Sugaring Hair Removal Market Size

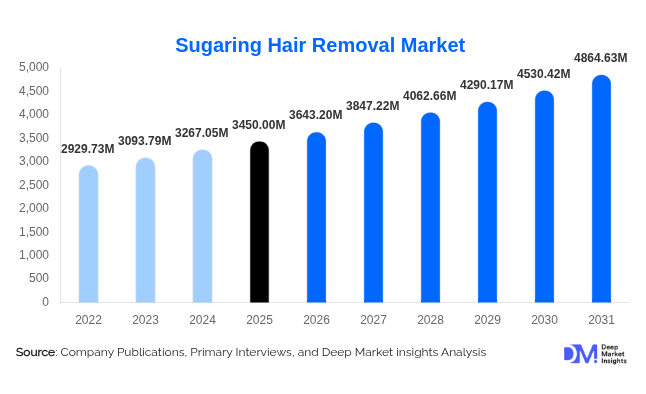

According to Deep Market Insights, the global sugaring hair removal market size was valued at USD 3450 million in 2025 and is projected to grow from USD 3643.2 million in 2026 to reach USD 4864.63 million by 2031, expanding at a CAGR of 5.6% during the forecast period (2026–2031). The market growth is primarily driven by rising consumer preference for natural, eco-friendly, and less painful hair removal solutions, increasing adoption of at-home beauty kits, and the expansion of professional spa and salon services globally.

Key Market Insights

- Consumers are increasingly preferring natural, biodegradable hair removal products, contributing to strong growth in at-home and professional segments.

- Professional salons and spa services are integrating sugaring as a premium offering, appealing to customers seeking gentler alternatives to conventional waxing.

- Women dominate the market, but the male grooming segment is rapidly expanding, offering new revenue streams for manufacturers.

- North America holds the largest share, led by high awareness, disposable incomes, and established salon networks.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class disposable incomes, growing beauty consciousness, and increasing ecommerce penetration.

- Digitalization and online retail, including influencer-led promotions and D2C channels, are reshaping consumer engagement and expanding at-home adoption.

What are the latest trends in the sugaring hair removal market?

Natural and Eco-Friendly Product Adoption

Consumers increasingly prefer sugar-based hair removal products that are free from synthetic chemicals, cruelty-free, and biodegradable. This trend aligns with the broader “clean beauty” movement, prompting manufacturers to innovate with organic and hypoallergenic formulations. Pre- and post-treatment natural products, such as calming lotions and conditioners, are becoming standard, enhancing customer experience and loyalty. Manufacturers are also highlighting environmental sustainability in packaging and marketing campaigns, reinforcing brand trust among eco-conscious users.

Growth of At-Home DIY Hair Removal Kits

At-home sugaring kits are gaining popularity due to convenience, privacy, and cost savings. E-commerce platforms, social media tutorials, and subscription models are driving awareness and adoption. Brands are leveraging influencer marketing and step-by-step online guides to educate consumers on proper application techniques, overcoming historical skill barriers. This trend is particularly strong among younger consumers and urban professionals, expanding market penetration beyond salon-goers.

What are the key drivers in the sugaring hair removal market?

Rising Awareness of Gentle Hair Removal Techniques

Consumers are increasingly seeking hair removal methods that reduce pain, irritation, and chemical exposure. Sugaring hair removal, which uses simple ingredients like sugar, water, and lemon, addresses these concerns effectively. Its compatibility with sensitive skin, low-temperature application, and reduced post-treatment inflammation make it a preferred choice over traditional waxing and depilatory creams.

Expansion of Professional Spa and Salon Services

Professional beauty services, including spas, salons, and dermatology clinics, are increasingly integrating sugaring into their offerings. This not only attracts customers seeking natural and gentler alternatives but also enables premium pricing. Multi-service wellness packages that combine sugaring with skincare treatments and relaxation therapies are driving higher revenues per customer, strengthening adoption in the professional segment.

Growth of the Male Grooming Segment

Historically dominated by women, the market is witnessing rising adoption among men. Shifting social norms, increased emphasis on personal grooming, and male-focused product launches (such as stronger pastes and pre/post-treatment care) are expanding the target demographic and boosting revenue potential.

What are the restraints for the global market?

Technical Skill Barrier for At-Home Use

Proper sugaring application requires skill to achieve optimal results. Inexperienced users may face issues such as incomplete hair removal or product wastage. This limits mass adoption of at-home kits and underscores the importance of consumer education, tutorials, and simplified product designs.

Competition from Alternative Hair Removal Methods

Established hair removal solutions, including laser treatments, waxing, and depilatory creams, continue to dominate consumer preference. Their convenience, long-lasting effects, and aggressive marketing campaigns can slow the adoption of sugaring products, particularly in regions where traditional methods are deeply entrenched.

What are the key opportunities in the sugaring hair removal market?

Integration into Professional Spa Services

Spas and beauty clinics are incorporating sugaring as a premium service offering. Bundling sugaring with holistic treatments, facials, or relaxation therapies enhances customer experience and increases average revenue per client. Expansion into medical aesthetic centers and dermatology clinics further broadens the professional segment, attracting clients seeking safe, gentle, and natural hair removal solutions.

Expansion via Digital Channels

E-commerce, social media marketing, and influencer-driven campaigns are increasing awareness and adoption of at-home sugaring products. Subscription kits, tutorials, and interactive online guides are helping brands educate consumers, overcome technical skill barriers, and expand reach in emerging markets. This digital-driven growth is especially impactful among tech-savvy younger demographics.

Emerging Market Growth

Regions such as Asia-Pacific and Latin America offer high-growth potential. Rising disposable income, increasing urbanization, and expanding beauty culture drive both at-home and professional adoption. Governments supporting small business growth, beauty service expansion, and export incentives for cosmetics further encourage market development in these regions.

Product Type Insights

Strip sugar products dominate the global sugaring hair removal market, accounting for approximately 40% of total revenue in 2025. Their leadership is primarily driven by ease of use, minimal skill requirements, and compatibility with both at-home consumers and professional salon settings. Pre-made strip sugar kits and roll-on formats offer convenience, consistent application, and reduced preparation time, making them particularly attractive to first-time users and high-throughput salons.

Repeat purchasing behavior is stronger in this segment due to standardized packaging, predictable results, and broader retail availability across online and offline channels. Strip sugar products also align well with the growing DIY beauty trend, as they require less technical expertise compared to hand-paste methods. Hand-paste products, while representing a smaller share, continue to gain traction in professional spas and specialty salons where trained practitioners prefer greater control over application. These products are favored for sensitive skin treatments and advanced techniques, but face adoption limitations due to higher skill requirements. Across all product types, innovation is focused on improving ease of application, enhancing texture stability, minimizing residue, and incorporating natural and skin-soothing ingredients to meet evolving consumer expectations.

Application Insights

Body hair removal applications remain the dominant application segment, contributing approximately 60% of total market demand in 2025. High-frequency grooming needs for areas such as legs, arms, bikini lines, underarms, back, and chest drive sustained demand, particularly in professional salon and spa environments. Body applications benefit from higher service repetition rates and greater product consumption per session, strengthening their revenue contribution.

The increasing popularity of at-home body hair removal kits further supports this segment, as consumers seek cost-effective and private alternatives to salon visits. Seasonal demand patterns, particularly in warmer climates and summer months, also favor body hair removal applications. Facial applications, including upper lip, chin, eyebrows, and sideburns, represent a smaller but stable share of the market. Growth in this segment is supported by demand for gentler, low-temperature hair removal methods suitable for sensitive facial skin. While body applications lead due to volume and frequency, facial applications benefit from premium pricing and professional treatment demand.

Distribution Channel Insights

Online distribution channels dominate global sales, driven by convenience, privacy, wider product availability, and access to detailed usage information. E-commerce platforms and direct-to-consumer (D2C) brand websites enable customers to compare products, read reviews, and access instructional content, which is particularly important for first-time users of sugaring products.

Subscription-based models and repeat-order incentives are gaining momentum, improving customer retention and lifetime value for brands. Social media platforms and influencer-led marketing campaigns play a critical role in educating consumers and demonstrating proper application techniques, accelerating adoption in the at-home segment. Offline channels, including specialty beauty stores, supermarkets, pharmacies, and professional salon supply distributors, remain important, particularly for professional-grade products and impulse purchases. The coexistence of online education and offline trial continues to support omnichannel growth strategies.

End-User Insights

At-home individual consumers represent the largest end-user segment, accounting for approximately 55–60% of total market demand in 2025. This dominance is driven by the growing DIY beauty movement, increased comfort with self-care routines, and the rising cost of professional beauty services. At-home users benefit from affordability, convenience, and discreet usage, particularly in urban and digitally connected populations.

Professional salons and spas remain a critical revenue contributor, especially in North America, Europe, and major urban centers in the Asia-Pacific. These establishments generate higher margins per treatment and drive repeat service demand through bundled beauty and wellness offerings. Emerging end-use applications in dermatology clinics, medical aesthetics centers, and wellness resorts are expanding the market base. These settings favor sugaring for sensitive skin, pre- and post-procedure hair removal, and holistic wellness treatments, further diversifying demand.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 37% of the global sugaring hair removal market in 2025, making it the largest regional market. Growth is driven by high consumer awareness of natural beauty products, strong purchasing power, and a well-established salon and spa ecosystem. The U.S. leads regional demand due to widespread adoption of at-home kits, strong D2C brand presence, and mature e-commerce infrastructure.

Additional growth drivers include the popularity of clean-label personal care products, rising male grooming adoption, and continuous product innovation. Canada supports steady growth through premium salon services and sustainability-focused consumer preferences.

Europe

Europe represents approximately 25% of the global market, with Western Europe leading adoption. Countries such as Germany, the U.K., and France benefit from strong beauty culture, regulatory emphasis on safe cosmetic formulations, and high consumer preference for eco-friendly and cruelty-free products.

Growth drivers include salon integration of natural hair removal methods, strong penetration of specialty beauty retailers, and advanced online retail infrastructure. Eastern Europe is emerging as a growth market due to rising disposable incomes, expanding urban populations, and increasing awareness of professional beauty treatments.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by rapid urbanization, rising middle-class incomes, and increasing beauty consciousness across India, China, Japan, South Korea, and Southeast Asia. Social media influence, beauty tutorials, and influencer marketing are accelerating adoption, particularly among younger consumers.

Growth is further supported by expanding e-commerce ecosystems, affordable at-home kits, and increasing professional salon density in urban centers. Cultural shifts toward personal grooming and the expansion of organized beauty retail are key long-term growth drivers.

Latin America

Latin America shows moderate but steady growth, with Brazil, Mexico, and Argentina as primary markets. Strong beauty culture, rising salon penetration, and increasing awareness of natural hair removal solutions support market expansion.

Economic recovery trends, expanding middle-class populations, and improving access to online beauty education are driving the adoption of at-home sugaring kits. Professional salons are also increasingly offering sugaring as a premium alternative to waxing.

Middle East & Africa

The Middle East & Africa region benefits from a combination of professional service demand and luxury beauty consumption. In Africa, countries with established spa and wellness industries continue to drive professional usage, supported by tourism and hospitality sectors.

The Middle East, particularly the UAE, Saudi Arabia, and Qatar, is experiencing growing adoption due to high disposable incomes, luxury beauty service demand, and expanding premium salon infrastructure. Cultural emphasis on grooming and personal care, combined with increasing female workforce participation, further supports regional market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sugaring Hair Removal Market

- Reckitt Benckiser Group plc

- Edgewell (Schick)

- Parissa Laboratories Inc.

- MOOM Inc.

- L.A. Bikini

- Sugaring NYC

- Nad’s

- Skin Inc.

- Sugar Sugar

- Radeq Lab

- Sweet & True Sugaring Co.

- Nacach Wax

- Guangzhou Fourto Sanitary Products Co., Ltd.

- Sugardoh Inc.

- Sugaring London