essential for hazard prevention, aesthetic maintenance, and long-term tree health across residential, municipal, and commercial segments. Tree removal services, especially emergency removals, are steadily growing due to storm frequency. Tree health management services, including disease diagnosis and pest control, are expanding rapidly as urban forestry programs emphasize longevity and canopy protection.

Application Insights

Urban landscape management leads global demand, comprising about 36% of the market in 2024, supported by municipal investment in city beautification, canopy expansion, and risk assessment. Infrastructure and right-of-way maintenance is the second-largest application, driven by utility and highway vegetation management. Storm cleanup services are experiencing rising demand due to climate events. Environmental conservation applications, including reforestation and habitat restoration, are gaining relevance as sustainability targets rise globally.

Distribution Channel Insights

Direct service contracting remains the dominant distribution mode, with customers engaging certified arborists or specialized tree service firms through direct outreach or long-term agreements. Online platforms are increasingly used for residential bookings, offering transparent pricing and rapid scheduling. Municipal and utility tenders represent major procurement channels for large-scale contracts, with multi-year maintenance agreements ensuring steady revenue flows. Digital marketplaces offering verified and insured arborists are growing in popularity among homeowners seeking reliable service providers.

End-User Insights

Residential end users account for the largest share, 41% of the 2024 market, driven by rising homeownership, landscaping investments, and safety concerns related to aging trees. Municipal and government clients form the second-largest segment, fueled by urban forestry initiatives and storm preparedness programs. Utility operators represent the fastest-growing end-use segment due to escalating wildfire risks and strict vegetation-management compliance. Commercial and industrial facilities increasingly utilize tree services for property enhancement, safety compliance, and environmental certifications.

Age Group Insights

While age groups are not directly measured in tree service demand like tourism markets, customer profiles show that homeowners aged 35–55 are the primary drivers of residential service revenue. Municipal administrators typically fall within 40–60 years and make long-term strategic procurement decisions. Younger demographics interact with the market indirectly through sustainability programs, urban greening initiatives, and community forestry volunteering.

| By Service Type | By Customer Type | By Equipment / Technology Type | By Application | By Contract Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the global tree services industry with a 38% share in 2024. The U.S. market alone accounts for 31% due to advanced arboriculture standards, strong residential spending, and regulatory-driven utility vegetation management. Canada’s expanding urban forestry programs also contribute to growing demand. The region leads in digital adoption, drones, GIS mapping, and electric tools.

Europe

Europe holds 24% of the global market, led by Germany, the U.K., France, and the Netherlands. Strict safety and urban-environment regulations drive consistent demand for pruning, risk assessment, and disease management. Northern Europe faces high storm frequency, increasing post-storm cleanup services. Eastern Europe is emerging due to infrastructure growth and expanding landscaping industries.

Asia-Pacific

Asia-Pacific accounts for 22% of the market and is the fastest-growing region with an 8.1% CAGR. China, Japan, India, Australia, and South Korea are key demand centers. Smart-city programs, rapid urbanization, and large-scale afforestation campaigns fuel growth. India is one of the strongest emerging markets, with urban-tree services growing above 9% CAGR.

Latin America

Latin America represents 7% of global demand, with Brazil, Mexico, and Chile driving growth. Increasing urbanization, climate-related tree risks, and environmental restoration programs support market expansion. Public green-space investments in Brazil are stimulating greater use of professional arborists.

Middle East & Africa

MEA holds 9% of the global market. Demand is rising in the UAE, Saudi Arabia, and South Africa due to urban greening initiatives and large-scale landscaping linked to real estate and tourism. African countries are expanding climate-resilience projects and reforestation activities, further increasing demand for tree planting and maintenance services.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tree Services Market

- Bartlett Tree Experts

- Davey Tree Expert Company

- Asplundh Tree Expert LLC

- BrightView Holdings

- SavATree

- Wright Tree Service

- ACRT Services

- Lewis Tree Service

- Monster Tree Service

- Lucas Tree Experts

- Arborwell Professional Tree Management

- Australian Tree Services

- The Arbor Group

- Tree Inc.

- Arbormaster

Recent Developments

- In March 2025, Davey Tree Expert Company launched an AI-powered tree health diagnostic tool for municipal clients, integrating remote sensing and predictive analytics.

- In January 2025, Asplundh expanded its drone-assisted utility vegetation management services across North America to improve inspection efficiency and wildfire prevention.

- In May 2025, SavATree invested in electric fleet upgrades, introducing battery-powered aerial lifts and low-noise equipment for urban operations.