Stand-Up Paddleboard (SUP) Market Size

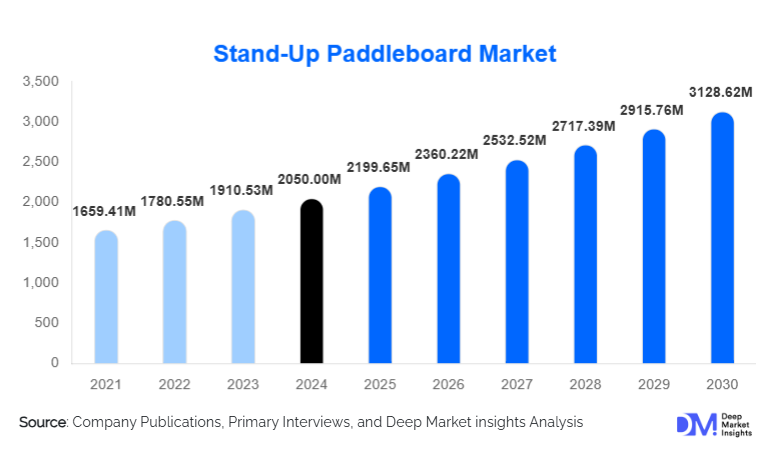

According to Deep Market Insights, the global stand-up paddleboard market size was valued at USD 2,050.00 million in 2024 and is projected to grow from USD 2,199.65 million in 2025 to reach USD 3,128.62 million by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). The SUP market growth is driven by rising participation in outdoor water sports, increasing demand for inflatable and portable SUP equipment, and the rapid expansion of adventure tourism, recreational paddling, and wellness-oriented fitness applications.

Key Market Insights

- Inflatable SUP boards dominate the market, accounting for nearly 55–60% of global sales due to their portability, affordability, and suitability for rentals and beginners.

- Recreational and flat-water paddling is the largest application segment, capturing close to half of overall demand, driven by casual users and expanding tourism.

- North America leads the global market with a 35–40% share in 2024, supported by strong outdoor recreation participation and well-developed water sports infrastructure.

- Asia-Pacific is the fastest-growing region, driven by tourism development, rising disposable incomes, and increasing fitness adoption among young consumers.

- Technology-driven innovation, lighter composites, eco-friendly materials, and advanced drop-stitch inflatable construction are reshaping performance and accessibility.

- Fitness and wellness applications, including SUP yoga, balance training, and low-impact workouts, are becoming a major growth accelerator.

What are the latest trends in the stand-up paddleboard market?

Inflatable SUPs Transforming Accessibility and Usage

Inflatable stand-up paddleboards have revolutionized the sport by eliminating key barriers such as storage and transportation. Made possible through advanced drop-stitch PVC technology, these boards now offer stiffness and stability comparable to rigid fiberglass boards at significantly lower weight. Consumers increasingly prefer inflatable SUPs for their ease of travel, enabling paddlers to explore lakes, rivers, and coastal waters without specialized roof racks or storage facilities. Rental operators and tourism agencies also favor inflatables due to easy maintenance, portability, and lower replacement costs. This trend is democratizing the sport, expanding participation among urban paddlers, travelers, and first-time users.

Growth of SUP Fitness, Wellness & Lifestyle Activities

SUP is increasingly integrated into the fitness and wellness industry. SUP yoga, core training, and mindfulness paddling retreats are gaining traction among wellness-focused travelers and fitness enthusiasts seeking low-impact, full-body exercise routines. Fitness studios, coastal resorts, and adventure-wellness operators now incorporate SUP-based activities into their offerings. As preventive healthcare trends accelerate globally, demand for SUP fitness equipment and wellness-oriented boards, featuring wider decks and stability-focused designs, is rising sharply. This trend is creating new premium product categories and boosting repeat purchases among health-conscious consumers.

What are the key drivers in the stand-up paddleboard market?

Growing Participation in Outdoor Recreation and Water Sports

The global shift toward outdoor activities, particularly after the pandemic, has pushed more consumers toward water-based recreation. Paddleboarding appeals to multiple demographic groups due to its accessibility, minimal skill requirements, and suitability for lakes, rivers, and coastal environments. Government investments in waterfront development and tourism infrastructure are further enabling participation. Increasing interest in nature-based leisure and adventure travel continues to fuel SUP adoption worldwide.

Health, Fitness & Wellness Demand Supporting Long-Term Growth

SUP’s benefits, including core strengthening, balance improvement, and low-impact conditioning, make it ideal for fitness-oriented consumers. The rise of SUP yoga and wellness retreats has deepened engagement beyond casual recreation. As consumers prioritize mental well-being, stress reduction, and physical fitness, SUP is positioned as a unique hybrid of outdoor recreation and holistic exercise. These attributes support strong and sustained market expansion.

Product Innovation and Material Advancements

Rapid advancements in board engineering, especially lightweight carbon composites and durable inflatable technologies, have expanded the market by improving usability and performance. Premium hardboards continue to attract enthusiasts, while inflatables broaden appeal to beginners and casual users. Eco-friendly materials and recyclable components are emerging as important differentiators for environmentally conscious buyers. Innovation is reducing production costs, improving performance stability, and boosting demand across both professional and recreational segments.

What are the restraints for the global market?

High Equipment Costs Limiting Widespread Adoption

Quality SUP boards, particularly composite and premium inflatable models, can be expensive, creating financial barriers for cost-sensitive consumers. Pricing challenges are heightened in inland regions with limited water-access infrastructure. Additional expenses for paddles, pumps, leashes, and safety gear further increase the overall cost of adoption, restricting the conversion of entry-level users into long-term participants.

Limited Water-Body Access and Infrastructure Constraints

SUP participation is heavily dependent on access to safe, clean, and regulated water bodies. Regions lacking waterfront infrastructure, rental facilities, or water-sports tourism offerings experience slower adoption rates. Environmental restrictions, seasonal weather variations, and regulatory limitations also constrain year-round usage, particularly in colder climates. These geographic dependencies form a significant barrier to market growth.

What are the key opportunities in the stand-up paddleboard industry?

Expansion of Adventure Tourism & Resort-Based Water Recreation

Global tourism destinations, especially in Asia-Pacific, Europe, and North America, are expanding their water-sport offerings to cater to adventure-seeking travelers. Resorts, lakeside retreats, cruise ships, and island destinations increasingly integrate SUP rentals and guided paddling tours. This creates recurring bulk-purchase opportunities for manufacturers and opens high-volume rental channels. As adventure tourism continues to grow, SUP is becoming a staple activity alongside kayaking and snorkeling.

Integration of SUP into Wellness, Training & Corporate Retreat Programs

SUP yoga, guided meditation floats, rehabilitation programs, and fitness classes are becoming mainstream offerings within wellness tourism. Corporations are adopting SUP-based team-building activities as part of employee well-being initiatives. Health clubs and boutique fitness studios are creating SUP-inspired programs, expanding the sport’s reach beyond aquatic environments. This trend presents new opportunities for specialized boards, training partnerships, and wellness-focused branding.

Technological Innovation and Sustainable Product Development

The push toward eco-friendly materials, such as recycled plastics, plant-based epoxies, and sustainable wood cores, presents a major opportunity for differentiation. Manufacturers adopting greener processes can target environmentally conscious consumers and institutions investing in sustainable recreation. At the same time, smart SUP technology, GPS-enabled training features, stability sensors, and app-integrated performance analytics offer potential for premium product lines that attract competitive paddlers and tech-savvy buyers.

Product Type Insights

Inflatable SUP boards dominate the global market, capturing nearly 55–60% of total sales in 2024. Their compactness, lightweight construction, and ease of storage make them ideal for beginners, travelers, and rental operators. Rigid/fiberglass boards maintain strong demand among advanced paddlers and racers seeking superior hydrodynamics and performance. Composite boards serve niche markets for surfing, touring, and competitive racing, where responsiveness and speed are essential. As technology improves, the performance gap between inflatables and rigid boards continues to narrow, fueling adoption across all skill levels.

Application Insights

Recreational and flat-water paddling is the largest application segment, representing 45–50% of global demand. This includes leisure paddling on lakes, calm coastlines, and rivers, ideal for families, beginners, and casual outdoor enthusiasts. Fitness and yoga-based applications are growing rapidly due to the sport’s alignment with wellness trends. Surf SUPs maintain popularity in coastal regions, while racing SUPs serve a smaller but passionate competitive community. Adventure tourism operators increasingly incorporate SUP into guided eco-tours, wildlife viewing, and island exploration activities, contributing to segment expansion.

Distribution Channel Insights

Offline channels, specialty retailers, sports equipment shops, and rental operators hold nearly 60% of the market due to consumers’ preference for in-person quality checks and professional guidance. Rental fleets at resorts and tour operators represent a major B2B purchasing segment, driving bulk orders. Online sales are rapidly gaining traction, supported by D2C brand strategies, marketplace promotions, and consumer reliance on digital reviews. E-commerce enables higher price transparency and access to specialized board designs, appealing particularly to younger consumers and DIY travelers.

Consumer Insights

Adults represent 85–90% of total users, as the sport’s physical requirements and gear costs skew participation toward adult demographics. Younger adults dominate adventure and fitness segments, while families contribute significantly to recreational purchases. Children’s boards form a small but growing niche, supported by rising interest in family-friendly paddle sports.

| By Product Type | By Application | By Distribution Channel | By Board Length | By Consumer Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for the largest regional share, nearly 35–40% of global demand. The U.S. leads with widespread lake and coastal recreation culture, strong tourism infrastructure, and high income levels. Canada contributes significantly through lake-based outdoor activities and provincial tourism programs. The region’s mature retail ecosystem and strong adoption of adventure sports further support growth.

Europe

Europe represents 20–25% of the global market, with high participation in recreation and water sports across Germany, France, the U.K., Spain, and Italy. The region is heavily influenced by sustainability trends, driving demand for eco-friendly SUP materials. Tourism-rich Mediterranean destinations fuel rental market expansion. Structured paddling communities and SUP racing events also boost engagement.

Asia-Pacific

Asia-Pacific is the fastest-growing region, contributing 20–25% of global share and expanding rapidly due to rising middle-class income, coastal tourism, and social media–driven adventure culture. China and Southeast Asia are emerging as major demand hubs. Australia remains a mature market with strong recreational adoption, while India is witnessing accelerated growth through tourism and lifestyle sports.

Latin America

LATAM contributes around 5–8% of global demand, led by Brazil, Mexico, and Chile. The region’s extensive coastline and lake systems support increasing SUP activity, though market growth is moderated by economic variability. Tourism and adventure travel are primary demand drivers.

Middle East & Africa

MEA holds a 3–5% share, with strong adoption in Gulf countries (UAE, Qatar), where water sports are integrated into luxury tourism. African coastal nations, including South Africa and Mauritius, contribute through adventure tourism and resort-based rentals. Infrastructure limitations restrain broader adoption, but premium tourism continues to elevate demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Stand-Up Paddleboard Market

- Red Paddle Co.

- Boardworks Surf & SUP

- Cascadia Board Co.

- TAHE (BIC Sport)

- RAVE Sports

- Airhead Sports Group

- Sea Eagle Boats Inc.

- EXOCET

- Tower Paddle Boards

- Slingshot Sports

- Jimmy Styks

- Starboard

- NRS (Northwest River Supplies)

- Pau Hana Surf Supply

- Solstice Watersports

Recent Developments

- In March 2025, Red Paddle Co. introduced a fully recyclable SUP board line, incorporating plant-derived resins and eco-friendly composite materials.

- In January 2025, Tower Paddle Boards expanded its inflatable SUP portfolio with next-generation drop-stitch construction for enhanced rigidity and durability.

- In May 2025, TAHE launched a new premium touring SUP series designed for long-distance paddling and competitive endurance events.