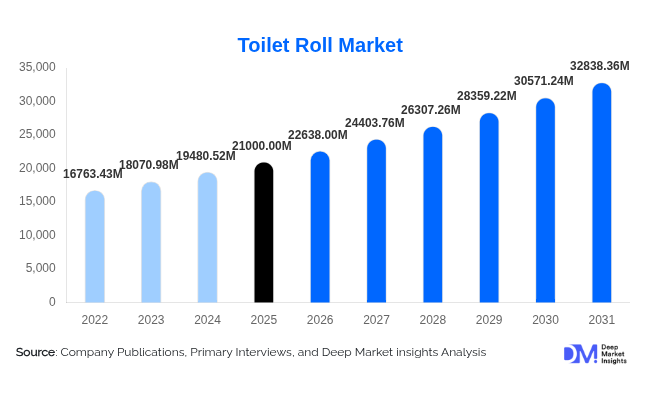

Toilet Roll Market Size

According to Deep Market Insights, the global toilet roll market size was valued at USD 21000 million in 2025 and is projected to grow from USD 22638.0 million in 2026 to reach USD 32838.36 million by 2031, expanding at a CAGR of 7.8% during the forecast period (2026–2031). The toilet roll market growth is primarily driven by rising hygiene awareness, steady population growth, increasing urbanization, and the expanding penetration of modern retail and e-commerce channels. The essential and non-discretionary nature of toilet rolls ensures stable demand across residential, commercial, and institutional end-use segments globally.

Key Market Insights

- Residential consumption dominates global demand, accounting for more than half of the total market value due to daily household usage.

- Asia-Pacific is the largest and fastest-growing region, supported by sanitation initiatives, urban housing growth, and rising disposable incomes.

- Premium and multi-ply toilet rolls are gaining share, driven by lifestyle upgrades and consumer preference for comfort and quality.

- Sustainability-focused products, including recycled and bamboo-based toilet rolls, are witnessing accelerated adoption in Europe and North America.

- E-commerce and direct-to-consumer channels are reshaping distribution dynamics, especially in urban markets.

- Institutional demand is rising, supported by investments in healthcare, hospitality, airports, and public infrastructure.

What are the latest trends in the toilet roll market?

Premiumization and Product Differentiation

The toilet roll market is witnessing a clear shift toward premium and value-added products. Consumers in developed markets are increasingly opting for multi-ply, ultra-soft, embossed, scented, and lotion-infused toilet rolls that enhance comfort and hygiene. Manufacturers are leveraging this trend to improve average selling prices and margins, particularly in North America, Western Europe, and Japan. Designer packaging and branded aesthetics are also becoming more prominent, positioning toilet rolls as lifestyle-oriented hygiene products rather than basic commodities.

Rapid Growth of Sustainable and Eco-Friendly Toilet Rolls

Sustainability has emerged as a defining trend in the global toilet roll market. Recycled paper, bamboo-based, and alternative fiber toilet rolls are gaining traction due to environmental regulations and growing consumer awareness around deforestation and water usage. Retailers are increasingly promoting eco-labeled products, while manufacturers are investing in plastic-free packaging, reduced water consumption, and carbon-neutral production processes. This trend is particularly strong in Europe, where sustainability compliance is influencing purchasing decisions at both consumer and institutional levels.

What are the key drivers in the toilet roll market?

Rising Global Hygiene Awareness

Growing awareness around sanitation and personal hygiene continues to be a primary driver of the toilet roll market. Increased emphasis on cleanliness across households, workplaces, healthcare facilities, and public spaces has led to consistent demand growth. This driver is especially impactful in emerging economies, where improving living standards and exposure to global hygiene norms are increasing toilet roll adoption rates.

Urbanization and Infrastructure Expansion

Rapid urbanization, particularly in the Asia-Pacific and Africa, is fueling toilet roll demand through expanding residential housing, commercial buildings, and public infrastructure. Investments in hotels, offices, airports, metro rail systems, and educational institutions are generating sustained institutional demand for bulk and jumbo toilet rolls. Growing tourism activity is also contributing to higher consumption in the hospitality sector.

Product Innovation and Retail Expansion

Continuous innovation in product quality, packaging formats, and branding is supporting market growth. Simultaneously, the expansion of modern retail chains and online platforms is improving product accessibility and encouraging bulk purchasing through multipacks. Private-label brands are also gaining traction, increasing overall market penetration.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuating prices of wood pulp and recycled paper pose a major challenge for toilet roll manufacturers. Rising energy and transportation costs further increase production expenses, impacting profit margins. Price-sensitive consumers in emerging markets limit the ability of manufacturers to fully pass on cost increases, creating margin pressures.

Environmental Regulations and Compliance Costs

Stringent environmental regulations related to deforestation, water usage, and emissions are increasing compliance costs, particularly for smaller manufacturers. The need for sustainable sourcing and upgraded manufacturing processes requires higher capital investment, potentially restricting new entrants and smaller players.

What are the key opportunities in the toilet roll industry?

Expansion in Emerging Markets

Emerging economies across Asia-Pacific, Africa, and Latin America present significant growth opportunities. Government-led sanitation initiatives, improving urban infrastructure, and rising disposable incomes are accelerating toilet roll adoption. Establishing localized manufacturing facilities and offering affordable product variants can help companies capture high-volume growth in these regions.

Sustainable Product Innovation

The increasing demand for environmentally friendly toilet rolls offers long-term growth potential. Companies investing in recycled fibers, bamboo pulp, biodegradable packaging, and circular economy models can differentiate their offerings and access premium pricing, particularly in developed markets.

Product Type Insights

Standard toilet rolls remain the largest product segment, accounting for approximately 46% of the global market in 2025. The dominance of this segment is primarily driven by its affordability, widespread availability, and high-volume consumption across residential and institutional settings. Standard rolls are particularly prevalent in emerging economies, where price sensitivity and mass-market demand favor basic hygiene products. Government-led sanitation initiatives and expanding urban households further reinforce demand for standard toilet rolls.

Premium toilet rolls represent around 22% of the global market value, supported by strong demand in developed regions such as North America, Western Europe, and Japan. Growth in this segment is driven by rising disposable incomes, lifestyle upgrades, and consumer preference for enhanced comfort, softness, higher ply counts, and value-added features such as embossing, fragrance, and lotion-infused variants. Premiumization enables manufacturers to improve margins and brand differentiation in mature markets.

Material Type Insights

Virgin pulp-based toilet rolls dominate the market with approximately 62% share, driven by superior softness, strength, absorbency, and consumer preference for premium quality hygiene products. This segment remains the preferred choice in developed markets, where product performance and comfort outweigh price considerations. Strong brand positioning and consistent quality standards further support the leadership of virgin pulp-based rolls.

Recycled paper-based toilet rolls account for nearly 28% of global demand and are experiencing steady growth under sustainability mandates, corporate ESG commitments, and increasing consumer awareness of environmental impact. Governments and retailers in Europe and North America are actively promoting recycled tissue products through eco-labeling and procurement guidelines, accelerating adoption in both residential and institutional applications.

Distribution Channel Insights

Modern retail formats such as supermarkets and hypermarkets lead toilet roll distribution globally, accounting for approximately 44% of total sales. Their dominance is driven by bulk purchasing behavior, frequent promotional campaigns, wide product assortments, and strong private-label presence. These channels play a critical role in brand visibility and volume sales, particularly in urban markets.

E-commerce and direct-to-consumer (DTC) channels account for around 14% of global sales and are expanding rapidly due to subscription-based purchasing models, doorstep delivery convenience, and digital brand engagement. The growth of e-commerce is especially strong in North America, Europe, and Asia-Pacific urban centers, where consumers value convenience, bulk ordering options, and competitive pricing. Institutional B2B sales remain a critical distribution channel for jumbo and bulk toilet rolls, catering to offices, hospitals, hotels, airports, and public facilities. Long-term supply agreements, centralized procurement, and consistent consumption patterns make this channel strategically important for manufacturers targeting stable, high-volume demand.

End-Use Insights

The residential segment dominates the global toilet roll market with approximately 55% share, supported by daily household consumption, population growth, and increasing penetration of packaged hygiene products in emerging markets. Rising urban housing developments and expanding middle-class populations continue to strengthen residential demand worldwide.

The commercial and hospitality sectors collectively contribute over 30% of total demand, driven by tourism recovery, increasing office occupancy rates, and expanding healthcare infrastructure. Hotels, restaurants, shopping malls, and corporate offices are major consumers, particularly of premium and jumbo toilet rolls. Growth in international travel and hospitality investments is further accelerating demand in this segment. Educational institutions and public facilities are emerging as stable demand generators, supported by government spending on schools, universities, sanitation facilities, and smart city infrastructure. These end-use segments provide consistent, long-term demand, particularly for cost-efficient and bulk toilet roll products.

| By Product Type | By Material Type | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global toilet roll market with approximately 38% share in 2025, making it the largest and fastest-growing region. China is the largest contributor, supported by its extensive manufacturing base, high population density, and expanding urban consumption. Japan follows with a strong demand for premium and high-quality hygiene products.

India represents the fastest-growing country in the region, driven by government-led sanitation initiatives, rapid urban housing expansion, improving access to modern retail, and rising middle-class consumption. Increasing awareness of personal hygiene and growing penetration of packaged toilet paper in semi-urban and rural areas are key growth drivers across Southeast Asia as well.

North America

North America accounts for approximately 24% of global demand, led by the United States. The region is characterized by high per-capita toilet roll consumption, strong preference for premium and multi-ply products, and widespread availability through modern retail and e-commerce channels. Growth in North America is driven by premiumization trends, strong institutional demand from healthcare and commercial facilities, and rising adoption of sustainable and recycled toilet rolls. Subscription-based purchasing and private-label expansion are also influencing consumption patterns.

Europe

Europe holds nearly 22% market share, driven by Germany, the UK, France, and Italy. The region is strongly influenced by environmental regulations, sustainability standards, and high consumer awareness regarding eco-friendly products. High adoption of recycled toilet rolls, stringent forestry regulations, and retailer-led sustainability initiatives are key drivers of market growth. Institutional procurement policies favoring recycled and certified products further support demand across commercial and public sectors.

Latin America

Latin America represents approximately 7% of global demand, led by Brazil and Mexico. Market growth is supported by improving retail infrastructure, increasing urbanization, and rising domestic manufacturing capacity. Gradual improvements in income levels and expanding hospitality and commercial sectors are driving steady demand growth, while private-label products are improving affordability and market penetration.

Middle East & Africa

The Middle East & Africa region accounts for roughly 9% of the global toilet roll market, supported by infrastructure development, hospitality investments, and rapid urban population growth. Countries such as the UAE and Saudi Arabia benefit from large-scale tourism and commercial construction projects, driving institutional demand. In Africa, expanding urban centers, improving sanitation coverage, and increasing government investment in public hygiene facilities are key growth drivers. South Africa remains a major market due to its relatively high per-capita consumption and established retail networks.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Toilet Roll Market

- Kimberly-Clark

- Procter & Gamble

- Essity

- Georgia-Pacific

- Sofidel Group

- Asia Pulp & Paper

- Hengan International

- Vinda International

- Cascades Inc.

- WEPA Group

- Metsä Tissue

- Kruger Products

- ICT Group

- Lucart Group

- CMPC Tissue