Tourism Event Market Size

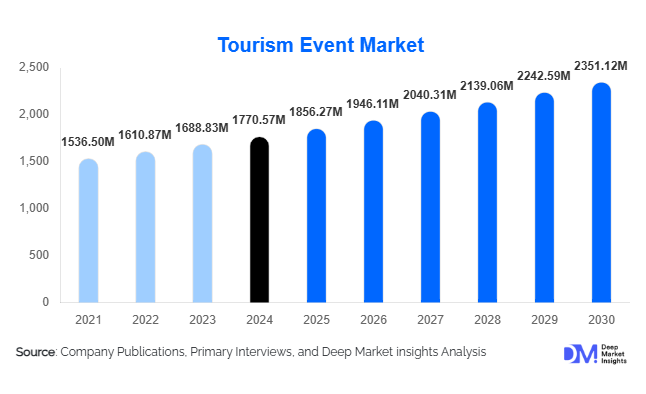

According to Deep Market Insights, the global tourism event market size was valued at USD 1,770.57 million in 2024 and is projected to grow from USD 1,856.27 million in 2025 to reach USD 2,351.12 million by 2030, expanding at a CAGR of 4.84% during the forecast period (2025–2030). The tourism event market growth is primarily driven by the resurgence of global travel, increasing demand for cultural and entertainment experiences, and rising public and private investments in world-class event infrastructure. Additionally, hybrid and experiential event formats, along with enhanced government support for tourism-led economic development, are creating strong momentum across both developed and emerging markets.

Key Market Insights

- Cultural and festival-based tourism remains the largest segment, accounting for over one-third of global tourism event demand due to strong international participation and high repeat attendance.

- Hybrid event adoption is rising, enabling destinations to expand global reach through digital engagement while retaining the value of physical tourism.

- Inbound international travelers contribute nearly half of total market revenue, driven by higher per-trip spending and longer stays during major events.

- North America and Europe collectively dominate the market, supported by advanced infrastructure, marquee global events, and mature business tourism ecosystems.

- Asia-Pacific is the fastest-growing region, propelled by rising middle-class travel, government-backed cultural programming, and expanding corporate event activity.

- Technological integration, AI event management, AR/VR previews, and immersive digital engagement are reshaping traveler expectations and elevating event-tourism experiences.

What are the latest trends in the tourism event market?

Experience-Led Cultural and Festival Tourism

Cultural festivals, heritage celebrations, and entertainment mega-events are increasingly becoming central travel motivations for international tourists. Destinations are designing curated experiences that combine local gastronomy, music, arts, and immersive storytelling to elevate visitor engagement. Many national tourism boards now position flagship cultural events as global branding tools, attracting travelers seeking authentic, community-driven, and experiential itineraries. This trend is reinforced by the rising preference for multi-day experiences, leading to extended visitor stays and higher economic impact for host destinations.

Expansion of Hybrid and Tech-Integrated Event Tourism

Destinations and event organizers are adopting hybrid formats that combine physical attendance with digital content delivery, allowing global audiences to participate in concerts, conferences, and cultural shows virtually. AR/VR destination previews, AI-powered itinerary planning, real-time event apps, and interactive traveler engagement tools are gaining momentum. These technologies improve pre-travel decisions, enhance on-ground navigation, and generate deeper post-event engagement. Tech-driven personalization is also creating new revenue streams for event organizers while expanding accessibility for international viewers.

What are the key drivers in the tourism event market?

Global Tourism Recovery and Rising Demand for Experiential Travel

The return of international mobility has revived large-scale gatherings, with travelers prioritizing experiences over transactional tourism. Festivals, sports competitions, and global exhibitions are major travel magnets, boosting visitation and spending. Post-pandemic travelers show strong interest in emotional, social, and culturally rich activities, significantly amplifying demand for tourism events. Destinations leveraging event calendars to shape year-round tourism offerings are seeing higher occupancy and diversified traveler demographics.

Growing Corporate and Business Event Participation

Business tourism, spanning MICE events, trade shows, and multinational conferences, remains a cornerstone of the market. Global corporations are reinstating in-person events to strengthen networking, innovation-sharing, and customer engagement. Business travelers tend to have high spend-per-trip ratios, stimulating demand across hospitality, dining, and entertainment sectors. The reopening of international convention centers and expansion of corporate events in APAC and the Middle East further reinforce this driver.

What are the restraints for the global market?

High Travel and Event Participation Costs

Rising airfare, hotel pricing, and logistical expenses make event-driven tourism cost-intensive, especially during peak seasons. For many travelers, the premium pricing of major global events, sports tournaments, international festivals, and large conferences creates accessibility barriers. Inflationary pressures also elevate operational costs for organizers, limiting the affordability and scalability of certain event formats.

Regulatory and Infrastructure Limitations

Countries with restrictive visa policies, underdeveloped transit networks, or insufficient event infrastructure face challenges in attracting international event tourists. Regulatory inconsistencies for event approvals, safety compliance, and venue licensing can hinder market expansion. Limited accommodation capacity during large events can suppress attendance and deter repeat visitors in emerging markets.

What are the key opportunities in the tourism event industry?

Hybrid & Immersive Digital Engagement Models

With travelers increasingly seeking flexible participation options, hybrid event models offer massive growth potential. Virtual add-ons, immersive digital content, and AI-enabled personalization extend the reach of global events and open new monetization channels. Destinations adopting digital-first strategies can attract tech-savvy global audiences and position themselves as year-round event hubs without physical capacity constraints.

Government-Led Destination Development & Tourism Branding

Governments are leveraging tourism events to strengthen national identity, stimulate local economies, and enhance global visibility. Investments in stadiums, convention centers, cultural districts, and smart mobility systems improve destination appeal and long-term tourism volume. Supportive visa policies, sustainability certifications for venues, and tourism stimulus programs create opportunities for both organizers and travelers. Countries in APAC and the Middle East are rapidly emerging as global event hosts due to these strategic interventions.

Product Type Insights

Cultural and festival events make up the largest product category, driven by mass participation, diverse demographic appeal, and strong repeat visitation patterns. Sports tourism events, marathons, championships, and global tournaments continue to gain traction, attracting high-spending international travelers. Business events maintain steady growth through corporate conferences and exhibitions. Entertainment events such as concerts and fan festivals are expanding through global artist tours, influencer culture, and youth-driven demand. Religious and spiritual events, including pilgrimages, form a stable and high-volume segment across Asia, the Middle East, and Latin America.

Application Insights

Tourism events serve multiple applications: leisure travel, business networking, cultural exchange, sports participation, entertainment consumption, and spiritual enrichment. Leisure-oriented event travel remains dominant due to its broad appeal and integration with hospitality and sightseeing. Business event applications are growing rapidly as organizations increase investments in global conventions and incentive travel. Sports applications generate significant international flows during seasonal competitions and global tournaments. Cultural and spiritual event applications continue to broaden access across diverse age and income groups.

Distribution Channel Insights

Online travel agencies (OTAs), event booking platforms, and D2C event websites dominate distribution due to real-time pricing, reviews, and bundled travel-event packages. Specialist travel agencies focusing on MICE, sports travel, or cultural tours maintain strong traction in premium segments. Direct bookings through tourism boards, event organizers, and destination websites are increasing as digital marketing campaigns expand. Social media promotions, influencer partnerships, and mobile event apps play an increasing role in shaping travel decisions among younger consumers.

Traveler Type Insights

Inbound international travelers represent the highest-value segment, accounting for nearly half of market revenue due to higher spending and extended stays. Domestic event travelers contribute strongly in large countries with vibrant internal tourism, such as the U.S., China, and India. Outbound travelers from developed nations significantly impact global event attendance, especially for sports and entertainment megashows. Group travelers dominate large festivals and religious events, while solo and millennial travelers increasingly participate in cultural and music events. Families and couples form a growing segment for multi-day festivals, entertainment shows, and destination weddings.

Age Group Insights

Travelers aged 25–45 years account for the largest share of tourism event participation due to higher mobility, disposable income, and preference for experiential travel. Younger demographics (18–30 years) drive growth in music festivals, entertainment events, and adventure-based gatherings. Older travelers (50–70 years) show strong demand for cultural, religious, and premium business events with curated itineraries and high comfort levels. Multigenerational travel for festivals and cultural programs is also rising, supported by destination packages tailored for families and seniors.

| By Event Type | By Traveler Type | By Distribution Channel | By Revenue Source | By Purpose |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for nearly 30–35% of global tourism event demand, driven by world-class sports leagues, corporate events, music festivals, and entertainment mega-shows. The U.S. remains a global leader in business conventions and entertainment tourism, while Canada continues to expand demand through cultural festivals and international conferences. High spending capacity and strong air connectivity underpin regional dominance.

Europe

Europe holds around 30% of the global share, supported by its rich heritage festivals, international expos, sports tournaments, and cross-border mobility. Destinations such as the U.K., France, Germany, Spain, and Italy attract millions of event tourists annually. Eco-centric festivals and cultural tourism programs are particularly popular among younger European travelers.

Asia-Pacific

APAC is the fastest-growing region, driven by rising middle-class income, government-backed event development, and expanding business tourism hubs. China, India, Japan, and South Korea host major exhibitions, entertainment festivals, and international sports events. Southeast Asian nations are increasingly leveraging cultural festivals and music tourism to enhance inbound travel.

Latin America

Latin America contributes 8–10% to the global market. Brazil’s carnival events, Mexico’s cultural festivals, and Argentina’s sports events are key demand drivers. Infrastructure expansion and tourism marketing initiatives are improving the region’s competitiveness in global event tourism.

Middle East & Africa

MEA is experiencing rapid growth fueled by large-scale government investment, global expos, sports tournaments, and religious tourism flows. The UAE, Saudi Arabia, and Qatar host rising numbers of international events, while African nations continue to expand cultural and festival tourism offerings. MEA’s high-value travelers significantly influence global event attendance patterns.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tourism Event Market

- Live Nation Entertainment

- Informa PLC

- Messe Frankfurt

- GL Events

- Reed Exhibitions (RELX)

- Comexposium

- Cvent

- Access Destination Services

- BCD Meetings & Events

- ATPI Ltd.

- Entertaining Asia

- FCM Travel Solutions

- Pollstar

- Fiera Milano

- MCI Group

Recent Developments

- In March 2025, Informa PLC expanded its global event portfolio by launching new hybrid trade shows across Europe and APAC.

- In January 2025, Live Nation announced partnerships with multiple tourism boards to promote international concert-driven tourism packages.

- In February 2025, GL Events opened a new convention complex in Southeast Asia to support regional business tourism growth.