Tabletop Glassware Market Size

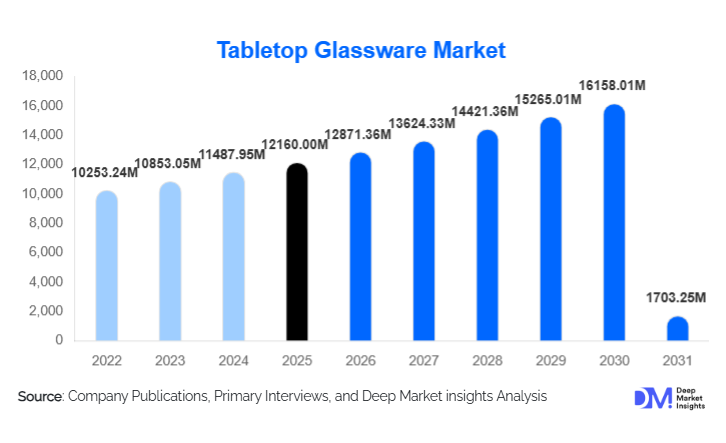

According to Deep Market Insights, the global tabletop glassware market size was valued at USD 12,160.00 million in 2025 and is projected to grow from USD 1,2871.36 million in 2026 to reach USD 1,7103.25 million by 2031, expanding at a CAGR of 5.85% during the forecast period (2026–2031). The tabletop glassware market growth is primarily driven by rising household spending on lifestyle products, expansion of the global hospitality industry, increasing preference for premium dining experiences, and continuous product innovation focused on durability, aesthetics, and sustainability.

Key Market Insights

- Drinkware dominates global demand, accounting for over 60% of total market value due to high replacement frequency and extensive use across residential and commercial settings.

- Mid-range and premium everyday glassware lead value consumption, as consumers seek a balance between affordability, design, and durability.

- Europe and North America together account for nearly 60% of global market share, supported by high per-capita consumption and mature hospitality sectors.

- Asia-Pacific is the fastest-growing region, driven by urbanization, hospitality expansion, and rising disposable incomes in China and India.

- Sustainability and lead-free crystal adoption are reshaping product portfolios, particularly in Europe and North America.

- Online and D2C channels are gaining momentum, driven by shifting consumer buying behavior and enhanced logistics.

What are the latest trends in the tabletop glassware market?

Premiumization and Design-Led Glassware

The tabletop glassware market is witnessing a strong shift toward premium and design-driven products. Consumers are increasingly opting for crystal, lead-free crystal, and aesthetically refined glassware to enhance dining and entertaining experiences at home. Design differentiation, minimalist aesthetics, and artisanal finishes are gaining popularity, especially in urban households and premium hospitality establishments. Limited-edition collections and designer collaborations are helping brands command higher margins and strengthen brand identity.

Sustainable and Lightweight Glass Innovations

Sustainability has become a key trend shaping the tabletop glassware industry. Manufacturers are investing in recyclable materials, increasing cullet usage, and utilizing energy-efficient furnaces to comply with regulations and meet consumer expectations. Lightweight and toughened glass technologies are being adopted to reduce breakage, improve safety, and lower transportation costs. Eco-label certifications and dishwasher-safe coatings are further improving product acceptance across residential and commercial segments.

What are the key drivers in the tabletop glassware market?

Expansion of the Global Foodservice Industry

The rapid growth of restaurants, cafés, bars, hotels, and catering services is a major driver for tabletop glassware demand. Commercial establishments require durable, standardized, and visually appealing glassware in large volumes, leading to consistent replacement demand. The expansion of quick-service restaurants and organized dining chains in emerging markets is further strengthening this driver.

Rising Household Spending on Home Dining and Gifting

Consumers are increasingly investing in home dining experiences, driven by lifestyle changes and social entertaining trends. Tabletop glassware is also widely used as a gifting product during festivals, weddings, and corporate events. These factors support stable residential demand and accelerate growth in mid-range and premium glassware categories.

Technological Advancements in Glass Manufacturing

Advancements in automated production, tempering, and chemical strengthening technologies have enhanced product durability while reducing costs. Machine-made glassware now offers consistent quality at scale, enabling manufacturers to serve both mass-market and horeca customers efficiently.

What are the restraints for the global market?

Volatility in Raw Material and Energy Costs

Glass manufacturing is energy-intensive and highly sensitive to fluctuations in soda ash, silica sand, and fuel prices. Rising energy costs, particularly in Europe, have pressured margins and forced periodic price increases, which can impact demand in price-sensitive markets.

Competition from Alternative Materials

High-grade plastics, stainless steel, and ceramic alternatives are increasingly used in casual dining, outdoor settings, and institutional applications. These substitutes offer advantages such as lower breakage risk and lighter weight, posing competitive pressure on traditional glassware.

What are the key opportunities in the tabletop glassware industry?

Hospitality Expansion in Emerging Economies

Rapid investments in hotels, resorts, and foodservice infrastructure across Asia-Pacific, the Middle East, and parts of Latin America present long-term growth opportunities. Countries such as India, Vietnam, Indonesia, the UAE, and Saudi Arabia are emerging as high-potential markets for commercial glassware suppliers.

Sustainability-Focused Product Differentiation

Manufacturers that invest in lead-free crystal, recycled glass usage, and energy-efficient production can access premium retail channels and institutional buyers with strict sustainability mandates. This creates opportunities for margin expansion and long-term brand loyalty.

Product Type Insights

Drinkware is the largest and most dominant product category in the global tabletop glassware market, accounting for approximately 62% of total market value in 2024. This leadership is primarily driven by the high-frequency usage and replacement cycles of products such as tumblers, wine glasses, beer mugs, and cocktail glasses across both residential households and commercial foodservice establishments. The growth of global hospitality, increasing consumption of alcoholic and non-alcoholic beverages, and rising consumer interest in home entertaining and barware collections continue to reinforce demand for drinkware. Additionally, premiumization trends, such as demand for crystal wine glasses, stemware, and specialty cocktail glasses, are further boosting value growth within this segment.

Dinnerware glass products, including plates, bowls, and serving dishes, represent a smaller yet stable portion of the market. Demand for this segment is supported by everyday household use and institutional applications, particularly in hotels and catering services that favor glass dinnerware for its visual appeal and hygiene benefits. Meanwhile, table accessories such as jugs, decanters, pitchers, and condiment containers are experiencing steady growth, driven by premium dining trends, fine-dining restaurant demand, and consumer preference for coordinated tabletop aesthetics. This segment benefits from higher average selling prices and is increasingly positioned as a lifestyle and gifting category.

End-Use Insights

Residential households account for approximately 55% of global tabletop glassware demand, making them the largest end-use segment. Demand in this segment is supported by regular replacement cycles due to breakage, evolving design preferences, and a strong gifting culture associated with festivals, weddings, and special occasions. Rising disposable incomes, urban living, and the growing popularity of home dining and social entertaining are further strengthening residential consumption, particularly for mid-range and premium glassware.

The commercial segment, which includes hotels, restaurants, cafés, bars, and catering services, is the fastest-growing end-use category, expanding at a CAGR of over 6%. Growth is driven by the rapid expansion of organized foodservice chains, increasing hotel construction, and frequent replacement requirements due to heavy usage. Commercial buyers prioritize durability, stackability, and design consistency, leading to large-volume procurement contracts with manufacturers. Institutional demand from airlines, railways, corporate dining facilities, healthcare institutions, and educational campuses represents a niche but stable segment, supported by standardized procurement and long-term supply agreements.

Distribution Channel Insights

Offline retail channels continue to dominate the tabletop glassware market, accounting for approximately 63% of total sales. Specialty homeware stores, departmental stores, and horeca supply outlets remain the preferred purchasing points, particularly for premium and bulk commercial orders where product inspection, brand trust, and after-sales support are critical. Offline channels are especially strong in Europe and North America, where established retail networks and brand showrooms play a key role in influencing purchasing decisions.

However, online distribution channels are growing rapidly at a CAGR exceeding 8%, driven by increasing e-commerce penetration, improved logistics, and shifting consumer buying behavior. Brand-owned websites, online marketplaces, and direct-to-consumer (D2C) platforms are gaining traction as manufacturers seek to improve margins, offer customization, and engage directly with end customers. Omnichannel strategies, integrating online discovery with offline fulfillment, are increasingly being adopted, particularly by premium and lifestyle-oriented glassware brands.

| By Product Type | By End Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Europe

Europe accounts for approximately 32% of the global tabletop glassware market, making it the largest regional market. Germany, France, Italy, and the UK are the primary demand centers, supported by a strong design heritage, high per-capita consumption, and a well-established hospitality industry. The region is a global hub for premium and crystal glassware, with consumers placing strong emphasis on aesthetics, craftsmanship, and brand legacy. Regulatory focus on sustainability, lead-free crystal, and recyclable materials is a key driver shaping product innovation and replacement demand. Additionally, Europe’s mature horeca sector ensures consistent commercial consumption, reinforcing regional market leadership.

North America

North America holds approximately 28% market share, driven predominantly by the United States, followed by Canada. High disposable incomes, widespread adoption of premium homeware products, and a large, organized foodservice industry are the primary drivers of regional demand. Replacement-driven consumption is a defining characteristic of this market, as households and commercial establishments frequently upgrade glassware for design, durability, and branding purposes. The strong culture of home entertaining, cocktail consumption, and gifting further supports steady demand for drinkware and premium table accessories.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR of over 7%. China and India are the largest contributors, driven by rapid urbanization, expansion of hospitality infrastructure, and rising middle-class disposable incomes. Increasing exposure to Western dining habits, growth of cafés and casual dining chains, and rising domestic tourism are significantly boosting demand for tabletop glassware. Japan and Southeast Asian countries contribute stable growth, particularly in premium and specialty glassware, supported by design-conscious consumers and a growing gifting culture. Manufacturing capacity expansion within the region also improves product affordability and availability.

Latin America

Latin America exhibits moderate growth, led by Brazil and Mexico. Demand is supported by the gradual expansion of the hospitality sector, urban population growth, and increasing middle-class consumption. While price sensitivity remains a factor, demand for durable and affordable glassware is rising across residential and commercial applications. International hotel chains entering the region are also contributing to consistent commercial demand.

Middle East & Africa

The Middle East is witnessing steady growth, driven by hospitality-led demand in countries such as the UAE and Saudi Arabia. Large-scale investments in hotels, resorts, restaurants, and tourism infrastructure are creating sustained demand for commercial-grade and premium tabletop glassware. Africa shows selective growth, primarily linked to tourism hubs and urban retail expansion. Rising tourism activity, coupled with growing urban consumer markets in select countries, supports gradual demand expansion across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tabletop Glassware Market

- Arc International

- Libbey Inc.

- Pasabahce (Şişecam Group)

- Bormioli Rocco

- Riedel Group

- Zwiesel Glas

- Ocean Glass

- Villeroy & Boch

- Krosno Glass

- Duralex

- Nachtmann

- Stölzle Lausitz

- Luigi Bormioli

- Crystalex

- Luminarc