Swim Watch Market Size

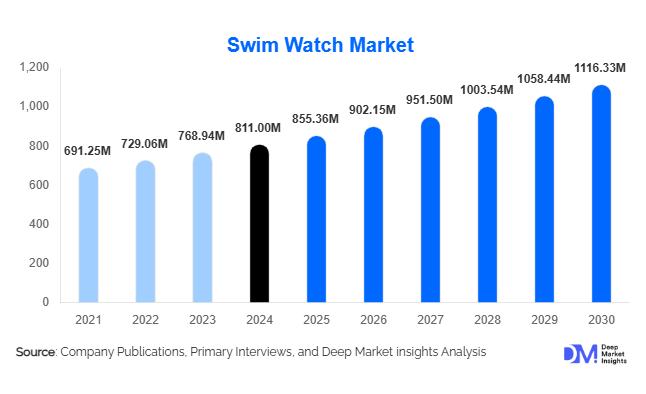

According to Deep Market Insights, the global swim watch market size was valued at USD 811.00 million in 2024 and is projected to grow from USD 855.36 million in 2025 to reach USD 1,116.33 million by 2030, expanding at a CAGR of 5.47% during the forecast period (2025–2030). The swim watch market’s expansion is fueled by rising health and fitness awareness, increasing adoption of swimming as a preferred low-impact exercise, and the rapid growth of multisport smart wearables integrating advanced swim-tracking technologies.

Key Market Insights

- Advanced smart swim watches dominate global sales, driven by increasing demand for stroke tracking, lap analysis, GPS features, and app-connected fitness monitoring.

- Asia-Pacific leads global demand growth, supported by expanding middle-class income, rising health consciousness, and strong e-commerce adoption.

- Online channels account for a rapidly growing share of swim watch purchases, as consumers favor convenience, wider assortment, and transparent pricing.

- Fitness-focused consumers represent the largest end-user base, driving demand for holistic wearables that integrate swim metrics with broader wellness tracking.

- Technology innovation, including waterproof sensors, AI-driven analytics, and advanced battery systems, is reshaping product performance and enabling premium market positioning.

- Export-driven production from Asia continues to support global availability and competitive pricing, strengthening supply chain scalability.

What are the latest trends in the swim watch market?

Integration of Multi-Sport and Holistic Fitness Ecosystems

Swim watches are increasingly being integrated into broader health ecosystems that combine swim analytics with sleep tracking, heart-rate variability, calorie management, recovery insights, and cross-training metrics. This trend is driven by consumers seeking all-in-one fitness companions rather than sport-specific devices. Major brands are launching multisport modes that allow seamless transitions between swimming, cycling, running, and gym workouts. Cloud-connected dashboards, personalized AI-driven workout recommendations, and in-app performance analytics are becoming core value propositions for premium swim watches. This convergence of fitness intelligence is transforming swim watches from niche aquatic devices into mainstream wellness wearables.

Advancements in Waterproof Sensors and Underwater Tracking

There is rapid evolution in the technology that enables accurate underwater tracking, particularly optical heart-rate sensors capable of functioning under varying water pressures and temperatures, enhanced gyroscope and accelerometer calibration for stroke recognition, and more durable water-resistant sealing. AI and machine learning are now being used to improve detection accuracy for swim strokes, pace, efficiency, and lap counting. Newer models support open-water GPS tracking, offering precise route mapping and performance analysis for triathletes. As competition intensifies among wearable manufacturers, enhanced waterproofing standards and sensor innovation are becoming critical differentiators.

What are the key drivers in the swim watch market?

Rising Global Health and Fitness Awareness

Global participation in swimming as a fitness activity is increasing, largely due to its low-impact nature and benefits for cardiovascular health. This rise in recreational and fitness-oriented swimming directly correlates to higher adoption of swim watches that help users track progress, optimize workouts, and maintain fitness routines. The growth of gyms, aquatic fitness centers, community pools, and swim clubs further supports this demand, especially in urban regions.

Technological Innovations in Wearables

Improved waterproofing standards, next-generation heart-rate sensors capable of underwater readings, extended battery life, and integration with smart fitness platforms have greatly enhanced the user experience. Advanced models now support multisport tracking, sophisticated analytics, and real-time performance feedback. These innovations attract competitive swimmers, triathletes, and everyday fitness enthusiasts looking for precision training tools.

Growth of E-Commerce and Direct-to-Consumer Sales

The rise of online retail has dramatically expanded access to swim watches worldwide. Consumers can compare models, browse reviews, and purchase devices from international brands without dependence on physical stores. This shift has democratized product availability, especially in emerging markets where specialty sports stores are limited. Direct-to-consumer strategies also allow manufacturers to maintain competitive pricing and build brand loyalty through personalized digital experiences.

What are the restraints for the global market?

Limited Awareness and Niche Adoption

Despite growing interest in fitness wearables, swim watches remain niche compared to general smartwatches. Many consumers engage in swimming infrequently and may not justify investing in a dedicated swim-optimized device. This limits penetration into mass-market segments. As a result, adoption is concentrated among committed fitness users, professional swimmers, and multisport athletes.

High Cost of Advanced Features

Premium swim watches equipped with advanced waterproofing, GPS tracking, and high-precision sensors tend to be priced significantly higher than entry-level smartwatches. Price sensitivity in developing markets, coupled with manufacturing complexities of waterproof electronics, can inhibit adoption. Battery limitations during long open-water sessions and the ongoing need for recalibration for accurate underwater readings also pose technical and cost challenges.

What are the key opportunities in the swim watch industry?

Expansion into Emerging High-Growth Regions

Asia-Pacific, Latin America, and parts of the Middle East are experiencing rapid growth in fitness culture and disposable income. The expansion of urban swimming facilities, widespread globalization of sports lifestyles, and rising e-commerce adoption create untapped opportunities for swim watch brands. Localization strategies, such as region-specific pricing, tailored marketing, and partnerships with regional swim academies, can accelerate penetration.

AI-Driven Swim Analytics and Personalized Coaching

There is a major opportunity for brands to integrate AI-driven performance insights, real-time technique correction, and personalized training modules. As consumers seek more precise, data-driven fitness guidance, swim watches can evolve into virtual coaching platforms. Features such as stroke efficiency scoring, auto-generated workout plans, fatigue monitoring, and energy expenditure modeling can help differentiate premium offerings and attract a broader customer base.

Product Type Insights

Advanced smart swim watches dominate the market, accounting for nearly 55% of total global revenue in 2024. These devices incorporate GPS, multisport tracking, underwater heart-rate sensors, and mobile app integration. Mid-range swim-optimized digital watches remain popular among recreational swimmers and fitness enthusiasts seeking reliable performance at moderate prices. Basic waterproof watches continue to serve entry-level consumers but face declining market share as smart wearables become more affordable and feature-rich. The premium segment is expanding rapidly, driven by competitive swimmers and triathletes who demand high-precision analytics and durability.

Application Insights

Fitness and health-focused applications represent the largest usage segment, fueled by rising interest in integrated wellness tracking. Competitive and professional swimmers rely on advanced analytics and GPS features to monitor training performance, particularly in open-water events. Triathlon applications are growing quickly as multisport wearables become standard training tools. Rehabilitation and medical fitness programs also contribute steadily, as swimming is widely used for recovery and low-impact therapy.

Distribution Channel Insights

Online platforms dominate global distribution, accounting for nearly 45% of 2024 sales, driven by convenience, competitive pricing, and wide product availability. E-commerce marketplaces, brand-owned websites, and specialty fitness platforms offer comprehensive inventories and user reviews that influence purchase decisions. Offline retail, sports stores, electronics retailers, and specialty swim shops remain significant, especially for premium or high-involvement purchases where customers require hands-on product evaluation. Hybrid models, including click-and-collect and experiential retail zones, are emerging as manufacturers integrate physical and digital channels.

End-User Insights

Fitness-focused consumers form the largest end-user segment, representing approximately 50% of market revenue in 2024. This demographic values comprehensive health tracking, multisport features, and app connectivity. Professional swimmers, triathletes, and aquatic sports professionals represent a smaller but high-value segment with strong demand for high-precision analytics. Recreational swimmers increasingly purchase mid-range swim watches as swimming grows in popularity as a lifestyle fitness activity. Institutional users, including swim academies, gyms, rehabilitation centers, and aquatic sports programs, are becoming notable buyers as they integrate digital training tools into structured fitness programs.

| By Product Type | By Technology/Feature Level | By End User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 25–30% of global market share, driven by strong demand for fitness wearables, high consumer purchasing power, and widespread adoption of smart health devices. The U.S. leads regional demand, fueled by advanced retail networks, widespread gym memberships, and a strong culture of recreational swimming and triathlon participation. Canada follows with steady adoption in urban centers and fitness-oriented demographics.

Europe

Europe represents 20–25% of the global share and exhibits strong preferences for high-quality fitness wearables. The U.K., Germany, France, and Nordic countries generate significant demand, supported by mature wellness cultures and high participation in swimming and endurance sports. European consumers tend to value durability, sustainability, and advanced analytics, driving the adoption of premium models.

Asia-Pacific

Asia-Pacific leads global growth, accounting for 30–35% of the market in 2024. China and India are major demand drivers, propelled by rising middle-class wealth, expanding sports infrastructure, and booming e-commerce ecosystems. Japan, South Korea, and Australia represent mature markets with strong interest in smart wearables, triathlon culture, and premium fitness electronics. Increasing numbers of public pools and fitness centers across Southeast Asia further enhance regional growth.

Latin America

Latin America is steadily emerging, with increasing interest from Brazil, Mexico, and Argentina. Growth is supported by rising urban fitness culture and expanding online retail access. While the region contributes a smaller share (~5–8%), affordability-focused mid-range devices are gaining traction among recreational swimmers and fitness enthusiasts.

Middle East & Africa

MEA represents a smaller but growing market, driven by increasing health awareness and rising disposable income in the Gulf region. The UAE and Saudi Arabia lead demand for premium fitness wearables, with strong participation in triathlons and aquatic fitness programs. Africa shows gradual growth, primarily concentrated in South Africa’s strong sports culture and urban swim communities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Swim Watch Market

- Garmin

- Apple

- Samsung

- Polar

- Suunto

- COROS

- Casio

- Timex

- Fitbit

- Honor

- Xiaomi

- Amazfit (Huami)

- Swimovate

- Form (AR Swim Goggles with tracking ecosystem)

- Decathlon (via high-performance sport watches)

Recent Developments

- In March 2025, Garmin introduced an upgraded multisport swim watch with enhanced underwater heart-rate accuracy and AI-driven stroke analytics.

- In February 2025, Apple released a firmware update enabling improved swim-tracking algorithms and open-water GPS enhancements for select Apple Watch models.

- In January 2025, Suunto announced a strategic partnership with regional swim academies in APAC to integrate its swim-performance platform into training programs.