Sports Gun Market Size

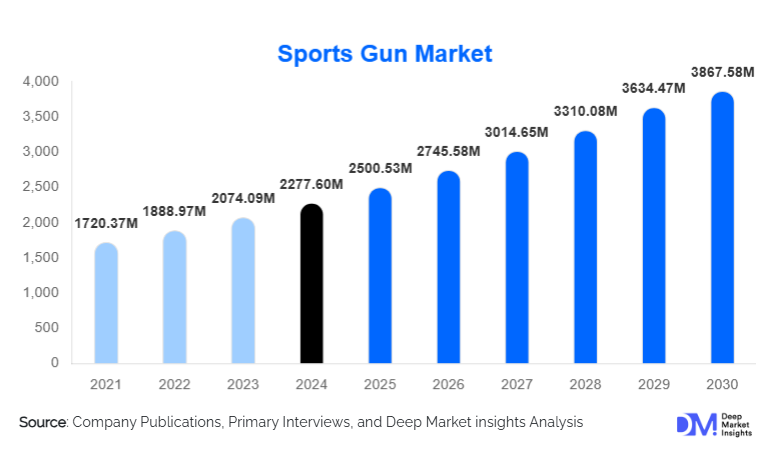

According to Deep Market Insights, the global sports gun market size was valued at USD 2,277.60 Million in 2024 and is projected to grow from USD 2,500.53 Million in 2025 to reach USD 3,867.58 Million by 2030, expanding at a CAGR of 9.80% during the forecast period (2025–2030). The sports gun market is primarily driven by rising participation in competitive shooting sports, rapid growth of recreational airsoft and paintball activities, expanding shooting academies worldwide, and the technological evolution of air-powered and PCP-based sport guns that enhance accuracy and user experience.

Key Market Insights

- Air rifles and PCP-powered sports guns dominate global demand, driven by Olympic discipline adoption and rising training infrastructure worldwide.

- Asia-Pacific is the fastest-growing region due to government-backed shooting academies, youth sports initiatives, and rapidly increasing disposable incomes.

- Professional sports shooting accounts for more than one-third of global revenue, fueled by ISSF-standard equipment demand and Olympic qualification programs.

- Paintball and airsoft are expanding rapidly, attracting younger demographics and creating new recurring revenue streams through upgrades and accessories.

- North America and Europe collectively account for over 59% of global value, with a well-established sports shooting culture and widespread recreational participation.

- Technological integration—including PCP systems, composite materials, and digital training tools— is reshaping product innovation and competitive performance.

What are the latest trends in the sports gun market?

Rising Adoption of PCP and Advanced Airgun Technologies

Pre-Charged Pneumatic (PCP) systems are becoming the gold standard in sports shooting due to their superior stability, high consistency, and minimal recoil. Competitive shooters increasingly prefer PCP rifles and pistols for training and tournaments, as these mechanisms offer unmatched precision and reduced fatigue. Manufacturers are integrating digital pressure regulators, upgraded barrels, ergonomic grips, and modular adjustable stocks to improve accuracy and user comfort. This trend is especially pronounced in professional shooting circuits and emerging markets where new academies prioritize PCP adoption over traditional CO₂ or spring-powered models.

Expansion of Airsoft and Paintball as Lifestyle Sports

Airsoft and paintball have transformed into mainstream recreational sports globally. Urban adventure parks, corporate team-building programs, and youth-focused leagues are driving equipment sales. Advanced AEG (Automatic Electric Gun) platforms, customizable airsoft guns, tactical gear, and performance upgrade kits are witnessing growing demand. Social media exposure and competitive gaming formats have further popularized these sports, especially among younger players seeking interactive, adrenaline-driven activities. This trend has created high-volume demand for mid-range and entry-level sports guns, boosting the broader recreational segment.

What are the key drivers in the sports gun market?

Growing Participation in Competitive Shooting and Training Programs

The increasing recognition of shooting as a precision sport is fueling widespread participation across national, regional, and grassroots levels. Government-backed sports academies in India, China, South Korea, and Eastern Europe are heavily investing in professional shooting infrastructure, driving demand for ISSF-compliant rifles, pistols, and training systems. Heightened visibility from international competitions, Olympic performances, and youth training initiatives further strengthens market growth.

Technological Innovation Enhancing Accuracy and User Experience

Advances in PCP airgun systems, precision triggers, carbon-fiber construction, and ergonomic customization have dramatically elevated sports gun performance. Athletes and enthusiasts increasingly prefer guns with digital shooting analytics, adjustable balance systems, and consistent shot cycles. Such innovations support both expert-level competitions and serious amateur training, helping manufacturers differentiate products and achieve premium pricing.

Growth in Non-Lethal Recreational Sports

Airsoft and paintball have become highly popular recreational sports, particularly in North America, Europe, Japan, and Southeast Asia. These activities require frequent equipment replacement, upgrades, and accessories, creating strong recurring revenues. The social, adventure-driven format of these sports appeals widely to younger demographics, strengthening long-term demand for non-lethal guns and related gear.

What are the restraints for the global market?

Stringent Regulations and Import/Export Restrictions

Sports guns, including air rifles and airsoft platforms, are regulated by diverse regional laws that may require licensing, background checks, or performance certification. Sudden regulatory shifts can disrupt distribution and limit market accessibility, particularly in developing regions with bureaucratic import frameworks. These restrictions create uncertainty for manufacturers and distributors, slowing adoption and complicating long-term planning.

High Cost of Premium Competition Guns

Professional-grade PCP rifles and precision pistols often cost over USD 1,500, placing them beyond reach for many amateurs and beginners. This cost barrier limits wider participation in competitive shooting and restricts market growth in price-sensitive economies. Even many recreational airsoft enthusiasts face rising equipment costs, including tactical gear and upgrade components, which suppresses broader demand.

What are the key opportunities in the sports gun industry?

Expansion of Shooting Academies and Regulated Sports Facilities

Governments and sports associations worldwide are investing in national shooting academies, indoor ranges, and Olympic training centers. This presents a major opportunity for manufacturers to supply standardized sports guns, digital scoring systems, and professional-grade training equipment. India, China, and Southeast Asia represent particularly high-potential regions where youth participation and government incentives are rapidly increasing.

Growth of Non-Lethal Tactical Sports

Airsoft and paintball present enormous untapped potential. With rising youth engagement, urban adventure parks, and organized weekend leagues, demand for electric, gas-powered, and customizable guns is escalating. Manufacturers can expand product lines, introduce modular systems, and provide upgrade kits and tactical accessories to strengthen consumer loyalty. This segment also offers recurring revenue through spare parts and replacements.

Product Type Insights

Air rifles dominate the global sports gun market, supported by their widespread use in Olympic disciplines, professional training, and recreational target shooting. PCP air rifles, in particular, have become essential for advanced shooters due to their superior accuracy and stability. Pistols represent the second-largest category, fueled by competitive shooting growth and ISSF-standard events. Shotguns maintain relevance primarily within sporting clay and trap shooting. Non-lethal airsoft and paintball guns are the fastest-growing categories, capturing youth-driven recreational demand and expanding adventure sports participation worldwide.

Application Insights

Professional sports shooting accounts for the largest share of global applications, driven by Olympic qualification events, national championships, and expanding training academies. Recreational target shooting remains a stable and growing segment, particularly in North America and Europe, where shooting clubs continue to attract hobbyists. Airsoft and paintball represent the highest-growth application category, supported by competitive leagues, social gaming influence, and the rise of team-based urban adventure sport formats. Legal hunting sports maintain a steady niche, particularly for shotguns and small-caliber rifles.

Distribution Channel Insights

Specialty sports stores lead global distribution, contributing the highest revenue share due to regulated handling requirements, expert consultation, and in-store demonstrations essential for sports gun purchases. Online-direct (D2C) platforms are growing rapidly, especially for airsoft and paintball gear, driven by transparent pricing, product comparisons, and user reviews. Shooting clubs and training academies also serve as niche distribution hubs, often partnering directly with manufacturers to provide standardized equipment to students and athletes.

End-User Insights

The primary end-users include professional shooters, shooting academies, sports federations, recreational shooters, airsoft/paintball participants, and adventure sports operators. Professional shooters and academies are high-value end-users who purchase premium PCP rifles and pistols. Recreational shooters and airsoft enthusiasts comprise the largest volume segment, driven by mid-range and customizable equipment demand. Growing adventure tourism and tactical sports activities contribute to an expanding consumer base, offering manufacturers opportunities to diversify product offerings.

| By Product Type | By Propulsion Mechanism | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents the largest regional market, accounting for nearly 32% of global revenue in 2024. The U.S. leads with strong participation in recreational target shooting, professional sports events, and extensive adoption of airsoft and paintball sports. Canada supports steady growth through hunting sports and training academies. High-income consumers and a strong competition culture continue to drive premium equipment sales.

Europe

Europe holds around 27% of the global market, supported by long-established shooting traditions in Germany, the U.K., Italy, France, and the Nordic countries. Professional sports shooting is deeply rooted across the region, and European manufacturers lead innovation in precision rifles and pistols. Strong regulatory frameworks and advanced training infrastructure contribute to sustainable demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at 9–11% CAGR. India, China, and South Korea are experiencing rapid growth due to expanding shooting academies, Olympic aspirations, and rising middle-class participation. Japan dominates airsoft manufacturing globally, influencing both domestic and international markets. Increasing government funding and sports modernization programs are accelerating regional adoption.

Latin America

Latin America shows moderate yet rising demand, particularly in Brazil, Mexico, and Argentina. Airgun sports, adventure activities, and recreational shooting are gaining popularity. Despite regulatory complexities, urban youth engagement and growing sports culture support long-term market potential.

Middle East & Africa

Demand is increasing in the UAE, Saudi Arabia, and South Africa, driven by rising recreational shooting clubs, sports tourism, and high-income levels. African nations with hunting sports traditions contribute to steady sports gun usage, while Middle Eastern regions focus on premium equipment for professional and recreational use.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Sports Gun Market

- Beretta Holding

- Anschutz

- Walther Arms

- SIG Sauer (Sports Division)

- Sturm, Ruger & Co.

- Gamo Outdoor SL

- Umarex Sportwaffen

- Air Arms

- Weihrauch Sport

- Tokyo Marui

- Crosman Corporation

- Daisy Outdoor Products

- Hatsan Arms

- FX Airguns

- Snowpeak Airguns

Recent Developments

- In March 2025, FX Airguns expanded its PCP production facility to meet growing demand for precision air rifles and enhance R&D capabilities.

- In February 2025, Tokyo Marui introduced a next-generation AEG platform with enhanced battery efficiency and smart recoil simulation.

- In January 2025, Walther Arms launched a new series of competition pistols integrating digital trigger modules and carbon-fiber frames.