Television Services Market Size

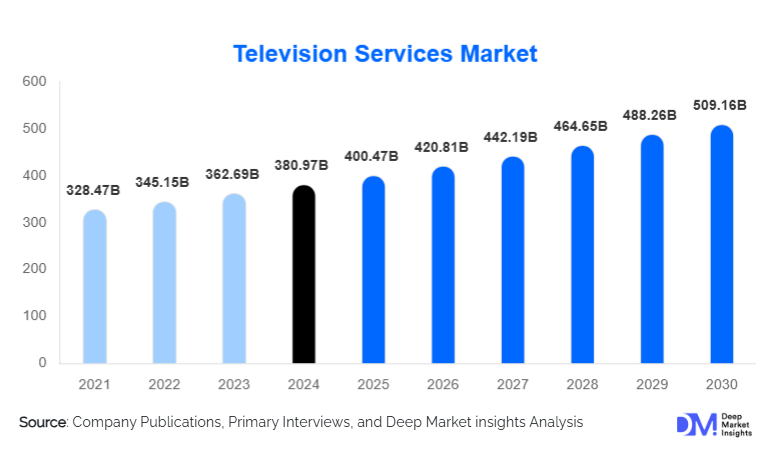

According to Deep Market Insights, the global television services market size was valued at USD 380.97 billion in 2024 and is projected to grow from USD 400.47 billion in 2025 to reach USD 509.16 billion by 2030, expanding at a CAGR of 5.08% during the forecast period (2025–2030). The market’s expansion is driven by the rapid adoption of OTT and IPTV platforms, the sustained relevance of live and premium broadcasting, rising broadband penetration in developing economies, and evolving consumer demand for flexible, personalised, and multi-device TV experiences.

Key Market Insights

- OTT and IPTV platforms are the fastest-growing segments, supported by rising broadband penetration, smart TV adoption, and growing demand for on-demand content.

- Cable and satellite TV continue to hold a combined 55–65% market share in 2024, though their growth is stabilising due to cord-cutting trends.

- North America dominates the global television services market, accounting for approximately 40% of total revenues in 2024, driven by high ARPU and strong streaming adoption.

- Asia-Pacific is the fastest-growing region, led by India, China, and Southeast Asia, where affordable IPTV and OTT services are seeing mass adoption.

- Hybrid bundling strategies (TV + broadband + mobile) are becoming central to revenue growth and customer retention for telecom and media companies.

- Advertising-supported video (AVOD) platforms are surging, driven by price-sensitive subscribers and the rise of targeted, programmatic ad technologies.

What are the latest trends in the Television Services Market?

OTT-Driven Transformation of Global Viewership

OTT services are fundamentally reshaping the television experience. Consumers increasingly favour subscription-based or ad-supported streaming platforms that offer on-demand access, binge-ready content libraries, and affordable monthly plans. Smart TV penetration and the proliferation of connected devices, streaming sticks, mobile phones, and tablets are enabling viewers to shift fluidly between screens. Major players are investing heavily in exclusive originals, localised content, flexible subscription tiers, and mobile-friendly plans to tap both mature and emerging markets. This shift is accelerating cord-cutting and pushing traditional broadcasters toward hybrid or streaming-first strategies.

Rise of Personalised & AI-Enhanced Television Experiences

Television services are incorporating AI-powered recommendation engines, predictive analytics, and user behavioural modelling to create personalised viewing journeys. Platforms now auto-curate content playlists, adapt advertising in real-time, and even adjust interface layouts based on viewer preferences. Smart TVs with embedded AI are integrating voice control, advanced search, and cross-platform content aggregation. For advertisers, AI-driven programmatic advertising enhances targeting accuracy, raising ROI and encouraging increased digital ad spending. These innovations are transforming TV from a linear, schedule-bound model into an intelligent, consumer-driven ecosystem.

What are the key drivers in the Television Services Market?

Growing Global Demand for On-Demand and Live Premium Content

Viewers now expect flexibility, on-demand movies, catch-up TV, binge-worthy series, and at the same time highly value live events such as sports, news, and international broadcasts. This dual consumption preference is significantly expanding revenue opportunities. Premium sports rights, in particular, continue to command high subscription prices. In emerging markets, surging demand for local-language content is a strong growth catalyst, with regional platforms becoming competitive alternatives to global services.

Rapid Broadband and Smart Device Penetration

The expansion of fibre networks, 4G/5G services, and affordable smartphones is making digital TV accessible to billions of new users. IPTV adoption is accelerating in countries deploying nationwide broadband infrastructure, while low-cost internet plans are encouraging OTT growth in price-sensitive markets. As smart TVs become standard, more viewers are transitioning from traditional TV boxes to app-driven content, thereby boosting platform diversification.

Bundled Telecom & TV Ecosystem Enhancing ARPU

Triple-play and quad-play packages (TV + broadband + mobile + OTT) are boosting subscriber retention and ARPU for telecom operators. Bundling reduces churn, simplifies billing, and enhances perceived value. Operators increasingly collaborate with OTT providers to integrate streaming apps directly into set-top boxes or telecom plans, creating seamless digital ecosystems that lock consumers into long-term service relationships.

What are the restraints for the global market?

Regulatory & Content Licensing Barriers

Licensing fees for premium content, especially sports rights and international movies, remain a significant cost burden. Regional regulations on censorship, broadcasting rights, and cross-border OTT distribution create operational complexities. Smaller players struggle to compete with large media conglomerates capable of acquiring expensive rights, slowing diversification and market entry.

Intensifying Cord-Cutting and Fragmented Subscription Fatigue

In developed markets, rising subscription costs and the availability of multiple competing streaming platforms have led consumers to cut traditional cable or satellite connections. Subscription fatigue is also emerging: viewers are increasingly selective, often opting for cheaper ad-supported offerings. Traditional broadcasters face revenue pressure as advertising shifts toward digital and streaming-based platforms.

What are the key opportunities in the Television Services Industry?

OTT & IPTV Expansion in Emerging Markets

Countries across Asia-Pacific, Latin America, and Africa are witnessing explosive growth in first-time internet users. Affordable smartphones and discounted data plans are enabling rapid adoption of mobile-first TV consumption. Operators can capture massive new audiences by offering localised content, micro-subscriptions, or mobile-only streaming packages. This is one of the largest revenue opportunities of the decade.

Data-Driven Advertising & Connected TV (CTV) Monetisation

As smart TVs gain traction, connected TV advertising is becoming a multibillion-dollar opportunity. Targeted ads, programmatic bidding, interactive ad formats, and personalised recommendations allow platforms to achieve higher CPMs compared to traditional TV. Brands are shifting significant budgets into CTV ecosystems, creating major revenue growth for streaming platforms, broadcasters, and ad-tech partners.

Hybrid Service Models & Next-Generation Bundling

Providers offering seamless integration between cable, satellite, IPTV, and OTT, in a single user interface, can differentiate themselves in crowded markets. Hybrid models eliminate customer friction, enabling consumers to switch between live TV, VOD, and streaming apps effortlessly. Telecom operators also have opportunities to create tiered bundles based on speed, content preferences, and device ecosystems.

Product Type Insights

Cable TV remains a dominant service type, holding approximately 30–35% of global market share in 2024 due to entrenched infrastructure and strong subscriber relationships. Satellite TV accounts for 25–30%, serving regions with limited terrestrial networks. IPTV has rapidly expanded to around 15–20% market share and continues to grow as broadband infrastructure improves. OTT services currently account for 10–15% of revenue but exhibit the fastest CAGR, supported by flexible pricing and rising global adoption. Hybrid TV solutions, combining broadcast and streaming content, are gaining traction as they provide seamless transitions between content formats and enrich user experience.

Application Insights

Residential viewing dominates global TV services consumption with 80–85% revenue share, supported by rising smart-home penetration and multi-screen family viewing habits. Commercial applications include hotels, hospitals, airports, gyms, restaurants, and corporate offices, collectively contributing 10–15% of market revenues. Institutions such as schools and government bodies utilise TV services for training and public information dissemination. Mobile streaming continues to emerge as a critical application, especially in high-growth markets where consumers rely on mobile data for content consumption.

Distribution Channel Insights

Direct-to-consumer digital platforms, OTT apps, IPTV portals, and service provider websites lead global distribution, offering personalised, subscription-based access. Traditional distribution channels through cable and satellite operators maintain strong relevance in developing regions. Telecom operators increasingly serve as key distribution partners through bundled plans and integrated content platforms. Retail electronics stores influence device-driven subscription activations through smart TVs and set-top boxes with preloaded applications.

End-User Insights

Households continue to generate the majority of TV service revenue, driven by rising demand for multi-device viewing and premium live content. Businesses, especially hospitality, aviation, and healthcare, represent a stable and growing end-user segment requiring commercial-grade TV packages. New end-use applications are emerging in transportation (buses, long-haul routes), educational institutions, and retail digital signage environments, broadening the commercial footprint of the market.

| By Delivery / Platform Type | By Revenue Model | By Content Type | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, contributing nearly 40% of global revenue in 2024. The U.S. leads adoption of OTT services, IPTV bundles, and premium cable packages. High household incomes and strong preference for exclusive content, sports broadcasting, and multi-stream subscriptions fuel market growth. Canada shows growing adoption of IPTV and digital cable upgrades. The region’s advanced broadband ecosystem and strong ad-tech value chain also make it a global hub for connected TV advertising.

Europe

Europe makes up approximately 18–20% of global revenue, driven by robust IPTV infrastructure in Western Europe and hybrid TV adoption in countries like the U.K., Germany, France, and the Nordics. EU-wide regulations support fair competition and transparency in digital broadcasting, while rising demand for localised content contributes to subscriber growth. Central and Eastern Europe are witnessing the fast adoption of OTT due to affordable subscriptions and improved broadband coverage.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding roughly 28% market share in 2024 and poised for rapid expansion through 2030. India and China drive massive subscriber growth across IPTV and mobile-first OTT. Japan, South Korea, and Australia represent mature markets with sophisticated hybrid services and high ARPU. Southeast Asia is emerging strongly due to youth-driven digital consumption and affordable streaming plans. Regional language content is a crucial differentiator, accelerating subscriber acquisition.

Latin America

Latin America contributes 7–8% of global revenues, with Brazil and Mexico leading adoption. While economic volatility affects spending power, affordable OTT and prepaid IPTV models are gaining significant traction. Satellite TV remains important in rural areas, but mobile broadband is enabling rapid digital migration among urban users.

Middle East & Africa

MEA represents 5–7% market share but offers a substantial long-term opportunity. Satellite TV dominates due to vast geography, but OTT subscriptions are rising, especially in GCC countries with high disposable incomes. Africa’s growing middle class and improving broadband infrastructure are set to drive IPTV and mobile-TV expansion. Government-backed digitisation initiatives support the transition to digital terrestrial and IP-based services.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Television Services Market

- Comcast Corporation

- AT&T (WarnerMedia)

- Netflix

- The Walt Disney Company

- Sky Group

- Charter Communications

- Dish Network

- Amazon Prime Video

- Verizon Communications

- Altice USA

- ViacomCBS (Paramount Global)

- DAZN Group

- Hulu

- BT Group

- Tencent Video

Recent Developments

- In March 2025, multiple global broadcasters launched AI-driven personalised content engines integrated directly into smart TVs.

- In January 2025, major OTT platforms expanded ad-supported tiers globally, targeting price-sensitive markets in Asia-Pacific and LATAM.

- In December 2024, telecom operators in Europe invested significantly in fibre-to-home networks to support next-gen IPTV and UHD streaming capabilities.