Soap Dispensers Market Size

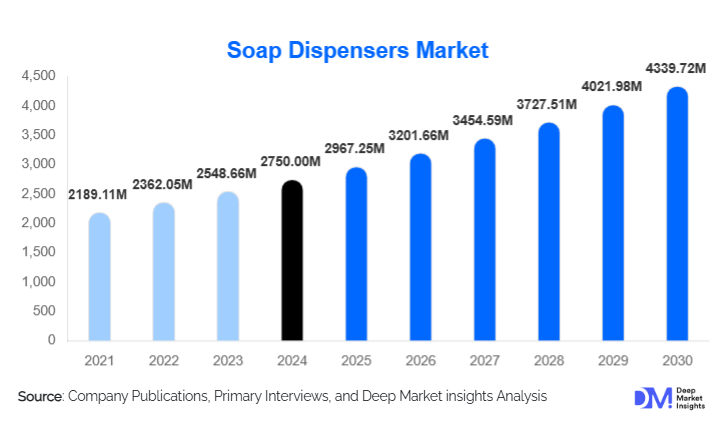

According to Deep Market Insights, the global soap dispensers market size was valued at USD 2,750 million in 2024 and is projected to grow from USD 2,967.25 million in 2025 to reach approximately USD 4,339.72 million by 2030, expanding at a CAGR of 7.9% during the forecast period (2025–2030). The soap dispensers market growth is primarily driven by rising hygiene awareness, stricter sanitation regulations across public and commercial facilities, and the accelerating adoption of touchless and automated dispensing systems. Increasing investments in healthcare infrastructure, hospitality expansion, and urban public facilities are further supporting sustained demand globally.

Key Market Insights

- Automatic and touchless soap dispensers are gaining rapid adoption due to their ability to reduce cross-contamination and comply with institutional hygiene standards.

- Commercial and institutional end-use dominates global demand, supported by healthcare facilities, offices, airports, and hospitality establishments.

- Asia-Pacific leads global consumption, driven by rapid urbanization, infrastructure development, and government-led sanitation programs.

- North America represents the largest replacement and premium market, with strong uptake of stainless-steel and smart dispensers.

- Sustainability trends, including refillable systems and recyclable materials, are influencing purchasing decisions among institutional buyers.

- Integration of IoT and smart sensors is emerging as a key differentiator among premium soap dispenser manufacturers.

What are the latest trends in the soap dispensers market?

Rapid Shift Toward Touchless and Smart Dispensers

The soap dispensers market is witnessing a strong shift toward automatic and touchless systems, particularly in healthcare, hospitality, and public infrastructure. These dispensers minimize physical contact, reduce infection risk, and optimize soap usage through controlled dispensing. Advanced models now incorporate infrared sensors, usage analytics, refill alerts, and compatibility with building management systems. This trend is especially prominent in airports, hospitals, and corporate offices, where hygiene compliance and operational efficiency are critical. As smart buildings become more common, demand for connected dispensers is expected to rise steadily.

Growing Focus on Sustainable and Refillable Systems

Sustainability is emerging as a key trend, with increasing demand for refillable soap dispensers, reduced single-use plastics, and recyclable materials. Institutional buyers are prioritizing bulk refill systems that lower operational costs and support ESG commitments. Manufacturers are responding by introducing durable plastic composites, stainless-steel designs with longer lifecycles, and eco-certified refill solutions. This trend is strengthening long-term supplier contracts and improving profit margins for manufacturers offering sustainable portfolios.

What are the key drivers in the soap dispensers market?

Institutionalization of Hygiene and Sanitation Standards

One of the strongest drivers of the soap dispensers market is the global enforcement of hygiene regulations across healthcare, food processing, and public facilities. Governments and regulatory authorities mandate the installation of handwashing stations in hospitals, schools, factories, and transportation hubs. This has resulted in consistent first-time installations and recurring replacement demand, especially in high-traffic environments.

Expansion of Commercial Infrastructure

Rapid development of commercial spaces such as offices, malls, hotels, airports, and metro stations is significantly boosting demand for soap dispensers. Emerging economies are investing heavily in urban infrastructure, while developed regions are upgrading existing facilities with modern, automated hygiene solutions. This infrastructure-led growth provides long-term volume stability for manufacturers.

Technological Advancements and Product Premiumization

Advancements in sensor accuracy, battery efficiency, and dispenser durability are enabling manufacturers to offer premium products with higher margins. Touchless dispensers with controlled dosing reduce soap wastage and operational costs, making them attractive to institutional buyers despite higher upfront prices.

What are the restraints for the global market?

High Upfront Costs of Automatic Dispensers

Automatic soap dispensers involve a higher initial investment compared to manual systems. In price-sensitive markets, particularly in developing regions, this limits adoption among small businesses and residential users. Maintenance costs related to sensors and batteries further add to total ownership expenses.

Maintenance and Refill Supply Challenges

Inconsistent availability of compatible refills and lack of service infrastructure can affect dispenser performance, especially in remote or underdeveloped regions. This acts as a restraint for widespread adoption of advanced dispensing systems.

What are the key opportunities in the soap dispensers industry?

Government-Led Public Sanitation Programs

Large-scale sanitation initiatives focused on schools, public buildings, and transportation hubs present significant opportunities. Government procurement contracts offer high-volume, long-term demand, particularly in Asia-Pacific, the Middle East, and Africa.

Smart Building and IoT Integration

The integration of soap dispensers with smart building ecosystems presents a major growth opportunity. Usage tracking, predictive refill alerts, and centralized monitoring enable facility managers to optimize hygiene operations, creating demand for premium, connected solutions.

Product Type Insights

Automatic soap dispensers dominate the global product landscape, accounting for approximately 42% of the total market value in 2024. Their leadership is primarily driven by increasing adoption across healthcare facilities, commercial offices, airports, and hospitality establishments, where minimizing touchpoints and ensuring regulatory hygiene compliance are critical. Automatic dispensers offer controlled dosing, reduced soap wastage, and lower cross-contamination risks, making them the preferred choice in high-traffic and infection-sensitive environments. The growing integration of infrared sensors, battery-efficient designs, and smart monitoring features has further strengthened demand for this segment, particularly in premium commercial and institutional settings.

Manual soap dispensers continue to hold a significant share of the market, especially in residential applications and low-traffic commercial environments such as small retail stores and educational facilities. Their continued relevance is supported by lower upfront costs, ease of installation, minimal maintenance requirements, and widespread availability. In emerging economies, manual dispensers remain the dominant choice for cost-sensitive buyers and large-scale public sanitation deployments where affordability and simplicity outweigh automation benefits.

Material Insights

Plastic soap dispensers represent the largest material segment, contributing nearly 48% of global revenue in 2024. The dominance of plastic dispensers is driven by their cost-effectiveness, lightweight nature, corrosion resistance, and high manufacturing flexibility, allowing manufacturers to offer a wide variety of designs, capacities, and mounting configurations. Plastic materials are particularly favored in residential applications and large-scale institutional procurement, where price competitiveness and volume deployment are key purchasing criteria.

Stainless steel soap dispensers are steadily gaining market share, especially in premium commercial, healthcare, and industrial environments. Their growth is supported by superior durability, resistance to vandalism, ease of cleaning, and long service life. Stainless steel dispensers also align with modern architectural aesthetics and sustainability goals, making them increasingly popular in airports, luxury hotels, hospitals, and corporate offices. While higher in cost than plastic alternatives, their lower lifecycle maintenance and enhanced durability justify adoption in high-usage settings.

End-Use Insights

The commercial segment accounts for approximately 46% of total global demand, making it the largest end-use category in the soap dispensers market. Offices, hospitality venues, shopping malls, and retail chains are the primary contributors, driven by standardized hygiene protocols, frequent replacement cycles, and growing emphasis on customer and employee safety. The hospitality sector, in particular, is increasingly adopting automatic and premium dispensers to enhance guest experience and brand perception.

Healthcare represents the fastest-growing end-use segment, expanding at a CAGR of over 8.5%. This growth is driven by stringent infection control standards, regulatory mandates, and continuous investments in hospital infrastructure. Hospitals, clinics, and diagnostic centers require high-performance, touchless dispensing systems to prevent hospital-acquired infections, resulting in strong demand for automated and antimicrobial dispenser solutions. Public infrastructure, including airports, railway stations, metro systems, and government buildings, is emerging as a high-volume demand segment. Large-scale urban mobility projects and public sanitation upgrades are driving bulk procurement of durable and vandal-resistant soap dispensers, particularly in developing economies.

Distribution Channel Insights

Offline retail and institutional procurement channels dominate the soap dispensers market, collectively representing over 70% of global sales. Large commercial buyers, healthcare institutions, and government bodies typically rely on direct contracts, tenders, and long-term supplier agreements to ensure consistent product quality, compatibility, and after-sales service.

Online distribution channels are the fastest-growing segment, supported by the rapid digitalization of procurement processes and the expansion of B2B e-commerce platforms. Manufacturers and institutional buyers increasingly utilize online channels for product comparison, bulk ordering, and direct-to-institution purchasing. Residential consumers also favor online platforms due to convenience, wider product selection, and competitive pricing.

| By Product Type | By Dispensing Mechanism | By Material | By Mounting Type | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global soap dispensers market with approximately 34% share in 2024, driven by rapid urbanization, population growth, and large-scale infrastructure development across China, India, Japan, and Southeast Asia. China dominates regional demand due to extensive commercial construction, healthcare expansion, and manufacturing-led supply advantages. India is the fastest-growing market in the region, with growth exceeding 9% CAGR, supported by public sanitation initiatives, rising hygiene awareness, and expanding retail and hospitality sectors. Government-backed infrastructure projects and increasing healthcare spending continue to drive high-volume installations across urban and semi-urban areas.

North America

North America accounts for approximately 28% of global demand, led by the United States. Growth in the region is driven by strong replacement demand, stringent workplace hygiene regulations, and high adoption of premium and automated dispensers. The presence of advanced healthcare infrastructure, widespread smart building adoption, and higher spending capacity among commercial buyers support demand for stainless steel and sensor-based soap dispensers. Sustainability-focused procurement and refurbishment of aging public infrastructure further contribute to steady regional growth.

Europe

Europe holds nearly 22% of the global market share, with Germany, the United Kingdom, and France as key contributors. Regional growth is driven by strict hygiene regulations, sustainability-oriented procurement policies, and a strong emphasis on eco-friendly and refillable dispensing systems. European institutions increasingly favor durable materials and low-waste solutions, supporting demand for stainless steel dispensers and bulk refill systems. Replacement demand across commercial and public facilities remains a key growth driver.

Middle East & Africa

The Middle East & Africa region is witnessing steady market expansion, supported by large-scale infrastructure development and healthcare investments. Countries such as the UAE and Saudi Arabia are driving demand through airport expansions, hospitality megaprojects, and government-led public sanitation initiatives. In Africa, rising healthcare infrastructure investments and increasing urban population density are contributing to gradual but sustained demand growth, particularly in public buildings and transportation hubs.

Latin America

Latin America accounts for approximately 6% of global demand, led by Brazil and Mexico. Growth in the region is driven by expanding hospitality and retail sectors, rising urban middle-class populations, and improving hygiene awareness. While price sensitivity remains a challenge, increasing investments in commercial real estate and public facilities are supporting the steady adoption of manual and mid-range automatic soap dispensers across key urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|