Steam Sauna Cabinets Market Size

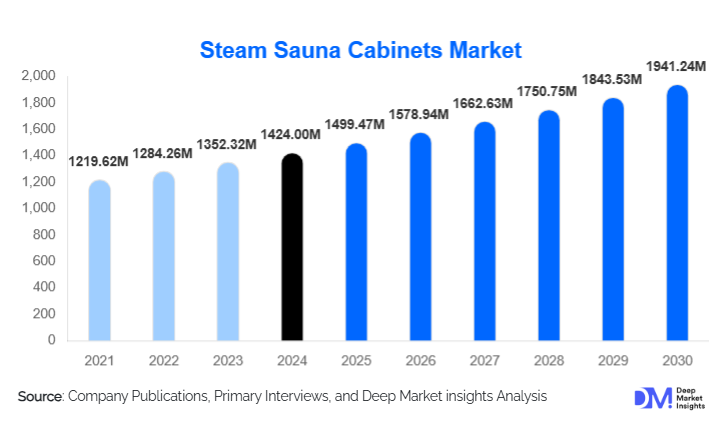

According to Deep Market Insights, the global steam sauna cabinets market size was valued at USD 1,424.00 million in 2024 and is projected to grow from USD 1,499.47 million in 2025 to reach USD 1,941.24 million by 2030, expanding at a CAGR of 5.3% during the forecast period (2025–2030). The market growth is primarily driven by rising global focus on preventive healthcare, increasing adoption of home wellness solutions, and strong demand from hospitality, spa, and rehabilitation sectors seeking compact and efficient steam-based therapy systems.

Key Market Insights

- Residential adoption is accelerating as consumers increasingly invest in home-based wellness and spa-style bathroom upgrades.

- Freestanding steam sauna cabinets dominate installations due to lower installation complexity and suitability for urban housing.

- North America leads global demand, supported by high disposable income, wellness awareness, and premium housing trends.

- Asia-Pacific is the fastest-growing region, driven by hospitality investments and rising middle-class spending on wellness.

- Mid-range steam sauna cabinets account for the largest revenue share, balancing affordability with advanced features.

- Smart and digitally controlled cabinets are gaining traction, enhancing personalization and user experience.

What are the latest trends in the steam sauna cabinets market?

Smart & Connected Steam Sauna Systems

Manufacturers are increasingly integrating digital control panels, IoT connectivity, mobile applications, and programmable wellness settings into steam sauna cabinets. These features allow users to customize temperature, humidity, aromatherapy, chromotherapy lighting, and session duration. Smart integration aligns steam sauna cabinets with broader smart home ecosystems, significantly increasing appeal among tech-savvy consumers and premium buyers.

Compact & Modular Wellness Solutions

Urbanization and smaller living spaces are driving demand for compact, modular steam sauna cabinets that can be installed in apartments and condominiums. Manufacturers are focusing on space-efficient designs without compromising therapeutic benefits, expanding adoption in densely populated cities across Asia and Europe.

What are the key drivers in the steam sauna cabinets market?

Rising Preventive Healthcare Awareness

Consumers are increasingly seeking non-invasive wellness therapies to manage stress, improve circulation, and support respiratory and muscular health. Steam sauna therapy is widely recognized for detoxification and relaxation benefits, making steam sauna cabinets a preferred solution in both residential and clinical settings.

Growth in Home Renovation & Luxury Housing

Global growth in home renovation spending, particularly in bathroom modernization, is driving the installation of steam sauna cabinets as lifestyle-enhancing amenities. High-income households increasingly view steam cabins as long-term wellness investments rather than luxury add-ons.

What are the restraints for the global market?

High Initial Cost & Installation Requirements

Premium steam sauna cabinets require plumbing and electrical integration, which can increase upfront costs. This remains a barrier for price-sensitive consumers and limits adoption in older buildings without retrofit-friendly infrastructure.

Energy & Water Efficiency Regulations

Stricter environmental regulations in developed markets require manufacturers to continuously improve energy efficiency and water usage, increasing R&D and compliance costs.

What are the key opportunities in the steam sauna cabinets industry?

Medical & Rehabilitation Applications

Steam sauna cabinets are increasingly being adopted in physiotherapy, sports rehabilitation, and post-operative recovery programs. Integration into medical wellness protocols creates new institutional demand and recurring revenue streams.

Emerging Market Expansion

Rapid urbanization and rising disposable income in Asia-Pacific, Latin America, and the Middle East present strong opportunities for affordable, localized steam sauna cabinet models tailored to regional housing and price sensitivities.

Product Type Insights

Single-person steam sauna cabinets dominate the global market, accounting for approximately 42% of total revenue in 2024. This segment’s leadership is primarily driven by accelerating urbanization, smaller residential floor spaces, and rising preference for individualized wellness routines. Single-person units are cost-effective, energy-efficient, and easier to install compared to larger systems, making them highly suitable for apartments, condominiums, and urban homes. Additionally, growing consumer awareness around stress management, respiratory health, and muscle recovery has increased adoption among working professionals and aging populations seeking daily therapeutic use.

Two-person steam sauna cabinets are witnessing steady growth, particularly among couples and small households, as they balance shared wellness experiences with moderate space and cost requirements. These units are increasingly popular in suburban homes and premium apartments. Meanwhile, multi-person steam sauna cabinets remain a niche but high-value segment, primarily installed in commercial spas, luxury hotels, fitness centers, and medical rehabilitation facilities, where higher footfall and group usage justify larger capacity systems.

Material Insights

Acrylic-based steam sauna cabinets lead the material segment with nearly 38% market share, supported by their superior durability, lightweight structure, ease of molding, and cost efficiency. Acrylic materials offer excellent heat retention, resistance to moisture damage, and flexibility in design, allowing manufacturers to produce ergonomic and visually appealing cabinets at scale. These advantages make acrylic the preferred choice for mass-market residential and mid-range commercial installations.

Tempered glass steam sauna cabinets are increasingly favored in premium and luxury installations due to their modern aesthetics, transparency, and high resistance to thermal stress. These cabinets are commonly adopted in upscale residential projects, hotels, and wellness resorts seeking a visually open and luxurious spa environment. Composite materials and wood-integrated hybrid cabinets serve niche segments, particularly in luxury wellness centers and boutique spas, where natural aesthetics and traditional sauna appeal justify higher pricing.

Installation Type Insights

Freestanding steam sauna cabinets account for approximately 64% of global installations, making them the dominant installation type. Their leadership is driven by ease of installation, minimal structural modification requirements, portability, and suitability for retrofit projects. Freestanding units appeal strongly to homeowners and commercial operators seeking faster deployment and flexibility, especially in rented or pre-existing properties.

Built-in and modular steam sauna cabinets are primarily adopted in new residential developments, luxury villas, hotels, and wellness resorts, where space planning is incorporated during construction. Although this segment represents a smaller share, it is growing steadily due to rising investments in premium real estate and hospitality infrastructure, where integrated spa facilities enhance property value and customer experience.

End-Use Insights

The residential segment leads overall demand, accounting for approximately 47% of market share in 2024. Growth in this segment is driven by the global shift toward home-based wellness, increasing disposable income, and rising home renovation activity focused on spa-style bathrooms. Consumers increasingly perceive steam sauna cabinets as long-term health investments rather than luxury accessories.

Commercial wellness centers and spas remain stable contributors, supported by consistent consumer spending on personal care and relaxation services. Hospitality and medical rehabilitation facilities represent the fastest-growing institutional segments. Hotels and resorts are integrating steam sauna cabinets to enhance guest amenities, while hospitals, physiotherapy clinics, and sports rehabilitation centers are adopting steam therapy as part of recovery and pain management protocols.

Distribution Channel Insights

Specialty wellness retailers and direct manufacturer sales collectively account for over 55% of global revenue, driven by the need for product customization, professional installation support, and after-sales services. Customers purchasing higher-value steam sauna cabinets often prefer expert consultation, which strengthens the role of direct and specialty channels.

E-commerce platforms are rapidly gaining traction, particularly in the mid-range and economy segments. Improvements in logistics, virtual product demonstrations, digital marketing, and transparent pricing have boosted online sales. Manufacturers are increasingly adopting direct-to-consumer (D2C) strategies to improve margins and customer engagement, further accelerating online channel growth.

| By Product Type | By Material | By Installation Type | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 32% of the global steam sauna cabinets market, led by strong demand in the United States and Canada. Regional growth is driven by high wellness awareness, widespread adoption of preventive healthcare practices, and strong spending on home renovation and luxury housing. The presence of established spa culture, fitness-conscious consumers, and premium hospitality infrastructure further supports market leadership. Additionally, favorable disposable income levels and early adoption of smart wellness technologies contribute to sustained demand.

Europe

Europe accounts for around 28% of the global market, with Germany, Italy, and Nordic countries leading adoption. Growth is strongly supported by Europe’s deep-rooted sauna and spa culture, particularly in Northern and Central Europe. Sustainability-driven wellness investments, energy-efficient building regulations, and strong demand from hospitality and medical wellness facilities reinforce market stability. European consumers also show a strong preference for premium materials, design aesthetics, and environmentally compliant products.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR of over 10.8%. China, Japan, and South Korea dominate demand, supported by rapid urbanization, rising middle-class income, and increasing awareness of wellness and preventive healthcare. Strong growth in hospitality infrastructure, medical tourism, and luxury residential developments further accelerates adoption. Additionally, government support for wellness tourism and localized manufacturing is improving affordability and accessibility across the region.

Latin America

Latin America exhibits moderate but steady growth, led by Brazil and Mexico. Regional demand is driven by expanding luxury residential projects, increasing investment in boutique hotels and wellness resorts, and rising consumer interest in lifestyle and personal care products. While penetration remains lower compared to developed markets, improving economic conditions and urban development are expected to support long-term growth.

Middle East & Africa

The Middle East benefits significantly from large-scale luxury hospitality investments in countries such as the UAE and Saudi Arabia, where steam sauna cabinets are increasingly integrated into high-end hotels, resorts, and wellness retreats. In Africa, growing adoption is observed in medical tourism hubs and premium wellness resorts, particularly in North and Southern Africa. Government-led tourism diversification strategies and rising demand for luxury wellness experiences continue to support regional expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Steam Sauna Cabinets Market

- Harvia

- KLAFS

- TyloHelo

- Sunlighten

- Jacuzzi Group

- Duravit

- Roca

- Villeroy & Boch

- Effegibi

- Amerec

- Steamist

- Finnleo

- Helo Group

- EOS Saunatechnik

- SAWO Inc.