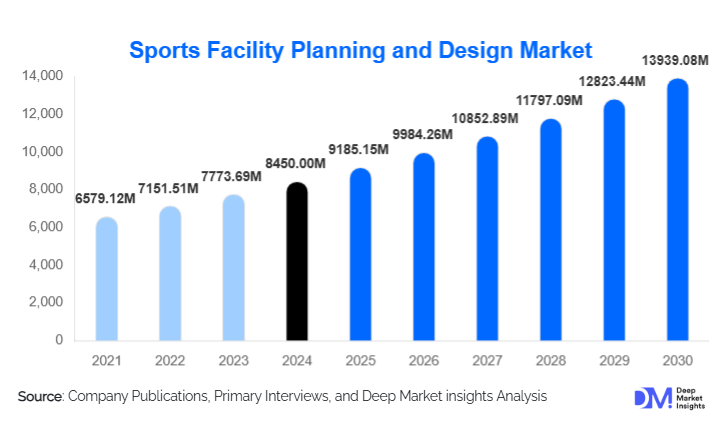

Sports Facility Planning and Design Market Size

According to Deep Market Insights, the global sports facility planning and design market size was valued at USD 8,450 million in 2024 and is projected to grow from USD 9,185.15 million in 2025 to reach USD 13,939.08 million by 2030, expanding at a CAGR of 8.7% during the forecast period (2025–2030). The market growth is primarily driven by rising investments in sports infrastructure, increasing global sports participation, rapid urbanization, and the growing emphasis on smart, sustainable, and multi-purpose sports facilities across both developed and emerging economies.

Key Market Insights

- Government-led infrastructure development remains the largest contributor to demand, driven by public sports complexes, stadium upgrades, and community recreation projects.

- Large-scale stadium and arena projects account for a disproportionate share of market value due to high design complexity and long project durations.

- North America dominates the market owing to the continuous renovation of aging stadiums and strong collegiate sports infrastructure.

- The Asia-Pacific region is the fastest-growing, driven by new stadium construction, youth sports programs, and hosting international sporting events.

- Sustainability-led design services are witnessing above-market growth as facilities adopt net-zero and green building standards.

- Technology integration, such as BIM, smart stadium systems, and digital fan experience planning, is reshaping competitive differentiation.

What are the latest trends in the sports facility planning and design market?

Rise of Smart and Digitally Enabled Sports Facilities

Sports facility planning is increasingly incorporating smart technologies to enhance operational efficiency and fan engagement. Design firms are integrating IoT-enabled infrastructure, real-time crowd management systems, high-speed connectivity, and digital twin modeling into stadium and arena projects. Smart seating, cashless concessions, and AI-powered security planning are becoming standard in large-scale developments. These capabilities are particularly prominent in North America, Europe, and the Middle East, where venue owners seek long-term operational cost optimization and enhanced user experience.

Sustainability-Centric Facility Design

Environmental sustainability has become a defining trend in sports facility planning and design. New projects increasingly emphasize energy-efficient building envelopes, renewable energy integration, water conservation systems, and climate-resilient architecture. Design firms offering LEED, BREEAM, and equivalent green certification consulting are gaining a competitive edge. Net-zero stadium concepts, modular construction methods, and low-carbon material selection are being prioritized by both public and private developers, reinforcing sustainability as a long-term growth lever.

What are the key drivers in the sports facility planning and design market?

Rising Global Sports Participation and Commercialization

Growing participation in professional, collegiate, and grassroots sports is fueling demand for modern, regulation-compliant facilities. Expanding sports leagues, international tournaments, and youth development programs are increasing the need for stadiums, training centers, and community sports complexes. Commercialization of sports through broadcasting, sponsorships, and live entertainment further drives investments in high-quality, multi-functional venues.

Urbanization and Smart City Development

Rapid urbanization is driving cities to incorporate sports infrastructure as a core element of urban regeneration and smart city planning. Sports complexes are increasingly designed as mixed-use developments that integrate retail, hospitality, and public spaces. Municipal authorities view such projects as catalysts for economic development, tourism, and social inclusion, thereby sustaining long-term demand for professional planning and design services.

What are the restraints for the global market?

High Capital Intensity of Sports Infrastructure Projects

Sports facilities require significant upfront capital investment, particularly for large stadiums and arenas. Budget overruns, financing delays, and economic uncertainties can lead to project postponements or downsizing, directly impacting design service revenues. Public-sector budget constraints remain a persistent challenge, especially in developing economies.

Regulatory and Approval Complexities

Complex zoning regulations, environmental approvals, and safety compliance requirements can extend project timelines and increase planning costs. Variations in local building codes and international sporting regulations add further complexity, requiring extensive coordination and compliance management by design firms.

What are the key opportunities in the sports facility planning and design industry?

Public–Private Partnership (PPP) Sports Projects

PPP models are gaining traction as governments seek private-sector expertise and funding for sports infrastructure development. These projects offer long-term, high-value opportunities for planning and design firms through master planning, lifecycle design, and operational optimization services. PPP-driven sports cities and multi-venue developments are particularly prominent in the Asia-Pacific and the Middle East.

Growth in Elite Training and High-Performance Sports Centers

Demand for elite training facilities and sports academies is increasing globally as countries invest in athlete development and Olympic performance programs. These facilities require specialized design expertise in biomechanics, recovery systems, and performance analytics integration, creating high-margin opportunities for niche design firms.

Service Type Insights

Architectural and structural design services dominate the market, accounting for approximately 32% of the 2024 market size. These services are mandatory across all facility types and involve high-value engagements throughout the project lifecycle. Engineering design services, including MEP and civil engineering, represent a substantial share due to increasing technical complexity. Sustainability consulting and technology integration services are the fastest-growing sub-segments, supported by regulatory requirements and smart stadium adoption.

Facility Type Insights

Outdoor sports facilities, including large stadiums and athletic complexes, account for nearly 38% of total market revenue, driven by football, cricket, and multi-sport venues. Indoor arenas and multi-purpose halls follow, benefiting from year-round utilization and event diversification. Recreational and community sports facilities represent a stable demand segment, particularly in urban and suburban developments.

End-Use Insights

Municipal and urban authorities represent the largest end-use segment, contributing around 29% of total demand in 2024. Professional sports organizations are significant contributors due to continuous facility upgrades and branding-driven design enhancements. Educational institutions are the fastest-growing end-use segment, driven by campus infrastructure modernization and increased investment in collegiate sports facilities.

| By Service Type | By Facility Type | By Ownership Model | By Project Scale | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global market, led by the United States and Canada. Demand is driven by stadium renovations, collegiate sports infrastructure, and technology upgrades in existing facilities. Strong private investment and established sports leagues sustain long-term growth.

Europe

Europe holds around 27% market share, supported by demand from the U.K., Germany, France, and Spain. Sustainability-focused retrofitting and compliance with stringent environmental standards are key demand drivers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR of over 10%. China, India, Japan, and Australia are investing heavily in new stadiums, training centers, and community sports infrastructure to support population growth and international event hosting.

Latin America

Latin America shows moderate growth, led by Brazil and Mexico, supported by football-centric infrastructure development and urban sports initiatives.

Middle East & Africa

The Middle East is emerging as a high-value market driven by mega projects in Saudi Arabia, the UAE, and Qatar, while Africa is witnessing selective investments tied to regional sports development and international events.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Sports Facility Planning and Design Market

- AECOM

- Populous

- HOK

- Gensler

- Arup

- Perkins&Will

- Foster + Partners

- HDR

- Nikken Sekkei

- CannonDesign

- KSS Architects

- Zaha Hadid Architects

- Grimshaw Architects

- WilkinsonEyre

- SmithGroup