Sustainable Devices Market Size

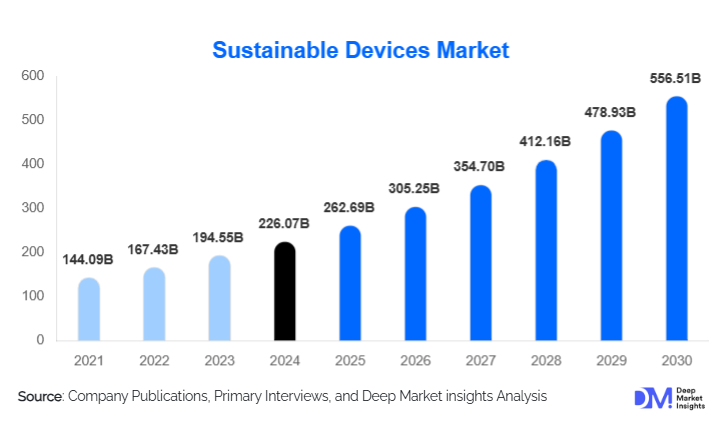

According to Deep Market Insights, the global sustainable devices market size was valued at USD 226.07 billion in 2024 and is projected to grow from USD 262.69 billion in 2025 to reach USD 556.51 billion by 2030, expanding at a CAGR of 16.2% during the forecast period (2025–2030). The sustainable devices market growth is primarily driven by tightening environmental regulations, accelerating adoption of energy-efficient electronics, rising ESG-led procurement by enterprises, and growing consumer preference for eco-friendly and durable electronic products across residential, commercial, and industrial applications.

Key Market Insights

- Energy-efficient consumer electronics dominate global demand, supported by high replacement cycles and increasing awareness of carbon footprint reduction.

- Asia-Pacific leads the global market, driven by large-scale electronics manufacturing, localization policies, and rising domestic consumption.

- Enterprise and government procurement is accelerating the adoption of sustainable industrial, healthcare, and smart infrastructure devices.

- Recycled materials are becoming standard inputs, as manufacturers comply with circular economy and extended producer responsibility regulations.

- Hybrid and renewable-powered devices are witnessing faster growth, particularly in off-grid and energy-resilient applications.

- Technological innovation in low-power chips and modular design is narrowing the cost gap between sustainable and conventional devices.

What are the latest trends in the sustainable devices market?

Circular Design and Modular Electronics Adoption

Manufacturers are increasingly redesigning devices to support circular economy principles. Modular hardware architectures, easy-to-repair components, and longer product lifecycles are becoming core design priorities. This trend is reducing electronic waste while enabling recurring revenue models such as device refurbishment, upgrades, and device-as-a-service offerings. Governments and enterprises are favoring products that demonstrate repairability and recyclability, reinforcing long-term demand for circular device designs.

Integration of Smart Energy Management Technologies

Sustainable devices are increasingly embedded with AI-driven power optimization, edge computing, and IoT connectivity to minimize energy consumption. Smart power management systems dynamically adjust device performance based on usage patterns, reducing electricity consumption without compromising functionality. These features are especially critical in industrial automation, smart buildings, and healthcare devices, where energy efficiency directly impacts operating costs and emissions targets.

What are the key drivers in the sustainable devices market?

Regulatory Pressure and ESG Compliance

Governments worldwide are enforcing stricter energy efficiency standards, right-to-repair laws, and carbon disclosure requirements. Enterprises are aligning procurement strategies with ESG goals, accelerating the adoption of certified sustainable devices. Compliance-driven demand is particularly strong in Europe and North America, where regulations directly influence purchasing decisions.

Rising Energy Costs and Operational Efficiency Needs

Increasing global energy prices are compelling households and businesses to invest in energy-efficient devices. Sustainable electronics reduce long-term electricity costs and maintenance expenses, making them economically attractive despite higher upfront prices. This driver is especially pronounced in industrial and commercial applications.

What are the restraints for the global market?

Higher Upfront Costs

Sustainable devices often involve higher manufacturing costs due to recycled materials, advanced components, and certification requirements. Price sensitivity among consumers and small enterprises can slow adoption, particularly in developing markets.

Supply Chain Complexity

Dependence on recycled and ethically sourced materials introduces supply volatility and pricing fluctuations. Limited availability of high-quality recycled inputs can impact margins and production scalability.

What are the key opportunities in the sustainable devices industry?

Government-Led Infrastructure and Smart City Programs

Large-scale public investments in smart grids, energy-efficient buildings, and digital infrastructure are creating long-term demand for sustainable devices. Public procurement policies favoring green technologies offer stable revenue pipelines for compliant manufacturers.

Emerging Market Expansion

Rapid urbanization and rising middle-class incomes in Asia-Pacific, Latin America, and the Middle East present strong growth opportunities. Local manufacturing incentives and sustainability mandates further support market expansion in these regions.

Product Type Insights

Consumer electronics account for the largest share of the sustainable devices market, representing nearly 38% of global revenue in 2024. This dominance is primarily driven by the massive shipment volumes of smartphones, laptops, tablets, and wearable devices, combined with rising consumer awareness around energy efficiency, carbon footprint reduction, and electronic waste management. Leading consumer electronics brands are increasingly incorporating recycled aluminum, plastics, and rare-earth materials, along with low-power chipsets and advanced battery management systems, to comply with regulatory standards and appeal to sustainability-conscious consumers. Short replacement cycles and premium pricing for eco-certified devices further reinforce the segment’s revenue leadership.

Industrial and commercial devices represent the fastest-growing product segment within the market. Growth is driven by the rapid deployment of smart meters, energy-efficient automation systems, industrial IoT sensors, and building management devices across factories, data centers, and commercial facilities. Enterprises are adopting these devices to reduce energy consumption, meet ESG targets, and comply with export-related environmental regulations. Long operational lifecycles, large-scale enterprise contracts, and integration with smart energy management platforms are key factors accelerating growth in this segment.

Material Composition Insights

Recycled plastics and metals dominate material usage in the sustainable devices market, accounting for approximately 42% of total market value in 2024. This leadership is driven by regulatory mandates on recycled content, extended producer responsibility (EPR) frameworks, and corporate sustainability commitments aimed at reducing dependence on virgin raw materials. Recycled aluminum, copper, steel, and post-consumer plastics are widely used in device enclosures, frames, and structural components due to their cost-effectiveness, scalability, and lower environmental impact.

Bio-based and biodegradable materials are an emerging high-growth sub-segment, particularly in device casings, packaging, and non-critical internal components. Advances in material science have significantly improved durability, heat resistance, and mechanical strength, making these materials commercially viable. Adoption is especially strong among premium consumer electronics and healthcare device manufacturers seeking differentiation through eco-design and reduced toxicity.

Energy Source Insights

Grid-powered energy-efficient devices constitute the majority of the sustainable devices market, benefiting from widespread infrastructure compatibility and immediate deployability across residential, commercial, and industrial environments. These devices leverage energy-efficient processors, optimized firmware, and advanced power management systems to reduce electricity consumption while maintaining performance.

However, hybrid energy devices, combining battery storage with renewable energy inputs such as solar, are witnessing the fastest growth. Demand is particularly strong in remote industrial sites, smart infrastructure projects, healthcare facilities, and regions with grid instability. Energy resilience requirements, rising electricity costs, and government incentives for renewable integration are key drivers accelerating the adoption of hybrid-powered sustainable devices.

End-Use Industry Insights

The residential sector leads overall demand for sustainable devices, driven by the rapid adoption of smart home systems, energy-efficient consumer electronics, and connected appliances. Rising household electricity costs, growing environmental awareness, and government incentives for energy-efficient products are key factors supporting this segment’s leadership.

Commercial and industrial end-use segments are the fastest-growing contributors to market expansion. Enterprises are increasingly investing in sustainable devices to meet ESG benchmarks, reduce operating costs, and comply with international trade and carbon disclosure requirements. Smart buildings, manufacturing automation, and logistics facilities are major adoption hubs. The healthcare sector is emerging as a high-potential end-use segment, supported by rising investments in energy-efficient diagnostic equipment, patient monitoring devices, and digital health infrastructure. Hospitals and clinics are prioritizing sustainable devices to lower energy costs, meet green building standards, and improve long-term operational efficiency.

Distribution Channel Insights

Direct OEM and enterprise sales dominate the sustainable devices market, accounting for nearly 46% of global revenue in 2024. This channel is particularly critical for industrial, healthcare, and government procurement, where sustainability certifications, lifecycle performance, and compliance with technical standards strongly influence purchasing decisions. Long-term contracts, bulk procurement, and customization requirements further reinforce the dominance of direct sales.

Online retail platforms are expanding rapidly within the consumer electronics segment. Enhanced transparency around sustainability certifications, energy ratings, and recycled content, combined with easy product comparisons and competitive pricing, is accelerating online adoption. Direct-to-consumer (D2C) channels are also gaining traction as manufacturers strengthen digital engagement and brand-led sustainability messaging.

| By Product Type | By Material Composition | By Energy Source | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the sustainable devices market with approximately 39% share in 2024. The region’s dominance is driven by large-scale electronics manufacturing, cost-efficient supply chains, and strong government-led sustainability mandates. China is the largest contributor, supported by policies promoting energy-efficient manufacturing, circular economy adoption, and green technology exports. India is the fastest-growing market in the region, fueled by localization initiatives, rising middle-class consumption, smart infrastructure investments, and government programs encouraging domestic production of sustainable electronics.

North America

North America accounts for around 26% of global demand, led by the United States. Growth in the region is driven by strong corporate ESG adoption, high consumer awareness, and significant investments in smart buildings, healthcare modernization, and digital infrastructure. Regulatory frameworks focused on energy efficiency, right-to-repair, and carbon disclosure further accelerate the adoption of sustainable devices across both consumer and enterprise segments.

Europe

Europe holds nearly 24% market share, supported by some of the world’s most stringent environmental regulations and circular economy laws. Countries such as Germany, France, and the UK are major contributors, driven by mandatory energy labeling, recycled content requirements, and strong public-sector procurement of sustainable technologies. Europe’s leadership in sustainability policy makes it a key innovation hub for eco-designed devices.

Latin America

Latin America represents a smaller but steadily growing market, driven by smart infrastructure investments, urbanization, and increasing adoption of energy-efficient consumer electronics. Brazil and Mexico are the primary demand centers, supported by government-led digitalization initiatives, rising electricity costs, and expanding middle-class consumption.

Middle East & Africa

The Middle East & Africa region is witnessing consistent growth due to large-scale smart city projects, renewable energy investments, and national energy efficiency programs. Countries such as the UAE and Saudi Arabia are driving demand through smart infrastructure development and sustainability-focused urban planning, while South Africa leads adoption in industrial and commercial applications. Energy security concerns and climate-resilient infrastructure needs are key regional growth drivers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Sustainable Devices Industry

- Apple

- Samsung Electronics

- Dell Technologies

- HP Inc.

- Lenovo

- Siemens

- Schneider Electric

- Panasonic

- LG Electronics

- ABB

- Bosch

- Cisco Systems

- Sony

- Philips

- Xiaomi