Solar Attic Fans Market Size

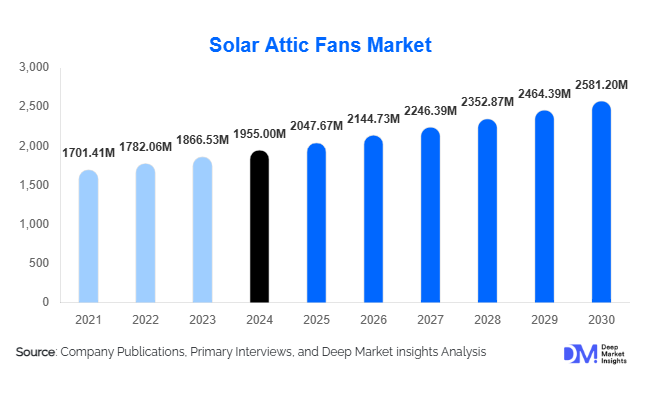

According to Deep Market Insights, the global solar attic fans market size was valued at USD 1,955.00 million in 2024 and is projected to grow from USD 2,047.67 million in 2025 to reach USD 2,581.20 million by 2030, expanding at a CAGR of 4.74% during the forecast period (2025–2030). The solar attic fans market growth is primarily driven by rising electricity costs, growing emphasis on energy-efficient building envelopes, and the increasing adoption of rooftop solar solutions that integrate solar-powered attic ventilation to reduce cooling loads and improve indoor comfort.

Key Market Insights

- Roof-mounted solar attic fans dominate global demand, accounting for the majority of installations due to optimal placement near the roof ridge and ease of integration with pitched residential roofs.

- Single-family residential buildings lead application demand, contributing over 60% of global revenue as homeowners seek cost-effective ways to cut cooling bills and extend roof life.

- Mid-range 21–40 W fans represent the core capacity segment, balancing airflow performance, aesthetics, and cost for typical residential attic volumes.

- North America is the largest regional market for solar attic fans, while Asia-Pacific is the fastest-growing region driven by rapid urbanization, rising AC penetration, and rooftop solar adoption.

- Smart, thermostat-controlled, and hybrid solar attic fans are gaining share, offering app-based monitoring, automated control, and grid backup for consistent performance.

- Offline distribution via roofing and HVAC contractors still dominates, but online marketplaces and D2C channels are rapidly expanding in DIY-focused markets.

What are the latest trends in the solar attic fans market?

Smart and Connected Solar Attic Ventilation

The solar attic fans market is witnessing a clear shift from basic, stand-alone units to smart, connected systems. Manufacturers are integrating thermostats, humidistats, variable-speed motors, and wireless connectivity to enable intelligent control based on attic temperature and humidity. App-based interfaces allow homeowners to monitor fan performance, view attic temperature trends, and adjust operating parameters remotely. Integration with smart-home ecosystems and connected HVAC systems is emerging, enabling coordinated operation to reduce peak cooling loads and optimize AC runtime. This trend is especially strong in developed markets, where tech-savvy consumers expect connectivity and data visibility as standard features in home energy devices.

Integration with Rooftop Solar and Energy-Efficiency Retrofits

Solar attic fans are increasingly being bundled with rooftop solar PV, attic insulation upgrades, and roof replacement projects as part of holistic energy-efficiency retrofits. Roofing and solar installers are offering combined packages in which solar attic fans enhance overall system returns by lowering attic temperatures and thus improving AC efficiency. Utility rebate programs and green building certifications often recognize attic ventilation as a qualifying measure, encouraging installers to position solar attic fans as a simple, visible add-on with measurable kWh savings. This integration is expanding sales opportunities beyond standalone retail purchases into project-based, specification-driven demand.

Growing Adoption in High-Heat Emerging Markets

Another important trend is the gradual but steady adoption of solar attic fans in hot, high-insolation regions across Asia-Pacific, the Middle East & Africa, and Latin America. In these markets, rapid growth in residential and light commercial construction, combined with rising air-conditioning usage and high power tariffs, is creating favorable conditions for solar-powered ventilation. Local OEM partnerships, adaptation to region-specific roof types (metal sheet roofs, tiled roofs, and lightweight prefabricated structures), and cost-optimized models are helping manufacturers tap into this emerging demand. As governments promote rooftop solar and energy-efficient buildings, solar attic fans are gaining recognition as a low-maintenance component of passive and hybrid cooling strategies.

What are the key drivers in the solar attic fans market?

Rising Energy Costs and Cooling-Dominated Consumption

Global electricity prices, particularly in regions with heavy summer cooling loads, are a major driver of solar attic fan adoption. Attic spaces can reach extremely high temperatures, forcing air-conditioners to work harder and consume more energy. Solar attic fans reduce attic temperatures and thereby lower the thermal burden on living spaces, translating into tangible reductions in monthly energy bills. Because the fans are powered by rooftop solar modules, the ventilation energy is essentially free after installation, and payback periods often fall within a two to four-year window. This bill-reduction narrative resonates strongly with cost-conscious homeowners and small businesses.

Policy Push for Energy-Efficient and Low-Carbon Buildings

Stringent building energy codes, green building standards, and climate-focused policies are pushing developers and building owners to adopt measures that improve thermal performance and reduce operational carbon emissions. Solar attic fans contribute to these goals by improving roof ventilation, reducing reliance on mechanical cooling, and extending roof and insulation life. In many jurisdictions, energy-efficiency incentives, tax credits, or utility rebates cover solar ventilation as an eligible technology, which lowers the effective cost for end-users and increases adoption. As more countries target net-zero or near-zero-energy buildings, solar attic fans are positioned as a simple, scalable solution in the overall decarbonization toolkit.

Declining PV Costs and Advancements in Product Design

Ongoing reductions in photovoltaic module costs and advances in brushless DC motors, aerodynamics, and corrosion-resistant materials are enabling more efficient, durable, and aesthetically pleasing solar attic fans at competitive price points. Higher-efficiency monocrystalline panels deliver greater airflow per unit of roof area, while improved housings and blade designs reduce noise and enhance weather resistance. These innovations, combined with smart controls and hybrid grid/solar designs, expand the addressable market to climates and applications that previously saw limited value in basic solar fans. As product performance improves and costs stabilize, the perceived risk of investment decreases, supporting wider adoption.

What are the restraints for the global market?

High Upfront Costs and Competing Ventilation Alternatives

Despite favorable lifecycle economics, the initial cost of solar attic fans remains a significant barrier in many markets, especially where household budgets are constrained. Traditional electric attic fans, passive vents, and ridge ventilation often come with lower upfront costs, even though they may be less efficient in the long term. In regions with subsidized electricity or lower awareness of attic heat impacts, homeowners may not immediately perceive the value of paying a premium for solar-powered solutions. This cost sensitivity, combined with competing low-cost ventilation options, can slow market penetration unless installers and manufacturers effectively communicate payback and performance benefits.

Seasonality, Performance Variability, and Awareness Gaps

Solar attic fan performance depends on solar resource, roof orientation, and shading conditions. In high-latitude or cloudier regions, or where roofs are heavily shaded, fans may operate at reduced capacity outside peak summer months, leading to variable user experiences. Poor system sizing or improper placement can further limit perceived benefits. Additionally, awareness of attic ventilation as a key component of home energy efficiency is still limited in many markets. Without strong installer education, marketing, and clear performance expectations, some potential buyers remain skeptical of the benefits of solar attic fans relative to other home improvements, constraining broader adoption.

What are the key opportunities in the solar attic fans industry?

Scaling Residential Retrofits and Green Home Upgrades

One of the most attractive opportunities lies in embedding solar attic fans into residential retrofit and energy-upgrade packages. As governments and utilities increase funding for home energy-efficiency improvements, measures that offer visible, easily quantifiable benefits are gaining favor. Solar attic fans can be bundled with roof replacement, attic insulation, and rooftop solar installations, increasing the average project value for contractors while enhancing overall energy performance for homeowners. Targeted marketing to roofing contractors, HVAC installers, and solar EPCs, along with financing options such as green loans and on-bill repayment, can significantly scale adoption in retrofit markets.

Smart, Hybrid, and Integrated Building Energy Systems

Another key opportunity is the development of smart and hybrid solar attic fans that integrate seamlessly with building energy-management systems. Hybrid designs that can draw limited grid power ensure continuous ventilation even during low-sun periods, addressing performance variability concerns. When integrated with smart thermostats, connected HVAC equipment, and rooftop solar-plus-storage systems, solar attic fans can be orchestrated as part of a broader demand-management strategy. This opens pathways to partnerships with utilities and home-energy platforms, positioning solar attic fans not just as stand-alone products but as components of intelligent, connected building ecosystems.

Penetration into Emerging High-Heat Regions and Local Manufacturing

High-growth markets across Asia-Pacific, the Middle East & Africa, and Latin America present significant untapped potential for solar attic fans. Many of these regions face high cooling loads, rising power tariffs, and grid reliability issues, making solar-powered ventilation particularly appealing. Local assembly and manufacturing, supported by incentives such as “Make in India” or similar localization policies, can reduce costs, shorten lead times, and adapt designs to regional roof types and climate conditions. OEM partnerships with regional HVAC companies and distributors can help global brands quickly establish a presence while enabling local players to climb the value chain from installation to manufacturing.

Product Type Insights

By product type, roof-mounted solar attic fans dominate the market, accounting for an estimated majority share of global revenue. These units are preferred because they can be positioned near the roof ridge, where hot air naturally accumulates, delivering superior exhaust performance. Roof-mounted systems integrate well with standard pitched roofs and are often installed during re-roofing or new construction, making them the default choice for professional contractors. Gable-mounted fans appeal to homes with suitable gable vents and are commonly used in retrofits where roof penetration is less desirable. Portable and freestanding solar fans serve niche applications, such as small structures, sheds, and temporary buildings, but represent a smaller portion of total market value.

Power Capacity Insights

The global solar attic fans market is segmented by panel wattage into up to 20 W, 21–40 W, 41–60 W, and above 60 W. The 21–40 W segment is the core of the market, delivering a balanced airflow that suits typical residential attic sizes while keeping panel and housing dimensions manageable. Fans below 20 W are mainly installed in smaller spaces or cooler climates but can be underpowered in hot regions. The 41–60 W and above 60 W categories are more commonly found in large homes, commercial buildings, or industrial structures with expansive roof cavities. As efficiency improves, mid-range wattage systems are achieving higher airflow, reinforcing the dominance of the 21–40 W segment for mainstream residential use.

Application Insights

In terms of application, single-family residential homes represent the largest segment, driven by homeowners seeking to cut air-conditioning costs, improve comfort, and protect roofing materials from heat damage. Multi-family residential projects, including apartments and condominiums, are seeing growing adoption where developers prioritize green building certifications. Commercial buildings, such as low-rise offices, retail stores, and hospitality properties, are increasingly using solar attic fans to manage roof cavity temperatures and support HVAC efficiency, especially in sun-exposed, single-story structures. Industrial and logistics facilities leverage solar attic ventilation as a supplementary measure to reduce heat buildup in warehouses and light manufacturing units, while public and institutional buildings integrate solar fans into broader sustainability and energy-saving programs.

Distribution Channel Insights

Offline distribution channels currently account for the majority of solar attic fan sales, led by roofing and HVAC contractors, home improvement retailers, and building-material distributors. Contractors often specify and install solar attic fans as part of larger projects, making these channels critical for reaching mainstream homeowners. However, online sales are growing rapidly, driven by DIY consumers and small contractors who purchase through e-commerce marketplaces and brand-direct websites. Online platforms enable broader geographic reach, easier price comparison, and direct customer education through reviews, videos, and installation guides. As digital adoption accelerates, especially in developed markets, online and D2C channels are expected to capture an increasing share of market growth.

Material Insights

By material, metal housings (aluminum and coated steel) lead the solar attic fans market due to their durability, weather resistance, and ability to withstand high temperatures and wind loads on rooftops. These products are particularly favored in harsh or coastal climates where UV exposure and corrosion risks are elevated. Polymer and plastic housings appeal to cost-sensitive or DIY segments because of their lighter weight and easier handling, although they may offer reduced lifespan in extreme conditions. Hybrid and composite designs, combining metals with engineered polymers, are emerging to optimize strength-to-weight ratios and improve aesthetics. As design innovation progresses, composite housings are expected to gain share in segments where both appearance and longevity are critical.

| Product Type | Power Capacity | Material | Application / Building Type | Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market for solar attic fans, with the United States accounting for the bulk of demand. A vast stock of single-family homes, high air-conditioning penetration, and relatively high summer electricity tariffs support strong adoption. Utility rebate programs, energy-efficiency financing, and the popularity of rooftop solar systems further encourage homeowners to add solar attic fans during roofing or solar installations. Canada contributes additional demand, mainly in southern provinces where cooling loads and energy-efficiency retrofits are growing. The region is characterized by high adoption of premium, smart, and hybrid models, and a well-developed contractor and retail ecosystem.

Europe

Europe holds a significant share of the solar attic fans market, with adoption concentrated in countries that combine warm summers with robust green building policies. Southern European nations such as Spain, Italy, and Greece, along with parts of France and Germany, are key markets where solar attic fans complement broader energy-efficiency measures and rooftop solar initiatives. EU-wide climate and building directives encourage improved building envelopes and ventilation performance, indirectly supporting solar attic ventilation. While cooler northern climates moderate the overall addressable market, rising heatwaves and climate-change awareness are increasing interest in passive and solar-powered cooling solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by rapid urbanization, expanding middle-class housing, and increasing AC penetration. China leads in terms of volume, benefiting from large-scale residential and commercial construction, widespread rooftop solar deployment, and government policies promoting energy-efficient buildings. Australia is another key market, where strong rooftop solar adoption, high insolation, and consumer awareness of attic heat issues support robust demand. India and Southeast Asian countries are emerging markets where high cooling loads and growing rooftop solar programs are gradually creating favorable conditions for solar attic ventilation, particularly in detached and low-rise housing.

Latin America

Latin America is an emerging market for solar attic fans, with Mexico and Brazil at the forefront. High solar resource, growing residential construction in hot climates, and increasing awareness of energy efficiency are driving gradual adoption. The majority of demand currently stems from residential and light commercial segments in urban and peri-urban areas. As rooftop solar and green building initiatives expand across the region, solar attic fans are expected to become more common in bundled energy-efficiency solutions, particularly for cost-conscious consumers seeking to reduce cooling expenses without major structural modifications.

Middle East & Africa

The Middle East & Africa region offers strong long-term growth potential due to extreme heat conditions, rising cooling demand, and abundant solar resource. In the Gulf Cooperation Council (GCC) countries, including Saudi Arabia and the UAE, government-led sustainability agendas and high-end residential and commercial developments support early adoption of solar attic fans as part of green building strategies. In Africa, countries such as South Africa and Kenya are beginning to deploy solar-powered ventilation in residential, educational, and public health facilities, often tied to donor-funded or government-backed energy-access and efficiency programs. As awareness grows and localized manufacturing capabilities develop, the region is expected to see accelerating demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Solar Attic Fans Market

- Broan-NuTone LLC

- Air Vent Inc.

- Solatube International Inc.

- Natural Light Energy Systems

- Attic Breeze LLC

- Solar Royal LLC

- iLiving USA

- Eco-Worthy Solar Technology Co., Ltd.

- SunRise Solar Inc.

- Sunforce Products Inc.

- GreenTech Environmental

- Nature Power Products

- Amtrak Solar

- Ventamatic Ltd.

- Sunpentown International Inc.

Recent Developments

- In September 2025, Xiamen Xunyang New Energy launched its 2nd Generation Hybrid Solar Exhaust Fan featuring dual power operations, remote humidity and temperature controls, and multi-speed ventilation.