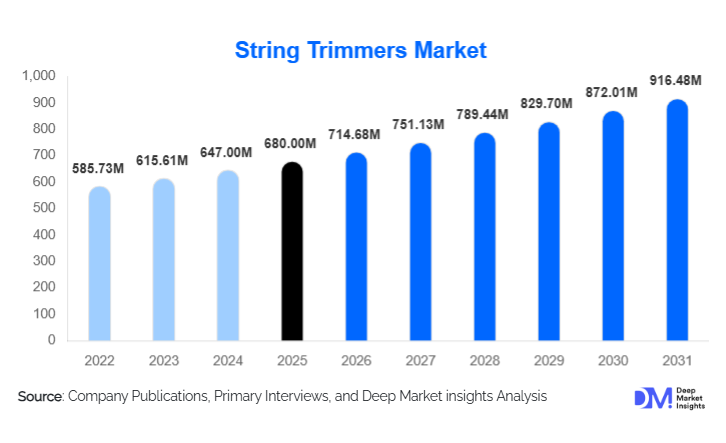

String Trimmers Market Size

According to Deep Market Insights, the global string trimmers market size was valued at USD 680.00 million in 2025 and is projected to grow from USD 714.68 million in 2026 to reach USD 916.48 million by 2031, expanding at a CAGR of 5.1% during the forecast period (2026–2031). The string trimmers market is experiencing growth primarily driven by increasing residential landscaping activities, rising demand from commercial landscaping services, and a rapid transition from gas-powered equipment to battery-powered and electric alternatives, largely due to environmental regulations and sustainability initiatives.

Key Market Insights

- Battery-powered string trimmers are rapidly replacing gas-powered models due to lower emissions, reduced noise levels, and advancements in lithium-ion battery technology.

- Residential users dominate global demand, supported by growing DIY lawn-care trends and increased spending on home improvement.

- North America leads the global market, driven by high household penetration, a high density of professional landscapers, and strong retail distribution networks.

- Asia-Pacific is the fastest-growing region, supported by urbanization, smart city initiatives, and the rising adoption of mechanized landscaping tools.

- Commercial landscaping services are the fastest-growing end-use segment, benefiting from urban infrastructure expansion and outsourcing of facility management.

- Technological innovation, including brushless motors, ergonomic designs, and smart battery management systems, is reshaping product differentiation.

What are the latest trends in the string trimmers market?

Shift Toward Battery-Powered and Electric Equipment

The most prominent trend in the string trimmers market is the accelerated shift toward battery-powered and electric models. Regulatory pressure to reduce emissions and noise pollution, especially in urban and residential areas, has significantly reduced reliance on gas-powered trimmers. Improvements in lithium-ion battery energy density, charging speed, and runtime have made battery-powered trimmers suitable for both residential and commercial applications. Manufacturers are increasingly focusing on interchangeable battery platforms that allow users to operate multiple outdoor power tools using a single battery system, improving cost efficiency and customer retention.

Ergonomic and User-Centric Design Innovations

Manufacturers are prioritizing ergonomic design enhancements to reduce operator fatigue and improve productivity. Adjustable handles, vibration-dampening shafts, lightweight composite materials, and improved balance are now standard features in premium string trimmers. These innovations are particularly important for professional landscapers who use equipment for extended periods. User-friendly features such as automatic line feed, tool-free line replacement, and adjustable cutting widths are also driving adoption among DIY users.

What are the key drivers in the string trimmers market?

Growth in Residential Landscaping and DIY Lawn Care

Rising homeownership, suburban expansion, and increased interest in outdoor aesthetics are key drivers of string trimmer demand. Consumers are investing more in lawn maintenance equipment to enhance property value and curb appeal. The availability of affordable, lightweight, and easy-to-operate trimmers has further accelerated adoption among first-time buyers and DIY users. Seasonal promotions by home improvement retailers and online platforms are also supporting sustained demand growth.

Expansion of Commercial Landscaping and Facility Management Services

The rapid growth of commercial landscaping services across corporate campuses, retail centers, hospitality properties, and public infrastructure is significantly boosting demand for high-performance string trimmers. Professional landscapers prioritize durability, cutting efficiency, and reduced downtime, driving demand for premium straight-shaft and high-capacity models. Increasing outsourcing of landscape maintenance by municipalities and private enterprises continues to support long-term market expansion.

What are the restraints for the global market?

High Upfront Cost of Advanced Battery-Powered Models

Although battery-powered string trimmers offer long-term cost benefits, their higher upfront costs compared to entry-level gas models remain a key restraint, particularly in price-sensitive developing markets. Commercial users also face additional expenses related to spare batteries and charging infrastructure, which can slow adoption in certain regions.

Battery Performance Limitations in Extreme Conditions

Battery efficiency can be impacted by extreme temperatures, limiting performance in very hot or cold climates. Concerns around battery degradation, replacement costs, and recycling infrastructure pose challenges for long-term adoption, especially for heavy-duty commercial applications.

What are the key opportunities in the string trimmers industry?

Emerging Demand from Developing Economies

Rapid urbanization and infrastructure development in Asia-Pacific, Latin America, and parts of the Middle East present significant growth opportunities. Rising labor costs and increasing mechanization in landscaping and agriculture are driving the adoption of string trimmers in these regions. Government-led urban beautification and smart city initiatives further support long-term demand.

Integration of Smart and Connected Technologies

The integration of IoT-enabled monitoring, predictive maintenance alerts, and fleet management solutions for commercial landscapers presents new growth avenues. Smart battery diagnostics, usage analytics, and remote equipment tracking can enhance operational efficiency and reduce downtime, creating strong value propositions for professional users.

Product Type Insights

Battery-powered string trimmers dominate the global market, accounting for approximately 44% of total revenue in 2024. These models are preferred for their low maintenance, reduced noise, and environmental compliance. Gas-powered trimmers continue to hold relevance in heavy-duty and rural applications. At the same time, corded electric models remain popular for small residential lawns due to their affordability and consistent power output.

Application Insights

Residential lawn maintenance represents the largest application segment, contributing nearly 52% of global demand in 2024. Commercial landscaping services are the fastest-growing application, supported by increasing urban infrastructure and outsourcing trends. Municipal applications, including park maintenance and roadside landscaping, are also witnessing rising mechanization, while agricultural and vineyard maintenance is emerging as a niche application.

Distribution Channel Insights

Offline retail channels, including home improvement stores and specialty equipment dealers, account for approximately 63% of global sales due to hands-on product evaluation and after-sales support. Online retail channels are expanding rapidly, driven by convenience, competitive pricing, and broader product availability. Direct-to-consumer sales through brand websites are gaining traction, supported by digital marketing and bundled accessory offerings.

End-Use Insights

Residential users remain the dominant end-use segment, while commercial landscapers represent the fastest-growing user group. Municipal and government entities contribute a steady demand through public infrastructure maintenance projects. Emerging use cases in agriculture, orchards, and forestry maintenance are creating incremental growth opportunities.

| By Power Source | By Cutting Capacity | By Shaft Type | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global string trimmers market, led by the United States, which represents nearly 26% of total demand. High household penetration, a strong culture of lawn maintenance, and widespread availability of professional landscaping services support market dominance. Regulatory support for electric equipment further accelerates adoption.

Europe

Europe holds around 27% market share, driven by Germany, the U.K., and France. Stringent emission regulations and strong environmental awareness are accelerating the shift toward battery-powered trimmers. Commercial landscaping and municipal demand remain key growth drivers across Western Europe.

Asia-Pacific

Asia-Pacific represents approximately 24% of the global market and is the fastest-growing region, with a CAGR exceeding 8%. China, Japan, and India are major contributors, supported by urban expansion, rising disposable income, and government-led infrastructure development.

Latin America

Latin America accounts for nearly 9% of global demand, led by Brazil and Mexico. Growth is supported by increasing mechanization in landscaping and rising adoption of professional lawn-care services in urban areas.

Middle East & Africa

The Middle East & Africa region holds about 6% market share. Demand is driven by urban development projects in GCC countries and growing commercial landscaping activity in South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the String Trimmers Market

- Husqvarna Group

- STIHL Holding AG

- Deere & Company

- Stanley Black & Decker

- Makita Corporation

- Robert Bosch GmbH

- Honda Motor Co., Ltd.

- HiKOKI (Hitachi Koki)

- ECHO Incorporated

- Toro Company