Stroller Wagon Market Size

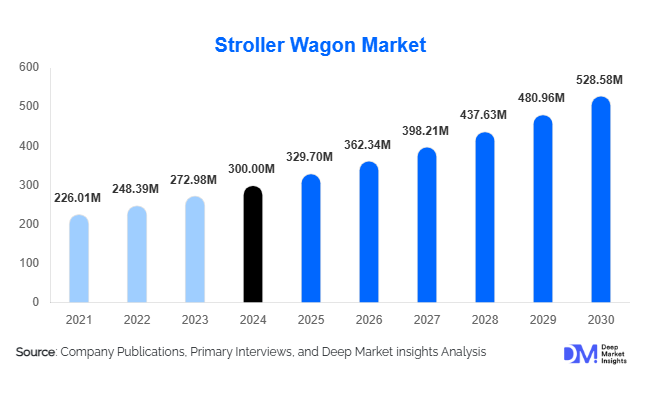

According to Deep Market Insights, the global stroller wagon market size was valued at USD 300.00 million in 2024 and is projected to grow from USD 329.70 million in 2025 to reach USD 528.58 million by 2030, expanding at a CAGR of 9.90% during the forecast period (2025–2030). The stroller wagon market growth is primarily driven by rising urbanization, increasing disposable incomes, growing nuclear-family households, and the rapidly expanding preference for multifunctional, portable, and space-efficient child mobility solutions.

Key Market Insights

- Collapsible and foldable stroller wagons dominate the market, driven by rising urban living and demand for compact, space-saving mobility solutions.

- Asia-Pacific leads global demand with the highest share in 2024, supported by demographic strength, rising middle-class wealth, and rapid urbanization.

- Double-seat stroller wagons represent the largest seating segment, driven by families with two young children seeking convenience and affordability.

- Online retail is the fastest-growing distribution channel, expanding accessibility in emerging markets and enhancing product variety.

- Premium stroller wagons with advanced features, all-terrain wheels, modular seating, and weather protection are lifting average selling prices.

- Export-driven manufacturing from Asia-Pacific continues to expand, particularly to North America and Europe.

What are the latest trends in the stroller wagon market?

Innovation-Driven Product Development

Manufacturers are increasingly focusing on product innovation to differentiate in a fragmented market. Modern stroller wagons now feature all-terrain wheels, collapsible aluminum frames, weatherproof canopies, storage compartments, ergonomic handles, and modular seating to cater to multi-child households. Premium brands are investing heavily in design optimization, safety certifications, and material upgrades, resulting in higher durability and enhanced comfort. Future-forward concepts such as GPS-enabled tracking and smart connectivity are beginning to emerge, reflecting growing technological integration in child mobility products.

Shift Toward Compact, Foldable, and Multi-Use Designs

Space-efficient stroller wagons are gaining significant traction, particularly in densely populated urban regions. Foldable designs that fit easily into car trunks or small apartments have become the preferred choice among city dwellers. Multi-use wagons, converting between stroller, wagon, cargo carrier, and travel gear, are aligning with modern parents’ preference for flexible mobility solutions. This trend is further boosted by nuclear-family lifestyles and increasing travel behaviors, which emphasize portability and convenience.

What are the key drivers in the stroller wagon market?

Rising Disposable Income and Urban Living Patterns

Growing global income levels, especially across Asia-Pacific and Latin America, are expanding spending on premium childcare products. As more families transition to dual-income structures, demand for convenient, stylish, and safe mobility solutions has increased. Stroller wagons are viewed not only as transport equipment but as multifunctional family utilities suitable for shopping, parks, travel, and outdoor leisure.

Expansion of E-Commerce and Digital Retail Channels

The global rise of online shopping has dramatically widened stroller wagon accessibility. E-commerce enables consumers to compare brands, read reviews, and explore features, significantly reducing purchase barriers. Online platforms also support new market entrants, allowing direct-to-consumer sales models with lower distribution costs. Rapid internet penetration across emerging economies further accelerates online-led market growth.

What are the restraints for the global market?

High Price Sensitivity and Fragmented Competition

The stroller wagon market is highly fragmented, with numerous small and medium manufacturers competing on price, making it difficult for brands to sustain margins. Consumers in developing regions often prefer low-cost alternatives or used strollers, restricting adoption among budget households. This pricing pressure slows the shift toward premium, feature-rich stroller wagons.

Safety Regulations and Compliance Requirements

Stroller wagons must meet stringent global safety standards regarding braking systems, harnesses, frame stability, load capacity, and material safety. Achieving compliance across multiple export markets raises costs and operational complexity, particularly for smaller manufacturers. Regulatory differences can slow market entry and reduce product availability in global markets.

What are the key opportunities in the stroller wagon industry?

Urban Expansion in Emerging Economies

Asia-Pacific, Latin America, and the Middle East present large, under-penetrated markets where urbanization and rising incomes are expanding demand for premium childcare mobility products. Foldable wagons tailored for small apartments, compact cars, and urban travel will see major adoption.

Commercial and Institutional Adoption

Daycare centers, preschools, resorts, parks, and recreational facilities are beginning to adopt multi-seat stroller wagons for group child transport. As childcare infrastructure grows, especially in developed economies, this institutional segment presents lucrative demand opportunities.

Product Type Insights

Collapsible stroller wagons remain the dominant product type globally, accounting for nearly 50% of total revenue in 2024. Their strong lead stems from rising urbanization, limited home storage space, and the growing popularity of family travel, which demands compact, lightweight, and portable mobility solutions. Parents in both developed and emerging economies increasingly prioritize products that can be easily folded, transported in small vehicles, and stored efficiently in apartments, needs that collapsible wagons address exceptionally well. The integration of advanced features such as all-terrain wheels, modular seating, weather-protective canopies, and enhanced safety mechanisms further strengthens adoption across premium and mid-range categories.

On the other hand, rigid-frame wagons maintain a niche but stable presence, appealing primarily to outdoor enthusiasts and families in rural or semi-urban areas who require heavy-duty durability. Although these wagons offer superior sturdiness and larger load capacity, their bulkier size and reduced portability limit their mass-market appeal. Consequently, rigid-frame models trail behind collapsible variants but remain relevant among consumers seeking robust functionality for camping, trekking, and extended outdoor activities.

Application Insights

Household use dominates the stroller wagon market, representing over 80% of global revenue in 2024. This leading position is anchored by the rising proportion of nuclear families, dual-income households, and urban parents who prioritize convenience, safety, and flexibility in child mobility. Stroller wagons have become popular as multifunctional equipment for shopping trips, park visits, weekend outings, and travel, making them indispensable family assets. The growing trend of active outdoor lifestyles, especially among millennials, further accelerates household adoption of lightweight and multi-seat wagons.

Meanwhile, commercial applications form a fast-growing secondary segment. Daycare centers, preschools, amusement parks, resorts, and family entertainment venues increasingly invest in multi-seat and durable stroller wagons to enhance visitor convenience and meet safety expectations. As global tourism recovers and family-oriented recreation expands, demand from institutional buyers is expected to rise steadily. In particular, premium hotels and theme parks are adopting stroller wagon rental services to elevate guest experiences, opening new opportunities for manufacturers and rental operators.

Distribution Channel Insights

Online retail continues to gain momentum, capturing 30–35% of total global sales in 2024. E-commerce platforms offer unmatched product visibility, competitive pricing, and customer reviews, enabling parents to make more informed purchase decisions. The shift to online shopping accelerated post-pandemic, reinforced by improved logistics, flexible return policies, and the rise of direct-to-consumer (D2C) brands offering stroller wagons without intermediary markups. Digital marketplaces in Asia-Pacific, North America, and Europe are particularly influential in boosting online sales penetration.

Despite this shift, offline retail, including baby specialty stores, supermarkets, and hypermarkets, continues to dominate overall sales. Physical stores allow consumers to test build quality, folding mechanisms, wheel stability, and comfort, which remain critical factors when purchasing child mobility products. However, in most regions, retailers are experiencing a gradual migration to omnichannel shopping behavior, with customers often discovering products online and completing purchases offline or vice versa. This interplay is expected to reshape the competitive landscape, encouraging brands to strengthen both digital and physical footprints.

| By Product Type | By Seating Capacity | By Application | By Distribution Channel | By Material Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America commands 25–30% of global stroller wagon demand in 2024, supported by high disposable income, sophisticated retail channels, and strong penetration of premium child mobility brands. The U.S. market, in particular, reflects a preference for multi-seat, all-terrain, and feature-rich stroller wagons, aligning with suburban lifestyles where families frequently engage in outdoor recreation, park visits, road trips, and sporting events.

Europe

Europe accounts for 20–25% of the global market, with Germany, France, the U.K., the Netherlands, and Scandinavia leading regional demand. European consumers exhibit strong preferences for eco-friendly materials, sustainability-certified products, and ergonomic designs. While the region’s declining birth rates may temper long-term volume growth, the continuous shift toward premium, durable, and design-centric wagons sustains value expansion.

Asia-Pacific

Asia-Pacific leads the global stroller wagon market with a 30–35% share in 2024 and remains the fastest-growing region through 2030. China and India form the core of mass-market demand due to large birth rates, expanding middle-class populations, and rapid urbanization. Japan, South Korea, and Australia contribute significantly to premium segment growth, favoring high-end collapsible wagons with advanced comfort and safety features.

Latin America

Latin America represents 8–12% of the global market share, led by Brazil, Mexico, Chile, and Argentina. Although price sensitivity remains a constraint, rising awareness of stroller wagon utility and improving access to online retail are expanding the mid-range and value segments. Urban parents in metropolitan areas are showing increasing interest in collapsible wagons for shopping, travel, and recreational use.

Middle East & Africa

The Middle East & Africa accounts for 5–8% of global demand, with the UAE, Saudi Arabia, Qatar, and Kuwait driving premium stroller wagon sales due to high-income household profiles. In Africa, the market is still emerging but gaining traction in countries such as South Africa, Nigeria, and Kenya, where rising urbanization and growing young families are increasing adoption rates.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Stroller Wagon Market

- Radio Flyer

- Bugaboo International B.V.

- UPPAbaby

- Goodbaby International Holdings Ltd.

- Peg Perego

- Britax

- Baby Jogger

- Joovy

- Stokke AS

- Nuna Intl BV

- Evenflo

- Clek

- Hauck GmbH & Co. KG

- Mima

- Thule Group

Recent Developments

- In March 2025, Radio Flyer expanded its premium wagon lineup with a new collapsible all-terrain series optimized for urban and outdoor use.

- In February 2025, UPPAbaby launched a modular double-seat stroller wagon targeting families with two young children.

- In January 2025, Goodbaby International announced new manufacturing investments in Asia to meet rising export demand from the U.S. and Europe.