Stylus Pens Market Size

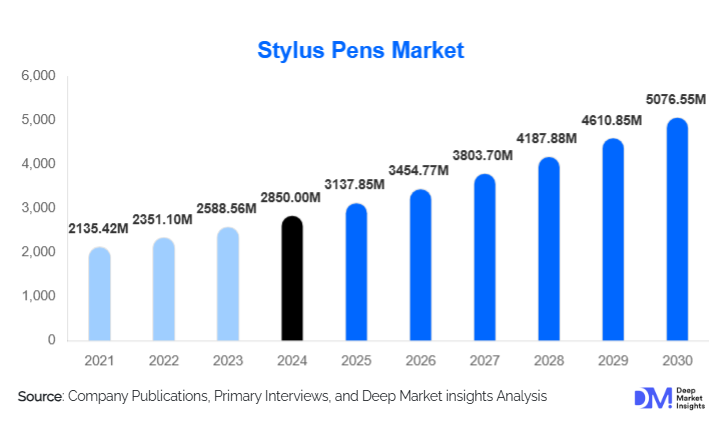

According to Deep Market Insights, the global stylus pens market size was valued at USD 2,850 million in 2024 and is projected to grow from USD 3,137.85 million in 2025 to reach USD 5,076.55 million by 2030, expanding at a CAGR of 10.1% during the forecast period (2025–2030). The stylus pen market growth is primarily driven by the rapid adoption of touchscreen-enabled devices, increasing penetration of tablets and 2-in-1 laptops, and rising demand for precision digital input across education, creative industries, healthcare, and enterprise applications.

Key Market Insights

- Active and smart stylus pens dominate value share due to rising demand for pressure sensitivity, palm rejection, and workflow integration.

- OEM-compatible stylus pens account for over half of global demand, supported by device bundling and ecosystem lock-in strategies.

- Asia-Pacific leads global consumption, driven by large-scale tablet manufacturing and education digitization initiatives.

- Mid-range stylus pens (USD 10–40) represent the largest price segment, balancing affordability and advanced features.

- Online distribution channels dominate, accounting for more than 60% of global sales through e-commerce and D2C platforms.

- Education and healthcare are the fastest-growing end uses, benefiting from digital classrooms and electronic medical record adoption.

What are the latest trends in the stylus pens market?

Shift Toward Smart and AI-Integrated Stylus Pens

The stylus pens market is witnessing a strong shift toward smart stylus solutions integrated with AI-based handwriting recognition, cloud synchronization, and application-level intelligence. These advanced stylus pens enable seamless conversion of handwritten notes into digital text, cross-device syncing, and real-time collaboration. Professionals in design, engineering, and business environments increasingly prefer stylus pens that integrate directly with productivity ecosystems, improving workflow efficiency. This trend is accelerating premiumization, with consumers willing to pay higher prices for enhanced precision, reduced latency, and intelligent features.

Rising Adoption in Digital Education Ecosystems

Educational institutions globally are accelerating the adoption of stylus-enabled devices to support interactive learning, digital assessments, and remote instruction. Governments and private institutions are deploying tablets bundled with stylus pens to improve student engagement and handwriting retention in digital environments. This trend is particularly strong in Asia-Pacific, the Middle East, and parts of Latin America, where national digital education programs are driving large-volume institutional procurement.

What are the key drivers in the stylus pens market?

Proliferation of Touchscreen Devices

The rapid growth of tablets, smartphones, and 2-in-1 laptops remains the strongest driver for the stylus pens market. Manufacturers are increasingly designing devices optimized for stylus input, directly boosting attach rates. Stylus pens are no longer optional accessories but essential tools for productivity, creativity, and note-taking, particularly in professional and educational settings.

Expansion of Remote Work and Digital Creativity

The normalization of remote and hybrid work has significantly increased demand for digital input tools. Stylus pens enable natural handwriting, sketching, and annotation, supporting collaboration across digital platforms. Creative professionals, including designers, illustrators, and content creators, are driving sustained demand for high-precision active stylus pens.

What are the restraints for the global market?

Price Sensitivity and Market Commoditization

The presence of low-cost, unbranded stylus pens has intensified price competition, particularly in the passive stylus segment. This commoditization exerts margin pressure on established brands and limits differentiation in entry-level categories.

Compatibility and Technology Fragmentation

Differences in operating systems, proprietary stylus technologies, and hardware standards create compatibility challenges. Limited cross-platform usability can slow replacement cycles and increase consumer hesitation, particularly for premium stylus products.

What are the key opportunities in the stylus pens industry?

Institutional and Government-Led Education Programs

Large-scale government investments in digital classrooms present long-term volume opportunities for stylus pen manufacturers. Institutional contracts enable predictable demand and encourage localized manufacturing partnerships, particularly in emerging markets.

Technological Differentiation and Premiumization

Opportunities exist for manufacturers to integrate biometric input, AI-powered note analysis, and advanced pressure sensitivity. These innovations support higher margins and reduce exposure to low-cost competition, particularly in professional and enterprise segments.

Product Type Insights

Active stylus pens dominate the global stylus pens market, accounting for approximately 46% of total revenue in 2024. Their market leadership is primarily driven by superior input precision, multi-level pressure sensitivity, palm rejection, and seamless integration with professional-grade software used in design, engineering, education, and enterprise productivity. The increasing adoption of tablets and 2-in-1 laptops as primary computing devices has further accelerated demand for active stylus pens, as they closely replicate the experience of traditional handwriting and sketching while enabling advanced digital functionality.

Passive stylus pens continue to retain relevance within low-cost and entry-level consumer applications, particularly among smartphone users and price-sensitive markets. These products benefit from universal compatibility and ease of use but face margin pressure due to commoditization. Meanwhile, smart stylus pens are gaining rapid traction in premium consumer and enterprise environments, driven by Bluetooth connectivity, onboard memory, shortcut controls, and cloud synchronization capabilities. Hybrid stylus pens address niche demand by combining digital stylus functionality with traditional ink writing, appealing to users transitioning from analog to digital workflows. Overall, innovation and performance differentiation remain the primary drivers shaping product type adoption.

Technology Insights

Active electrostatic (AES) technology leads the stylus pens market with an estimated 38% share, supported by its widespread integration into modern tablets, laptops, and touchscreen displays. AES technology offers a strong balance between accuracy, responsiveness, and cost efficiency, making it the preferred choice for OEM-compatible stylus solutions. Its scalability across consumer, education, and enterprise devices continues to reinforce its dominance.

Electromagnetic resonance (EMR) stylus technology remains highly favored among professional designers and digital artists due to its battery-free operation, superior pressure sensitivity, and consistent performance. While EMR devices command premium pricing, their adoption is concentrated in specialized creative workflows. Capacitive stylus pens dominate the low-cost segment, benefiting from simplicity and universal compatibility but offering limited functionality. Optical stylus technology remains confined to niche and industrial applications due to higher costs and limited mainstream adoption.

Distribution Channel Insights

Online distribution channels dominate global stylus pen sales, accounting for more than 60% of total revenue. Growth is driven by the expansion of e-commerce marketplaces, brand-owned direct-to-consumer platforms, and increasing consumer preference for digital purchasing. Online channels offer extensive product comparisons, competitive pricing, and global reach, making them particularly effective for both branded and unbranded stylus products.

Offline electronics retail remains strategically important for premium and professional-grade stylus pens, where hands-on experience and device compatibility validation influence purchasing decisions. Institutional sales channels are expanding rapidly, driven by bulk procurement from educational institutions, healthcare providers, and enterprises deploying standardized digital infrastructure. These long-term contracts provide manufacturers with predictable demand and higher volume stability.

End-Use Insights

The consumer segment represents nearly 48% of global stylus pen demand, supported by widespread tablet and smartphone adoption for personal productivity, entertainment, and creative use. Consumers increasingly view stylus pens as essential accessories rather than optional add-ons, particularly for note-taking and digital art.

The education sector is the fastest-growing end-use segment, expanding at a CAGR exceeding 12%, driven by digital classroom initiatives, e-learning platforms, and government-led education digitization programs. Healthcare is emerging as a high-growth segment, with stylus pens increasingly used for electronic medical records (EMR), diagnostics, and telemedicine workflows. Commercial and creative professional users continue to represent a stable, high-value segment, benefiting from recurring replacement cycles and demand for advanced performance features.

| By Product Type | By Technology | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global stylus pens market with approximately 38% share in 2024. Regional dominance is driven by large-scale tablet manufacturing, rapid digitalization of education systems, and expanding consumer electronics adoption. China remains the largest market due to its integrated manufacturing ecosystem and strong domestic demand. India is the fastest-growing market, registering growth above 15% CAGR, supported by national digital education initiatives, rising middle-class income, and increasing tablet penetration. Japan and South Korea contribute through strong demand from creative professionals and enterprise users.

North America

North America accounts for nearly 30% of the global market share, led by the United States. Growth is driven by high penetration of premium tablets and 2-in-1 devices, strong enterprise mobility adoption, and a well-established creative industry. The region also benefits from early adoption of advanced stylus technologies and high replacement rates, particularly in professional and education segments.

Europe

Europe represents approximately 20% of global demand, with Germany, the U.K., and France as key contributors. Growth is supported by sustained investments in education technology, digital government initiatives, and strong adoption among professional designers and engineers. Increasing emphasis on hybrid work environments and digital documentation is further driving stylus pen demand across the region.

Latin America

Latin America holds a smaller but steadily expanding share of the stylus pens market. Brazil and Mexico lead regional demand, supported by growing middle-class populations, improving digital infrastructure, and gradual adoption of tablets in education and enterprise settings. Price-sensitive demand favors mid-range and passive stylus products, while institutional procurement is emerging as a key growth driver.

Middle East & Africa

The Middle East & Africa region is witnessing accelerating growth, driven by government-led digital transformation programs and expanding enterprise adoption. Countries such as the UAE and Saudi Arabia are investing heavily in smart education, e-government platforms, and healthcare digitization, creating strong demand for stylus-enabled devices. In Africa, growing tablet usage in education and mobile-first digital strategies are supporting long-term market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|