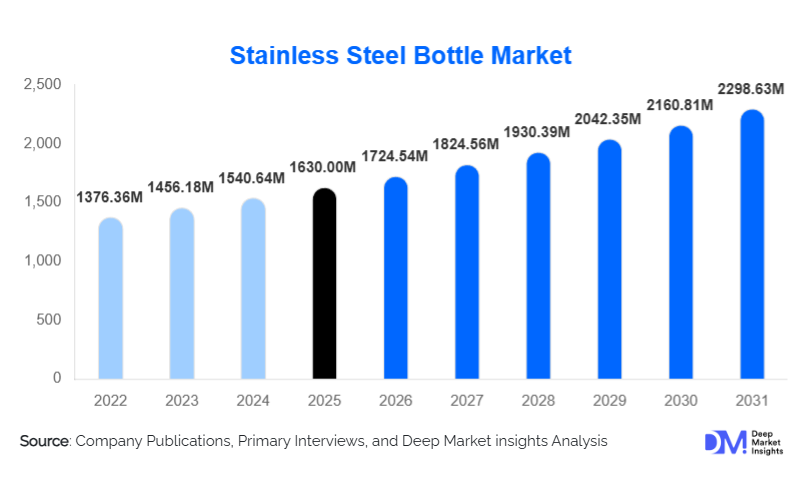

Stainless Steel Bottle Market Size

According to Deep Market Insights, the global stainless steel bottle market size was valued at USD 1630 million in 2025 and is projected to grow from USD 1724.54 million in 2026 to reach USD 2298.63 million by 2031, expanding at a CAGR of 5.8% during the forecast period (2026–2031). The market growth is primarily driven by rising environmental awareness, global bans on single-use plastics, increasing adoption of reusable drinkware across residential and institutional users, and strong premiumization trends supported by innovation in insulation technology and product design.

Key Market Insights

- Double-wall and vacuum-insulated stainless steel bottles dominate global demand, driven by outdoor, fitness, and travel usage requiring extended thermal retention.

- Mid-range pricing (USD 10–25 per unit) accounts for the largest revenue share, balancing affordability with durability and insulation performance.

- Asia-Pacific leads global production and consumption, supported by large-scale manufacturing in China and rapidly rising domestic demand in India.

- North America represents the most premium-driven market, with higher average selling prices and strong brand loyalty.

- Online marketplaces and direct-to-consumer channels are reshaping distribution, improving price transparency and brand margins.

- Corporate gifting and institutional procurement are emerging as high-volume, stable demand segments.

What are the latest trends in the stainless steel bottle market?

Premiumization and Lifestyle-Oriented Designs

The stainless steel bottle market is witnessing a strong shift toward premium and lifestyle-driven products. Consumers increasingly view bottles as personal accessories rather than utility items, driving demand for aesthetically appealing designs, powder-coated finishes, ergonomic shapes, and brand-led customization. Premium bottles with advanced insulation, scratch resistance, and leak-proof lids are gaining traction, particularly in North America and Europe. Limited-edition collections, co-branding with sports and outdoor brands, and influencer-driven marketing are reinforcing the positioning of stainless steel bottles as aspirational lifestyle products.

Technology-Enhanced and Smart Bottle Features

Technological integration is becoming an important differentiator in the market. Manufacturers are introducing bottles with temperature display caps, UV self-cleaning lids, antimicrobial coatings, and enhanced vacuum insulation. While still a niche, smart features are gaining acceptance among fitness enthusiasts and premium buyers. At the same time, manufacturing technology improvements such as automated welding, laser sealing, and precision insulation processes are improving product consistency, reducing defect rates, and supporting large-scale production with better margins.

What are the key drivers in the stainless steel bottle market?

Global Shift Away from Single-Use Plastics

Government regulations and consumer-led sustainability movements are accelerating the shift from plastic to reusable alternatives. Bans on single-use plastics across schools, offices, public institutions, and hospitality establishments have directly boosted demand for stainless steel bottles. Consumers increasingly perceive stainless steel as a safer, non-toxic, and environmentally responsible option, supporting long-term replacement demand.

Rising Outdoor, Fitness, and Travel Activities

Growth in fitness culture, adventure tourism, trekking, cycling, and daily commuting has increased the need for durable and thermally efficient hydration solutions. Stainless steel bottles, particularly vacuum-insulated variants, are well-suited for these applications. This driver is especially strong in urban centers across North America, Europe, and Asia-Pacific, where active lifestyles and health consciousness continue to rise.

What are the restraints for the global market?

Volatility in Stainless Steel Raw Material Prices

Fluctuations in prices of key raw materials such as nickel and chromium directly impact production costs. Manufacturers operating in price-sensitive markets often face challenges in passing on cost increases to consumers, which can compress margins, particularly in economy and mid-range segments.

Competition from Alternative Materials

Glass and Tritan plastic bottles continue to compete in lower price categories. Although less durable, these alternatives attract budget-conscious consumers and can slow stainless steel bottle adoption in emerging markets where price sensitivity remains high.

What are the key opportunities in the stainless steel bottle industry?

Institutional and Corporate Bulk Procurement

Corporate sustainability initiatives and employee wellness programs are driving bulk procurement of stainless steel bottles. Educational institutions, construction companies, manufacturing plants, and government organizations are increasingly standardizing reusable bottles for employees and students. This creates long-term, high-volume opportunities for manufacturers with scalable production and customization capabilities.

Emerging Market Penetration and Urbanization

Rapid urbanization and rising disposable incomes in India, Southeast Asia, Africa, and Latin America present strong growth opportunities. Expanding urban workforces and improving retail penetration are increasing awareness and affordability of stainless steel bottles, particularly in the mid-range pricing segment.

Product Type Insights

Double-wall and vacuum-insulated stainless steel bottles dominate the market, accounting for approximately 48% of global revenue in 2025. Their ability to retain hot and cold temperatures for extended periods makes them the preferred choice for daily commuters, travelers, and outdoor enthusiasts. Single-wall bottles continue to see demand in cost-sensitive markets and institutional use cases where insulation is not critical. Triple-layer insulated bottles, while niche, are gaining traction in premium segments due to superior thermal performance and durability.

End-Use Insights

Residential consumers represent the largest end-use segment, contributing over 50% of total demand, driven by repeat household purchases and replacement cycles. Corporate and promotional buyers are the fastest-growing segment, supported by sustainability-driven gifting and branding initiatives. Hospitality and foodservice sectors are gradually replacing disposable bottles with reusable stainless steel options to meet ESG goals, while educational institutions are emerging as a significant volume-driven end-use segment.

Distribution Channel Insights

Online marketplaces account for the largest share of distribution, supported by wide product availability, competitive pricing, and consumer reviews. Direct-to-consumer brand websites are growing rapidly, enabling manufacturers to improve margins and customer engagement. Specialty stores focused on sports, outdoor, and lifestyle products continue to play an important role in premium product sales, while supermarkets and hypermarkets dominate volume sales in urban markets.

| By Product Type | By Lid / Closure Type | By Insulation Performance | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global stainless steel bottle market with approximately 38% share in 2025. China dominates manufacturing and export volumes, while India is the fastest-growing consumer market, supported by urbanization, government sustainability initiatives, and expanding middle-class demand. Japan and South Korea contribute steady demand, particularly for high-quality insulated bottles.

North America

North America accounts for around 26% of the global market, driven primarily by the United States. High consumer spending, strong outdoor culture, and premium brand adoption result in higher average selling prices. Demand is heavily skewed toward insulated and premium stainless steel bottles.

Europe

Europe holds nearly 22% market share, with Germany, the U.K., and France leading demand. Strong environmental regulations and consumer preference for sustainable products support steady growth. Premium and mid-range segments perform particularly well across Western Europe.

Latin America

Latin America is an emerging market, led by Brazil and Mexico. Growing urban populations and rising health awareness are gradually increasing adoption, although price sensitivity remains a key challenge.

Middle East & Africa

The Middle East shows growing demand driven by corporate gifting, tourism, and premium consumption in countries such as the UAE and Saudi Arabia. Africa remains a developing market with rising institutional and NGO-driven demand for reusable bottles.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Stainless Steel Bottle Market

- Thermos

- Hydro Flask

- YETI

- Stanley

- Tiger Corporation

- Klean Kanteen

- Zojirushi

- CamelBak

- Contigo

- S’well

- Milton

- Tupperware

- Lock&Lock

- SIGG

- Snow Peak