Surfing Tourism Market Size

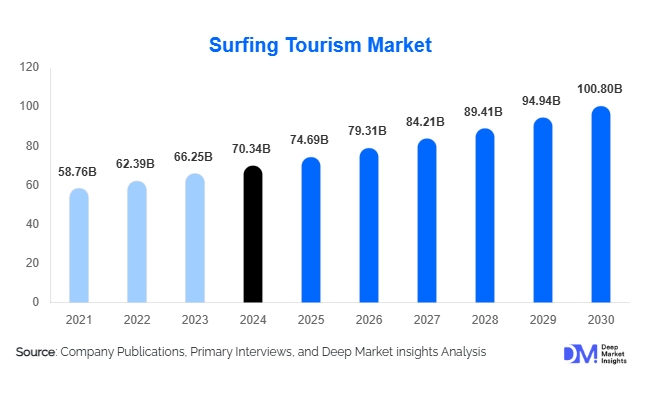

According to Deep Market Insights, the global surfing tourism market size was valued at USD 70.34 billion in 2024 and is projected to grow from USD 74.69 billion in 2025 to reach USD 100.8 billion by 2030, expanding at a CAGR of 6.18% during the forecast period (2025–2030). The surfing tourism market growth is primarily driven by rising participation in adventure travel, expanding global surf culture, the rapid development of surf infrastructure across emerging coastal destinations, and the increasing popularity of surf-focused lifestyle travel among Millennials and Gen Z.

Key Market Insights

- Surfing tourism is increasingly shifting toward eco-conscious and sustainability-integrated travel experiences, as travelers seek ethical, environmentally friendly coastal adventures.

- Surf resorts and surf camps are expanding across Asia-Pacific, Latin America, and Africa, offering curated experiences that combine skill learning, wellness, and cultural immersion.

- North America remains the largest regional market, supported by strong domestic surf culture and high outbound travel activity to global surf destinations.

- Asia-Pacific is the fastest-growing region, propelled by rapidly developing surf spots in Indonesia, the Philippines, Sri Lanka, and India.

- Digital transformation, including AI-powered surf forecasting, mobile trip planning, and VR destination previews, is reshaping traveler expectations and enabling personalized surf itineraries.

- Solo and experience-driven travelers dominate participation, particularly younger demographics seeking flexible, skill-based coastal travel.

What are the latest trends in the surfing tourism market?

Eco-Sustainable and Community-Integrated Surf Tourism

Operators in the surfing tourism market increasingly integrate sustainability and community upliftment into their travel offerings. Experiences now commonly include coral-reef restoration activities, beach clean-up programs, and partnerships with marine conservation groups. Surf camps in Indonesia, Costa Rica, Portugal, and South Africa are adopting renewable energy systems, water-efficient infrastructure, and locally sourced materials. Community-based tourism models are gaining traction, where local surf instructors, indigenous guides, and small businesses directly benefit from visiting surfers. These initiatives resonate strongly with environmentally conscious travelers while supporting long-term coastal ecosystem preservation.

Technology-Enhanced Surf Travel Experiences

Technological adoption is rapidly transforming both pre-travel planning and on-ground surfing experiences. AI-enabled surf forecasting apps help travelers choose destinations based on real-time swell, tide, and weather predictions. VR beach previews allow travelers to explore surf spots before booking, enhancing decision-making. Mobile platforms now offer surf skill-level matching with local instructors, equipment reservations, and instant trip customization. Wearable tech for performance analytics, GPS-enabled boards, and drone-based wave scouting are emerging features appealing to tech-savvy travelers and adventure athletes. Digital booking platforms increasingly integrate sustainability ratings and traveler-generated content to improve transparency and trust.

What are the key drivers in the surfing tourism market?

Growing Demand for Adventure & Experiential Travel

Global travelers, particularly Millennials and Gen Z, are seeking immersive, experience-centric activities, driving strong demand for surfing tourism. Surfing combines adventure, physical challenge, community engagement, and natural exploration, making it a high-value experiential travel category. Social media exposure has amplified interest in iconic surf destinations, with aspirational content accelerating global participation. The adventure travel sector’s overall expansion directly supports the upward trajectory of surf tourism.

Expansion of Coastal Infrastructure & Surf Destinations

Significant investment in coastal tourism infrastructure, including surf resorts, training schools, eco-lodges, and improved transportation access, is expanding the range and quality of surfing destinations globally. Countries such as Indonesia, Portugal, Costa Rica, Sri Lanka, and South Africa are promoting surf tourism through government-backed tourism development programs. Enhanced safety standards, certified surf coaches, and skill-based surf camps are also increasing accessibility for new participants, bolstering market growth.

What are the restraints for the global market?

Seasonality and Natural Variability of Surf Conditions

Surf tourism is heavily influenced by seasonal wave conditions, storm patterns, and climatic fluctuations. Many destinations experience limited peak seasons, restricting tourism revenue stability. Seasonal unpredictability can lead to inconsistent wave quality, reducing traveler satisfaction and complicating capacity planning for surf operators. Climate change intensifies these challenges through rising sea levels, reef degradation, and coastal erosion.

Environmental Pressures on Coastal Ecosystems

Overtourism in popular surf regions can strain fragile marine and beach ecosystems. Poorly managed surf activity contributes to coral damage, waste accumulation, and water pollution. Regulatory differences and inconsistent marine protection policies across countries create challenges in standardizing sustainable practices. Without effective environmental management, declining ecological health could impair surf quality and long-term market stability.

What are the key opportunities in the surfing tourism industry?

Adventure-Wellness Surf Retreats

The integration of surfing with wellness tourism, yoga, meditation, nutrition programs, and holistic health therapies is a rapidly growing opportunity. Surf-and-wellness retreats attract health-focused travelers seeking mental rejuvenation and physical activity in natural settings. Operators are offering surf therapy programs, mindfulness camps, and detox retreats that blend wave riding with relaxation and self-improvement. This hybrid model expands beyond traditional surf travelers and increases average spend and stay duration.

Community-Based Surf Tourism

Engaging local communities directly in surf tourism presents a major opportunity for inclusive, sustainable growth. Programs that employ local surf instructors, promote indigenous cultural exchanges, and support local entrepreneurship differentiate surf destinations from mass-market beach tourism. Community-based surf tourism enhances authenticity, strengthens social acceptance of tourism, and incentivizes environmental protection. Government and NGO support for coastal livelihood programs creates additional pathways for expanding this model globally.

Product Type Insights

Surf tours and surf resorts dominate the product landscape, catering to travelers seeking structured, skill-building surf experiences. Luxury surf resorts offer premium accommodations, private surf guides, wellness amenities, and curated itineraries for affluent travelers. Mid-range surf camps attract mainstream tourists through cost-effective group lessons, shared accommodations, and cultural activities. Budget surf experiences, including backpacker surf camps, group training sessions, and local instructor-led lessons, are increasingly popular among younger travelers. Artificial wave parks and indoor surf centers are expanding product diversity, enabling year-round surfing in non-coastal regions.

Application Insights

Skill-based surf tourism, beginner training, skill progression camps, and intermediate surf clinics, represents the largest application segment. Surf expeditions for advanced surfers seeking premium breaks in Indonesia, Mexico, or South Africa are growing steadily. Cultural surf tourism, which includes local community interaction, coastal excursions, and environmental education, is broadening market appeal. Eco-volunteering surf trips connected to marine conservation projects and beach restoration are rapidly emerging. Adventure-focused variations such as surf-trekking, longboarding retreats, and big-wave surf camps are niche segments attracting repeat travelers.

Distribution Channel Insights

Online travel platforms dominate surfing tourism bookings due to real-time surf condition data, peer reviews, transparent pricing, and instant package comparisons. Direct bookings through surf camps and resort websites are rising as operators build stronger digital footprints with interactive tools, dynamic pricing, and online customization. Specialist surf travel agencies that offer curated, destination-specific expertise remain essential for advanced surfers seeking exclusive breaks. Social media, influencers, and surf community apps play a major role in shaping traveler decisions, particularly for younger demographics.

Traveler Type Insights

Solo travelers represent a substantial share of surfing tourism, particularly among Millennials and Gen Z, who seek flexible itineraries and skill-building adventures. Group travelers, friends, surf clubs, and student groups benefit from cost efficiencies and structured programs. Couples increasingly choose surf-and-wellness retreats, combining romantic experiences with adventure. Family travelers form a growing segment as surf schools enhance child-friendly programs and multi-generational accommodations.

Age Group Insights

Travelers aged 21–40 dominate the surfing tourism market, driven by higher adventure travel participation and strong engagement with surf culture. The 18–30 age group fuels demand for budget-friendly surf camps and shared experiences. Travelers aged 31–50 contribute heavily to mid-range and premium surf offerings, valuing comfort, safety, and family-oriented packages. Older demographics (50+) are increasingly attracted to wellness-integrated surf retreats and low-impact surf experiences.

| By Experience Type | By Traveler Type | By Booking Channel | By Tour Duration |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest region in the global market, supported by strong domestic surfing in California, Hawaii, and Florida, and significant outbound surf travel to Central America, the Caribbean, and the Indo-Pacific. High disposable income, advanced surf infrastructure, and strong cultural affinity drive continuous demand.

Europe

Europe shows robust demand led by the U.K., France, Spain, and Portugal. European travelers exhibit a strong interest in sustainable surf tourism, eco-lodges, and community-based programs. Portugal’s rapid ascent as a global surf hub continues to attract both beginners and professional surfers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, anchored by Indonesia, the Philippines, Sri Lanka, India, and Australia. Rising middle-class incomes, improving coastal infrastructure, and globally recognized surf breaks are driving high inbound and domestic participation. APAC is expected to surpass North America in growth rate through 2030.

Latin America

Latin America, led by Brazil, Mexico, Costa Rica, and Peru, has a strong mix of domestic participation and inbound surf tourism. Brazil’s surf culture and Costa Rica’s eco-resorts are major demand drivers. Unique wave conditions and biodiversity continue to attract adventure-focused travelers.

Middle East & Africa

Africa’s Morocco and South Africa remain premier global surf destinations. The Middle East, supported by artificial wave parks and luxury travel markets in the UAE and Qatar, is emerging as a growing source of outbound surf travelers. Regional investments in surf events and indoor surfing facilities are expanding participation.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Surfing Tourism Market

- World Surfaris

- G Adventures

- Waterways Travel

- Epic Surf Adventures

- Wavehunters Surf Travel

- LUEX

- Nomad Surfers

- True Blue Travel

- ZOCOTRAVEL

- Atoll Travel

- Perfect Wave

- Surf The Earth

- Driftwood Mentawai

- Ocean Spell Surf Travel

- Global Surf Adventures