Sponge and Scouring Pads Market Size

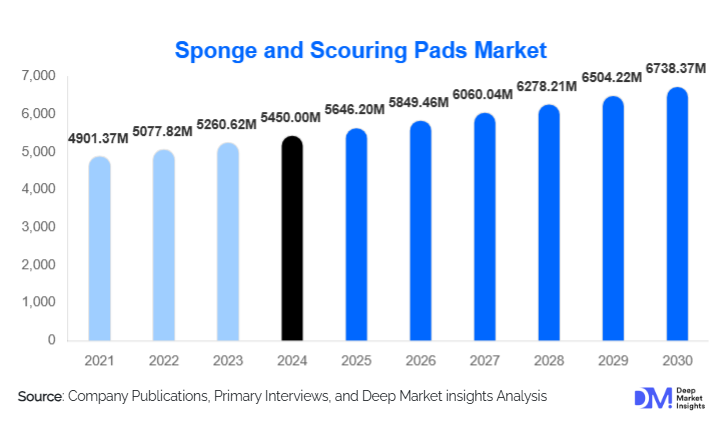

According to Deep Market Insights, the global sponge and scouring pads market size was valued at USD 5,450.00 million in 2024 and is projected to grow from USD 5,646.20 million in 2025 to reach USD 6,738.37 million by 2030, expanding at a CAGR of 3.60% during the forecast period (2025–2030). Market expansion is largely driven by rising hygiene awareness, robust household cleaning demand, and the growth of commercial and industrial cleaning sectors worldwide. Increasing disposable incomes, expanding food-service industries, and the shift toward durable and eco-friendly cleaning materials further support market growth.

Key Market Insights

- Heavy-duty abrasive pads dominate product demand due to extensive use in kitchens, restaurants, and industrial cleaning operations.

- Polymer-based sponges remain the largest material segment, driven by low manufacturing cost, durability, and high household penetration.

- Residential applications account for over half of global consumption, supported by routine kitchen, cookware, and general home-cleaning use.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, rising commercial establishments, and lifestyle modernization in India, China, and Southeast Asia.

- Eco-friendly, cellulose-based, and biodegradable sponges are gaining significant traction amid global sustainability initiatives.

- E-commerce and direct-to-consumer models are rapidly reshaping purchasing behavior, especially in urban markets.

What are the latest trends in the sponge and scouring pads market?

Eco-Friendly and Biodegradable Sponge Products Rising Rapidly

Environmental concerns and global anti-plastic regulations are accelerating the adoption of biodegradable, cellulose-based, and natural-fiber sponges. Manufacturers are increasingly utilizing wood pulp, coconut coir, sisal, and recycled fibers to produce sustainable cleaning pads. Retailers are also promoting “green cleaning” aisles, while consumers show growing preference for compostable or long-lasting reusable pads. Many brands are incorporating minimal packaging and non-toxic colorants, reinforcing the sector’s transition toward low-impact cleaning solutions. This trend is reshaping product innovation, marketing strategies, and supply-chain sourcing practices.

Technology-Integrated Cleaning Solutions

While the sponge and scouring pad industry is traditionally low-tech, digital transformation is being observed in distribution, product design, and antimicrobial treatment technologies. Some manufacturers are introducing antibacterial-treated sponges, layered dual-sided pads, ergonomic grip designs, and improved non-scratch coatings. Digital retail tools, including AI-powered product recommendations, subscription services, and data-driven inventory management, are enhancing consumer engagement. E-commerce marketplaces provide real-time customer feedback, enabling faster product iteration. QR-enabled packaging is emerging, offering usage guides, sanitation tips, and recycling methods to support informed, hygienic consumer behavior.

What are the key drivers in the sponge and scouring pads market?

Growing Hygiene and Sanitation Awareness

Post-pandemic lifestyle changes have reinforced consumer focus on surface cleaning, utensil hygiene, and sanitation routines. This has boosted the replacement cycle of kitchen sponges, especially since households replace them frequently due to bacterial buildup concerns. Increased awareness of cross-contamination risks in food preparation further supports regular sponge and pad usage, particularly in Asia-Pacific and North America.

Expansion of Hospitality, Food-Service, and Commercial Cleaning Sectors

The global rise in restaurants, cafés, industrial kitchens, hotels, and facility-management services has significantly boosted demand for heavy-duty abrasive pads and industrial-grade sponges. Frequent cleaning of cookware, large kitchen equipment, and commercial surfaces requires durable, high-abrasion pads, making this a major driver of repeat bulk purchases. Emerging economies are witnessing a boom in hospitality infrastructure, which further accelerates demand.

E-commerce Penetration and Changing Purchasing Behavior

Digital retail has transformed consumer access to cleaning supplies. The availability of bulk packs, subscription-based delivery, and product comparison tools encourages repeat purchases and brand switching. With rapid growth in online grocery platforms, sponge and pad manufacturers are witnessing increased sales through D2C channels, especially in urban areas.

What are the restraints for the global market?

Environmental Concerns and Regulatory Pressure

Conventional polymer-based sponges and plastic-heavy abrasive pads face increasing scrutiny due to waste management challenges. Many governments are restricting single-use plastics and pushing for biodegradable household products. This forces manufacturers to reformulate materials, increasing production costs and creating compliance challenges.

Substitution from Microfiber Cloths and Silicone Scrubbers

Microfiber cloths, reusable silicone scrubbers, and multi-purpose cleaning wipes are gaining popularity due to longer lifespan and perceived better hygiene. These substitutes can reduce consumer dependency on traditional sponge products and may slow growth in several developed markets.

What are the key opportunities in the sponge and scouring pads industry?

Sustainable Product Innovation

The largest opportunity lies in transitioning to natural, biodegradable, and recyclable materials. Brands can differentiate through cellulose, bamboo, coconut fiber, and hybrid-layered pads designed for sustainability-conscious consumers. Certification programs, eco-labeling, and compostable packaging can further enhance adoption and allow premium pricing.

Commercial and Industrial Market Penetration

Restaurants, industrial kitchens, food processors, and institutional cleaning contractors represent a high-volume growth avenue. These sectors replace heavy-duty scour pads frequently due to intense usage. Bulk supply partnerships, B2B subscription services, and hotel/restaurant procurement networks can significantly increase recurring revenue.

Digital & Omni-Channel Expansion

E-commerce and direct ordering platforms create opportunities for bundled product sales, replenishment reminders, and brand-led subscription models. Digital engagement, through product tutorials, hygiene guides, and customer review platforms, supports brand credibility and scalability across global markets.

Product Type Insights

Heavy-duty abrasive scouring pads hold approximately 35–36% of the global market share, driven by widespread adoption in households and commercial kitchens. These pads are essential for scrubbing cookware, grills, and stubborn grease surfaces. Medium-duty sponges serve daily kitchen cleaning and enjoy strong household penetration, while light-duty non-scratch pads address delicate surfaces such as glassware and non-stick utensils. Extra-heavy-duty metal scourers remain niche but indispensable for industrial cookware and equipment cleaning. The rising demand for dual-layer sponges (soft + abrasive) further supports the versatility of this product category.

Application Insights

Residential applications account for more than 50% of total global demand, as households use multiple sponge varieties for dishwashing, kitchen cleaning, and bathroom scrubbing. Commercial applications, including hotels, restaurants, and cafeterias, represent the fastest-growing segment due to rising hospitality infrastructure worldwide. Industrial uses such as manufacturing equipment cleaning, food-processing surfaces, and automotive maintenance require highly durable scouring pads. Healthcare and institutional cleaning are emerging applications, supported by stricter sanitation standards.

Distribution Channel Insights

Offline retail, supermarkets, hypermarkets, and grocery stores continue to dominate distribution globally. However, e-commerce channels are expanding rapidly, driven by convenience, bulk pack offerings, and subscription-based household essentials. Direct-to-consumer (D2C) platforms are also gaining traction, offering eco-friendly brands a way to communicate sustainability storytelling and provide custom multipacks. Institutional supply chains and B2B distributors cater to bulk-buying commercial clients such as restaurant chains and cleaning contractors.

End-Use Insights

Households remain the largest end-use segment, benefiting from short replacement cycles and high consumption volumes. Commercial food-service and hospitality establishments represent a rapidly expanding end-use category, fueled by increased hotel development and global restaurant proliferation. Industrial facilities, such as food-processing plants and automotive workshops, are steadily adopting heavy-duty pads for machinery and equipment cleaning. Emerging uses in healthcare sanitation, hotel housekeeping, and automotive detailing further broaden the end-use landscape.

| By Product Type | By Material Type | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents one of the largest markets, with strong household adoption and high standards for kitchen and equipment cleanliness. The U.S. drives the majority of demand due to frequent product replacement cycles and high penetration of branded sponges and scouring pads. Commercial demand, restaurants, cleaning contractors, and cafeterias, remains particularly strong. North America accounts for a significant share of global revenues in 2024, supported by mature retail infrastructure and strong brand preference.

Europe

Europe demonstrates strong demand, especially from the U.K., Germany, France, and Italy. Consumers in this region show heightened preference for biodegradable and sustainable cleaning products, accelerating the shift from synthetic polymer sponges to cellulose-based alternatives. Commercial adoption is steady, driven by institutional cleaning standards and hospitality sector growth. Environmental regulations in the EU further reinforce demand for eco-certified products.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rapid urbanization, rising disposable income, and strong expansion of restaurants, cafés, and hospitality businesses. China and India are major contributors, with large populations and increasing hygiene awareness supporting mass consumption of inexpensive sponges and pads. Southeast Asia and Japan show rising demand for premium and imported eco-friendly products. The region’s diverse consumer base supports both high-volume economy products and growing adoption of sustainable alternatives.

Latin America

Latin America shows moderate growth, led by Brazil, Mexico, and Argentina. Rising household spending and the expansion of modern retail formats are enabling broader product access. Increasing restaurant and café openings in urban areas are boosting commercial sponge and pad consumption. Growth is steady, but slower than in the Asia-Pacific due to economic fluctuations and price sensitivity.

Middle East & Africa

MEA demand continues to rise, driven by expanding hospitality and cleaning-service industries in Gulf countries, including the UAE, Saudi Arabia, and Qatar. Africa, particularly South Africa, Kenya, and Nigeria, is witnessing the growing adoption of branded and eco-friendly cleaning pads. Commercial cleaning companies and institutional facilities are contributing significantly to demand in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sponge and Scouring Pads Market

- 3M Company

- The Procter & Gamble Company

- Unilever PLC

- The Clorox Company

- S.C. Johnson & Son, Inc.

- Amway Corp.

- Freudenberg Home & Cleaning Solutions

- Armaly Brands Inc.

- Kiwi Scourers Ltd.

- Weiman Products LLC

- Bio90 Manufacturing Inc.

- Scrub Daddy Inc.

- Impact Products LLC

- The Crown Choice

- Corazzi Fibre S.r.l.

Recent Developments

- In March 2024, 3M launched a new biodegradable cellulose-based sponge series aimed at reducing plastic waste in home-cleaning applications.

- In January 2025, Unilever expanded its sustainable home-care product line, introducing natural-fibre scouring pads targeting European markets with strong eco-friendly product adoption.

- In April 2025, Freudenberg’s O-Cedar brand announced new antibacterial-treated kitchen sponges, designed for longer life and reduced bacterial residue.