Stick PC Market Size

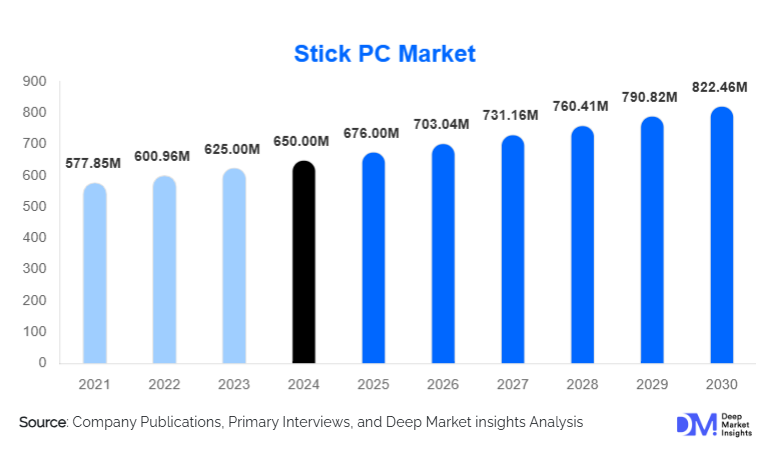

According to Deep Market Insights, the global stick pc market size was valued at USD 650.00 million in 2024 and is projected to grow from USD 676.00 million in 2025 to reach USD 822.46 million by 2030, expanding at a CAGR of 4.0% during the forecast period (2025–2030). The stick PC market growth is primarily driven by rising demand for compact, low-power computing devices, expanding digital signage networks across retail and hospitality industries, and the increasing adoption of cost-effective thin clients for enterprise and education environments.

Key Market Insights

- Windows-based stick PCs continue to dominate the global market, supported by widespread enterprise compatibility and software ecosystem maturity.

- Digital signage and commercial display applications remain the largest end-use segment, as retailers and transportation hubs expand screen networks.

- Asia-Pacific is the fastest-growing region, fueled by rapid retail digitisation, low-cost computing programs, and increased manufacturing output.

- North America holds the largest share of global demand, particularly driven by enterprise thin-client deployments and hospitality applications.

- Advancements in ARM and Intel low-power chipsets are significantly improving performance, energy efficiency, and thermal stability in next-generation stick PCs.

- Rising adoption of cloud computing, VDI, and remote-access systems is increasing the use of stick PCs as affordable endpoints for distributed teams.

What are the latest trends in the Stick PC Market?

Expansion of Digital Signage & Smart Retail Applications

Digital signage has become one of the most important growth engines for stick PCs. Retailers, restaurants, airports, and entertainment venues increasingly use stick PCs as compact media controllers for dynamic displays. These devices deliver lower operational costs, centralised control, and easy maintenance compared to bulky media players. The shift toward cloud-managed signage, 4K display compatibility, and AI-driven content targeting has pushed demand for mid-range stick PCs with better processing and storage capabilities. As global retail chains expand, multi-location deployments of signage solutions are reinforcing sustained long-term demand for stick PC hardware.

Industrial IoT & Edge Computing Adoption Accelerating

Stick PCs are emerging as cost-effective micro-edge computing devices capable of handling data acquisition, sensor communication, and localised processing. Industrial users are adopting ruggedised Linux-based stick PCs for manufacturing line monitoring, warehouse automation, and utility grid oversight. As IoT ecosystems mature, businesses prefer compact compute devices that reduce latency and integrate easily with SCADA and cloud systems. The convergence of 5G, AI-enabled analytics, and industrial automation is accelerating stick PC penetration in edge computing environments, where low-power devices can help reduce overall infrastructure costs.

What are the key drivers in the Stick PC Market?

Rising Adoption of Thin Clients in Enterprise Computing

Enterprises are increasingly shifting toward remote-access solutions, virtual desktops, and cloud-based productivity environments. Stick PCs serve as affordable thin clients that support browser-based work, VPNs, and cloud applications. Corporations prefer them for their low maintenance, plug-and-play nature, and compact form factor, which simplifies device replacement and deployment across distributed offices. Growth in hybrid work culture continues to boost demand for scalable, low-cost compute endpoints.

Growth of Global Digital Signage Networks

Retailers, quick-service restaurants, transportation hubs, and event venues are accelerating investments in digital screens. Stick PCs offer a low-power, easy-to-install solution for powering these displays. Their compatibility with standard HDMI ports, remote management features, and improved thermal performance make them ideal for continuous commercial operation. As advertising and in-store engagement increasingly rely on dynamic digital content, stick PCs remain core to signage hardware strategies.

Advancements in Low-Power Processor Technology

Progress in ARM and Intel Atom/Core m processors has significantly boosted performance-per-watt, enabling better multitasking, 4K playback, and extended operational life. These improvements eliminate earlier limitations of overheating and slow response times, allowing stick PCs to enter new markets such as industrial IoT and advanced educational applications. Enhanced energy efficiency also appeals to enterprises seeking sustainable IT infrastructure.

What are the restraints for the global market?

Performance and Thermal Limitations

Despite improvements, stick PCs still face performance ceilings due to their ultra-compact size. Heavy workloads, extended runtime, or multimedia-intensive tasks can cause thermal throttling. These constraints limit their adoption for complex enterprise applications or industrial systems requiring continuous high processing capability. Vendors must balance size reduction with improved thermal engineering to maintain competitiveness.

Competition from Mini PCs and Tablets

Mini PCs, which offer superior processing power at slightly higher price points, present a strong substitute for stick PCs. Tablets paired with keyboards also serve as flexible, affordable computing options for education and enterprise sectors. These alternatives, along with Chromebooks, restrict overall stick PC adoption, especially in mid-range use cases where performance expectations are higher.

What are the key opportunities in the Stick PC Industry?

Smart Retail Expansion Across Emerging Markets

Retail modernisation programs in Asia-Pacific, the Middle East, and Latin America are driving demand for digital signage, self-checkout screens, and interactive kiosks. Stick PCs, being cost-effective and easy to deploy, support mass rollouts of such solutions. As more retailers adopt cloud-based content management, stick PCs are poised to serve as essential display controllers across multiple sectors.

Education Digitalisation & Low-Cost Computing Programs

Developing countries are increasingly adopting budget-friendly computing technologies for digital classrooms. Stick PCs can convert existing displays and TVs into functional computers, dramatically lowering infrastructure costs. Government-led initiatives in India, Indonesia, Brazil, and Kenya are creating large-scale demand opportunities, especially for Linux- and Android-based stick PCs with remote management capabilities.

Product Type Insights

Windows stick PCs hold the largest share of the market, driven by widespread enterprise compatibility and support for professional software ecosystems. Android-based devices offer strong adoption in signage and consumer streaming environments, benefiting from app-store integration. Linux stick PCs are gaining traction in industrial IoT due to better customisation and security. ChromeOS-based devices remain niche but are emerging as education-focused options due to native cloud integration.

Application Insights

Digital signage dominates global stick PC applications, accounting for the largest share due to widespread use in retail, hospitality, transportation, and entertainment. Enterprise computing represents a rapidly expanding segment as companies adopt cloud-based productivity environments. Education deployments continue rising as stick PCs convert existing displays into affordable digital learning stations. Industrial IoT is emerging as a high-growth application, leveraging stick PCs as sensor gateways and edge-processing units in automation environments.

Distribution Channel Insights

Online retail channels, including Amazon, Alibaba, and Newegg, account for the majority of consumer and SMB purchases due to product variety and transparent pricing. Offline IT distributors and electronics retailers support enterprise and institutional procurement. OEM/ODM partnerships are growing as enterprises deploy bulk orders for signage and thin-client setups, creating long-term supply contracts for manufacturers in China and Taiwan.

End-User Insights

Commercial signage is the leading end-use segment as global retailers adopt cloud-managed display networks. Enterprise adoption is rising due to remote work environments and the need for scalable thin clients. Education is one of the fastest-growing segments, driven by digital literacy programs and cost-efficient deployments. Industrial use cases are expanding as factories adopt compact edge-computing nodes for automation and monitoring.

| By Product Type | By Processor Type | By Connectivity | By End-Use Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global stick PC market, led by the U.S., which alone accounts for over one-quarter of global demand. High adoption of enterprise thin clients, digital signage deployments, and advanced IoT systems supports sustained growth. Retailers and hospitality chains increasingly rely on stick PCs for digital displays, while education districts explore cost-effective classroom computing.

Europe

Europe demonstrates strong demand, particularly in Germany, the U.K., France, and the Nordics. Digital signage adoption across airports, metro systems, and retail hubs fuels growth. Industrial IoT integration further supports demand for Linux-based stick PCs. Eastern Europe is emerging as a price-sensitive but growing market due to rising small-business digitisation.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at a 13–14% CAGR. China leads both production and consumption, while India drives demand for education and retail modernisation. Japan and South Korea adopt stick PCs in manufacturing automation and industrial monitoring. Government-backed digital infrastructure projects across ASEAN are accelerating adoption.

Latin America

Brazil and Mexico dominate regional demand, driven by education modernisation and small-business adoption of signage systems. Retail digitisation and growing IT modernisation budgets are expanding opportunities for mid-range stick PCs. Chile and Colombia exhibit smaller but steady growth in signage deployments.

Middle East & Africa

The Middle East is a rapidly growing market due to large-scale retail infrastructure, hospitality expansion, and smart city initiatives in the UAE, Saudi Arabia, and Qatar. Africa shows rising demand for low-cost computing solutions in education and small enterprises. Stick PCs are increasingly used in hospitals, banks, and government offices seeking affordable digital transformation.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Stick PC Market

- Intel

- ASUS

- Lenovo

- Azulle

- MeLE

- Dell

- Acer

- Samsung

- SinoVoip

- ECS (Elitegroup Computer Systems)

- Zotac

- Panasonic

- Ugoos

- Raspberry Pi Foundation

- CloudStick Technologies

Recent Developments

- In 2024, multiple stick PC manufacturers began integrating next-generation ARM chipsets, improving energy efficiency and multimedia performance.

- In 2025, ASUS and Lenovo expanded their commercial stick PC portfolios, targeting the enterprise thin-client and signage industries.

- In 2025, several Chinese ODMs launched industrial-grade stick PCs with extended temperature support for IoT and automation environments.