Sustainable Personal Care Products Market Size

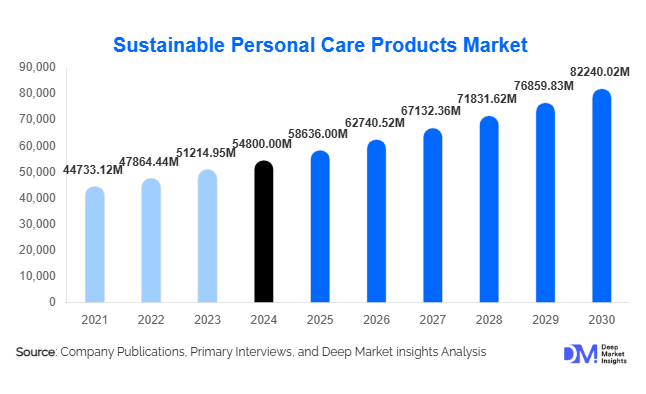

According to Deep Market Insights, the global sustainable personal care products market size was valued at USD 54,800.00 million in 2024 and is projected to grow from USD 58,636.00 million in 2025 to reach USD 82,240.02 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). Market expansion is being driven by rising consumer preference for clean-label formulations, increased adoption of eco-friendly packaging, and the large-scale shift toward ethically sourced, chemical-free personal care solutions across global demographics.

Key Market Insights

- Clean-label and organic personal care products are becoming mainstream as consumers increasingly reject synthetic ingredients, parabens, sulfates, and chemical additives.

- Eco-friendly and refillable packaging formats are expanding rapidly, supported by government restrictions on single-use plastics and rising environmental awareness.

- Asia-Pacific dominates global demand, driven by large populations, rising incomes, and the rapid adoption of sustainable beauty trends.

- Europe remains the most regulated and certification-driven market, with strong demand for certified organic and cruelty-free products.

- E-commerce is the fastest-growing distribution channel, allowing indie sustainable brands to scale rapidly and reach global audiences.

- Technological advancements, including waterless formulas, plant-derived actives, biotechnology-enabled sustainable ingredients, and traceability platforms, are transforming product development.

What are the latest trends in the sustainable personal care products market?

Rapid Growth in Zero-Waste, Waterless, and Refillable Products

Manufacturers are increasingly shifting toward zero-waste and refillable product models to reduce plastic consumption and improve environmental sustainability. Innovations such as solid shampoo bars, concentrated serums, tablet-based oral care, waterless lotions, and reusable dispensers are gaining mainstream acceptance. Brands are introducing biodegradable, compostable, or fully recyclable packaging to meet growing consumer and regulatory demands. The waterless beauty trend is particularly strong, offering reduced shipping emissions, higher ingredient potency, and improved shelf stability. This shift is creating new manufacturing ecosystems and reshaping product formats across the industry.

Biotechnology, Natural Actives, and Clean Formulation Science

Biotech-enabled ingredients such as lab-grown collagen, plant-derived peptides, fermentation-based actives, and precision-sourced botanical extracts are redefining sustainability in personal care. These innovations reduce dependency on environmentally sensitive resources and enable high-performance sustainable alternatives to conventional chemical ingredients. Clean formulation science is also advancing, eliminating endocrine disruptors, microplastics, silicones, and petroleum derivatives while maintaining performance. Certifications like COSMOS, USDA Organic, and cruelty-free labels are becoming key purchasing decision drivers, strengthening trust and transparency.

What are the key drivers in the sustainable personal care products market?

Growing Shift Toward Health, Safety, and Environmental Responsibility

Consumers increasingly recognize the long-term impact of synthetic chemical exposure on skin and health. Rising cases of allergies, sensitivities, and awareness of ingredient toxicity have accelerated demand for natural, organic, and clean-label products. Sustainability consciousness, including climate concerns, microplastic pollution, and ethical sourcing, strengthens this shift. Younger generations (Millennials & Gen Z) are leading this demand, driving brands to adopt safer formulations and transparent labeling practices.

E-commerce Expansion and Rise of Digital Beauty Ecosystems

Online marketplaces and D2C platforms have dramatically accelerated the adoption of sustainable personal care products by improving accessibility, transparency, and consumer education. Independent sustainable brands now scale globally through digital channels, supported by influencer marketing, ingredient-transparency tools, and personalized recommendation engines. Subscription boxes, refill programs, and AI-driven skin analysis further enhance online consumer engagement, making e-commerce the fastest-growing sales channel within the sustainable personal care market.

Innovation in Sustainable Packaging and Circular Economy Initiatives

Global pressure to reduce packaging waste has propelled rapid innovation in biodegradable materials, compostable films, aluminum and glass packaging, PCR (post-consumer recycled) plastics, and refillable container systems. Governments across Europe, APAC, and North America are enforcing plastic reduction mandates, stimulating the adoption of circular economy models in personal care. Brands that incorporate refill stations, return-and-reuse systems, and carbon-neutral packaging processes gain a competitive advantage and consumer loyalty.

What are the restraints for the global market?

High Production Costs and Premium Pricing

Sustainable personal care products often require expensive organic or plant-derived ingredients, eco-friendly packaging, and certification processes, all of which elevate production costs. As a result, sustainable products are priced at a premium, limiting adoption among price-sensitive consumers in developing regions. The cost of sustainable packaging, especially biodegradable and compostable materials, remains significantly higher than conventional plastics, extending the price gap.

Variable Regulations and Limited Awareness in Emerging Markets

Regulatory standards for “clean,” “natural,” and “organic” vary widely across countries, leading to consumer confusion and inconsistent labeling. In many emerging markets, awareness of sustainable personal care benefits is still limited, with traditional, lower-cost conventional products dominating. Skepticism regarding product authenticity and lack of education on sustainability reduces penetration, slowing overall global adoption despite strong momentum in developed regions.

What are the key opportunities in the sustainable personal care industry?

Expansion Across Emerging Markets in Asia-Pacific and Latin America

Rising disposable incomes, rapid urbanization, and increased health and environmental awareness in India, China, Brazil, and Southeast Asia are creating major new growth opportunities. Brands that offer locally adapted formulations, region-specific botanical ingredients, and affordable pricing can capture large market shares. Partnerships with regional e-commerce platforms and retailers can accelerate penetration across urban and semi-urban populations.

Advancement in Refillable, Reusable, and Circular Packaging Systems

Zero-waste stores, beauty refill stations, and subscription-based refill programs are gaining popularity, especially in Europe and North America. Companies investing in durable packaging, reusable components, and reverse logistics can differentiate themselves and reduce long-term packaging costs. This trend aligns strongly with ESG mandates, appealing to both regulators and conscious consumers while boosting brand loyalty and recurring revenue.

Product Type Insights

Skin care dominates the sustainable personal care market, accounting for nearly 40% of global revenue in 2024. This is driven by strong demand for natural moisturizers, serums, cleansers, and sunscreens featuring plant-derived actives and chemical-free formulations. Hair care is the second-largest category, with growing adoption of sulfate-free shampoos, solid shampoo bars, and scalp-friendly botanical treatments. Oral care is rapidly evolving with natural toothpaste tablets, bamboo toothbrushes, and fluoride-free formulations. Cosmetics and hygiene products are also expanding due to rising interest in vegan makeup and aluminum-free deodorants.

Application Insights

Sustainable personal care products are primarily used for daily hygiene, skincare, and grooming. Clean beauty applications such as natural makeup, plant-based serums, and sensitive-skin formulations are rapidly gaining traction among health-conscious consumers. Eco-friendly bath and shower products, including bar soaps and waterless alternatives, are expanding as part of the zero-waste trend. Institutional applications in salons, spas, and hotels are increasing, with demand for eco-certified amenities and hygiene products. Export-driven demand is also rising as producers in Europe, APAC, and North America ship sustainable personal care solutions to emerging markets.

Distribution Channel Insights

E-commerce is the dominant distribution channel due to rising online beauty spending, influencer-driven discovery, and direct-to-consumer models that benefit sustainable brands with limited retail presence. Specialty stores focusing on natural and organic products are expanding, offering curated selections and educational experiences. Supermarkets and drugstores are integrating wider sustainable product sections to meet mainstream consumer demand. Professional salons and spas are also adopting sustainable product lines, bolstering institutional sales. Subscription models and refill services are emerging as high-loyalty channels in developed regions.

Consumer Type Insights

Individual consumers account for over 70% of market demand, driven by personal grooming and wellness routines. Millennials and Gen Z consumers are the largest adopter groups, valuing transparency, eco-friendliness, and ethical production. Families increasingly prefer natural products for children, such as chemical-free shampoos, lotions, and oral care products. Institutional buyers, including salons, wellness centers, hotels, and spas, represent a fast-growing professional segment, with rising adoption of eco-certified amenities and hygiene products.

Age Group Insights

The 25–45 age group represents the largest consumer segment due to higher disposable income and a strong preference for sustainable and clean beauty products. Young adults aged 18–25 drive demand for affordable, trendy, and vegan-friendly solutions purchased primarily online. Consumers aged 45–65 are increasingly adopting sustainable personal care for anti-aging and sensitive-skin needs. The above-65 segment represents a smaller but growing base, particularly for hypoallergenic, dermatologist-tested, sustainable skincare.

| By Product Type | By Formulation / Sustainability Attribute | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for a significant share of the market, supported by high awareness of clean beauty, strong regulatory standards, and high adoption of organic skin and hair care products. The U.S. leads due to its robust e-commerce ecosystem, rising demand for cruelty-free cosmetics, and widespread willingness to pay premium prices for sustainable alternatives. Canada shows steady growth driven by eco-conscious consumers and high organic certification adoption.

Europe

Europe is one of the most mature and regulated sustainable personal care markets, with strong demand in Germany, France, the U.K., and the Nordic countries. Consumers seek certified organic, vegan, and cruelty-free products, and governments impose stringent bans on harmful chemicals and microplastics. Eco-packaging, refill systems, and zero-waste models are particularly advanced in this region. Europe holds an estimated 20–25% of the global market share.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, with 30–35% global market share. China, India, Japan, and South Korea drive massive demand due to rising middle-class incomes, booming beauty sectors, and rapidly increasing environmental awareness. K-beauty and J-beauty innovations are increasingly integrating sustainable packaging and natural actives. India is a major hotspot due to demand for Ayurvedic, herbal, and plant-based formulations. APAC’s growing e-commerce penetration accelerates widespread adoption.

Latin America

Latin America, led by Brazil and Mexico, is witnessing a rising demand for organic and plant-based products, fueled by rich biodiversity and cultural preference for natural ingredients. Growth is moderate but accelerating as local brands adopt sustainability standards and international brands expand into the region. Import-driven premium product segments are particularly strong in urban markets.

Middle East & Africa

MEA is an emerging market with rising interest in luxury, organic, and halal-certified personal care. The Gulf countries (UAE, Saudi Arabia, Qatar) exhibit high demand for premium sustainable beauty brands. Africa’s natural ingredient resources (e.g., shea butter, aloe, and marula) support both local production and export markets. Growth is promising due to rising incomes and expanding retail infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sustainable Personal Care Products Market

- L'Oréal Group

- The Estée Lauder Companies Inc.

- Procter & Gamble Co.

- Unilever PLC

- Shiseido Co., Ltd.

- Beiersdorf AG

- Johnson & Johnson

- Coty Inc.

- Kao Corporation

- Amway Corporation

- Yves Rocher SA

- The Body Shop International

- Burt’s Bees (via parent company)

- Weleda AG

- Dr. Bronner’s

Recent Developments

- In March 2025, L'Oréal announced the expansion of its waterless beauty line with biodegradable packaging, strengthening its sustainability targets for 2030.

- In January 2025, Unilever launched new refill stations in Southeast Asia to accelerate circular packaging adoption and reduce single-use plastics.

- In April 2025, Shiseido introduced a biotech-driven skincare range using fermentation-derived actives to reduce environmental strain from botanical sourcing.