Travel Irons Market Size

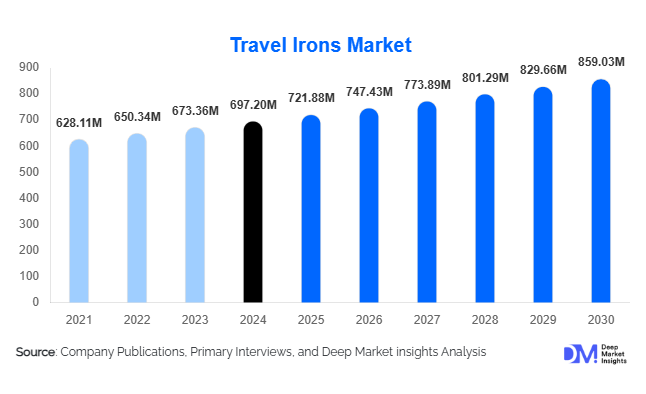

According to Deep Market Insights, the global travel irons market size was valued at USD 697.20 million in 2024 and is projected to grow from USD 721.88 million in 2025 to reach USD 859.03 million by 2030, expanding at a CAGR of 3.54% during the forecast period (2025–2030). The travel irons market growth is primarily driven by rising international and domestic travel, expansion of the global hospitality sector, and increasing consumer preference for compact, portable grooming appliances that provide professional garment care on the go.

Key Market Insights

- Corded travel irons remain the dominant product category, supported by reliable performance, cost-effectiveness, and strong adoption in hotels and business travel kits.

- Ceramic soleplate travel irons are gaining share, as consumers favor smooth gliding, even heat distribution, and higher scratch resistance over basic stainless-steel models.

- 600–900W travel irons account for the largest power-rating share, balancing rapid heating with energy efficiency, making them ideal for frequent travelers and in-room hotel use.

- Online retail channels lead global distribution, with e-commerce platforms and brand-owned webstores accounting for more than half of total unit sales.

- Individual leisure and business travelers represent the largest end-user segment, driven by rising outbound tourism from Asia-Pacific and sustained business travel in North America and Europe.

- Asia-Pacific is the fastest-growing regional market, powered by a booming middle class, expanding outbound tourism, and large-scale manufacturing capabilities.

- Competition from portable garment steamers is reshaping the market, pushing manufacturers to innovate with cordless, dual-voltage, and ultra-compact travel iron designs.

What are the latest trends in the travel irons market?

Rise of Cordless and Smart Travel Irons

One of the most prominent trends in the travel irons market is the emergence of cordless and smart-enabled models. Battery-operated and rechargeable travel irons are increasingly preferred by frequent travelers who value mobility, convenience, and quick usage in tight spaces such as hotel rooms, RVs, and cruise cabins. Manufacturers are experimenting with lithium-ion batteries, induction charging bases, and rapid-heat technologies that allow garments to be pressed within seconds. Smart temperature control systems, auto shut-off functions, and fabric-specific presets are being integrated to prevent scorching and improve safety, especially in hospitality settings. Some high-end models incorporate LED indicators, digital displays, and microcontroller-based heat regulation, reflecting a broader shift toward intelligent, user-friendly appliance design.

Dual-Voltage, Ultra-Compact and Travel-Friendly Designs

Globalization of travel and increased cross-border mobility are driving innovation in dual-voltage and ultra-compact travel irons. Dual-voltage compatibility (typically 110–120V and 220–240V) is now becoming a standard feature, allowing users to operate the same device across regions without performance disruption. Foldable handles, collapsible bodies, and mini-irons that fit easily into cabin baggage or laptop bags are increasingly popular among business and leisure travelers who pack light but still require polished attire. Lightweight ceramic or titanium-coated soleplates, space-saving carry pouches, and bundled travel kits with adapters and steam cups further enhance portability. This trend aligns with the growth of minimalistic packing, digital nomad lifestyles, and short-stay city trips, all of which favor compact, multi-functional travel accessories.

What are the key drivers in the travel irons market?

Rising Global Travel and Tourism Activity

Steady growth in global tourism and business travel is a core driver of the travel irons market. As more travelers attend corporate events, meetings, and social occasions abroad, the need to maintain a professional or well-groomed appearance increases demand for portable garment care solutions. Business travelers, in particular, view crease-free clothing as essential to personal branding, prompting the inclusion of travel irons in personal luggage or corporate travel kits. The rebound of air traffic, growth in low-cost carriers, and the proliferation of short-haul city breaks are expanding the addressable user base for travel irons across all income brackets.

Expansion and Upgrading of the Hospitality Sector

The hospitality industry—comprising hotels, serviced apartments, boutique stays, and corporate lodging—is significantly influencing travel iron adoption. As guest expectations rise, hotels increasingly provide high-quality travel irons and ironing stations as in-room or on-request amenities to improve satisfaction scores and online ratings. Large hotel chains periodically renew small appliances due to wear-and-tear, safety requirements, and brand standardization, generating recurring B2B demand. The rapid expansion of mid-scale and upscale hotels across Asia-Pacific, the Middle East, and Latin America further magnifies bulk procurement, supporting sustained market growth for reliable and durable travel iron models.

Product Innovation, Miniaturization, and Premiumization

Technological advancements in heating elements, lightweight materials, and soleplate coatings are enabling manufacturers to reduce product size while maintaining or improving performance. Ceramic and titanium-coated soleplates, precision steam holes, and rapid heat-up technologies deliver faster, more efficient ironing with minimal effort. These innovations support the premiumization of the category, where consumers are willing to pay more for compact devices that deliver near full-size performance. Enhanced ergonomics, modern aesthetics, and multifunctional features—such as vertical steaming capability and combined iron-steamer hybrids—are further driving adoption among style-conscious and tech-savvy travelers.

What are the restraints for the global market?

Intense Competition from Portable Garment Steamers

Portable garment steamers have emerged as a major substitute for travel irons, particularly among younger travelers and frequent flyers who prioritize convenience over precision pressing. Steamers are generally perceived as easier to use, faster for quick touch-ups, and safer on delicate fabrics. This shift in preference is impacting demand for traditional travel irons in certain segments, especially in premium and urban markets. Manufacturers must therefore differentiate travel irons through improved performance on structured garments, sharper creasing capabilities, multifunctionality, and competitive pricing to retain share against steamer-centric offerings.

Safety Standards, Voltage Compatibility and Cost Pressures

Strict safety, energy efficiency, and compliance regulations across regions can pose barriers to market entry and expansion, particularly for smaller or regional manufacturers. Requirements for automatic shut-off, overheat protection, insulation standards, and dual-voltage operation add to design complexity and production costs. Simultaneously, rising raw material prices—such as metals, ceramics, and electronic components—compress margins in an already price-sensitive category. Voltage compatibility issues and the need for travel adapters in some regions can also discourage purchase or lead consumers to alternatives like steamers or hotel-provided appliances.

What are the key opportunities in the travel irons industry?

Technology-Enabled, Energy-Efficient and Eco-Friendly Travel Irons

There is a significant opportunity for brands to differentiate through smart, energy-efficient, and eco-friendly travel irons. Models that offer low standby consumption, rapid heating with minimal power draw, and recyclable materials can appeal to environmentally conscious travelers and hospitality operators aiming to meet sustainability targets. Integration with smart sockets, auto-calibrating temperature control, and diagnostic indicators can reduce safety incidents and extend product life. Manufacturers who invest in R&D around efficient heating elements, improved insulation, and modular components stand to capture premium segments and B2B buyers focused on total cost of ownership and ESG-linked procurement.

Emerging Markets, E-Commerce Expansion and B2B Partnerships

Strong growth in outbound tourism and rising disposable incomes in emerging economies—particularly in Asia-Pacific, Latin America, and parts of Africa—open up new demand pockets for travel irons. E-commerce platforms and cross-border marketplaces make it easier for brands to reach first-time buyers in these regions with minimal physical retail investment. Partnerships with luggage brands, travel accessory companies, airlines, and corporate gift providers offer additional channels to bundle travel irons as part of curated kits. Hospitality chains, co-living operators, and serviced apartment providers also present scalable B2B opportunities for standardized appliance procurement across properties, creating recurring, predictable demand for certified and durable travel iron models.

Product Type Insights

Corded travel irons currently dominate the product landscape, accounting for an estimated 38% of global market share in 2024. Their popularity is rooted in robust heat performance, consistent power delivery, and lower price points compared to emerging cordless or hybrid alternatives. Dual-voltage corded models are particularly favored by international travelers and hospitality buyers because they ensure compatibility across major regions without sacrificing wattage or steam output. While cordless and battery-powered travel irons are gaining traction, especially in premium and tech-forward segments, corded devices remain the preferred choice for hotels, serviced apartments, and value-conscious consumers thanks to their reliability, simple maintenance, and proven track record under frequent use conditions.

Application Insights

From an application perspective, individual travelers—including both leisure and business users—represent the single largest application category, contributing roughly 48% of global demand in 2024. This group relies on travel irons to maintain neat, wrinkle-free clothing for meetings, events, or social occasions, particularly on extended trips where hotel ironing services may be costly or unavailable. The hospitality segment forms another critical application cluster, with hotels and serviced apartments procuring travel irons as in-room amenities or shared-use appliances. Additionally, corporate procurement of travel kits for executives, airline crew usage, and integration into premium luggage sets are emerging application niches. As hybrid work and “work-from-anywhere” trends grow, more professionals travelling with limited luggage are expected to invest in compact, multi-use travel irons that support both business and personal travel needs.

Distribution Channel Insights

Online channels have become the most influential distribution route for travel irons, capturing an estimated 52% share of global sales in 2024. E-commerce marketplaces, brand-owned webstores, and digital-first retailers allow consumers to compare specifications, read reviews, and access international brands at competitive prices. This transparency is particularly important for compact appliances where performance differences may not be immediately visible. Offline channels—such as hypermarkets, specialty appliance stores, and travel accessory shops—remain relevant for hands-on evaluation and impulse purchases at airports or transit hubs. However, the convenience of home delivery, frequent promotional campaigns, and the ability to bundle irons with other travel accessories have firmly positioned online retail as the primary growth engine, especially in Asia-Pacific and North America.

Traveler Type Insights

In the context of travel irons, “traveler type” segments align with distinct usage profiles. Business travelers form a high-value segment that prioritizes reliability, dual-voltage capability, and premium build quality. These users are more likely to purchase mid- to high-end travel irons or rely on high-spec devices provided by hotels and corporate travel programs. Leisure tourists, including families and couples, typically favor affordable, compact models that can handle occasional use during vacations. Backpackers and budget travelers increasingly opt for multi-functional, lightweight garments that reduce the need for ironing, yet some still invest in ultra-compact or mini irons for longer trips. Airline crew and frequent-flyer segments demand robust, quick-heating irons optimized for repetitive use in constrained spaces, presenting a niche yet profitable opportunity for specialized designs.

Age Group Insights

Consumers aged 30–50 years represent the core demographic for travel iron purchases, combining high travel frequency with mid-to-high disposable income. This segment tends to favor reliable, feature-rich models and is particularly responsive to online reviews and brand reputation. Younger consumers, particularly those aged 18–30, are more inclined to experiment with portable garment steamers or rely on hostel and hotel services, yet they remain an important target for budget travel irons and compact multipurpose devices sold via e-commerce platforms. Older demographics (50+ years) often value traditional ironing performance, safety features, and familiarity, favoring corded travel irons with clear controls and robust construction. As aging but active travelers increasingly participate in international leisure tourism and cruises, demand for ergonomic and easy-to-use travel irons with enhanced safety and visibility features is expected to rise.

| Product Type | Soleplate Material | Wattage / Power Rating | Portability Feature | Distribution Channel | End User |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America holds a significant share of the global travel irons market, accounting for around 24% of total demand in 2024. The United States drives the majority of regional sales, supported by a large business travel segment, strong corporate procurement, and widespread availability of mid- to high-end products. Canadian consumers demonstrate similar preferences, with a growing inclination toward premium, dual-voltage travel irons purchased via online platforms. High household appliance penetration, mature hospitality infrastructure, and a strong culture of professional appearance in corporate environments collectively stimulate steady replacement and upgrade cycles, particularly in mid- and premium price bands.

Europe

Europe represents approximately 21% of global travel iron consumption in 2024, with key markets including the U.K., Germany, France, Italy, and Spain. European buyers are generally attuned to energy efficiency and product safety, driving demand for certified, eco-conscious designs with advanced safety features such as auto shut-off and overheat protection. The region’s strong business travel and tourism sectors, coupled with extensive rail and air networks, sustain demand for compact garment care appliances. Hotels and serviced apartments across major European cities commonly provide travel irons as standard room amenities, reinforcing B2B demand. Increasing online retail penetration and cross-border e-commerce are further widening brand choices for European consumers.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the travel irons market, projected to expand at an estimated CAGR of around 8.2% through 2030. China leads both consumption and production, acting as a global manufacturing hub for travel irons and other portable appliances. Rising outbound tourism from China, India, and Southeast Asia is rapidly enlarging the addressable consumer base. Indian travelers, in particular, are increasingly purchasing affordable, dual-voltage travel irons as international travel becomes more accessible. Japan, South Korea, and Australia represent mature but stable demand bases, with consumers in these markets often favoring high-quality, energy-efficient models. The combination of manufacturing scale, growing domestic consumption, and export orientation positions Asia-Pacific as the strategic epicenter of future market expansion.

Latin America

Latin America is an emerging market for travel irons, with Brazil and Mexico at the forefront of regional demand. While ownership levels are lower than in North America or Europe, rising middle-class incomes, increasing participation in international travel, and improved e-commerce logistics are gradually expanding the category. Consumers in Latin America often favor versatile, mid-priced models that offer acceptable performance without premium pricing. As regional carriers and tour operators promote international tourism, demand for compact garment care accessories is expected to grow, albeit from a relatively smaller base.

Middle East & Africa

The Middle East & Africa region shows strong growth potential driven by rapid hospitality expansion in countries such as the United Arab Emirates, Saudi Arabia, and Qatar, alongside established tourism markets in South Africa, Kenya, and Egypt. Luxury hotels and serviced apartments in Gulf Cooperation Council (GCC) countries routinely invest in high-quality room appliances, including travel irons, to cater to business and high-income leisure travelers. In Africa, urbanization and rising participation in regional and international travel are slowly increasing ownership of travel irons among middle-income households. The combination of inbound tourism, growing air connectivity, and government investment in tourism infrastructure is expected to support sustained, long-term market development in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Travel Irons Market

- Koninklijke Philips N.V.

- Panasonic Corporation

- Conair Corporation

- Rowenta (Groupe SEB)

- Morphy Richards

- Black+Decker Inc.

- Tefal (Groupe SEB)

- Hamilton Beach Brands, Inc.

- Russell Hobbs

- Bajaj Electricals Ltd.

Recent Developments

- In September 2024, Versuni India introduced the Philips Azur 8000 DST8040 smart steam iron with OptimalTEMP and DynamIQ steam technology for safer and faster ironing.