Snail Mucin Skincare Market Size

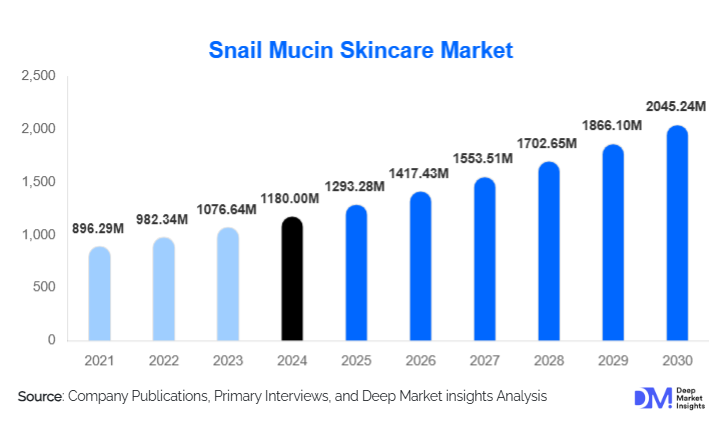

According to Deep Market Insights, the global snail mucin skincare market size was valued at USD 1,180 million in 2024 and is projected to grow from USD 1,293.28 million in 2025 to reach USD 2,045.24 million by 2030, expanding at a CAGR of 9.6% during the forecast period (2025–2030). The snail mucin skincare market growth is primarily driven by rising consumer demand for skin barrier repair, anti-aging solutions, and ingredient-led skincare products supported by clinical efficacy and natural origins.

Key Market Insights

- Snail mucin is transitioning from a niche K-beauty ingredient to a global cosmeceutical staple, supported by dermatologist recommendations and scientific validation.

- Blended formulations combining snail mucin with peptides, niacinamide, and hyaluronic acid dominate, enhancing multifunctional skincare benefits.

- Asia-Pacific leads global consumption, driven by South Korea, China, and Japan as both production and innovation hubs.

- North America represents the fastest-growing premium market, fueled by high disposable income and demand for dermatologist-backed skincare.

- E-commerce and D2C platforms account for a significant share, enabling global brand reach and consumer education.

- Ethical sourcing, cruelty-free extraction, and bioengineered alternatives are reshaping product innovation and brand positioning.

What are the latest trends in the snail mucin skincare market?

Rise of Skin Barrier Repair and Post-Procedure Care

Snail mucin-based skincare products are increasingly positioned as skin barrier repair solutions rather than cosmetic enhancers alone. Their regenerative proteins, glycoproteins, and humectant properties make them highly effective for post-acne, post-laser, and sensitive skin recovery. Dermatology clinics and medical spas are incorporating snail mucin creams and serums into post-procedure regimens, driving demand in clinical and professional skincare channels. This trend is strengthening snail mucin’s credibility as a cosmeceutical ingredient rather than a novelty component.

Premiumization and Ingredient Transparency

Consumers are increasingly scrutinizing ingredient sourcing, concentration levels, and formulation science. Brands are responding by highlighting high-percentage snail secretion filtrate, cruelty-free extraction methods, and clinical testing results. Premium and luxury snail mucin products are gaining traction, particularly in North America and Europe, where consumers are willing to pay higher prices for proven efficacy, clean-label formulations, and ethical sourcing claims.

What are the key drivers in the snail mucin skincare market?

Growing Demand for Anti-Aging and Regenerative Skincare

Snail mucin’s ability to stimulate collagen production, reduce fine lines, and improve skin elasticity has positioned it as a key anti-aging ingredient. With aging populations in North America, Europe, and East Asia, demand for regenerative skincare solutions is rising. Anti-aging applications account for approximately 31% of total market demand in 2024, making this the largest skin concern segment globally.

Influence of K-Beauty and Social Media Education

The global influence of Korean beauty standards has normalized snail mucin as a science-backed, effective skincare ingredient. Social media platforms, dermatology influencers, and skincare educators are accelerating consumer acceptance and repeat purchases. Ingredient-led purchasing behavior has significantly reduced consumer hesitation around unconventional ingredients, further supporting market expansion.

What are the restraints for the global market?

Ethical and Religious Sensitivities

Despite growing acceptance, snail mucin products face resistance from consumers concerned about animal welfare and religious restrictions. These concerns can limit adoption in certain regions unless brands adopt transparent cruelty-free certifications or bioengineered alternatives.

Raw Material Supply and Cost Volatility

Snail farming and mucin extraction remain labor-intensive and geographically concentrated. Supply disruptions and rising labor costs can impact pricing stability and margins, particularly for high-purity formulations.

What are the key opportunities in the snail mucin skincare industry?

Development of Bioengineered and Vegan Alternatives

Advancements in biotechnology are enabling the development of lab-cultured snail mucin analogs that replicate regenerative properties without animal sourcing. Brands investing in bioengineered alternatives can access ethically sensitive markets and command premium pricing.

Expansion into Emerging Markets

Rising disposable incomes and beauty consciousness in India, Southeast Asia, Latin America, and the Middle East present strong growth opportunities. Affordable mass-premium snail mucin products tailored to regional skin needs can significantly expand consumer penetration.

Product Type Insights

Snail mucin creams and moisturizers dominate the market, accounting for approximately 34% of global revenue in 2024 due to their daily-use nature and broad suitability across skin types. Serums and ampoules represent the fastest-growing product type, driven by high active concentration and premium positioning. Sheet masks and essences continue to gain popularity in Asia-Pacific, while eye care and hybrid sunscreen formulations are emerging as niche but high-margin categories.

Application Insights

Anti-aging and wrinkle reduction applications lead global demand, followed by acne scar repair and skin barrier restoration. Hyperpigmentation treatment and post-procedure recovery are emerging applications, particularly within dermatology-backed skincare lines. Sensitive skin solutions incorporating snail mucin are also gaining traction as consumers seek gentle yet effective formulations.

Distribution Channel Insights

E-commerce marketplaces and brand-owned D2C platforms collectively account for nearly 38% of global sales, driven by convenience, influencer marketing, and detailed product education. Specialty beauty retailers and pharmacies remain important offline channels, particularly for premium and dermatologist-recommended products. Clinical and professional distribution through dermatology clinics and medical spas represents a smaller but rapidly growing high-margin channel.

End-Use Consumer Insights

Premium and luxury skincare consumers represent the largest end-use segment, contributing approximately 42% of global market revenue in 2024. Mass-market consumers are driving volume growth through affordable blended formulations, while dermatology and clinical users represent the fastest-growing segment with double-digit CAGR. Professional spa and aesthetic clinic usage is expanding as snail mucin gains recognition for post-treatment recovery benefits.

| By Product Type | By Formulation Type | By Skin Concern | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the snail mucin skincare market with approximately 44% share in 2024. South Korea leads innovation and exports, accounting for nearly 18% of global demand, followed by China and Japan. Strong domestic consumption, advanced formulation capabilities, and export-driven manufacturing underpin regional leadership.

North America

North America holds around 26% of the global market share, led by the United States. Growth is driven by premium skincare adoption, dermatologist endorsements, and rising demand for clean-label, high-efficacy products. The region represents the fastest-growing premium market globally.

Europe

Europe accounts for approximately 18% of global demand, with strong uptake in Germany, France, and the U.K. Regulatory emphasis on ingredient transparency and cruelty-free claims is shaping product innovation.

Latin America

Latin America is an emerging market, led by Brazil and Mexico. Growing beauty awareness and expanding e-commerce penetration are supporting steady growth.

Middle East & Africa

The Middle East is the fastest-growing regional market, supported by high disposable income, luxury skincare demand, and increasing dermatology clinic adoption. The UAE and Saudi Arabia are key growth hubs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Snail Mucin Skincare Market

- COSRX

- Amorepacific Corporation

- Missha

- Benton Cosmetics

- Mizon

- The Saem

- Innisfree

- Some By Mi

- Neogen Dermalogy

- Purito

- Farmstay

- iUNIK

- Tonymoly

- Secret Key

- Dr. G