Toasters Market Size

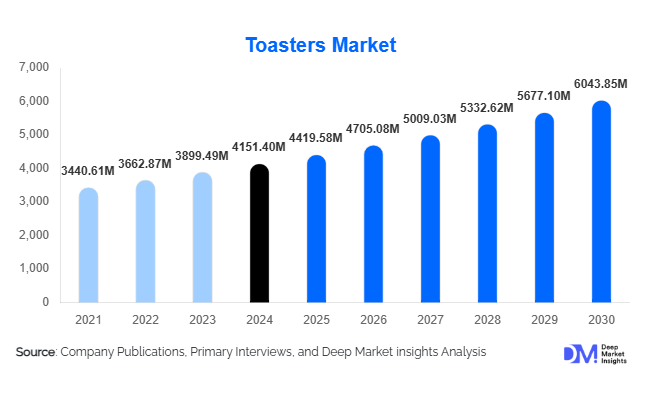

According to Deep Market Insights, the global toasters market size was valued at USD 4,151.40 million in 2024 and is projected to grow from USD 4,419.58 million in 2025 to reach USD 6,043.85 million by 2030, expanding at a CAGR of 6.46% during the forecast period (2025–2030). The toasters market growth is primarily driven by rising residential adoption of small kitchen appliances, increasing demand for smart and multifunctional toasters, and growing commercial use in the hospitality and foodservice sectors.

Key Market Insights

- Residential households remain the largest demand segment, driven by convenience, urbanization, and growing disposable incomes, especially in the Asia-Pacific and Latin America.

- Technological innovation is reshaping the market, with smart toasters, app-enabled controls, AI-based browning, and energy-efficient designs becoming mainstream.

- North America dominates the market, with high consumer preference for multifunctional and premium toasters in countries like the U.S. and Canada.

- Europe is the fastest-growing market for premium toasters, led by Germany, the U.K., and France, driven by sustainability-focused consumer preferences.

- Asia-Pacific is emerging as a key growth hub, led by China, India, and Japan, with rising urban households adopting both mid-range and premium toaster products.

- Online retail channels are gaining traction globally, providing greater product variety, convenient delivery, and price transparency to consumers.

What are the latest trends in the toasters market?

Smart and Connected Toasters Gaining Popularity

Toaster manufacturers are increasingly integrating IoT features, allowing users to control devices via smartphones, adjust browning levels precisely, and schedule toasting remotely. Some smart toasters also provide AI-assisted settings for optimal toasting based on bread type. This trend is particularly strong in North America and Europe, where tech-savvy consumers are willing to pay a premium for convenience and energy efficiency. Additionally, app-enabled connectivity is creating opportunities for integration with smart home ecosystems, further enhancing consumer engagement and differentiation.

Energy-Efficient and Eco-Friendly Designs

Consumers are becoming more environmentally conscious, driving demand for energy-efficient toasters and appliances with recyclable components. Manufacturers are responding with devices that consume less power, use durable and sustainable materials, and comply with stringent energy standards. European and North American markets are leading adoption due to stricter regulations and incentives for low-energy appliances. This trend not only addresses environmental concerns but also positions brands as socially responsible, influencing purchasing decisions.

What are the key drivers in the toasters market?

Growing Household Adoption and Urbanization

The expansion of urban centers and higher disposable incomes in the Asia-Pacific and Latin America is increasing demand for convenient kitchen appliances. Pop-up and multifunction toaster ovens remain preferred choices for households seeking easy-to-use, time-saving solutions. Rising dual-income families also drive the need for appliances that simplify meal preparation.

Technological Innovation in Products

Advances in smart appliances, IoT connectivity, and multifunctional designs are encouraging consumers to upgrade from conventional toasters. Features such as precision browning, app-controlled settings, and integrated timers add value, particularly in premium segments, and allow manufacturers to command higher price points. Continuous innovation in heating technology and design aesthetics is fueling consumer interest globally.

Commercial and Hospitality Sector Demand

Hotels, cafes, and restaurants are increasingly investing in high-capacity toasters, conveyor systems, and multifunction toaster ovens to optimize operational efficiency. This trend is especially pronounced in North America and Europe, where quick-service and boutique foodservice chains drive volume purchases. Commercial adoption also supports recurring sales of replacement parts and maintenance services.

What are the restraints for the global market?

Price Sensitivity and High Competition

The global toasters market is highly competitive, with numerous players offering similar products. Price-sensitive consumers, particularly in emerging markets, make it challenging for manufacturers to maintain healthy profit margins. This often results in promotional pricing, discounting, and pressure on mid-range segment profitability.

Raw Material Cost Fluctuations

Stainless steel, heating elements, and electronic components constitute significant portions of production costs. Volatility in these raw material prices can impact manufacturer margins and may lead to price adjustments, which could slow adoption in cost-conscious markets.

What are the key opportunities in the toasters market?

Expansion in Emerging Markets

Rising urban populations, growing middle-class incomes, and increased household appliance penetration in India, China, Brazil, and the UAE present lucrative opportunities. Companies can leverage localized marketing strategies, affordable mid-range products, and e-commerce channels to capture demand in these regions.

Smart and Connected Appliances

The rising adoption of IoT-enabled smart home devices provides a key opportunity for manufacturers. Smart toasters with AI-based features, app control, and energy efficiency allow differentiation in a commoditized market, creating premium pricing potential and fostering brand loyalty among tech-savvy consumers.

Sustainability and Energy Efficiency

Eco-conscious consumers are increasingly seeking appliances that reduce energy consumption and use recyclable materials. Manufacturers introducing energy-efficient, environmentally responsible toasters can align with government initiatives, especially in Europe and North America, enhancing brand positioning and opening new market segments.

Product Type Insights

Pop-up toasters lead the global market with a 40% share in 2024, driven by affordability and household adoption. Conveyor toasters dominate commercial applications due to high throughput, while multifunction toaster ovens appeal to premium segments with features like baking, broiling, and app-enabled control. Mid-range toasters ($30–$100) capture 50% of market sales, offering the ideal balance of functionality and price. Smart and connected toasters are witnessing rapid growth, particularly in North America and Europe, as consumers adopt energy-efficient and tech-enabled appliances.

Application Insights

The residential segment drives 70% of total demand (USD 2,275 million), with consumers seeking convenience and multifunctional kitchen appliances. Commercial applications, including hotels, restaurants, and cafes, are growing steadily, especially for conveyor and multifunction toaster ovens. Emerging industrial applications include food processing units where specialized toasters are used for baking, snack preparation, and packaging, driving additional demand. Export-driven sales from North America and Europe to the Asia-Pacific and the Middle East further support global growth.

Distribution Channel Insights

Offline retail remains dominant (60% of sales), with supermarkets, hypermarkets, and specialty appliance stores leading consumer purchases. Online platforms, including e-commerce marketplaces and D2C websites, are rapidly expanding due to convenience, wider product selection, and real-time pricing comparisons. Direct sales to commercial buyers and institutional procurement channels also support market growth, particularly in high-volume and industrial applications.

| By Product Type | By Technology | By Price Range | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market (USD 1,100 million in 2024), led by the U.S. and Canada. High disposable incomes, technology adoption, and preference for premium and multifunctional appliances drive demand. The hospitality sector also contributes significantly through bulk purchases of commercial toasters.

Europe

Europe holds USD 950 million of the global market, with Germany, the U.K., and France leading. Consumers show a strong preference for energy-efficient and smart appliances. Premium toasters with multifunctional capabilities are gaining popularity, while mid-range products maintain volume sales in urban households.

Asia-Pacific

Asia-Pacific is the fastest-growing region (7.5% CAGR), driven by China, India, and Japan. Rising urbanization, middle-class growth, and e-commerce expansion are fueling residential adoption, while commercial and hospitality sectors drive B2B sales. Smart and multifunctional toasters are increasingly popular among younger urban consumers.

Latin America

Latin America (USD 300 million) is growing steadily, led by Brazil and Mexico. Urban households increasingly adopt mid-range appliances, while limited commercial uptake is supplemented by imports from Europe and North America.

Middle East & Africa

The market (USD 200 million) is driven by luxury appliance imports in the UAE and Saudi Arabia. Africa’s hospitality sector, particularly in South Africa, Nigeria, and Kenya, contributes to demand for commercial and multifunctional toasters. High-income populations in the Middle East are increasingly purchasing premium smart toasters.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Toasters Market

- Philips

- Breville

- Cuisinart

- Black+Decker

- KitchenAid

- DeLonghi

- Hamilton Beach

- Morphy Richards

- Panasonic

- Russell Hobbs

- Kenwood

- Tefal

- Smeg

- Braun

- Oster

Recent Developments

- In 2025, Philips launched a new smart toaster series with app-enabled control and AI browning settings, targeting North American and European consumers.

- In 2025, Breville expanded its multifunction toaster oven portfolio in Asia-Pacific, incorporating energy-efficient heating elements and IoT connectivity.

- In 2024, Cuisinart introduced premium connected toaster ovens in Europe, integrating sustainability features such as low-energy consumption and recyclable materials.