SRPG Games Market Size

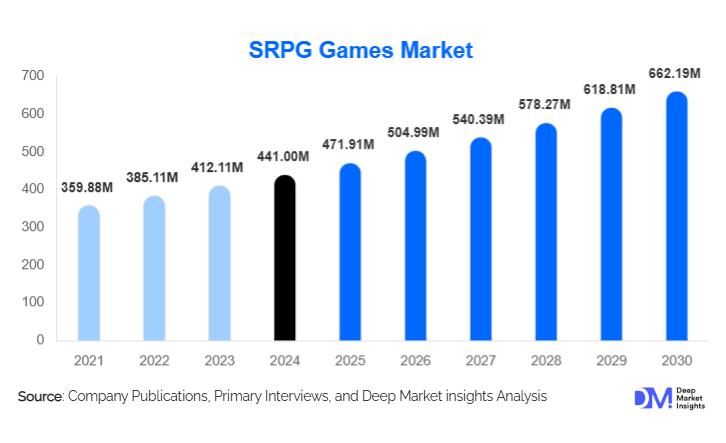

According to Deep Market Insights, the global SRPG games market size was valued at USD 441.00 million in 2024 and is projected to grow from USD 471.91 million in 2025 to reach USD 662.19 million by 2030, expanding at a CAGR of 7.01% during the forecast period (2025–2030). The SRPG market growth is primarily driven by increasing mobile gaming adoption, rising interest in competitive esports, and technological advancements in AI, cloud gaming, and AR/VR integrations, which are reshaping strategic gameplay experiences for both casual and hardcore gamers worldwide.

Key Market Insights

- Mobile platforms dominate the SRPG market, attracting casual gamers with freemium and in-app purchase models that enable widespread engagement.

- Turn-based SRPGs remain the most popular genre, driven by long-standing franchises like Fire Emblem and Final Fantasy Tactics, appealing to both nostalgic players and new audiences.

- APAC leads global demand, with Japan, China, and South Korea accounting for nearly 45% of the 2024 market, fueled by mobile penetration and esports culture.

- North America maintains a significant market share, driven by premium console and PC SRPGs and a growing competitive gaming ecosystem.

- Technological adoption is accelerating market growth, including AI-driven gameplay, cloud gaming, AR/VR experiences, and blockchain-enabled in-game assets.

- Freemium and in-app purchase models are reshaping monetization, contributing approximately 50% of market revenue in 2024.

What are the latest trends in the SRPG games market?

Cloud Gaming and Cross-Platform Play

Cloud-based SRPGs are enabling gamers to access high-quality titles without high-end devices, breaking barriers to entry. Cross-platform play between PC, mobile, and consoles is increasingly popular, enhancing multiplayer experiences and broadening player bases. This trend allows developers to maintain engagement across platforms, boost in-game purchases, and expand global reach.

Integration of AI, AR/VR, and Blockchain

Advanced AI algorithms are creating more intelligent NPC behavior, adaptive difficulty levels, and personalized gameplay experiences. AR/VR technologies are increasingly being tested for immersive tactical encounters, while blockchain-enabled assets and NFTs are opening new monetization streams for loyal players. These innovations cater to tech-savvy gamers and create differentiated gaming experiences that improve retention and engagement.

What are the key drivers in the SRPG games market?

Rapid Mobile Gaming Adoption

The growing accessibility of smartphones and affordable internet services has led to a surge in mobile SRPG players, accounting for 55% of the 2024 market. Mobile-first design and casual-friendly gameplay are capturing a wide audience, driving recurring revenue through freemium and in-app purchase models.

Esports and Competitive Gaming Growth

Online tournaments, live streaming, and esports competitions are expanding the SRPG audience. Multiplayer competitive modes in SRPGs attract professional and amateur players alike, generating sponsorship opportunities, in-game purchases, and viewership-driven revenue.

Technological Advancements in Gaming

AI-driven game design, real-time tactical decision-making, AR/VR immersion, and cloud gaming are enhancing gameplay quality and accessibility. Gamers increasingly seek sophisticated, interactive experiences that push engagement and retention, benefiting developers who innovate in these areas.

What are the restraints for the global market?

High Development Costs

Creating high-quality SRPGs requires significant investment in graphics, storyline, AI programming, and cross-platform integration. Smaller developers face entry barriers due to budget constraints, potentially limiting market diversity.

Piracy and Intellectual Property Risks

Unauthorized distribution of SRPG titles, particularly in emerging markets, affects revenue. Developers must invest in anti-piracy measures and regional licensing strategies to mitigate losses, which adds operational complexity and cost.

What are the key opportunities in the SRPG games industry?

Emerging Markets Expansion

Countries in APAC, LATAM, and MEA are showing rapid growth in mobile gaming adoption. Developers can leverage localized content, regional languages, and culturally relevant storylines to capture these untapped audiences. India, Brazil, and Mexico, in particular, are high-potential growth markets.

Esports and Competitive Play

Competitive SRPG tournaments and community-driven gameplay present opportunities for brand building, monetization, and player retention. Streaming platforms like Twitch and YouTube Gaming allow developers to monetize visibility while enhancing global engagement with their titles.

Advanced Technology Integration

Cloud gaming, AI-driven gameplay, AR/VR experiences, and blockchain for in-game assets are unlocking innovative revenue streams. These technologies enhance engagement, extend playtime, and allow developers to monetize beyond traditional purchase models.

Platform Insights

Mobile SRPGs dominate the global market with approximately 55% share in 2024, primarily driven by widespread smartphone penetration, low entry barriers, and the scalability of freemium monetization models. Mobile platforms enable developers to reach a broad demographic, including casual and mid-core gamers, through accessible gameplay formats, shorter session lengths, and continuous content updates delivered via live-ops. The success of gacha mechanics, event-based rewards, and character-driven progression systems has further strengthened mobile SRPG engagement and lifetime user value, particularly across Asia-Pacific and emerging markets.

PC and console SRPGs remain critical for revenue quality and franchise longevity, especially among hardcore and strategy-focused gamers. These platforms support complex mechanics, advanced AI systems, high-fidelity graphics, and expansive storylines that appeal to dedicated players willing to pay premium prices. Console exclusives and PC modding communities also extend game lifecycles, reinforcing sustained demand. Meanwhile, cloud gaming platforms are emerging as a strategic growth enabler, allowing SRPG titles to be streamed across devices, reducing hardware dependency and supporting subscription-based access models, particularly in North America and Europe.

Genre Insights

Turn-based SRPGs lead the genre landscape, accounting for nearly 40% of the global market, due to their deep tactical gameplay, structured progression systems, and strong appeal to long-time strategy enthusiasts. The dominance of this segment is reinforced by established intellectual properties, nostalgic value, and strong replayability, particularly within Japanese and Western markets. Turn-based mechanics also translate effectively to mobile platforms, enabling wider adoption without compromising strategic depth.

Tactical real-time SRPGs are experiencing steady growth, driven by demand for faster-paced, skill-intensive gameplay and real-time decision-making. This sub-segment appeals strongly to competitive players and esports-oriented audiences. Additionally, hybrid and experimental SRPG formats—blending roguelike mechanics, simulation elements, or narrative-driven RPG systems—are gaining traction among niche audiences seeking innovation, helping developers differentiate their offerings in an increasingly crowded market.

Monetization Model Insights

Freemium and in-app purchase models generate approximately 50% of total SRPG market revenue, making them the most influential monetization strategy globally. This dominance is driven by mobile-first SRPG titles that leverage microtransactions for character upgrades, cosmetic items, seasonal content, and battle passes. Continuous engagement models, supported by live events and content expansions, allow publishers to maximize average revenue per user (ARPU) over extended lifecycles.

Premium one-time purchase models remain highly relevant within the PC and console ecosystem, particularly for story-rich and franchise-based SRPGs. These titles command higher upfront pricing and benefit from expansion packs and downloadable content (DLC). Subscription-based access models, supported by platforms such as game passes and cloud services, are emerging as a complementary revenue stream, offering players broader access while providing publishers with predictable recurring income.

Player Type Insights

Hardcore gamers account for approximately 60% of the SRPG market, primarily concentrated on PC and console platforms. This segment values strategic complexity, long-term progression systems, competitive modes, and immersive narratives. Their willingness to invest in premium titles, DLCs, and collectibles makes them a high-value audience for developers.

Casual gamers are the primary growth engine for mobile SRPGs, driven by accessibility, intuitive interfaces, and shorter play sessions. Meanwhile, competitive and esports-oriented players represent a smaller but highly lucrative segment, contributing disproportionately to in-game spending, tournament participation, and streaming engagement. Their influence also enhances game visibility and community-driven growth across digital platforms.

| By Platform | By Genre | By Monetization Model | By Player Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 30% of the global SRPG market in 2024, led by the United States and Canada. Regional growth is driven by high disposable income, a mature console and PC gaming ecosystem, and strong adoption of premium-priced SRPG titles. The region’s well-established esports infrastructure and streaming culture support competitive SRPG formats, while widespread cloud gaming adoption is accelerating cross-platform play. Strong IP recognition and franchise loyalty further sustain long-term demand.

Europe

Europe represents nearly 20% of global SRPG demand, with Germany, the U.K., and France serving as key markets. Growth in the region is driven by a strong preference for narrative-rich, strategy-intensive games and increasing acceptance of digital distribution platforms. High broadband penetration, regulatory stability, and a growing indie development ecosystem support innovation in SRPG design. Additionally, European gamers show rising interest in ethical monetization and long-form gameplay experiences, reinforcing demand for premium and subscription-based SRPGs.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, contributing approximately 45% of the global SRPG market. Japan, China, and South Korea dominate due to deep-rooted RPG culture, strong mobile gaming ecosystems, and advanced esports infrastructure. High smartphone penetration, aggressive live-service models, and character-collection mechanics drive sustained engagement. Emerging markets such as India and Southeast Asia are witnessing rapid growth due to expanding internet access, affordable smartphones, and increasing youth engagement with mobile gaming, positioning APAC as the primary growth engine for the industry.

Latin America

Latin America is an emerging SRPG growth region, led by Brazil, Mexico, and Argentina. Market expansion is supported by improving digital infrastructure, rising disposable income, and strong adoption of mobile gaming. Price-sensitive consumers in the region favor freemium SRPGs and mid-range titles, while increasing localization efforts and regional payment options are lowering entry barriers for global publishers.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of global demand, with the UAE, Saudi Arabia, and South Africa leading growth. High-income populations, strong smartphone adoption, and government-backed digital entertainment initiatives are key drivers. Increasing interest in competitive gaming, coupled with investments in esports infrastructure and cloud connectivity, is gradually expanding SRPG adoption across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the SRPG Games Market

- Square Enix

- Nintendo

- Sega

- Bandai Namco

- Paradox Interactive

- Atlus

- NetEase

- Koei Tecmo

- Nexon

- Capcom

- Tencent

- GungHo Online

- Com2uS

- Level-5

- Ubisoft