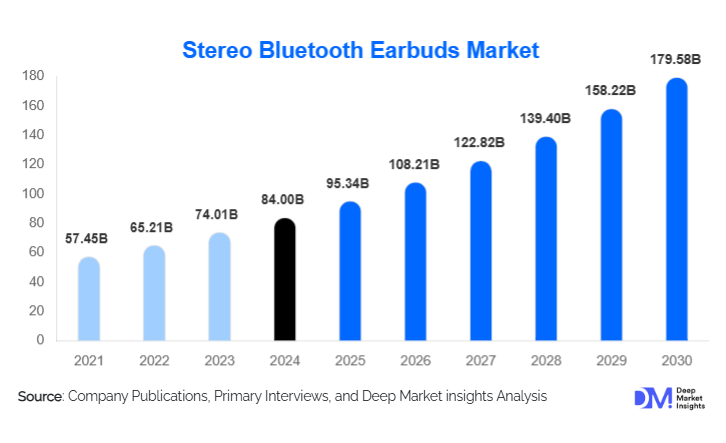

Stereo Bluetooth Earbuds Market Size

According to Deep Market Insights, the global stereo Bluetooth earbuds market size was valued at USD 84.00 billion in 2024 and is projected to grow from USD 95.34 billion in 2025 to reach USD 179.58 billion by 2030, expanding at a CAGR of 13.5% during the forecast period (2025–2030). Market growth is primarily driven by rapid adoption of true wireless stereo (TWS) devices, the removal of wired audio jacks in smartphones, rising usage of mobile entertainment and gaming, and continuous innovation in active noise cancellation (ANC), battery efficiency, and AI-powered audio enhancement.

Key Market Insights

- True Wireless Stereo (TWS) earbuds dominate the market, accounting for nearly three-fourths of global revenue due to convenience, compact design, and improved charging cases.

- Mid-range earbuds (USD 50–150) lead demand, balancing affordability with advanced features such as ANC, fast charging, and multipoint connectivity.

- Asia-Pacific is the largest manufacturing and consumption hub, supported by high smartphone penetration and aggressive pricing by regional brands.

- North America leads premium adoption, driven by ecosystem-integrated earbuds and strong brand loyalty.

- Online marketplaces remain the dominant distribution channel, benefiting from discount-driven sales and wide product availability.

- Rapid technological adoption, including spatial audio, adaptive ANC, and AI tuning, is reshaping consumer expectations.

What are the latest trends in the stereo Bluetooth earbuds market?

Shift Toward AI-Enabled and Adaptive Audio

Manufacturers are increasingly embedding AI-based sound processing and adaptive noise cancellation into earbuds. These technologies dynamically adjust sound profiles and ANC intensity based on surrounding environments, enhancing call quality and listening comfort. AI-powered features are particularly popular in mid-range and premium segments, helping brands differentiate and justify higher average selling prices.

Premiumization and Ecosystem Integration

Premium earbuds are increasingly positioned as ecosystem products rather than standalone audio devices. Seamless integration with smartphones, smartwatches, tablets, and voice assistants is driving demand in developed markets. Spatial audio, head tracking, and proprietary audio chips are becoming standard in flagship models, reinforcing brand lock-in and customer retention.

What are the key drivers in the stereo Bluetooth earbuds market?

Smartphone Design Evolution

The removal of 3.5mm headphone jacks across flagship and mid-tier smartphones has structurally increased demand for wireless audio accessories. Stereo Bluetooth earbuds have become a default companion product, driving consistent replacement demand and first-time adoption across regions.

Expansion of Mobile Entertainment and Fitness Usage

Growth in music streaming, mobile gaming, video conferencing, and fitness tracking has increased the daily usage time of earbuds. Consumers increasingly rely on earbuds for work, workouts, and entertainment, accelerating replacement cycles and boosting demand for durable, feature-rich models.

What are the restraints for the global market?

Price Competition and Margin Pressure

Intense competition in the entry-level segment has led to rapid price erosion. Numerous regional brands compete aggressively on price, compressing margins and increasing marketing and customer acquisition costs, particularly in emerging markets.

Battery Longevity and Sustainability Concerns

Limited battery lifespan remains a concern, as earbuds are often discarded rather than repaired. Growing regulatory scrutiny around e-waste and sustainability in Europe and North America may increase compliance costs and pressure manufacturers to improve recyclability.

What are the key opportunities in the stereo Bluetooth earbuds industry?

Emerging Market Penetration

Low wireless audio penetration in South Asia, Southeast Asia, Latin America, and Africa presents significant growth opportunities. Affordable TWS earbuds priced below USD 50 are expected to drive high-volume growth, supported by localized manufacturing and expanding e-commerce infrastructure.

Enterprise and Institutional Adoption

Hybrid work models, digital classrooms, and corporate standardization of communication devices are creating new B2B demand streams. Bulk procurement by enterprises, educational institutions, and fitness organizations offers stable, recurring revenue opportunities beyond consumer retail sales.

Product Type Insights

True Wireless Stereo (TWS) earbuds lead the market with approximately 74% share in 2024, driven by their cable-free design and compact charging cases. Wireless neckband earbuds continue to find demand in price-sensitive markets due to longer battery life and durability. Ear-hook and sports-focused earbuds serve niche fitness users seeking stability and sweat resistance, contributing modest but steady demand.

Price Band Insights

Mid-range earbuds (USD 50–150) account for nearly 46% of global revenue, as consumers seek a balance between price and advanced features. Entry-level models dominate shipment volumes in emerging economies, while premium earbuds above USD 150 capture higher margins in North America and Europe through ecosystem integration and superior audio performance.

Technology Integration Insights

ANC-enabled earbuds represent around 41% of market revenue, reflecting strong consumer preference for immersive audio experiences. Adaptive and AI-based ANC is gaining traction rapidly, particularly in premium models, while spatial audio and head-tracking technologies are emerging as key differentiators.

Distribution Channel Insights

Online marketplaces dominate with approximately 44% share, driven by competitive pricing, user reviews, and extensive product variety. Brand-owned D2C platforms are expanding, particularly for premium players seeking higher margins and customer data ownership. Offline electronics stores remain relevant for experiential purchases in developing markets.

End-Use Insights

Personal consumer use accounts for nearly 81% of demand, driven by entertainment, communication, and fitness applications. Enterprise and education segments are the fastest-growing, supported by hybrid work policies and digital learning initiatives. Gaming and content creation are emerging as high-growth niche applications due to demand for low-latency and spatial audio features.

| By Product Type | By Technology Integration | By Battery & Charging Capability | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global market with approximately 43% share in 2024. China alone contributes about 18%, supported by large-scale manufacturing and high replacement rates. India is the fastest-growing country, expanding at over 18% CAGR, driven by affordable pricing, local production incentives, and rising smartphone adoption.

North America

North America accounts for nearly 26% of global revenue, led by the United States. The region shows a strong preference for premium earbuds with ecosystem integration, spatial audio, and advanced ANC. High disposable income and strong brand loyalty support sustained demand.

Europe

Europe represents around 21% of the market, with Germany, the U.K., and France leading demand. Sustainability regulations and preference for high-quality audio products drive premium and mid-range adoption.

Latin America

Latin America contributes roughly 6% of global demand, led by Brazil and Mexico. Growth is driven by expanding e-commerce penetration and rising middle-class consumption.

Middle East & Africa

The Middle East & Africa account for about 4% of the market. The UAE and Saudi Arabia drive premium demand, while Africa shows growing entry-level adoption due to smartphone penetration.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|