Sunglasses Coating Market Size

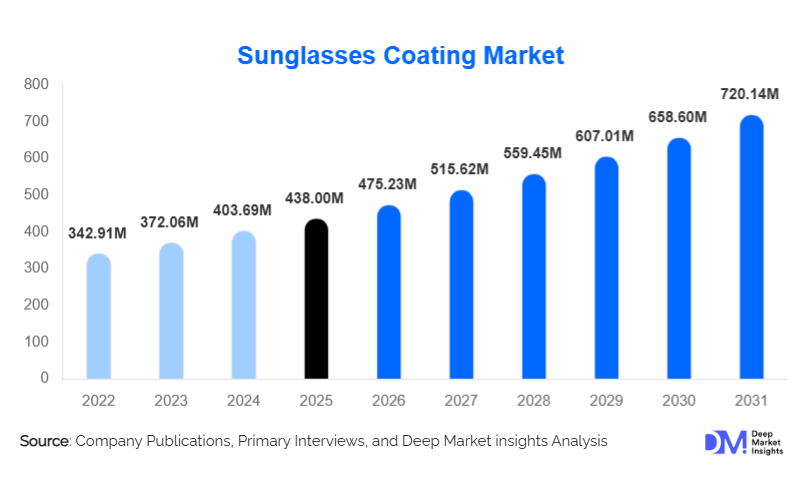

According to Deep Market Insights, the global sunglasses coating market size was valued at USD 438 million in 2025 and is projected to grow from USD 475.23 million in 2026 to reach USD 720.14 million by 2031, expanding at a CAGR of 8.5% during the forecast period (2026–2031). Market growth is primarily driven by rising awareness of eye health, increasing demand for UV and polarized protection, expanding sports and outdoor activities, and continuous technological advancements in lens coating processes.

Key Market Insights

- UV protection and polarized coatings are becoming standard features across both prescription and non-prescription sunglasses globally.

- OEM lens manufacturers dominate coating applications, driven by quality control, scale efficiencies, and integrated production models.

- Plastic lenses account for the majority of coated sunglasses, supported by their lightweight nature and compatibility with advanced coating technologies.

- Asia-Pacific is the fastest-growing regional market, led by China and India, due to rising disposable incomes and eyewear penetration.

- Premium and performance sunglasses are driving value growth, supported by sports, outdoor recreation, and lifestyle trends.

- Sustainability-focused coating processes, including solvent-free and energy-efficient technologies, are gaining traction among manufacturers.

What are the latest trends in the sunglasses coating market?

Multi-Functional and Nano-Coating Technologies

The market is witnessing a strong shift toward multi-functional coatings that integrate UV protection, anti-reflective properties, scratch resistance, hydrophobic behavior, and blue-light filtering into a single coating stack. Nano-coating technologies are enabling thinner, more durable layers without compromising optical clarity. These innovations are particularly attractive in premium, sports, and prescription sunglasses, allowing brands to differentiate products and command higher margins.

Sustainable and Eco-Friendly Coating Processes

Environmental concerns and regulatory pressures are accelerating the adoption of sustainable coating technologies. Manufacturers are increasingly investing in water-based formulations, low-emission vacuum deposition systems, and longer-lasting coatings that reduce replacement frequency. Sustainability credentials are becoming a key purchasing factor, particularly among younger consumers and premium eyewear buyers.

What are the key drivers in the sunglasses coating market?

Rising Awareness of Eye Health and UV Protection

Increasing awareness of the long-term impact of UV exposure on eye health, including cataracts and retinal damage, is a major growth driver. Regulatory standards in several countries mandate UV400 protection, making coatings an essential component rather than an optional add-on. Optometrists and healthcare organizations continue to reinforce the importance of protective eyewear.

Growth in Sports, Outdoor, and Lifestyle Activities

The expanding participation in outdoor sports such as cycling, skiing, fishing, and running is boosting demand for high-performance coatings. Features such as anti-fog, mirror, and hydrophobic coatings enhance visibility and comfort in extreme environments, driving adoption in sports and performance sunglasses.

What are the restraints for the global market?

High Capital Investment for Advanced Coating Technologies

Advanced coating processes such as sputtering and plasma-enhanced deposition require significant capital investment. Smaller optical labs and regional players often struggle to adopt these technologies, limiting penetration in cost-sensitive markets.

Price Sensitivity in Emerging Economies

In developing regions, affordability remains a key concern. Consumers often prioritize basic UV protection over advanced multi-layer coatings, which can constrain premium product adoption and pressure profit margins.

What are the key opportunities in the sunglasses coating industry?

Expansion in Emerging Markets

Rapid urbanization, rising disposable incomes, and expanding optical retail networks in Asia-Pacific, Latin America, and the Middle East present strong growth opportunities. Localized manufacturing and partnerships can help reduce costs and improve market penetration.

Integration with Smart and Digital Eyewear

The emergence of smart sunglasses and digitally enhanced eyewear creates new demand for specialized coatings, including anti-glare, blue-light filtering, and durability-enhancing layers designed for integrated electronics.

Coating Type Insights

UV protection coatings dominate the global sunglasses coating market, accounting for approximately 32% of total revenue in 2025. The leadership of this segment is driven primarily by universal regulatory requirements mandating UV400 protection across major markets, coupled with growing consumer awareness of UV-related eye disorders such as cataracts and macular degeneration. UV coatings have transitioned from optional features to baseline expectations, particularly in North America and Europe, ensuring consistent demand across both prescription and non-prescription sunglasses.

Polarized coatings represent a significant and steadily expanding share, particularly within the sports, outdoor, and premium sunglasses categories. Their ability to reduce glare and enhance visual clarity makes them essential for activities such as driving, fishing, skiing, and cycling. Meanwhile, scratch-resistant and hydrophobic coatings are increasingly integrated as bundled, multi-functional layers rather than standalone products. This trend is driven by consumer demand for durability, ease of maintenance, and long-lasting lens performance, allowing manufacturers to increase average selling prices while improving product differentiation.

Lens Material Insights

Plastic lenses dominate the sunglasses coating market, accounting for nearly 78% of total demand in 2025. Their leadership is supported by several structural advantages, including lightweight construction, high impact resistance, and superior compatibility with advanced coating technologies such as vacuum deposition and plasma-enhanced processes. Materials such as polycarbonate, CR-39, and Trivex are particularly well-suited for multi-layer coatings, making them the preferred choice for mass-market, sports, and prescription sunglasses.

Glass lenses continue to serve premium and niche segments due to their superior optical clarity and scratch resistance. However, their higher weight, limited impact resistance, and reduced flexibility for complex coatings have resulted in a gradual decline in market share. As eyewear brands increasingly prioritize comfort, safety, and versatility, plastic lenses are expected to further strengthen their dominance over the forecast period.

Technology Insights

Vacuum deposition technologies, including sputtering and physical vapor deposition (PVD), lead the market with approximately 46% share in 2025. This segment’s dominance is driven by its ability to deliver highly uniform, durable, and optically precise coatings, particularly for anti-reflective, mirror, and polarized applications. These technologies are widely adopted by large OEM lens manufacturers due to their scalability, automation potential, and consistent quality output.

Sol-gel and dip-coating technologies remain relevant in cost-sensitive and high-volume applications, especially in emerging markets. These methods offer lower capital investment requirements and are commonly used for basic UV and scratch-resistant coatings. However, their limited durability compared to vacuum-based processes restricts their adoption in premium and performance eyewear, reinforcing the long-term growth advantage of advanced deposition technologies.

End-Use Insights

Non-prescription fashion sunglasses represent the largest volume segment, driven by fast fashion cycles, seasonal replacement trends, and strong demand from younger demographics. High turnover rates in this segment ensure consistent coating demand, particularly for UV and mirror coatings.

Sports and performance sunglasses are the fastest-growing end-use segment, expanding at over 9% CAGR. Growth is supported by rising participation in outdoor sports, fitness activities, and adventure tourism, which require specialized coatings such as anti-fog, polarized, and hydrophobic layers. Industrial and safety eyewear coatings are emerging as a niche but high-value application, driven by stricter workplace safety regulations and increasing adoption of protective eyewear in construction, manufacturing, and logistics sectors.

| By Coating Type | By Lens Material | By Coating Technology | By Sunglasses Category | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 31% of the global sunglasses coating market in 2025, led by the United States. Regional growth is driven by high consumer awareness of eye health, strong adoption of premium and prescription sunglasses, and widespread participation in outdoor and sports activities. The presence of established eyewear brands, advanced optical labs, and high healthcare spending further supports demand for technologically advanced coatings, including polarized and blue-light filtering solutions.

Europe

Europe held around 27% market share, driven primarily by Germany, France, and Italy. The region benefits from a strong eyewear manufacturing ecosystem and a mature consumer base that prioritizes quality, sustainability, and premium design. Growth is further supported by stringent environmental regulations, which are accelerating the adoption of eco-friendly coating technologies, and a high penetration of prescription sunglasses among aging populations.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, registering nearly 9% CAGR during the forecast period. China and India together account for over 22% of global demand, driven by rising disposable incomes, expanding middle-class populations, and increasing awareness of UV protection. Rapid growth of organized optical retail chains, local manufacturing expansion, and government initiatives promoting domestic production are further accelerating market growth across the region.

Latin America

Latin America is witnessing steady growth, with Brazil and Mexico leading regional demand. Growth drivers include increasing adoption of branded eyewear, improving access to optical services, and rising urbanization. While price sensitivity remains a challenge, demand for basic UV and scratch-resistant coatings is increasing, particularly in mass-market sunglasses.

Middle East & Africa

The Middle East & Africa region shows growing demand for premium sunglasses, particularly in the UAE and Saudi Arabia, driven by high disposable incomes, strong luxury retail presence, and intense sunlight exposure. In Africa, South Africa leads regional manufacturing and consumption, supported by a well-established optical industry and rising awareness of eye protection. Harsh climatic conditions across the region further reinforce demand for durable, UV-resistant coatings.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sunglasses Coating Market

- EssilorLuxottica

- Zeiss Vision Care

- Hoya Corporation

- Nikon Optical

- Rodenstock

- Tokai Optical

- Seiko Optical

- Shamir Optical

- Younger Optics

- Vision Ease

- Mitsubishi Chemical Optical

- FUJIFILM Optical Devices

- PPG Industries

- Satisloh

- Carl Zeiss Meditec