Tabletop Kitchen Products Market Size

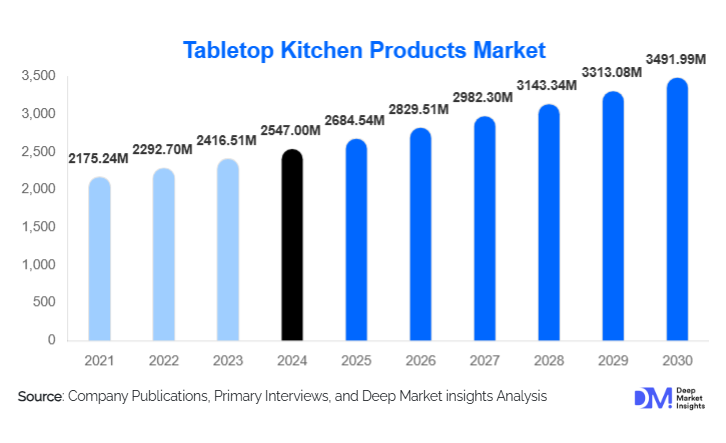

According to Deep Market Insights, the global tabletop kitchen products market size was valued at USD 2,547.00 million in 2024 and is projected to grow from USD 2,684.54 million in 2025 to reach USD 3,491.99 million by 2030, expanding at a CAGR of 5.4% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer focus on dining aesthetics, premium home décor trends, expansion of the hospitality sector, and increasing replacement demand across residential and commercial end uses.

Key Market Insights

- Premiumization of everyday dining is reshaping consumer preferences, with higher demand for coordinated dinnerware and designer serveware.

- Residential households dominate demand, supported by urbanization, nuclear family growth, and rising per-capita ownership of tabletop products.

- Asia-Pacific accounts for the largest share of global demand, driven by population scale, rising incomes, and hospitality expansion.

- Online retail is the fastest-growing distribution channel, benefiting from product visibility, customization options, and direct-to-consumer strategies.

- Ceramic and porcelain materials lead due to durability, design flexibility, and premium appeal.

- Sustainability and material innovation are increasingly influencing purchase decisions, especially in Europe and North America.

What are the latest trends in the tabletop kitchen products market?

Premium and Design-Led Tabletop Products

Consumers are increasingly viewing tabletop kitchen products as lifestyle and décor items rather than basic utilities. This has driven demand for premium designs, coordinated table settings, and limited-edition collections. Brands are emphasizing minimalist aesthetics, cultural motifs, and artisanal finishes to differentiate offerings. The trend is particularly strong in urban households and among younger consumers who prioritize social dining and home entertaining experiences.

Sustainable and Eco-Friendly Materials

Sustainability has become a central trend, with growing adoption of bamboo, wood composites, recycled glass, and lead-free ceramics. Manufacturers are investing in environmentally responsible production processes, reducing packaging waste, and complying with food safety and sustainability regulations. This trend is gaining traction across Europe and parts ofthe Asia-Pacific, where regulatory frameworks and consumer awareness strongly favor eco-friendly products.

What are the key drivers in the tabletop kitchen products market?

Growth of the Hospitality and Foodservice Sector

The global expansion of hotels, restaurants, cafés, and cloud kitchens is a major driver of demand for tabletop kitchen products. Commercial operators require durable, standardized, and visually appealing dinnerware and serveware, resulting in recurring bulk procurement. Post-pandemic recovery in travel and dining has significantly boosted demand from the HoReCa segment, particularly for ceramic, glass, and stainless-steel products.

Rising Disposable Income and Urban Lifestyles

Increasing disposable incomes and urbanization are driving higher spending on home décor and dining experiences. Consumers are upgrading from basic plastic or low-cost products to mid-premium and premium tabletop items. This driver is especially prominent in Asia-Pacific and Latin America, where middle-class expansion is accelerating lifestyle-oriented consumption.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in the prices of ceramic minerals, stainless steel, glass, and energy inputs have increased production costs for manufacturers. Intense competition limits the ability to fully pass on cost increases to consumers, compressing profit margins, particularly in the mass-market segment.

High Market Fragmentation and Price Competition

The presence of numerous regional and unorganized manufacturers creates pricing pressure, especially in developing markets. Private-label brands and low-cost producers challenge established players, making differentiation and margin protection increasingly difficult.

What are the key opportunities in the tabletop kitchen products industry?

Expansion of Online and Direct-to-Consumer Channels

The rapid growth of e-commerce presents a significant opportunity for manufacturers to improve margins, gather consumer insights, and launch customized or limited-edition products. Direct-to-consumer platforms allow brands to build loyalty, optimize pricing strategies, and expand reach in both developed and emerging markets.

Hospitality-Led Demand in Emerging Economies

Tourism-driven economies in the Asia-Pacific, the Middle East, and Africa are investing heavily in hospitality infrastructure. This creates long-term opportunities for suppliers of durable and standardized tabletop products through institutional contracts and long-term partnerships with hotel chains and restaurant groups.

Product Type Insights

Dinnerware dominates the tabletop kitchen products market, accounting for approximately 34% of global revenue in 2024. Its leading position is primarily driven by its essential utility in daily dining and frequent replacement cycles due to wear and breakage. Consumers are increasingly prioritizing aesthetic appeal and design coordination in dinnerware, which boosts the demand for premium and designer sets. Serveware and drinkware follow as significant contributors, supported by growing trends in home entertaining, social dining, and the rising demand from hotels and restaurants seeking stylish, durable products. Table accessories and specialty tabletop products, including condiment sets, cheese boards, and thematic serveware, are niche but fast-growing segments. These are propelled by gifting trends, festive consumption, and the increasing desire for unique, experiential dining settings, especially in urban households and luxury hospitality environments.

Material Insights

Ceramic and porcelain products lead the market with nearly 38% share in 2024, attributed to their durability, heat resistance, versatility in design, and premium aesthetic appeal. Glass and stainless steel materials follow, driven by modern dining preferences, functionality, and extensive usage in commercial settings such as restaurants, hotels, and institutional cafeterias. Additionally, wood, bamboo, and other sustainable materials are witnessing growing adoption, particularly in eco-conscious and premium product lines. The rising consumer focus on environmentally friendly alternatives and the integration of natural materials in home décor are providing additional momentum for these categories.

Distribution Channel Insights

Offline retail remains the dominant distribution channel, accounting for nearly 58% of global sales in 2024. Supermarkets, department stores, and specialty homeware outlets continue to drive bulk sales and brand visibility. Nevertheless, online retail is the fastest-growing channel, expanding at over 8% CAGR. Factors driving online growth include convenience, access to a broader product assortment, competitive pricing, and the ability for consumers to purchase customized or premium collections directly from brands. E-commerce platforms also allow manufacturers to collect data-driven insights for marketing, inventory management, and product innovation.

End-Use Insights

Residential households account for approximately 62% of total demand, largely driven by lifestyle upgrades, home décor trends, and frequent replacement cycles. Increasing disposable income, urbanization, and the rise of nuclear families have also contributed to residential demand. The HoReCa segment is the fastest-growing end-use category, expanding at nearly 6.8% CAGR. This growth is supported by the global expansion of the hospitality sector, increased dining out trends, and rising consumer expectations for premium dining experiences in hotels and restaurants. Institutional end users, including educational facilities, hospitals, and corporate cafeterias, provide stable, volume-driven demand through standardized procurement and long-term supply contracts, further stabilizing the market.

| By Product Type | By Material | By End Use | By Distribution Channel | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 26% of the global market in 2024, led by the United States. Growth is driven by high disposable incomes, a strong culture of premium dining, and significant hospitality and institutional demand. Consumers increasingly seek designer dinnerware and coordinated table settings for home entertaining. The HoReCa segment is a key driver, with hotels and restaurants investing in durable, aesthetically appealing tabletop products. Additionally, e-commerce penetration in North America is high, supporting the growth of both mass-market and premium products.

Europe

Europe held nearly 23% market share in 2024, driven by Germany, France, the U.K., and Italy. Regulatory emphasis on sustainability and the rising preference for eco-friendly and premium ceramic products strongly influence consumer choices. Urbanization, rising disposable income, and a culture of home entertaining further drive demand for designer tabletop products. Commercial demand from high-end restaurants, hotels, and institutional buyers also supports market expansion. Additionally, the trend of gifting premium homeware during festivals and social occasions contributes to segment growth.

Asia-Pacific

Asia-Pacific represents the largest and fastest-growing region, accounting for around 31% of global demand. Growth is primarily fueled by China, India, and Japan. Key drivers include rising middle-class incomes, rapid urbanization, and a burgeoning hospitality sector catering to both domestic and international tourism. The residential segment benefits from increasing home ownership and lifestyle upgrades, while HoReCa demand is expanding alongside the proliferation of hotels, restaurants, and cafes. E-commerce adoption is high, enabling consumers to access premium and niche products. Cultural preferences for gifting and table décor during festivals also contribute to regional growth.

Latin America

Latin America contributes approximately 8% of global revenue, led by Brazil and Mexico. Market expansion is supported by urbanization, rising consumer spending on home décor, and increased retail penetration of both organized and e-commerce channels. Residential demand is fueled by lifestyle upgrades and replacement cycles, while hospitality-led demand is growing due to the expansion of mid-tier hotels and restaurant chains. Promotional and seasonal buying during festivals further supports product uptake in this region.

Middle East & Africa

Demand in the Middle East and Africa is driven by tourism-focused economies such as the UAE and Saudi Arabia, as well as the increasing sophistication of the hospitality sector. High-income populations, premium dining culture, and growth in hotel and restaurant infrastructure support market expansion. Residential consumers in urban centers also favor luxury and designer tabletop products. Additionally, government initiatives promoting tourism and luxury hospitality are creating long-term opportunities for both domestic and imported tabletop kitchen products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tabletop Kitchen Products Market

- IKEA

- Villeroy & Boch

- Arc International

- Fiskars Group

- Lenox Corporation

- Lifetime Brands

- Libbey Inc.

- Churchill China

- Noritake

- WMF Group