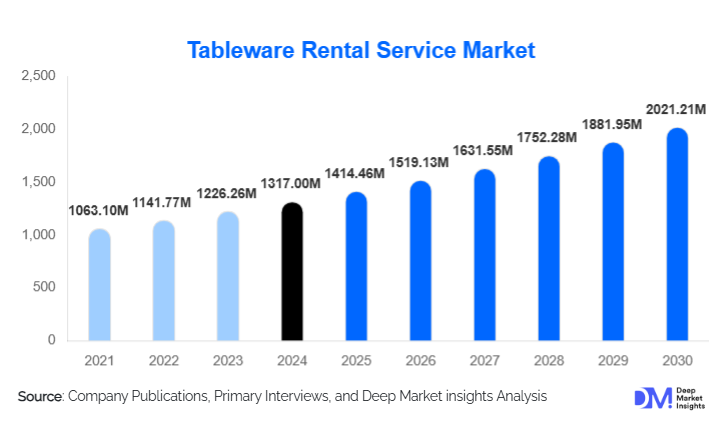

Tableware Rental Service Market Size

According to Deep Market Insights, the global tableware rental service market size was valued at USD 1,317.00 million in 2024 and is projected to grow from USD 1,414.46 million in 2025 to reach USD 2,021.21 million by 2030, expanding at a CAGR of 7.4% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for sustainable and reusable tableware solutions, the expansion of corporate events and hospitality sectors, and the adoption of technology-enabled rental platforms for efficient logistics and inventory management.

Key Market Insights

- Growing adoption of reusable and eco-friendly tableware is driving the market, with businesses and event organizers seeking alternatives to disposable products in line with ESG commitments.

- Full-service rental solutions are increasingly preferred, offering delivery, setup, cleaning, and pickup services that reduce operational burdens for corporates and hospitality providers.

- North America dominates the market, led by the U.S. and Canada, driven by high corporate event frequency and a mature hospitality ecosystem.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class affluence, organized event services, and expanding hospitality infrastructure in countries like China and India.

- Europe maintains steady growth, driven by luxury weddings, corporate conventions, and stringent sustainability regulations that encourage reusable tableware.

- Technology integration, including app-based bookings, RFID tracking, and AI-powered inventory management, is transforming operational efficiency and customer experience.

What are the latest trends in the tableware rental service market?

Sustainability-Driven Tableware Solutions

With global regulations and corporate ESG initiatives discouraging single-use tableware, rental providers are increasingly focusing on reusable, eco-certified, and designer tableware. Providers are offering sustainable materials, such as porcelain, glass, and bamboo, and incorporating water-efficient cleaning technologies. Lifecycle tracking and carbon-neutral service certifications are gaining importance, positioning rental services as eco-conscious alternatives to disposables.

Technology-Enabled Operations

Advanced technology adoption is reshaping the tableware rental market. RFID and GPS-enabled inventory systems allow real-time tracking of assets, reducing loss and breakage. AI-powered demand forecasting ensures optimal inventory allocation across events and locations, while mobile apps enable seamless booking, customized menu planning, and direct corporate contracts. Subscription models and recurring rental plans are becoming increasingly popular in the corporate and hospitality segments, enhancing predictability and customer retention.

What are the key drivers in the tableware rental service market?

Expansion of Corporate and Social Events

The increasing number and scale of corporate conferences, exhibitions, weddings, and large social gatherings have fueled demand for tableware rentals. Renting tableware allows organizers to scale inventory as needed without the high capital expenditure associated with ownership. Short-term events contribute the largest demand volume, particularly for premium and designer tableware.

Focus on Sustainable Practices

Environmental awareness and government regulations discouraging disposables have made reusable tableware rentals a necessity for businesses and hospitality providers. Companies are leveraging rental services to meet ESG requirements, improve brand reputation, and reduce operational waste. This trend is particularly strong in North America and Europe, where compliance and sustainability drive procurement decisions.

Operational Cost Optimization

Tableware rental services provide cost-effective solutions by converting fixed capital expenses into variable operational costs. Hotels, caterers, and event organizers benefit from reduced storage, maintenance, and cleaning costs while accessing a wide range of premium tableware designs. This efficiency encourages repeat and long-term rental contracts.

What are the restraints for the global market?

Logistics and Operational Complexity

Managing transportation, cleaning, and breakage for large inventories can be challenging, particularly for smaller providers. High operational overheads and the need for skilled staff can limit profitability and market scalability.

Seasonality and Demand Volatility

Demand for tableware rental services peaks during wedding seasons, corporate event periods, and holiday cycles, causing revenue fluctuations. Providers must carefully manage inventory utilization and storage capacity to maintain consistent profitability throughout the year.

What are the key opportunities in the tableware rental service market?

Emerging Regional Markets

Asia-Pacific and the Middle East present significant growth opportunities due to rising disposable incomes, expanding luxury weddings, and growing hospitality infrastructure. Companies can gain first-mover advantages by establishing regional warehouses, partnerships, and localized service offerings in high-demand countries like India, China, the UAE, and Saudi Arabia.

Integration of Technology

Providers integrating AI, mobile platforms, and RFID-enabled logistics are improving operational efficiency, reducing losses, and enhancing client experience. Subscription-based and contract-based rental services provide predictable revenue streams, especially for corporates and hotels, creating scalable business models.

Sustainability-Focused Premium Services

Eco-conscious event planning is creating opportunities for premium reusable tableware rentals. Providers offering designer, themed, and certified sustainable tableware can command higher margins and appeal to corporate, hospitality, and high-end wedding segments, differentiating themselves from generic rental services.

Product Type Insights

Dinnerware continues to dominate the tableware rental service market, accounting for approximately 38% of the 2024 market size. Its widespread adoption across weddings, corporate events, and hospitality operations makes it a staple requirement for rental providers. Demand for dinnerware is further boosted by trends in luxury and themed events, which require high-quality, aesthetically appealing plates, bowls, and serving sets. Glassware and flatware contribute significantly as well, particularly for corporate banquets, high-end social gatherings, and fine-dining experiences. Additionally, the specialty and designer tableware segments are witnessing rapid growth due to the rising demand for premium, personalized, and culturally themed event setups. This growth is driven by consumer preference for bespoke experiences and the willingness of event organizers to invest in visually distinctive table settings that elevate guest experiences.

Application Insights

Corporate and business events account for the largest end-use share, approximately 31% in 2024. This segment benefits from recurring rental contracts for conferences, exhibitions, trade shows, and large-scale corporate gatherings. Weddings, social events, and hospitality banquets remain critical drivers of the market, particularly in regions with high disposable incomes and strong event cultures. Emerging applications include government and institutional events, destination weddings, and innovative pop-up dining experiences, reflecting the diversification of rental services. The growing trend of experience-focused events, where aesthetics and functionality of tableware are emphasized, is significantly influencing the expansion of all application segments.

Distribution Channel Insights

Direct rental platforms and D2C websites are increasingly preferred, offering real-time inventory availability, customization options, and seamless booking processes. Full-service providers, which include delivery, setup, and pickup, dominate the market due to the operational convenience they provide for corporates and hospitality clients. Smaller operators typically rely on local agency partnerships or event management firms. Technology-enabled distribution channels, including app-based rentals and subscription models, are gaining traction, enabling improved logistics, higher inventory utilization, and better client engagement. Corporate clients are particularly adopting these channels for recurring events and long-term contracts.

Customer Insights

Corporate event planners, hotels, catering companies, and wedding organizers constitute the primary customer base for tableware rental services. Large-scale events drive the highest demand, given the volume of tableware required and the complexity of logistics. Smaller events, including private gatherings and boutique weddings, often utilize per-item or per-event rental models. Subscription-based and contractual rental models are increasingly preferred among corporate campuses, hotels, and resorts due to their operational efficiency, predictable costs, and ease of planning recurring events. Demand is also being influenced by the growing expectation for sustainable and premium tableware offerings.

| By Product Type | By End User | By Service Model | By Pricing Model | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global market (34% in 2024), driven primarily by the U.S. and Canada. The dominance is supported by a mature corporate events industry, a high frequency of luxury weddings, and a strong hospitality sector that favors outsourcing tableware logistics to specialized rental providers. Sustainability and ESG compliance further accelerate demand for reusable tableware. Technological adoption, including RFID tracking, app-based bookings, and inventory management systems, has optimized operational efficiency, contributing to growth in this region. Additionally, the prevalence of large-scale conferences, exhibitions, and institutional events ensures steady recurring demand.

Europe

Europe accounts for approximately 27% of the market, with Germany, France, the U.K., and Italy leading demand. Luxury weddings, high-end corporate events, and strict regulations on disposable tableware are the primary drivers. European clients increasingly prefer full-service rental solutions, combining delivery, setup, and cleaning, which enhances operational efficiency. The adoption of technology-enabled rental platforms has strengthened market growth. Furthermore, sustainability awareness and government initiatives encouraging eco-friendly event practices support the expansion of reusable and premium tableware rentals across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region (11.5% CAGR), led by China, India, Japan, and Australia. Rising middle-class incomes, urbanization, and expanding tourism infrastructure are major growth drivers. The hospitality and wedding industries are witnessing rapid development, creating significant demand for high-quality, designer tableware. Sustainable practices and the adoption of full-service rentals for corporate events and luxury weddings are also fueling growth. Additionally, the increasing popularity of destination weddings and international events has prompted rental providers to offer scalable and regionally diverse inventories.

Latin America

Brazil and Mexico dominate the Latin American market (6% share). Growth is driven by social events, luxury weddings, and emerging hospitality infrastructure in urban centers. Demand is supported by rising disposable incomes and the adoption of organized event management practices. Outbound travel for destination events and international weddings is also gradually boosting demand. The region is increasingly adopting technology-based rental platforms, enabling event organizers to streamline operations and improve service quality for large-scale events.

Middle East & Africa

The Middle East & Africa market holds 7% share, with the UAE and Saudi Arabia as the leading contributors. Growth is fueled by mega-events, luxury tourism, and a high-income consumer base seeking premium tableware rentals. Rapid development of hospitality infrastructure, government investments in tourism, and regional events such as expos and international conferences create consistent demand. The presence of localized warehouses and full-service rental solutions further supports operational efficiency. In Africa, intra-regional travel and local high-profile social events are emerging as additional growth drivers for tableware rental services.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tableware Rental Service Market

- CORT Events

- Classic Party Rentals

- United Rentals (Event Services Division)

- Bright Event Rentals

- AFR Furniture Rental

- Party City Holdings (Event Rentals)

- Options Greentable

- Event Source

- Tavola Fine Linen

- Marquee Event Rentals

- Luxe Event Rentals

- Event Rentals Inc.

- TableArt

- A1 Party & Event Rentals

- Design Cuisine Event Rentals