Sponge Wipes Market Size

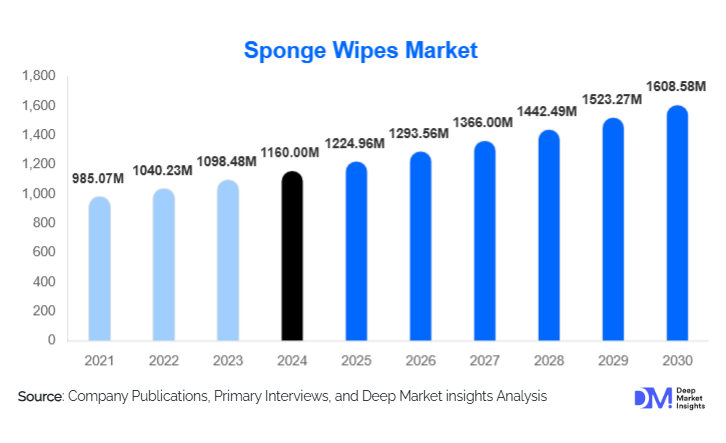

According to Deep Market Insights, the global sponge wipes market size was valued at USD 1,160.00 million in 2024 and is projected to grow from USD 1,224.96 million in 2025 to reach USD 1,608.58 million by 2030, expanding at a CAGR of 5.60% during the forecast period (2025–2030). Market growth is driven by rising household hygiene awareness, increasing adoption of eco-friendly cellulose-based sponge wipes, and expanding industrial cleaning applications across healthcare, hospitality, food processing, and automotive sectors. Additionally, demand for premium anti-bacterial, odor-resistant, and highly absorbent sponge wipe variants is reshaping product innovation and pushing manufacturers to adopt sustainable materials and advanced manufacturing technologies.

Key Market Insights

- Cellulose-based biodegradable sponge wipes dominate the market, holding more than half of global demand due to sustainability regulations and consumer preference for environmentally safe products.

- Residential cleaning remains the largest end-use segment, driven by heightened hygiene practices and the adoption of reusable alternatives to disposable wipes and paper towels.

- Europe leads global consumption of eco-friendly sponge wipes, driven by stringent environmental policies and strong retail penetration of sustainable homecare products.

- Asia-Pacific is the fastest-growing regional market, supported by rising urbanization, middle-class expansion, and booming e-commerce sales.

- Technological advancements, including anti-bacterial coatings, hydrophilic PU materials, and microfiber-cellulose hybrids, are transforming product performance and attracting premium consumers.

- B2B industrial demand is increasing rapidly as healthcare, automotive, and hospitality sectors adopt durable, high-absorbency wipes to meet sanitation standards.

What are the latest trends in the sponge wipes market?

Eco-Friendly & Biodegradable Sponge Wipes Leading Global Adoption

The market is experiencing a strong shift toward sustainable materials such as cellulose, bamboo fiber, and compostable plant-based sponge wipes. Governments across Europe, Japan, and North America are implementing restrictions on synthetic cleaning products, significantly boosting demand for biodegradable sponge wipes. Brands are adopting eco-label certifications, recyclable packaging, and plant-based anti-bacterial coatings to differentiate in a competitive market. Premium retail channels are increasingly prioritizing products that align with sustainable living trends, while consumers are switching from single-use plastics to reusable cellulose wipes with lower environmental impact.

Technological Integration Driving Product Innovation

Manufacturers are integrating advanced materials and smart manufacturing technologies to produce sponge wipes with superior absorbency, quick-drying capabilities, odor resistance, and microbial protection. Microfiber-cellulose hybrid wipes are gaining traction in automotive and industrial sectors due to enhanced durability. Automation, AI-driven quality control, and advanced embossing techniques are improving consistency in sponge structure. E-commerce marketplaces now feature digitally optimized product listings, subscription-based cleaning bundles, and customer-personalized cleaning kits, enhancing buying convenience and supporting premium product sales.

What are the key drivers in the sponge wipes market?

Rising Hygiene Awareness Across Residential & Commercial Sectors

Consumer cleaning habits have become more rigorous since the pandemic, driving widespread adoption of multipurpose sponge wipes for kitchens, bathrooms, floors, and electronic surfaces. Commercial establishments, including offices, retail stores, and restaurants, are investing in high-performance wipes to comply with hygiene standards. As a result, the demand for anti-bacterial and fast-drying sponge wipes continues to strengthen globally.

Sustainability Regulations & Eco-Conscious Consumer Behavior

Increasing global focus on sustainability is a major growth catalyst for cellulose and bamboo-based sponge wipes. Governments promoting plastic reduction and eco-friendly household products are encouraging manufacturers to shift toward compostable materials. This regulatory push, coupled with rising consumer awareness of microplastic pollution, is accelerating market penetration of green cleaning products.

What are the restraints for the global market?

Volatile Raw Material Prices

Cost fluctuations of cellulose pulp, cotton, and polyurethane significantly affect manufacturing costs. Companies dependent on imported materials face higher pricing pressure, impacting margins and limiting price competitiveness in regions with low-cost cleaning product alternatives.

Competition from Low-Cost Substitutes

Microfiber cloths, disposable wipes, and synthetic sponges, often priced lower, pose competition to sponge wipes. Price-sensitive markets in Southeast Asia, Africa, and Latin America often favor cheaper alternatives, limiting the adoption of premium sponge wipes.

What are the key opportunities in the sponge wipes industry?

Expansion in Industrial & Commercial Cleaning Applications

Healthcare facilities, food processing units, hospitality sectors, and automotive workshops are increasingly adopting durable sponge wipes designed for heavy-duty cleaning. These sectors demand wipes with high absorbency, resistance to chemicals, and anti-bacterial properties, creating opportunities for manufacturers to develop specialized professional-grade products with stronger margins.

Growth of Online Retail & D2C Cleaning Brands

E-commerce penetration is rapidly shifting purchasing behavior, especially in the Asia-Pacific and North American regions. Direct-to-consumer brands offering subscription-based kits, customizable cleaning bundles, and premium biodegradable wipes are gaining traction. Online channels enable smaller manufacturers to scale globally while offering detailed product demos, performance videos, and customer reviews to boost sales.

Product Type Insights

Multi-purpose household sponge wipes lead the global market, representing nearly 48% of 2024 revenues. They are widely used for diverse cleaning tasks, including dishwashing, countertop cleaning, bathroom maintenance, and general household sanitation. Anti-bacterial sponge wipes are growing quickly due to greater hygiene awareness, while heavy-duty industrial wipes are capturing strong B2B demand. Non-coated sponge wipes remain cost-effective options for emerging markets, where affordability outweighs value-added features.

Application Insights

Residential cleaning dominates global consumption, supported by everyday needs and broader adoption of reusable cleaning solutions. Industrial and commercial applications, including automotive detailing, restaurant sanitation, and hospital surface cleaning, are witnessing the rapid adoption of microfiber-cellulose hybrids. In healthcare, demand for antimicrobial and chemical-resistant sponge wipes is growing steadily. The hospitality and food processing sectors increasingly rely on high-absorbency wipes for compliance with cleanliness regulations, making them key future growth contributors.

Distribution Channel Insights

Offline retail channels, including supermarkets, hypermarkets, and specialty cleaning stores, maintain the largest share with 54% of 2024 sales, as consumers prefer to inspect product texture and density before purchasing. Online channels are expanding rapidly, especially in urban regions, as marketplaces offer product comparisons, user reviews, and subscription models. B2B distribution networks remain crucial for industrial buyers seeking bulk procurement, customized packaging, and long-term supply agreements.

End-Use Industry Insights

Residential cleaning accounts for the largest share (45%), driven by growing hygiene awareness and increased preference for reusable wipes. Healthcare facilities are adopting specialty anti-bacterial wipes for infection control. Automotive detailing centers and service workshops increasingly prefer soft, scratch-free microfiber sponge wipes for interiors. Hospitality and foodservice sectors rely on sponge wipes for efficient cleaning of surfaces, utensils, and equipment. Emerging end-use sectors, such as electronics cleaning and robotic cleaning systems, are also adopting custom-designed sponge wipes compatible with automated dispensers.

| By Material Composition | By Product Type | By Thickness / GSM Category | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 26% of global sponge wipe consumption, led by the U.S., which has high household spending and strong adoption of premium cleaning products. Commercial demand from healthcare, hospitality, and foodservice sectors supports growth. Consumers increasingly prefer eco-friendly cellulose wipes and anti-bacterial products.

Europe

Europe leads the market with a 30% share in 2024, driven by stringent environmental regulations and the strong retail presence of sustainable sponge wipe brands. Germany, France, the U.K., and Scandinavian nations are major buyers of biodegradable cellulose wipes. The region’s high environmental consciousness supports premium pricing and market maturity.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at nearly 9.1% CAGR. China and India dominate volume demand due to rising middle-class households, while Japan and South Korea drive premium sales. E-commerce penetration and rapid urbanization fuel demand for both mid-range and premium sponge wipes.

Latin America

Latin America shows steady growth, with Brazil, Mexico, and Chile showing rising demand for affordable and mid-tier sponge wipes. Growth in the hospitality and foodservice sectors supports the adoption of multi-purpose wiping products.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa lead demand, driven by rising commercial cleaning requirements and expanding retail distribution. Industrial cleaning applications are growing, particularly in hospitality, healthcare, and institutional sectors across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sponge Wipes Market

- 3M

- Spontex (Maped Group)

- Vileda (Freudenberg Group)

- Kimberly-Clark

- Clorox

- Scotch-Brite

- Wettex

- Quickie Manufacturing

- Marna Inc.

- Puraid Cleaning Solutions

- Gala Clean

- Asia Wipe Technologies

- EcoWipes Global

- Scrub-It

- Amabrush Industries

Recent Developments

- In June 2024, Vileda introduced a new line of biodegradable cellulose sponge wipes enhanced with plant-based anti-odor technology.

- In April 2024, 3M launched a microfiber-cellulose hybrid sponge wipe targeting automotive and industrial cleaning applications.

- In January 2025, Spontex announced the expansion of its European manufacturing facility to meet the rising demand for compostable sponge wipes.