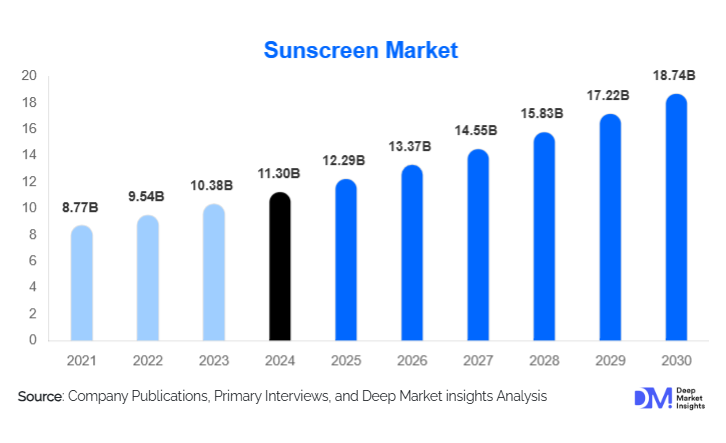

Sunscreen Market Size

According to Deep Market Insights, the global sunscreen market size was valued at USD 11.3 billion in 2024 and is projected to grow from USD 12.29 billion in 2025 to reach USD 18.74 billion by 2030, expanding at a CAGR of 8.8% during the forecast period (2025–2030). The sunscreen market growth is primarily driven by rising awareness of skin cancer and UV-related skin damage, increasing adoption of daily-use facial sunscreens, and growing demand for premium, multifunctional skincare products that combine sun protection with cosmetic and dermatological benefits.

Key Market Insights

- Sunscreen usage is shifting from seasonal to daily application, particularly for facial skincare routines in urban populations.

- SPF 50 and above products dominate demand, as consumers increasingly prioritize high-protection and long-lasting formulations.

- Asia-Pacific holds the largest market share, driven by strong demand from China, Japan, South Korea, and India.

- Online retail channels are the fastest-growing distribution segment, supported by DTC brand strategies and influencer-led marketing.

- Mineral and reef-safe sunscreens are gaining traction due to regulatory pressure and rising environmental awareness.

- Premiumization is reshaping pricing structures, with multifunctional and dermatologist-recommended products commanding higher margins.

What are the latest trends in the sunscreen market?

Rise of Daily-Use Facial Sunscreens

Sunscreens are increasingly positioned as everyday skincare essentials rather than beach-only products. Lightweight, non-greasy, and cosmetically elegant facial sunscreens are seeing strong adoption, particularly in urban markets. Products offering added benefits such as anti-aging, anti-pollution, hydration, and tinted coverage are driving higher repeat purchase rates. Dermatologist endorsements and social media education have reinforced sunscreen’s role in preventive skincare, significantly expanding consumption frequency and overall market value.

Shift Toward Mineral and Reef-Safe Formulations

Environmental concerns and regulatory bans on certain chemical UV filters have accelerated innovation in mineral-based sunscreens. Brands are investing in advanced zinc oxide and titanium dioxide technologies to improve texture, transparency, and wearability. Reef-safe labeling and clean beauty positioning are increasingly influencing purchasing decisions, especially among environmentally conscious consumers in North America and Europe.

What are the key drivers in the sunscreen market?

Growing Awareness of UV-Induced Skin Damage

The rising incidence of skin cancer, premature aging, and pigmentation disorders has significantly increased sunscreen adoption worldwide. Public health campaigns and dermatological recommendations are encouraging year-round use, particularly in high-UV regions. This driver has transformed sunscreen from a discretionary cosmetic product into a preventive healthcare necessity.

Convergence of Sunscreen and Skincare

The integration of sun protection into broader skincare routines is a major growth driver. Consumers increasingly prefer multifunctional products that combine SPF with moisturization, anti-aging actives, and cosmetic benefits. This convergence has fueled premium product launches and expanded market value faster than volume growth.

What are the restraints for the global market?

Regulatory Complexity Across Regions

Divergent global regulations governing UV filters and safety testing increase formulation costs and slow product approvals. Ingredient bans and evolving compliance standards create barriers for smaller manufacturers and complicate global product standardization.

Price Sensitivity in Emerging Economies

Despite rising awareness, sunscreen penetration remains limited in price-sensitive markets. High-quality formulations often remain unaffordable for mass consumers in developing regions, restricting volume growth and slowing rural market adoption.

What are the key opportunities in the sunscreen industry?

Expansion in Asia-Pacific and Emerging Markets

Asia-Pacific presents the largest growth opportunity, supported by rising disposable incomes, urbanization, and increasing skincare awareness. Localized formulations designed for humid climates, darker skin tones, and affordability thresholds can unlock significant untapped demand.

Innovation in Mineral and Dermatology-Grade Sunscreens

Growing preference for sensitive-skin and dermatologist-recommended products creates opportunities for medical-grade and prescription-strength sunscreens. Brands investing in clinically tested, mineral-based formulations are well-positioned to capture premium segments and regulatory-driven demand.

Product Type Insights

Creams and lotions dominate the sunscreen market, accounting for approximately 42% of global revenue in 2024. Their ease of application, SPF stability, and suitability for both face and body applications support their leadership. Sprays and mists are gaining popularity for convenience, while sticks and roll-ons are expanding in niche segments such as sports and travel. Powders and compacts, though smaller in share, are growing rapidly due to cosmetic integration and on-the-go usage.

UV Protection Type Insights

Chemical sunscreens hold the largest market share at nearly 58% in 2024, driven by lighter textures and superior cosmetic elegance. However, mineral sunscreens represent the fastest-growing segment, supported by regulatory compliance, sensitive-skin demand, and reef-safe positioning. Hybrid formulations combining chemical and physical filters are emerging as a balanced solution.

Distribution Channel Insights

Online retail accounts for approximately 31% of global sunscreen sales and is the fastest-growing channel. Pharmacies and drugstores remain critical for dermatologist-recommended and medical-grade products, while supermarkets and hypermarkets dominate mass-market sales. Specialty beauty stores play a key role in premium and niche brand positioning.

End-Use Insights

Adults represent over 80% of total sunscreen consumption, driven by daily-use adoption and lifestyle exposure. Facial sunscreens are the fastest-growing application segment, expanding at double-digit rates. The children and baby segment, while smaller, is growing steadily due to increased pediatric recommendations and parental awareness.

| By Product Type | By UV Protection Type | By SPF Level | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 31% of the global sunscreen market in 2024, making it the largest regional market. China, Japan, South Korea, and India drive demand through strong skincare cultures, innovation, and rising middle-class populations. India is the fastest-growing country, expanding at over 12% CAGR.

North America

North America holds around 28% of the global market, led by the United States. High awareness of skin cancer, premium product adoption, and dermatologist influence support strong demand. Mineral and reef-safe sunscreens are particularly popular.

Europe

Europe accounts for roughly 25% of the market, with France, Germany, and the U.K. leading consumption. Regulatory compliance and preference for clean beauty products drive innovation and premiumization.

Latin America

Latin America represents about 9% of global demand, led by Brazil and Mexico. High UV exposure and beach culture support steady growth.

Middle East & Africa

The region holds approximately 7% of the market, with strong demand from GCC countries due to extreme UV conditions and premium skincare consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sunscreen Market

- L’Oréal

- Beiersdorf

- Johnson & Johnson

- Shiseido

- Procter & Gamble

- Unilever

- Edgewell Personal Care

- Kao Corporation

- Amorepacific

- Estée Lauder Companies

- Pierre Fabre

- Coty

- Galderma

- ISDIN

- Rohto Pharmaceutical