Tailoring and Alteration Services Market Size

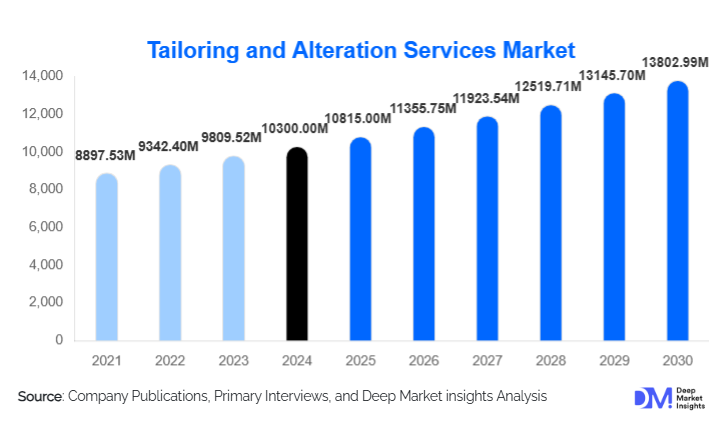

According to Deep Market Insights, the global tailoring and alteration services market size was valued at USD 10,300.00 million in 2024 and is projected to grow from USD 10,815.00 million in 2025 to reach USD 13,802.99 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). Market growth is driven by increasing apparel consumption, poor standard garment fitting, rising sustainability-led repair and reuse trends, and growing demand for customization across both developed and emerging economies.

Key Market Insights

- Garment alteration services dominate global demand, accounting for over half of total market revenue due to high-frequency usage across all apparel categories.

- Women’s apparel represents the largest end-use segment, supported by higher fashion turnover, occasion wear usage, and body-fit sensitivity.

- Asia-Pacific leads the global market, driven by strong cultural reliance on tailoring, a large skilled workforce, and rising middle-class spending.

- Online and app-based tailoring platforms are the fastest-growing delivery model, enabling convenience, standard pricing, and urban penetration.

- Sustainability and circular fashion trends are accelerating demand for garment repair, restyling, and life-extension services.

- Corporate and institutional uniform contracts are emerging as a stable, high-growth B2B revenue stream.

What are the latest trends in the tailoring and alteration services market?

Digital and On-Demand Tailoring Platforms

The tailoring industry is witnessing rapid digital transformation through mobile applications, online booking systems, and doorstep measurement services. Technology-enabled platforms allow consumers to schedule alterations, track orders, and receive garments at home, significantly improving convenience and transparency. Urban consumers, particularly younger demographics, are increasingly adopting app-based tailoring solutions that offer standardized pricing, faster turnaround, and quality assurance. The integration of AI-based body measurement tools and CRM-driven personalization is further enhancing customer retention and scalability for organized players.

Sustainability-Driven Garment Repair and Restyling

Growing awareness around textile waste and environmental impact is driving consumers to repair, resize, and restyle existing garments instead of discarding them. Tailoring services are becoming central to circular fashion ecosystems, supported by apparel brands offering in-store or post-purchase alteration partnerships. Consumers are increasingly opting for garment modification to extend usability, making sustainability a structural growth trend rather than a cyclical one.

What are the key drivers in the tailoring and alteration services market?

Rising Apparel Consumption and Poor Fit Accuracy

Mass-produced apparel often fails to meet individual body-fit requirements, especially with the growth of online clothing sales. This has led to consistent post-purchase demand for alterations such as hemming, resizing, and sleeve adjustments. The mismatch between standardized sizing and diverse body profiles remains one of the strongest structural drivers for tailoring services globally.

Growth in Formal, Occasion, and Ethnic Wear

Weddings, cultural ceremonies, corporate events, and professional dress codes continue to generate strong demand for precise fitting and customization. Emerging economies show robust growth in ethnic and traditional wear tailoring, while developed markets drive steady demand for formalwear and occasion-based alterations.

Sustainability and Cost-Conscious Consumer Behavior

Consumers are increasingly choosing tailoring services to repair or repurpose garments as a cost-effective alternative to purchasing new clothing. This behavior has proven resilient even during economic slowdowns, positioning tailoring services as a non-discretionary and stable market segment.

What are the restraints for the global market?

High Market Fragmentation and Low Standardization

The tailoring and alteration services market remains highly fragmented, dominated by small independent operators and informal businesses. This limits brand scalability, pricing consistency, and quality standardization, particularly in developing regions.

Shortage of Skilled Tailoring Labor

Tailoring is labor-intensive and skill-dependent, and younger workforces are increasingly reluctant to enter the profession. Rising labor costs and limited skill-transfer mechanisms pose challenges to capacity expansion and service consistency.

What are the key opportunities in the tailoring and alteration services industry?

Technology-Enabled Customization and AI-Based Fitting

The adoption of 3D body scanning, virtual fitting tools, and AI-powered measurement systems presents significant opportunities for organized players. These technologies can reduce rework, improve accuracy, and enable scalable operations across multiple locations.

Corporate and Institutional Uniform Contracts

The rapid expansion of healthcare, hospitality, aviation, logistics, and education sectors is increasing demand for uniforms requiring regular fitting and maintenance. Long-term service contracts offer predictable revenue streams and higher utilization rates for tailoring service providers.

Luxury and Bespoke Tailoring Growth

Premium and bespoke tailoring is experiencing renewed demand driven by weddings, high-net-worth individuals, and a preference for craftsmanship and exclusivity. Europe, the Middle East, and East Asia remain key growth regions for this segment.

Service Type Insights

Garment alteration services account for approximately 52% of the global market in 2024, driven by frequent use and affordability. Custom tailoring services represent around 34%, supported by formalwear and made-to-measure demand. Specialty tailoring services, including bridal wear, uniforms, and ethnic apparel, contribute the remaining 14%, with higher margins and event-driven demand.

End-Use Apparel Insights

Women’s apparel dominates with nearly 44% market share, followed by men’s apparel at 39% and children’s apparel at 17%. Women’s segment leadership is driven by higher garment variety, fashion cycles, and occasion wear consumption.

Delivery Model Insights

Physical tailoring stores remain dominant with around 62% share, reflecting trust and local accessibility. Home-based tailors account for 27%, particularly in emerging markets. Online and app-based platforms currently represent 11% but are the fastest-growing segment, expanding at over 8% CAGR.

Customer Type Insights

Individual consumers account for approximately 68% of global demand, while corporate and institutional clients contribute 22%. Fashion designers and apparel brands represent the remaining 10%, driven by the outsourcing of alterations and finishing services.

| By Service Type | By End-Use Apparel | By Customer Type | By Delivery Model | By Price Positioning |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global market with approximately 38% share in 2024. India alone contributes over USD 12 billion, supported by a vast tailoring workforce, cultural reliance on custom apparel, and growing urban demand. China, Japan, and Southeast Asia further strengthen regional dominance.

Europe

Europe accounts for around 26% of the market, led by Italy, the U.K., France, and Germany. Demand is driven by luxury tailoring, sustainability-led garment repair, and high spending on formalwear.

North America

North America holds approximately 22% share, with the U.S. as the primary contributor. Online apparel penetration, corporate dress codes, and premium tailoring services support steady demand.

Latin America

Latin America represents about 6% of the market, led by Brazil and Mexico. Urbanization and rising disposable incomes are gradually strengthening demand.

Middle East & Africa

This region accounts for roughly 8%, driven by luxury tailoring demand in GCC countries and uniform requirements across African economies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tailoring and Alteration Services Market

- Indochino

- Hugo Boss

- Ermenegildo Zegna

- Ralph Lauren

- Suitsupply

- Brooks Brothers

- Canali

- Brioni

- Jos. A. Bank

- Men’s Wearhouse

- Ascot Chang

- Turnbull & Asser

- Tailored Brands

- Brooks England

- Zegna Couture