Sports Tourism Market Size

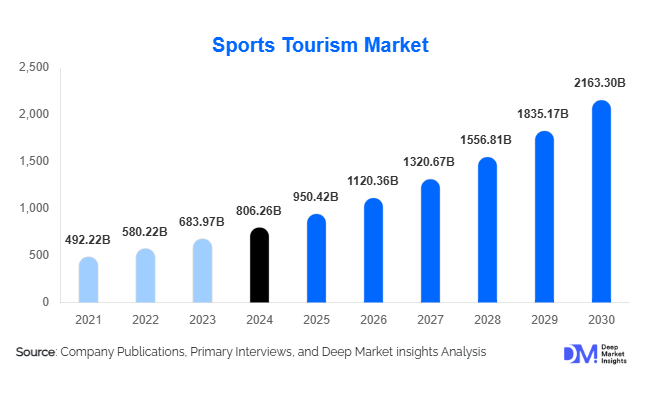

According to Deep Market Insights, the global sports tourism market size was valued at USD 806.26 billion in 2024 and is projected to grow from USD 950.42 billion in 2025 to reach USD 2,163.30 billion by 2030, expanding at a CAGR of 17.88% during the forecast period (2025–2030). Sports tourism growth is driven by rising global participation in athletic events, the expanding popularity of professional sports leagues, increasing international fan mobility, and accelerated investments in stadiums, sports facilities, and tourism infrastructure across emerging economies.

Key Market Insights

- Passive sports tourism, spectator travel for major events, dominates global demand, driven by mega-events such as the FIFA World Cup, Olympics, NBA, F1, and cricket leagues.

- Active and wellness sports tourism is the fastest-growing segment, fueled by rising global fitness culture, endurance event participation, and adventure sports expansion.

- Europe leads the global market with strong inbound and outbound sports tourism flows centered around elite football leagues and historic stadiums.

- Asia-Pacific is the fastest-growing region due to rising middle-class affluence, government-backed sports infrastructure investments, and expanding event calendars.

- Digital transformation, AI itineraries, blockchain ticketing, and VR stadium previews, is reshaping traveler engagement and improving booking transparency.

- Sports training tourism is emerging as a major revenue stream, with global demand for elite camps, altitude training, and youth athletic programs.

What are the latest trends in the sports tourism market?

Immersive Fan Engagement & Hyper-Digital Sports Travel

Sports tourism is experiencing rapid digital integration. Platforms now offer AI-generated travel packages, AR/VR preview tours of stadiums, blockchain-enabled ticketing, and real-time team travel insights. Stadiums increasingly use augmented reality overlays for enhanced fan experiences, while virtual fan zones and immersive hospitality lounges extend engagement beyond traditional seating. These innovations attract younger, tech-savvy travelers and elevate premium ticket sales. Mobile-first booking journeys, influencer-driven travel content, and gamified engagement programs are redefining how fans plan and experience sports trips.

Rise of Active, Adventure & Wellness-Oriented Sport Travel

Experiential travel is driving demand for active participation sports tourism, including marathons, triathlons, surfing tours, skiing experiences, and high-performance athlete retreats. Wellness-centered sports travel, yoga-athlete hybrids, recovery-focused camps, and fitness retreats, continues to expand. Travelers increasingly seek purpose-driven trips that combine physical challenge with cultural immersion and outdoor exploration. The trend is particularly strong among millennials, Gen Z, and health-conscious professionals seeking travel that supports personal performance and lifestyle goals.

What are the key drivers in the sports tourism market?

Global Surge in Spectator Travel and Mega-Event Attendance

The worldwide popularity of elite sports leagues and international championships has triggered unprecedented cross-border travel. Events like the FIFA World Cup, Olympics, Formula 1 Grand Prix, NBA Finals, and ICC Cricket tournaments attract millions of international spectators. Expanded air connectivity, easier visa policies, and bundled hospitality packages amplify this demand. The emotional appeal of sports fandom remains one of the strongest motivators driving travel decisions globally.

Rapid Infrastructure Investments in Emerging Markets

Governments in Asia-Pacific and the Middle East are investing billions into new stadiums, sports academies, athlete villages, transport infrastructure, and sports tourism clusters. Initiatives such as Saudi Vision 2030 and China’s national sports development plan aim to diversify economies through tourism and international event hosting. These investments enhance global competitiveness and create long-term revenue for sports tourism stakeholders.

What are the restraints for the global market?

High Travel, Ticketing & Accommodation Costs

International sports travel remains premium-priced, especially during mega-events. High airfare volatility, surge hotel pricing, limited accommodation supply near venues, and rising ticket costs restrict participation for middle-income travelers. These financial barriers reduce accessibility and can dampen demand in cost-sensitive markets.

Geopolitical, Environmental & Scheduling Uncertainties

Geo-political tensions, weather disruptions, and sudden event cancellations pose a significant risk to travel planning. Unpredictable schedules, pandemic-related contingencies, and climate-driven venue risks challenge industry stability. These uncertainties require stronger contingency planning and diversified revenue models among operators.

What are the key opportunities in the sports tourism industry?

Tech-Enabled Personalization and Virtual-Integrated Travel

AI-driven itinerary builders, personalized fan experiences, VR-enhanced stadium tours, and blockchain ticketing present major opportunities for industry players. Tailoring travel packages based on fan behavior, fitness profiles, or league engagement can significantly enhance conversion rates. Digital fan communities and subscription-based sports travel memberships represent new monetization avenues.

Community-Based Sports Tourism & Youth Engagement

Youth training programs, community tournaments, and locally hosted sports festivals present growing opportunities for destination development. These models foster inclusivity, create new revenue channels, and strengthen domestic tourism. Governments and NGOs increasingly support grassroots sports tourism, aligning economic development with social well-being and youth empowerment.

Product Type Insights

Premium sports tourism packages, VIP stadium access, hospitality suites, and exclusive athlete meet-and-greets dominate revenue share. Mid-range packages attract mainstream travelers attending leagues, marathons, and regional tournaments. Budget sports tourism is growing among adventure enthusiasts, student groups, and amateur athletes traveling for competitions or training. Self-organized sports trips, especially among cyclists, runners, and hikers, are expanding due to low-cost gear availability and digital route-planning tools.

Application Insights

Spectator sports tourism remains the largest application segment, driven by global events and professional league followings. Participation-based tourism, marathons, triathlons, and endurance cycling are the fastest-growing segments. Sports training tourism (youth camps, elite programs, rehabilitation retreats) is emerging as a high-value niche. Adventure sports applications such as surfing, skiing, and mountain biking continue to diversify global tourism offerings. Corporate sports travel for incentives and sponsored events is also expanding rapidly.

Distribution Channel Insights

Online travel agencies (OTAs) dominate the market with real-time pricing, dynamic sports bundles, and mobile-first booking experiences. Specialized sports tour operators thrive in premium, event-linked, and customized travel. Direct booking via stadiums, leagues, and hotel platforms is increasing due to loyalty programs and integrated digital ticketing. Subscription-based sports travel memberships and influencer-driven booking links are emerging as strong digital channels.

Traveler Type Insights

Group travelers represent the largest market share due to team-based travel, fan groups, and organized amateur competitions. Solo travelers increasingly participate in marathons, adventure trips, and cultural sports tours. Couples and families drive premium sales during major league events, combining sports with leisure travel. Youth athletes represent a rapidly expanding category, supported by international training camps and tournaments.

Age Group Insights

Travelers aged 31–50 dominate global demand due to high disposable income and interest in both spectator and participation sports. The 18–30 group fuels growth in adventure and budget sports tourism. Mature travelers aged 51–65 increasingly seek premium experiences with comfort-driven itineraries. The above-65 segment contributes to niche travel focused on golf, walking tours, and low-impact sports travel.

| By Tourism Type | By Sport Category | By Traveler Profile | By Distribution Channel | By Expenditure Category |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds a significant share of outbound and domestic sports tourism, driven by the popularity of the NFL, NBA, MLB, MLS, and major collegiate sports. The U.S. accounts for over 80% of regional demand. The upcoming 2026 FIFA World Cup (U.S.–Canada–Mexico) is expected to significantly boost inbound sports tourism through 2030.

Europe

Europe remains the global leader with strong demand for football tourism, F1 events, rugby championships, and tennis Grand Slams. The U.K., Germany, Spain, Italy, and France collectively represent the region’s core markets. Cross-border fan mobility makes Europe the world’s most dynamic sports tourism ecosystem.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China and India’s expanding sports culture and rising incomes. Japan and Australia maintain mature, high-value sports tourism sectors focused on rugby, motorsports, and tennis. Government-funded infrastructure and mega-event hosting accelerate regional growth.

Latin America

Latin America’s sports tourism is strongly influenced by football culture, with Brazil, Argentina, and Mexico leading demand. Adventure and endurance sports participation is increasing, driving tourist flows domestically and internationally.

Middle East & Africa

Africa offers growing participation tourism (marathons, adventure sports) and strong inbound sports travel linked to major events. The Middle East is becoming a major global hub with Saudi Arabia, Qatar, and the UAE investing heavily in sports cities, events, and tourism infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sports Tourism Market

- TUI Group

- Thomas Cook

- QuintEvents

- Sports Travel & Hospitality Group

- Circuit Hospitality

- Kuoni Travel

- Roadtrips Sports Travel

- STA Travel (sports division)

- Sports Tours International

- Gulliver's Sports Travel

- Marathon Tours & Travel

- Anthony Travel

- Tourism Ireland (sports programs)

- Jet Tours Sports

- World Rugby Travel

Recent Developments

- In February 2025, QuintEvents partnered with multiple European football clubs to expand premium hospitality travel packages for international spectators.

- In April 2025, TUI Group launched AI-powered sports travel itineraries integrating dynamic pricing, event scheduling, and hyper-personalized recommendations.

- In June 2025, Sports Travel & Hospitality Group expanded into India’s cricket tourism market with new IPL-based premium fan experiences.