Still Images Market Size

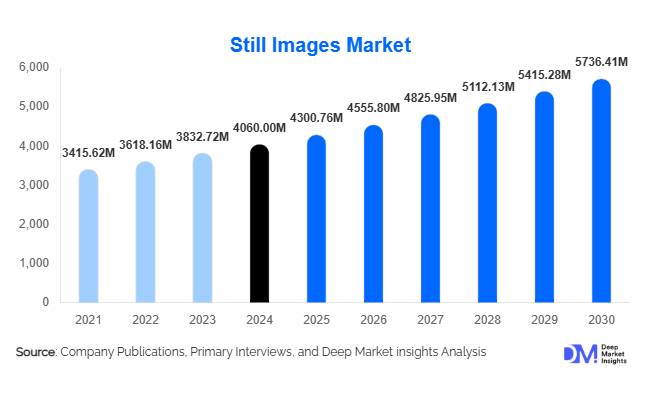

According to Deep Market Insights, the global still images market size was valued at USD 4,060.00 million in 2024 and is projected to grow from USD 4,300.76 million in 2025 to reach USD 5,736.41 million by 2030, expanding at a CAGR of 5.93% during the forecast period (2025–2030). Market growth is primarily driven by the continued expansion of digital advertising and social media, the rapid scaling of e-commerce and retail media, and the professionalization of visual communication across entertainment, publishing, corporate, and education sectors. In parallel, emerging AI-native licensing models and data partnerships are transforming still images from a simple download-based product into a strategic content and training asset in the broader AI and cloud ecosystem.

Key Market Insights

- Rights-managed and enterprise licensing models account for the largest revenue share, even as royalty-free and microstock formats dominate volumes.

- Stock and curated library images generate over half of the market’s value, reflecting strong demand from advertising, media, and corporate users.

- Advertising and digital marketing remain the leading application segment, followed closely by e-commerce, entertainment, and publishing.

- North America leads the global still images market by revenue, while Asia-Pacific is the fastest-growing region supported by booming digital economies.

- People and lifestyle imagery is the most commercially important subject category, driven by brand demand for authentic, diverse, and inclusive visual storytelling.

- Market concentration is moderate, with the top five agencies collectively controlling around 55–60% of global revenue, complemented by a long tail of niche and regional providers.

What are the latest trends in the still images market?

AI-Native Licensing and Generative Content Partnerships

The most disruptive trend in the still images market is the rapid integration of generative AI and data licensing. Leading agencies are signing multi-year agreements with AI and cloud platforms to provide licensed image libraries for model training, fine-tuning, and content safety filters. This is creating a new, high-value revenue stream where libraries are monetized as structured visual datasets rather than only per-image downloads. At the same time, agencies are launching AI-assisted tools that let users generate new images based on licensed assets, automate background removal, and perform style matching within safe, rights-cleared environments. These developments are blurring the line between photography and synthetic imagery and positioning major stock platforms as key data infrastructure providers in the AI era.

Authentic, Diverse and Localized Visual Storytelling

Another major trend is the shift toward authenticity, diversity, and localization in visual content. Brands, publishers, and public-sector organizations increasingly reject generic, staged “stock-looking” imagery in favor of content that accurately reflects local cultures, body types, age groups, and work styles. This is driving demand for region-specific collections, inclusive representation, and imagery aligned with ESG, sustainability, and social-impact narratives. Contributors in emerging markets are gaining prominence as buyers search for visuals that reflect real neighborhoods, signage, languages, and lifestyles. At the same time, vertical-specific image sets for industries such as healthcare, fintech, climate tech, and education are becoming more important as companies seek contextually precise and regulation-compliant visuals.

What are the key drivers in the still images market?

Expansion of Digital Advertising and Social Media

Global advertising spend has crossed the trillion-dollar mark, with digital channels steadily increasing their share. Social platforms, short-form video, performance marketing, and mobile-first formats all rely heavily on compelling visual assets to attract attention and drive clicks. Campaigns are refreshed frequently to combat ad fatigue, which fuels recurring demand for high-quality still images across hero creatives, thumbnails, banners, and A/B test variants. The integration of stock libraries into ad platforms, social scheduling tools, and creative automation suites amplifies usage and embeds still images in the core workflow of digital marketers.

Growth of E-Commerce and Retail Digitalization

The explosive growth of e-commerce and retail media networks is another fundamental driver. Every product listing typically requires multiple images—front, back, close-ups, contextual lifestyle images, and sometimes 360-degree views. Marketplaces, direct-to-consumer brands, and live-commerce platforms need consistent, high-resolution visuals optimized for mobile and conversion. This creates ongoing demand for packshots, lifestyle context, and template-ready photos that can be easily adapted across platforms and campaigns. As more small and mid-sized retailers come online, many rely on stock imagery and hybrid models (stock plus custom) to accelerate catalog development and go-to-market timelines.

Professionalization of Visual Communication in Media, Corporate and Education

Entertainment and media, streaming platforms, corporate communications, and e-learning providers are standardizing their use of imagery. Instead of ad-hoc sourcing from free sites, organizations increasingly use centrally managed, rights-cleared libraries tied to brand guidelines and design systems. Still images power key art, editorial layouts, UX components, infographics, course covers, and internal training content. This professionalization creates more predictable, contract-based demand for stock and custom imagery, especially among large enterprises and public institutions that prioritize compliance, consistency, and long-term licensing clarity.

What are the restraints for the global market?

Competition from Free Content and User-Generated Imagery

One of the most significant restraints is the widespread availability of free or freemium imagery from open-license platforms, social networks, and user-generated content. For many generic themes—such as landscapes, simple office scenes, and abstract backgrounds—buyers can often find acceptable alternatives at no cost. This puts downward pressure on pricing and limits growth in average revenue per image, especially at the lower end of the market. Professional agencies need to differentiate through quality, curation, legal safety, and advanced search capabilities to justify premium pricing in the face of abundant free content.

Legal and Ethical Complexities of Generative AI

Generative AI introduces substantial uncertainty around copyright, training data, and ownership of AI-generated visuals. Ongoing litigation and evolving regulations create risk for both providers and buyers of imagery, especially when datasets include content for which rights were not clearly obtained. Enterprises are cautious about using unverified AI-generated images in brand-sensitive contexts. This uncertainty can slow adoption of new AI-based offerings, increase compliance costs, and force agencies to invest heavily in legal, technical, and governance frameworks. Smaller players may struggle to keep up, limiting their ability to innovate and compete at scale.

What are the key opportunities in the still images industry?

AI Training, Data Licensing and Hybrid Creation Models

The rise of AI models that depend on large-scale, high-quality visual datasets is creating a structural opportunity for still image providers. Agencies can monetize their libraries through training data licenses, specialized datasets for regulated sectors (healthcare, industrial, financial), and ongoing retrieval-augmented generation services. Hybrid workflows that combine traditional photography with AI-generated extensions, variations, and background alterations enable new product offerings that preserve quality and rights clarity while unlocking creative flexibility. Providers that build robust metadata, rights-tracking, and consent mechanisms can become preferred partners for AI platforms and large enterprises.

Verticalized and Regulated Industry Content

There is growing demand for vertical-specific imagery that meets strict regulatory and brand-safety standards in sectors such as healthcare, financial services, government, and education. These industries often have detailed requirements regarding representation, disclosures, and contextual accuracy. Agencies that curate specialized collections, invest in expert review, and offer clear usage guidance can tap into premium, contract-based revenue streams. Additionally, sustainable and ESG-themed imagery—renewable energy, circular economy, inclusive workplaces—represents a growing niche aligned with corporate reporting and stakeholder communications.

Regional and Language-Localized Image Libraries

As digital economies in Asia-Pacific, Latin America, and parts of the Middle East and Africa expand, there is strong demand for localized visuals that reflect real cultural, linguistic, and architectural contexts. Regional agencies and global platforms that invest in local contributor networks, multilingual keywording, and culturally aware curation can secure long-term relationships with brands and public bodies. Authentic depictions of cities, neighborhoods, festivals, and everyday life from these regions are increasingly used in global campaigns, creating export opportunities for photographers and studios in emerging markets.

Product Type Insights

Within the still images market, rights-managed content accounts for the largest share of licensing revenue, driven by premium editorial, advertising, and exclusive commercial uses where control over territory, duration, and exclusivity is critical. Royalty-free and microstock imagery dominate by volume and serve cost-sensitive users, but typically at lower price points. From a subject-matter perspective, people and lifestyle imagery is the dominant product type, as brands and institutions require relatable, diverse depictions of work, family, health, and daily life. Business and finance, technology, medical, and industrial images form high-value niches for B2B communication. JPEG remains the most widely used file format for web and social channels due to its balance of quality and file size, while PNG, TIFF, and vector formats are important for design-heavy, print, and illustration use cases. Overall, the product mix is shifting toward curated, vertical-specific collections and AI-ready assets that emphasize authenticity and compliance.

Application Insights

Advertising and digital marketing represent the largest application segment for still images, covering brand campaigns, performance ads, social posts, email marketing, and retail media. E-commerce platforms and retailers rely heavily on still images for product pages, homepages, and promotional banners, making imagery a direct driver of conversion and revenue. Media and entertainment companies use still images extensively for editorial layouts, key art, thumbnails, and promotional assets, particularly in streaming and digital news. Education and e-learning incorporate images into courseware, assessments, and explainer content, while corporate communications teams depend on photography for annual reports, internal campaigns, and employer branding. Social media creators and influencers form a fast-growing segment, using stock and semi-custom imagery for thumbnails, channel branding, and templates. Collectively, these applications are becoming more integrated into automated design and marketing systems, which increases recurring demand and favors subscription and enterprise-licensing models.

Distribution Channel Insights

Online stock platforms and marketplaces remain the primary distribution channel for still images, serving freelancers, small businesses, agencies, and independent creators through pay-per-download and subscription models. Large enterprises increasingly procure imagery through direct contracts and APIs that integrate libraries into DAM systems, creative suites, and marketing platforms, enabling streamlined access for distributed teams. Creative SaaS tools such as design platforms, website builders, and presentation software now embed stock libraries directly within their interfaces, turning image licensing into a frictionless in-app experience. Specialist and niche platforms focusing on editorial, scientific, or regional content cater to high-value use cases where generic libraries fall short. Contributor portals and direct-to-consumer photographer sites complement these channels for bespoke and highly specialized work. Together, these distribution mechanisms reflect a shift from stand-alone image shopping to integrated, workflow-embedded content access.

End-User Insights

Large enterprises, including global brands, media conglomerates, and technology companies, account for a significant share of still image spending through enterprise licenses, data deals, and long-term partnerships. Advertising and creative agencies are critical intermediaries, procuring imagery on behalf of multiple clients and often driving high-volume usage across campaigns and channels. Small and medium-sized businesses increasingly rely on stock platforms and embedded creative tools to professionalize their websites, social feeds, and marketing materials without maintaining in-house production teams. Freelancers, influencers, and independent creators form a dynamic, fast-growing user base that values affordability, ease of search, and flexible licensing. Public-sector organizations, NGOs, and educational institutions use still images for outreach, advocacy, and learning content, with heightened sensitivity to representation and compliance. Across all end-user groups, demand is converging around authenticity, legal safety, and seamless integration into existing digital workflows.

| Content Type | Licensing Model | Application | End User | Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market for still images, accounting for roughly 35% of global revenue. The United States dominates regional demand, supported by its massive digital advertising spend, mature media and entertainment industry, and high concentration of global brands and technology platforms. Agencies headquartered in North America play a central role in exporting imagery worldwide and in signing AI training and data-licensing agreements. Canadian demand is strong in broadcasting, publishing, and government communications, with a growing emphasis on diversity and indigenous representation in visual content.

Europe

Europe holds around 28% of the global still images market, led by the U.K., Germany, and France. The region’s dense ecosystem of broadcasters, publishers, agencies, and cultural institutions drives significant demand for editorial and commercial imagery. European buyers are at the forefront of sustainable and ethical content requirements, including strict adherence to copyright, data protection, and emerging AI transparency regulations. This makes compliance, clear licensing, and ESG-aligned imagery particularly important. Demand is further supported by robust e-commerce and cross-border trade within the EU, which rely heavily on localized product and lifestyle imagery.

Asia-Pacific

Asia-Pacific represents about 27% of global still image revenues and is the fastest-growing region. China, Japan, India, South Korea, and Australia are key markets, each with distinctive digital ecosystems. Chinese platforms drive large-scale demand for localized imagery aligned with domestic regulations, while Japanese and Korean demand is boosted by mature media, gaming, and pop culture industries. India and ASEAN countries are experiencing rapid growth in mobile-first e-commerce, social media, and digital advertising, creating strong opportunities for both local and international providers. As more regional contributors supply authentic APAC imagery, the region is emerging as both a major buyer and exporter of visual content.

Latin America

Latin America currently accounts for roughly 5–6% of the global still images market, with Brazil and Mexico as primary contributors. Rising internet penetration, expanding e-commerce, and growth in regional streaming and digital media are supporting demand. Local agencies and photographers are increasingly supplying imagery that reflects Latin American cities, cultures, and lifestyles to global libraries, filling long-standing representation gaps. While budget constraints can limit pricing at the mass-market level, high-end advertising and corporate campaigns in the region rely on professional, rights-cleared imagery and offer growth potential for premium and custom content.

Middle East & Africa

The Middle East and Africa together account for around 5–6% of global revenues but exhibit high growth potential. In the Middle East, the UAE, Saudi Arabia, and Qatar drive demand through large-scale tourism, smart-city, and national branding initiatives, often emphasizing luxury, innovation, and heritage narratives. Across Africa, iconic landscapes and wildlife support tourism and conservation-focused communications, while growing urban centers fuel demand for modern, locally relevant lifestyle imagery. Governments, NGOs, and development agencies are important users, often seeking visuals that balance authenticity with positive, future-oriented storytelling. As intra-regional media and digital economies expand, MEA’s share of global still image demand is expected to rise.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Still Images Market

- Getty Images Holdings Inc.

- Shutterstock Inc.

- Adobe Inc. (Adobe Stock)

- Alamy Ltd.

- Dreamstime

- Depositphotos

- 123RF

- Envato Pty Ltd.

- Canva Pty Ltd.

- Freepik Company

- Visual China Group Co., Ltd.

- Pixta Inc.

- Stocksy United

- Storyblocks

- Vecteezy

Recent Developments

- In January 2025, Getty Images and Shutterstock announced a USD 3.7 billion merger plan aimed at consolidating leadership in stock images, editorial photography, and AI-driven content.

- In 2024, Getty Images rolled out updated versions of its commercially safe generative AI tool trained exclusively on licensed data.

- In November 2024, Adobe added AI-powered generation and editing tools within Adobe Stock while maintaining contributor compensation protections.