Tea Tree Oil Market Size

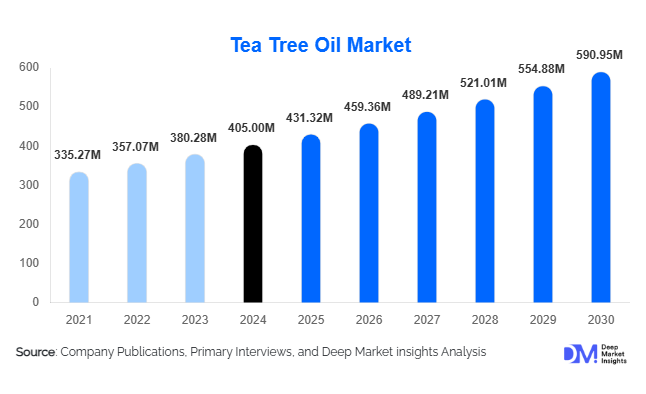

According to Deep Market Insights, the global tea tree oil market size was valued at USD 405.00 million in 2024 and is projected to grow from USD 431.32 million in 2025 to reach USD 590.95 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The tea tree oil market growth is primarily driven by rising consumer preference for natural and clean-label ingredients, expanding use in personal care and pharmaceutical formulations, and growing demand from aromatherapy and wellness industries worldwide.

Key Market Insights

- Tea tree oil demand is strongly aligned with the clean beauty and natural therapeutics movement, particularly in skincare, hair care, and topical pharmaceutical applications.

- Cosmetic and personal care applications dominate global consumption, supported by anti-acne, anti-dandruff, and antimicrobial product launches.

- Asia-Pacific leads global demand, driven by Australia’s production dominance and rapid consumption growth in China, India, Japan, and South Korea.

- North America remains a high-value consumption market, with strong demand for pharmaceutical-grade and organic tea tree oil.

- Organic and sustainably sourced tea tree oil is gaining traction, enabling premium pricing and long-term supplier contracts.

- Technological advancements in extraction and traceability are improving oil quality consistency and supply-chain transparency.

What are the latest trends in the tea tree oil market?

Rising Demand for Clean-Label and Organic Ingredients

One of the most prominent trends in the tea tree oil market is the growing shift toward clean-label, plant-based, and organic formulations. Consumers are increasingly avoiding synthetic preservatives, parabens, and chemical antimicrobials, driving manufacturers to incorporate tea tree oil as a multifunctional natural active ingredient. Organic tea tree oil, in particular, is gaining popularity among premium skincare and wellness brands due to its traceability, sustainability credentials, and perceived higher efficacy. This trend is accelerating certification programs and encouraging producers to adopt regenerative farming practices.

Integration into Pharmaceutical and Clinical Applications

Tea tree oil is increasingly being integrated into pharmaceutical and clinical-grade topical products, including antifungal creams, antiseptic solutions, and wound-care formulations. Advances in formulation science have enabled controlled concentration usage that meets regulatory standards while preserving efficacy. This trend is expanding tea tree oil’s application beyond cosmetics into higher-margin pharmaceutical segments, supported by growing clinical validation and physician acceptance.

What are the key drivers in the tea tree oil market?

Growing Personal Care and Cosmetic Industry

The global personal care and cosmetics industry remains the largest driver of tea tree oil demand, accounting for nearly half of total consumption. Tea tree oil is widely used in acne treatments, facial cleansers, shampoos, and scalp-care products due to its antimicrobial and anti-inflammatory properties. The rapid expansion of natural skincare brands, particularly in Asia-Pacific and North America, continues to fuel steady volume growth.

Rising Awareness of Antimicrobial and Therapeutic Benefits

Increasing awareness of tea tree oil’s antifungal, antibacterial, and antiviral properties has boosted its adoption in household cleaning products, topical medications, and aromatherapy. Post-pandemic hygiene awareness has further strengthened demand for natural antimicrobial agents, positioning tea tree oil as a preferred ingredient across multiple consumer categories.

What are the restraints for the global market?

Supply Concentration and Price Volatility

The tea tree oil market faces supply-side risks due to heavy production concentration in Australia, which accounts for more than two-thirds of global output. Climatic variability, crop yield fluctuations, and labor availability can lead to price volatility, affecting procurement planning for downstream manufacturers.

Regulatory Restrictions on Usage Levels

Strict regulatory guidelines governing concentration limits in cosmetics and pharmaceuticals can restrict formulation flexibility. Compliance with international standards such as ISO specifications increases testing and certification costs, particularly for smaller producers and new market entrants.

What are the key opportunities in the tea tree oil industry?

Expansion in Emerging Asia-Pacific Markets

Rapid urbanization, rising disposable incomes, and growing awareness of herbal and natural products in countries such as India, China, and Southeast Asia present significant growth opportunities. Localized production partnerships and private-label manufacturing can help companies tap into these high-growth markets.

Technology-Driven Quality and Sustainability Differentiation

Opportunities are emerging through the adoption of advanced extraction technologies such as CO₂ supercritical extraction and digital traceability systems. Producers that invest in yield optimization, sustainability certification, and carbon-neutral processing are well-positioned to secure premium contracts with global FMCG and pharmaceutical companies.

Product Grade Insights

Cosmetic and personal care grade tea tree oil dominates the market, accounting for approximately 41% of global demand in 2024, driven by its widespread use in skincare and haircare formulations. Pharmaceutical-grade tea tree oil represents a fast-growing segment due to its application in antifungal and antiseptic treatments. Food and flavor-grade oil remains a niche segment, constrained by regulatory approvals, while industrial-grade oil is primarily used in cleaning and agricultural applications.

Application Insights

Personal care and cosmetics represent the largest application segment, contributing nearly 46% of total market revenue in 2024. Pharmaceutical and therapeutic applications are expanding rapidly, supported by rising demand for topical treatments. Aromatherapy and wellness applications continue to grow steadily, while household cleaning and agriculture applications are emerging as complementary demand drivers.

Distribution Channel Insights

B2B bulk sales dominate the tea tree oil market, accounting for about 58% of global distribution, as manufacturers procure oil directly from producers. Specialty retail and pharmacies play a key role in consumer-facing sales, while e-commerce and direct-to-consumer platforms are expanding rapidly, particularly for branded essential oils and wellness products.

End-Use Insights

Cosmetics and personal care manufacturers constitute the largest end-use segment, followed by pharmaceutical companies and wellness brands. Household product manufacturers and the agriculture and veterinary sector represent smaller but growing end-use segments. Export-driven demand from Europe and North America continues to shape production strategies in Australia and the Asia-Pacific.

| By Product Grade | By Form | By Extraction Method | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global tea tree oil market with approximately 38% market share in 2024. Australia dominates production, while China, India, Japan, and South Korea drive consumption growth through expanding personal care and pharmaceutical industries. The region is also the fastest-growing, with a CAGR exceeding 9%.

North America

North America accounts for around 26% of global demand, led by the United States. Strong consumer preference for clean-label products, high awareness of therapeutic benefits, and robust pharmaceutical demand support market growth in this region.

Europe

Europe represents approximately 23% of the market, with Germany, France, and the United Kingdom as major consumers. Demand is driven by natural cosmetics, aromatherapy, and stringent quality standards favoring certified suppliers.

Latin America

Latin America is an emerging market, led by Brazil and Mexico. Growth is supported by expanding personal care consumption and increasing imports of essential oils for formulation.

Middle East & Africa

The Middle East & Africa region shows steady growth, supported by rising demand for natural cosmetics and increasing import volumes in the UAE and South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tea Tree Oil Market

- Thursday Plantation

- Australian Botanical Products

- G.R. Davis Pty Ltd

- Coromandel International

- NOW Health Group

- Florihana

- Phoenix Aromas

- AOS Products

- Native Extracts

- Plant Therapy

- Aura Cacia

- Young Living

- doTERRA

- Aethon International

- Mountain Rose Herbs