Table Tennis Footwear Market Size

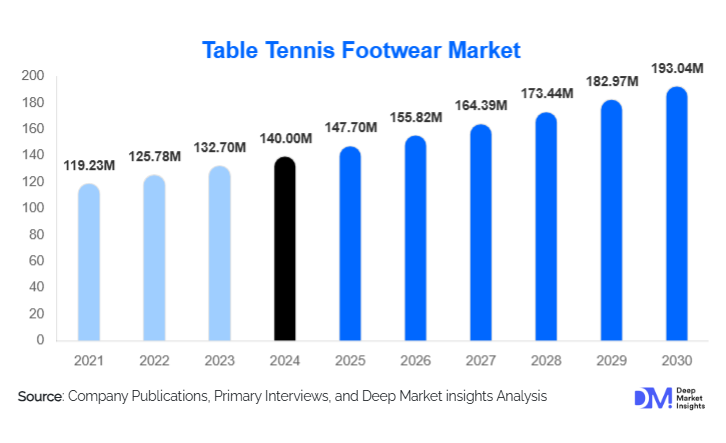

According to Deep Market Insights, the global Table Tennis Footwear Market was valued at USD 140 million in 2024 and is projected to reach USD 147.7 million in 2025 and USD 193.04 million by 2030, expanding at a steady CAGR of 5.5% (2025–2030). Market expansion is driven by the rising popularity of table tennis across professional and recreational segments, increasing investment in performance-oriented footwear technology, and growing consumer preference for lightweight, stable, and sport-specific designs. Asia-Pacific remains the largest and fastest-growing regional market, with China, Japan, and India contributing most of the demand.

Key Market Insights

- Men’s performance footwear dominates the market, accounting for nearly 65% of the total revenue share in 2024, supported by a larger male player base and higher product availability.

- Asia-Pacific leads the global market with approximately 45% share in 2024, driven by widespread participation and robust local manufacturing.

- Online retail channels are expanding rapidly, capturing about 40% of 2024 sales as brands shift toward direct-to-consumer (D2C) strategies.

- Recreational and home-use segments are the fastest-growing end-users, reflecting rising adoption of table tennis in schools, offices, and leisure facilities.

- Product innovation is accelerating, with manufacturers introducing advanced grip systems, breathable 3D-knit uppers, and eco-friendly materials.

- Leading brands such as Mizuno, ASICS, and Li-Ning dominate the performance segment, while global sports giants like Adidas and Nike expand via crossover indoor-court designs.

What are the latest trends in the table tennis footwear market?

Performance-Driven Innovation

Manufacturers are increasingly investing in lightweight materials, responsive midsole technologies, and improved lateral stability designs tailored for table-tennis-specific footwork. Carbon-infused plates and gum-rubber outsoles provide superior grip and traction on indoor floors, while 3D-knit uppers enhance flexibility and ventilation. Brands are also developing gender-specific fits and wider sizing options, addressing growing female participation. This trend toward functional innovation not only enhances player performance but also allows manufacturers to command premium pricing.

Sustainable and Eco-Friendly Materials

Growing consumer awareness about environmental impact is prompting footwear brands to integrate sustainable materials and production methods. Recycled polyester fabrics, water-based adhesives, and biodegradable packaging are increasingly adopted. This aligns with corporate sustainability goals and resonates strongly with younger players who prioritize eco-friendly products. Several brands are launching “green lines” of table tennis footwear, leveraging marketing campaigns around sustainability and performance synergy.

Digital Sales and Direct-to-Consumer Growth

Online platforms and D2C models are reshaping how players purchase footwear. E-commerce penetration allows small niche brands to reach global customers, while major players like Mizuno and ASICS are strengthening online configurators and virtual try-on tools. Social-media-driven marketing, influencer endorsements, and athlete collaborations enhance visibility. This digital transformation is expected to sustain double-digit online growth annually through 2030.

What are the key drivers in the table tennis footwear market?

Increasing Global Participation and Club Expansion

Table tennis has evolved from a competitive sport into a popular recreational activity worldwide. Expansion of clubs, indoor sports complexes, and institutional sports programs fuels footwear demand. Asia’s dominance in participation, coupled with growing interest in Europe and North America, provides a continuous inflow of new players requiring specialized footwear.

Rising Awareness of Sport-Specific Performance Gear

Players now recognize the importance of sport-specific shoes that enhance grip, prevent injury, and support rapid lateral movements. Marketing campaigns and endorsements from professional athletes are accelerating adoption, particularly among amateur and intermediate players seeking performance advantages.

Expansion of Online Retail Networks

The rise of e-commerce has democratized access to professional-grade footwear. Consumers can now directly compare technical features and pricing, increasing product visibility and global reach. This accessibility has been a major driver of demand outside traditional strongholds like China and Japan.

What are the restraints for the global market?

Limited Market Scale and Economies of Scale Challenges

Despite consistent growth, table tennis footwear remains a niche within the broader athletic footwear industry. Lower production volumes restrict cost efficiencies, leading to higher prices and slower innovation cycles compared to mainstream categories such as running or basketball shoes.

Substitution by Multi-Sport Indoor Shoes

Many amateur players continue to use general indoor-court footwear for badminton or volleyball instead of table-tennis-specific models. This substitution effect limits dedicated footwear demand, especially in cost-sensitive markets where consumers prioritize versatility and price over specialization.

What are the key opportunities in the table tennis footwear industry?

Emerging Market Expansion

Rapid urbanization and government-led sports promotion in countries such as India, Indonesia, and Brazil are opening new consumer bases. Affordable, durable footwear lines designed for mass-participation programs can capture untapped demand in these developing regions. Strategic partnerships with local distributors and federations can further strengthen market penetration.

Technological Integration and Customization

Digital design and manufacturing advances are enabling personalized footwear solutions, custom fits, grip patterns, and cushioning tailored to player preferences. Integration of motion-capture analytics and 3D-printing techniques provides new opportunities for differentiation, particularly in the premium segment.

Government and Institutional Sports Programs

National sports initiatives such as “Fit India Movement” and “Made in China 2025” are fostering local production and youth engagement in racket sports. These programs encourage domestic footwear manufacturing and provide incentives for R&D investment, creating opportunities for new entrants and expanding supply capacity.

Product Type Insights

Men’s table-tennis shoes dominate the market, representing nearly 65% of total revenue in 2024. This leadership stems from a larger male player base and wider model availability. Women’s footwear, however, is gaining traction as female participation increases in professional and recreational play. Unisex and junior shoes are also expanding, driven by school-level training programs and youth tournaments.

End-User Insights

Recreational and home-use players represent the fastest-growing end-user segment, accounting for about 30% of the market in 2024. Growth is fueled by the installation of table-tennis setups in schools, offices, and households. Club and intermediate players maintain consistent demand for mid-range performance shoes, while elite athletes prefer premium lightweight models designed for competition.

Distribution Channel Insights

Online retail channels captured nearly 40% of global sales in 2024 and continue to rise with D2C brand initiatives and social-media-driven marketing. Offline retail, comprising specialty sports stores, pro-shops, and sporting-goods chains, remains important for try-before-buy experiences but is expected to cede additional share to online channels by 2030.

| By Product Type | By Material Type | By Cushioning Technology | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global table tennis footwear market, holding about 45% share in 2024. China, Japan, and Korea lead both production and consumption. China alone contributes nearly 30% of global demand, supported by large player bases and local manufacturing. India and Southeast Asia are emerging growth frontiers due to increasing recreational participation and affordable product launches. APAC is forecast to remain the fastest-growing region through 2030.

North America

North America accounts for roughly 20% of 2024 revenue. Rising club memberships, online retail penetration, and youth sports programs contribute to growth. The United States remains the largest market, while Canada shows rising adoption through school-level programs and community recreation centers.

Europe

Europe holds approximately 18% of the global share in 2024. Countries such as Germany, the U.K., and France demonstrate steady demand due to strong club ecosystems. European players favor eco-friendly materials and sustainability certifications, influencing product design and brand positioning.

Latin America

LATAM contributes about 10% of global sales, led by Brazil. Urban club development and regional tournaments are supporting uptake, though overall market maturity remains low. The region shows significant potential for mid-range and value footwear segments.

Middle East & Africa

MEA accounts for roughly 7% of global revenue in 2024. Growth stems from expanding sports infrastructure in the Gulf region and rising recreational adoption in South Africa and Nigeria. Government-funded sports complexes are expected to enhance participation and import demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Table Tennis Footwear Market

- Mizuno Corporation

- ASICS Corporation

- Li-Ning Company Limited

- Adidas AG

- Nike Inc.

- Tamasu Co. Ltd (Butterfly)

- Stiga Sports AB

- JOOLA Sport GmbH

- Nittaku Co. Ltd

- Donic-Schildkröt GmbH & Co. KG

- Yonex Co. Ltd

- Babolat SA

- Puma SE

- The Sunrock Group

- Decathlon S.A.

Recent Developments

- In June 2025, Mizuno launched its new “Wave Drive Neo 4” table tennis shoe featuring enhanced sidewall stability and a recycled upper, strengthening its sustainability commitment.

- In April 2025, ASICS unveiled a lightweight carbon-plate indoor footwear line co-developed with professional table-tennis players for improved agility and rebound performance.

- In February 2025, Li-Ning expanded production in Guangdong Province to serve rising export demand for mid-range and junior table-tennis shoes in Europe and India.