Tiny Homes Market Size

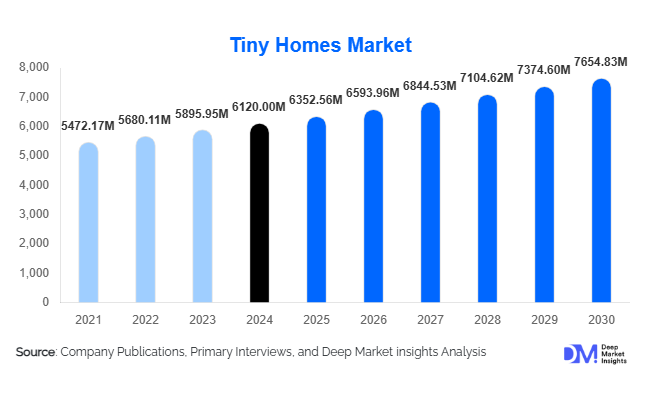

According to Deep Market Insights, the global tiny homes market size was valued at USD 6,120 million in 2024 and is projected to grow from USD 6,352.56 million in 2025 to reach USD 7,654.83 million by 2030, expanding at a CAGR of 3.8% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for affordable housing, urban space constraints, and the increasing popularity of sustainable and modular living solutions, alongside the growing use of tiny homes for rentals, tourism, and lifestyle-driven applications.

Key Market Insights

- Stationary tiny homes dominate the market, providing long-term, code-compliant residential solutions that attract first-time homeowners, downsizers, and retirees.

- Compact homes (130–500 sq. ft.) are the most preferred size band, offering a balance between affordability, functionality, and livable space.

- Modular and prefabricated construction methods are gaining traction, reducing build times and costs while improving quality and scalability.

- North America leads the market, with strong adoption in the U.S. and Canada driven by housing shortages and cultural acceptance of tiny living.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising housing costs, and increasing awareness of compact living solutions in countries like China, India, and Australia.

- Sustainability and smart-home integration are reshaping buyer preferences, with energy-efficient, eco-friendly, and connected tiny homes becoming mainstream.

Latest Market Trends

Modular & Prefabricated Construction Expansion

Manufacturers are increasingly adopting modular and prefabricated construction methods, enabling faster production and consistent quality. Factory-built tiny homes reduce labor costs, minimize on-site construction delays, and allow for scalable production to meet growing demand. Prefabrication also facilitates integration of energy-efficient systems, sustainable materials, and modern design elements, making tiny homes more attractive to eco-conscious and urban buyers. These advancements are transforming the tiny homes market from a niche lifestyle product into a mainstream housing solution.

Sustainability and Minimalist Lifestyle Adoption

Consumer preference is shifting toward environmentally sustainable, minimalist living. Tiny homes, due to their small footprint, energy efficiency, and use of renewable or recycled materials, align with this trend. Builders are integrating solar panels, rainwater harvesting, and off-grid-ready designs, catering to buyers seeking low-impact, energy-efficient housing. Minimalist lifestyles are further supported by smaller, multifunctional spaces, enabling cost savings on both housing and utilities while promoting eco-conscious living practices.

Tiny Homes Market Drivers

Affordable Housing Demand and Urban Space Limitations

High real estate prices and limited urban land are major drivers of the tiny homes market. Tiny homes offer cost-effective, compact, and flexible housing solutions suitable for first-time buyers, retirees downsizing, or urban professionals seeking an alternative to conventional housing. Municipal support in some regions, including zoning adaptations and incentives, further enhances adoption.

Rising Popularity of Flexible, Multi-use Living Spaces

Tiny homes are increasingly used beyond primary residences, including vacation rentals, short-term housing, accessory dwelling units, and mobile offices. This versatility caters to diverse consumer needs, from digital nomads to tourism operators, increasing overall market demand and investment potential.

Technological Advancements in Construction

Innovations in prefab manufacturing, 3D modeling, and modular design reduce costs, improve structural quality, and enable faster deployment. The integration of smart-home technologies, energy-efficient appliances, and sustainable materials further differentiates tiny homes, making them attractive to modern buyers and investors.

Market Restraints

Regulatory and Zoning Challenges

Stringent building codes, zoning laws, and classification issues in many countries limit the placement, financing, and resale of tiny homes. Regulatory uncertainties can delay construction and discourage potential buyers, restricting market growth in certain regions.

Financing and Resale Limitations

Traditional mortgage and insurance systems often do not recognize tiny homes as standard dwellings. This limits access to financing and complicates resale, especially for mobile or custom-built units, which can slow adoption among mainstream consumers and investors.

Tiny Homes Market Opportunities

Affordable Housing Solutions

Governments and municipalities facing housing shortages are increasingly considering tiny homes as a solution. Incentives, relaxed zoning, and supportive policies can enable developers and builders to meet the demand for low-cost housing. Tiny homes can help provide options for urban low-income families, students, retirees, and seasonal workers, creating large-scale market opportunities.

Eco-friendly and Smart-Integrated Housing

Growing demand for sustainable living and smart-home integration presents an opportunity for manufacturers to differentiate products. Homes equipped with energy-efficient systems, sustainable building materials, and smart connectivity can attract environmentally conscious buyers, increase market adoption, and command higher margins.

Tourism, Rental, and Investment Use

Short-term rentals, vacation homes, glamping, and accessory dwelling units (ADUs) are emerging as profitable applications for tiny homes. Investors and developers can establish tiny-home communities or rental portfolios, while tourism operators can expand eco-lodges and glamping experiences. These diversified use cases extend market potential beyond traditional residential buyers.

Product Type Insights

Stationary or fixed tiny homes lead the global market, accounting for approximately 54% of revenue in 2024. This dominance is primarily driven by regulatory acceptance in key regions, long-term suitability for residential purposes, and easier access to financing compared to mobile units. Buyers seeking primary homes, downsizing opportunities, or retirement options prefer stationary homes for their stability, compliance with local building codes, and higher resale value. Mobile or on-wheels tiny homes are growing in popularity, particularly in vacation rental markets, lifestyle-driven purchases, and for digital nomads seeking flexible living solutions. However, zoning restrictions, insurance limitations, and municipal regulations continue to restrain the expansion of mobile units, making stationary homes the leading product type globally.

Size Band Insights

Compact homes, ranging from 130–500 sq. ft., dominate the market with a 72% share in 2024. This size provides an optimal balance of livability, functionality, and affordability, making it attractive to first-time homeowners, small families, and downsizers. Ultra-compact homes (500 sq. ft.) compete with conventional small houses, often targeting buyers seeking additional space while retaining the cost and sustainability benefits of compact living. The preference for compact homes is reinforced by urban housing constraints, rising real estate costs, and the growing trend of minimalist lifestyles across developed and emerging markets.

Material Insights

Timber and wood-framed tiny homes account for 64% of the 2024 market revenue. Wood offers multiple advantages, including cost efficiency, ease of construction, aesthetic appeal, and environmental sustainability. These factors make timber the preferred choice globally, especially in regions emphasizing green construction and renewable resources. Alternative materials, such as steel and composite structures, are gaining traction, particularly in high-tech, urban, and modular designs, where durability, lightweight construction, and faster assembly times are critical. Material innovation also enables integration of smart-home technologies and energy-efficient solutions, further enhancing market appeal.

Application Insights

Residential applications dominate the market, accounting for 72% of revenue in 2024, driven by primary and secondary housing needs. Recreational and tourism-related applications, such as vacation rentals, glamping, and eco-resorts, are witnessing rapid growth, fueled by lifestyle trends and short-term rental opportunities. Additionally, commercial uses, including student housing, short-term rental portfolios, and corporate wellness lodges, are emerging as promising applications. The versatility of tiny homes across residential, recreational, and commercial segments contributes to overall market expansion and investment attractiveness.

| By Product Type | By Size Band | By Material | By Application |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 42% of the global market in 2024, with the U.S. and Canada leading demand. The region’s growth is driven by persistent urban housing shortages, escalating real estate costs, and cultural acceptance of compact living. Government incentives for accessory dwelling units (ADUs) and zoning reforms promoting modular construction have further accelerated adoption. Stationary, prefabricated tiny homes dominate, particularly for residential and short-term rental applications. The region also benefits from a mature ecosystem of modular home manufacturers, established financing options, and consumer familiarity with downsizing and minimalist lifestyles, making it a consistent growth driver.

Europe

Europe is the second-largest market, supported by Germany, the U.K., the Netherlands, and Scandinavian countries. Key growth drivers include increasing sustainability awareness, high urban density, and eco-conscious consumer behavior. Prefabricated and timber-framed constructions dominate due to their energy efficiency and lower environmental impact. Zoning reforms and government incentives for micro-living solutions enable wider adoption, especially in urban centers facing housing shortages. The rising trend of environmentally friendly lifestyle choices and urban minimalism further encourages the uptake of compact, high-quality residential units.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, and Australia. Rapid urbanization, escalating land prices, and housing affordability challenges are primary growth drivers. Prefabricated, modular, and compact designs are favored, enabling quicker deployment in high-density urban areas. Government support for sustainable housing, integration of energy-efficient technologies, and growing acceptance of flexible and minimalist living are contributing factors. Rising awareness of lifestyle-driven tiny homes among middle-class consumers and increased interest in short-term rental and tourism applications further accelerate market expansion.

Latin America

Latin America shows moderate but growing adoption, particularly in Brazil, Argentina, and Mexico. Key drivers include rising real estate costs, limited urban space, and increasing tourism demand for glamping and eco-resort options. International imports of prefabricated tiny homes complement local manufacturing capabilities, addressing both residential and recreational needs. Urban millennials and lifestyle-conscious consumers are adopting compact, mobile, and sustainable tiny home solutions, providing growth momentum for both residential and investment applications.

Middle East & Africa

MEA leverages tiny homes primarily for tourism, eco-resorts, and urban housing solutions. The Middle East, led by the UAE and Saudi Arabia, invests in lifestyle and vacation-oriented tiny homes, supported by high-income populations, luxury tourism demand, and innovative urban projects. African nations utilize tiny homes for affordable housing, community projects, and eco-tourism. Drivers include growing tourism infrastructure, government-backed affordable housing initiatives, and the adoption of sustainable building practices. Prefabricated, modular, and timber-based designs are increasingly favored to meet demand efficiently in both high-income urban centers and rural community developments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tiny Homes Market

- Cavco Industries

- Skyline Champion Corp.

- Clayton Homes

- Tumbleweed Tiny House Company

- Tiny Heirloom

- Escape Traveler

- Wheelhaus

- Mustard Seed Tiny Homes

- New Frontier Tiny Homes

- ICON Technology Inc.

- Meka Modular

- The Tiny Housing Co.

- Mini Mansions Tiny Home Builders LLC

- Aussie Tiny Houses / BAAHOUSE

- GREEN-house / Sustainable Eco-home Builders

Recent Developments

- In May 2025, Cavco Industries expanded its modular production facilities in the U.S., improving delivery times and adding sustainable design options for residential buyers.

- In April 2025, Tumbleweed Tiny House Company launched new eco-friendly prefab models in Europe, integrating solar panels and energy-efficient appliances.

- In February 2025, Escape Traveler introduced a series of mobile tiny homes for rental and tourism applications in the Asia-Pacific region, targeting digital nomads and vacation rental markets.