Synthetic Media Market Size

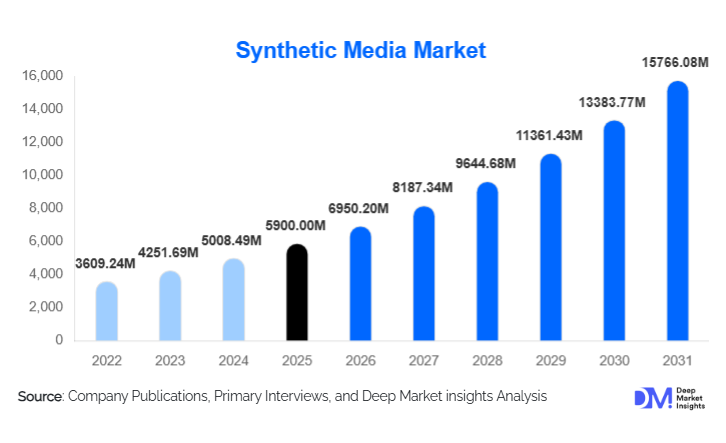

According to Deep Market Insights, the global synthetic media market size was valued at USD 5,900.00 million in 2025 and is projected to grow from USD 6,950.20 million in 2026 to reach USD 15,766.08 million by 2031, expanding at a CAGR of 17.8% during the forecast period (2026–2031). The synthetic media market growth is primarily driven by rapid advancements in generative artificial intelligence, rising enterprise demand for scalable digital content creation, and the increasing adoption of AI-generated video, audio, image, and text solutions across industries.

Key Market Insights

- Synthetic video dominates the market, driven by the growing use of AI avatars, virtual presenters, and automated video production in marketing and training.

- Cloud-based deployment models lead adoption, enabling scalability, faster implementation, and cost efficiency for enterprises.

- Media & entertainment remains the largest end-use industry, leveraging synthetic media for virtual production, gaming, and visual effects.

- North America holds the largest market share, supported by early AI adoption, strong digital infrastructure, and high enterprise spending.

- Asia-Pacific is the fastest-growing regional market, fueled by expanding digital economies, regional-language content demand, and government AI initiatives.

- Ethical AI and content authentication technologies are becoming critical differentiators as regulators focus on deepfake governance.

What are the latest trends in the synthetic media market?

Enterprise Adoption of AI Avatars and Virtual Presenters

Organizations across marketing, corporate communications, and e-learning are rapidly adopting AI-generated avatars to deliver consistent, multilingual, and personalized content at scale. Virtual presenters are increasingly used for product demonstrations, internal training, customer onboarding, and digital sales enablement. These solutions significantly reduce production costs and time-to-market while ensuring brand consistency across global operations. As avatar realism improves through diffusion models and neural rendering, adoption is expanding into customer-facing applications.

Integration of Trust, Watermarking, and Content Authentication

Rising concerns around misinformation and deepfakes have accelerated the integration of content provenance tools within synthetic media platforms. AI watermarking, cryptographic signatures, and detection frameworks are becoming standard features, particularly in regulated industries such as BFSI, defense, and government communications. This trend is shaping the emergence of “trusted synthetic media” ecosystems, where compliance and transparency are core value propositions.

What are the key drivers in the synthetic media market?

Explosion of Digital Content Demand

Global digital consumption continues to rise sharply, with video and interactive content accounting for the majority of online engagement. Enterprises are under pressure to produce high volumes of localized, personalized content across platforms. Synthetic media enables automated generation of videos, voiceovers, images, and text, addressing scalability challenges while maintaining creative flexibility.

Cost Optimization and Operational Efficiency

Synthetic media significantly lowers production costs by reducing reliance on physical studios, actors, and post-production teams. Enterprises can achieve cost reductions of up to 70% while accelerating content delivery cycles from weeks to minutes. This strong return on investment is a major driver of adoption across marketing, training, and internal communications.

What are the restraints for the global market?

Ethical, Legal, and Regulatory Uncertainty

The misuse of synthetic media for impersonation and misinformation has led to regulatory scrutiny across regions. Fragmented legal frameworks and evolving compliance requirements create uncertainty for vendors and slow adoption in sensitive applications. Ensuring responsible AI usage remains a critical challenge.

High Compute and Infrastructure Requirements

Training and deploying high-quality generative models requires significant GPU resources and energy consumption. While cloud infrastructure is reducing barriers, compute costs remain a restraint for smaller enterprises and startups, particularly for video-heavy applications.

What are the key opportunities in the synthetic media industry?

Enterprise Content Automation Platforms

There is a significant opportunity to develop end-to-end synthetic media platforms tailored for enterprise use cases such as sales enablement, HR training, and customer engagement. Subscription-based SaaS models with API integrations offer scalable revenue potential for both new entrants and established players.

Regional-Language and Emerging Market Expansion

Asia-Pacific, Latin America, and the Middle East represent high-growth opportunities driven by demand for regional-language digital content. Synthetic media enables cost-effective localization, unlocking new customer segments in education, entertainment, and digital marketing.

Content Type Insights

Synthetic video accounts for the largest share of the global synthetic media market, representing approximately 42% of total revenue in 2024. This dominance is primarily driven by the rapid commercialization of AI-generated avatars, virtual presenters, automated marketing videos, and virtual production pipelines. Enterprises across advertising, corporate communications, and e-learning increasingly rely on synthetic video to deliver personalized, multilingual, and high-frequency content at scale. The ability to reduce production timelines, eliminate physical filming constraints, and maintain brand consistency has positioned synthetic video as the leading revenue contributor.

Synthetic audio represents the second-largest content segment, supported by the widespread adoption of voice cloning, text-to-speech (TTS), and AI-generated narration. Strong demand from gaming, audiobooks, virtual assistants, call centers, and accessibility applications continues to accelerate growth. Advances in emotional voice synthesis and multilingual speech generation are further expanding enterprise and consumer use cases. Synthetic images and synthetic text are gaining significant traction, particularly within advertising, digital design, e-commerce, and content marketing workflows. These formats are increasingly embedded into creative automation platforms, enabling rapid generation of visuals, ad copy, and campaign content. While currently smaller in revenue share, these segments are expected to experience sustained growth as multimodal AI adoption increases across creative and commercial applications.

Technology Insights

Diffusion models and transformer-based architectures dominate the synthetic media technology landscape due to their superior output quality, contextual accuracy, and scalability. Diffusion models have become the preferred choice for high-fidelity image and video generation, offering improved realism, motion coherence, and facial detail compared to earlier approaches. Transformer-based models, particularly multimodal large language models, are driving advances in text, audio, and cross-format content generation.

Generative adversarial networks (GANs) remain relevant, especially in real-time image synthesis, facial animation, and low-latency video generation use cases. However, their share is gradually being complemented by newer architectures that provide greater stability and training efficiency. Hybrid AI architectures are increasingly adopted by leading vendors to integrate multiple generative techniques—combining diffusion models, transformers, and neural rendering engines. This approach enables seamless multimodal content creation, positioning hybrid architectures as a key enabler of next-generation synthetic media platforms.

End-Use Industry Insights

Media & entertainment leads the synthetic media market with approximately 34% share in 2024, driven by demand for virtual production, visual effects, AI-generated characters, and gaming content. Studios and content creators increasingly use synthetic media to reduce production costs, accelerate post-production workflows, and expand creative possibilities. The IT & digital services sector follows closely, leveraging synthetic media for enterprise communications, customer engagement, marketing automation, and internal training. Gaming represents another major end-use industry, driven by demand for AI-generated characters, voices, environments, and interactive storytelling.

Healthcare and education are emerging as high-growth end-use segments. In healthcare, synthetic media is used for medical training simulations, virtual patients, and procedural visualization. In education, AI-generated instructors, localized learning content, and immersive training environments are gaining traction. These sectors are expected to play a critical role in sustaining long-term market expansion due to their recurring demand and high scalability potential.

| By Content Type | By Technology | By Deployment Mode | By Application | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 41% of the global synthetic media market, led primarily by the United States. Regional dominance is driven by early enterprise adoption of generative AI, mature cloud infrastructure, and strong venture capital investment in AI startups. High demand from media & entertainment, advertising, and enterprise software companies further supports growth. Additionally, the presence of leading technology providers and continuous innovation in AI governance and ethical frameworks reinforces North America’s leadership position.

Europe

Europe represents around 18% of the global market, with demand driven by media production, advertising, and corporate communications. A strong regional emphasis on ethical AI, data privacy, and content transparency is shaping adoption patterns. Countries such as the U.K., Germany, and France are key contributors, supported by creative industries and public-sector digitalization initiatives. Regulatory clarity is encouraging responsible synthetic media adoption, particularly in enterprise and government applications.

Asia-Pacific

Asia-Pacific holds nearly 29% market share and is the fastest-growing region, expanding at close to 39% CAGR. Growth is fueled by government-led AI initiatives, rapid digital transformation, and rising demand for regional-language and culturally localized content. China, India, Japan, and South Korea are major markets, with strong adoption in entertainment, gaming, education, and digital marketing. Expanding cloud infrastructure and large consumer bases further accelerate regional growth.

Latin America

Latin America is an emerging synthetic media market, with Brazil and Mexico leading regional adoption. Growth is supported by increasing digitalization, rising social media usage, and growing investment in digital advertising. While enterprise adoption remains in early stages, demand for cost-effective content creation tools is driving uptake among marketing agencies, media producers, and SMEs.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing rising adoption driven by AI-driven media strategies, smart city initiatives, and digital government communication programs. Heavy public-sector investment in AI infrastructure is creating new opportunities for synthetic media platforms. Africa remains nascent but shows growing adoption in entertainment, education, and mobile-first digital content, supported by expanding internet penetration and youth-driven digital consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|