Staple Gun Market Size

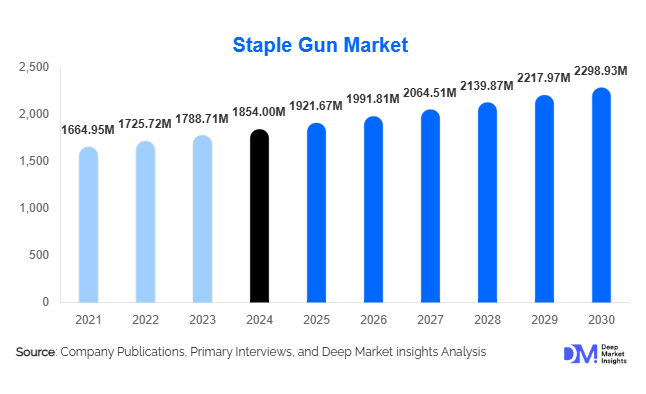

According to Deep Market Insights, the global staple gun market size was valued at USD 1,854.00 million in 2024 and is projected to grow from USD 1,921.67 million in 2025 to reach USD 2,298.93 million by 2030, expanding at a CAGR of 3.65% during the forecast period (2025–2030). The staple gun market growth is primarily driven by rising demand from the furniture and upholstery industry, expanding construction and industrial applications, and increasing adoption of ergonomic, battery-powered, and pneumatic models across residential, commercial, and industrial sectors.

Key Market Insights

- Demand is surging for industrial-grade pneumatic and battery-powered staple guns, particularly in large-scale construction, automotive, and furniture manufacturing applications, due to efficiency and portability.

- Furniture and upholstery applications dominate the market globally, driven by urbanization, rising disposable incomes, and growing DIY trends in both developed and emerging markets.

- North America holds the largest market share, led by the U.S. and Canada, owing to high industrial adoption, mature infrastructure, and a strong DIY culture.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rapid industrialization, and increasing adoption in construction and automotive manufacturing in countries such as China and India.

- Technological innovations, including ergonomic designs, adjustable staple depth, and cordless operation,n are reshaping professional and residential user preferences.

- Online sales channels are increasingly important, offering easy access to both DIY consumers and industrial buyers while enabling manufacturers to reach niche regional markets efficiently.

What are the latest trends in the staple gun market?

Shift Toward Electric and Battery-Powered Tools

Battery-powered and electric staple guns are increasingly replacing manual variants in professional applications. These models offer portability, reduced operator fatigue, and consistent stapling performance. High adoption is observed in furniture assembly lines, automotive interiors, and large construction projects. Manufacturers are focusing on integrating advanced battery technology, longer life cycles, and faster reloading mechanisms to increase productivity and user convenience. This trend is especially prevalent in North America and Europe, where professional users prioritize efficiency and precision.

Integration of Smart and Ergonomic Features

Modern staple guns are incorporating smart and ergonomic designs to enhance safety, usability, and accuracy. Features like adjustable staple depth, electronic triggers, lightweight frames, and anti-jamming mechanisms are gaining popularity. These innovations cater to both professional and DIY consumers seeking precision and reduced operator strain. Ergonomic improvements are driving repeat adoption in commercial and industrial settings, while battery-powered variants are particularly favored in residential DIY and small-scale furniture workshops.

What are the key drivers in the staple gun market?

Growth in the Furniture and Upholstery Industry

The furniture and upholstery industry is expanding globally due to urbanization, rising disposable income, and increased preference for modern home interiors. Staple guns are critical for assembling furniture, fixing fabrics, and cushioning, with electric and pneumatic variants widely adopted to improve productivity. This segment contributed approximately 35% of the global market in 2024, reflecting its dominance in demand generation.

Industrialization and Construction Expansion

Staple guns are increasingly utilized in industrial construction for applications such as insulation, flooring, paneling, and roofing. Pneumatic models are favored for high-speed operations, while battery-powered guns are becoming common in smaller construction projects. Growth in commercial and public infrastructure projects in Asia-Pacific and North America is driving adoption in large-scale industrial applications, increasing overall market penetration.

Technological Advancements and Innovation

Continuous innovations in staple gun design, including safety locks, ergonomic handles, and cordless operation, are enhancing usability. Manufacturers are also exploring smart technologies, such as sensors and automatic depth adjustment, improving accuracy and efficiency. These advancements encourage adoption among professional users and premium residential consumers.

What are the restraints for the global market?

High Initial Cost of Advanced Models

While manual staple guns are cost-effective, pneumatic and battery-powered models require significant initial investment. High costs and maintenance requirements can limit adoption among small-scale users and DIY consumers, particularly in emerging economies.

Availability of Alternative Fastening Solutions

Alternatives such as nail guns, adhesives, or sewing in upholstery applications may restrict market expansion. Companies need to emphasize the efficiency, speed, and cost-effectiveness of staple guns to mitigate this challenge.

What are the key opportunities in the staple gun market?

Expansion into Emerging Markets

Emerging economies in the Asia-Pacific, Latin America, and MEA present significant opportunities. Rapid urbanization, rising disposable income, and expanding industrial and residential construction projects are creating strong demand. Manufacturers can establish localized production or distribution to capture regional growth efficiently.

Technological Integration and Ergonomic Design

Introducing smart, ergonomic, and battery-powered staple guns offers differentiation in a competitive market. Integration of features like depth adjustment, digital monitoring, and cordless operation is attracting professional users seeking efficiency and convenience, particularly in the industrial and furniture sectors.

Government and Infrastructure Projects

Public investment in infrastructure and government-backed industrial programs such as “Make in India” and “Made in China 2025” provide steady demand for staple guns. Large-scale construction and furniture projects create predictable procurement opportunities for manufacturers of industrial-grade pneumatic and electric staple guns.

Product Type Insights

Pneumatic staple guns lead the market, accounting for approximately 40% of global revenue in 2024. Their efficiency, speed, and high durability make them ideal for construction, industrial, and large-scale furniture applications. Manual staple guns remain popular among DIY consumers due to affordability, while battery-powered variants are gaining traction for portability and convenience, especially in residential and small-scale commercial applications. Electric staple guns offer a balance between manual and pneumatic functionality, catering to mid-sized professional tasks.

Application Insights

Furniture and upholstery dominate applications with 35% market share, driven by industrial demand and DIY projects. Construction and carpentry follow, where staple guns are used in roofing, flooring, insulation, and paneling. Automotive interiors and packaging/logistics are emerging applications, with increasing demand for precision fastening and time-saving tools. DIY and crafts applications are growing steadily in developed regions, reflecting changing consumer lifestyles and interest in home improvement projects.

Distribution Channel Insights

Offline retail remains the dominant sales channel, contributing approximately 55% of sales due to a strong presence in hardware stores and industrial suppliers. Online retail is rapidly growing, offering convenience, wider product selection, and direct access to both industrial and DIY consumers. E-commerce platforms also enable manufacturers to reach remote or niche markets, offering digital marketing, reviews, and post-purchase support to increase adoption.

End-User Insights

Industrial users represent 38% of the global market, driven by automotive, construction, and large-scale furniture manufacturing. Residential users are adopting battery-powered and manual staple guns for DIY purposes, while commercial furniture manufacturers are increasingly switching to pneumatic and electric variants to improve productivity. Emerging applications in automotive interiors and packaging are expected to create incremental demand over the next five years.

| By Product Type | By Application | By End-User Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 30% of the global staple gun market in 2024. The U.S. leads demand due to mature industrial sectors, DIY trends, and high adoption of advanced pneumatic and battery-powered models. Canada follows with strong construction and furniture manufacturing activities. The region benefits from high disposable incomes and a preference for ergonomic, safe, and efficient tools.

Europe

Europe accounts for around 28% of the market, led by Germany, the U.K., and France. Germany dominates due to its strong industrial base, advanced manufacturing sector, and furniture exports. Europe’s focus on workplace safety, ergonomic designs, and innovation drives the adoption of electric and battery-powered staple guns. Mid-sized enterprises in Italy and Spain also contribute to the growing demand.

Asia-Pacific

APAC is the fastest-growing region with a CAGR of ~7.2%, driven by China and India. Urbanization, rising disposable incomes, and industrialization are boosting adoption in construction, furniture, and automotive sectors. Japan and South Korea represent mature markets with steady demand, while Southeast Asian countries are emerging due to increased infrastructure and manufacturing investments.

Latin America

Brazil and Argentina are key contributors, with demand driven by commercial construction and furniture manufacturing. Adoption remains moderate, with growth expected from infrastructure development and rising DIY trends.

Middle East & Africa

Demand is concentrated in Saudi Arabia, the UAE, and South Africa, driven by construction and commercial projects. Africa, as a manufacturing and export hub, also uses staple guns for industrial applications in the furniture and packaging sectors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Staple Gun Market

- Stanley Black & Decker

- Bosch

- Hitachi Koki

- Makita

- Bostitch

- Arrow Fastener

- Tacwise

- Novus

- Rapid

- Surebonder

- Prebena

- Senco

- Anex Tools

- Raptor Tools

- Max USA

Recent Developments

- In March 2025, Stanley Black & Decker launched a new battery-powered staple gun with advanced depth adjustment and anti-jamming technology, targeting industrial and DIY users.

- In January 2025, Bosch introduced an ergonomic pneumatic staple gun optimized for furniture manufacturing, reducing operator fatigue and improving speed.

- In February 2025, Makita expanded its online distribution network in APAC, enhancing access to battery-powered and cordless staple guns for both commercial and residential users.