Smart Toys Market Size

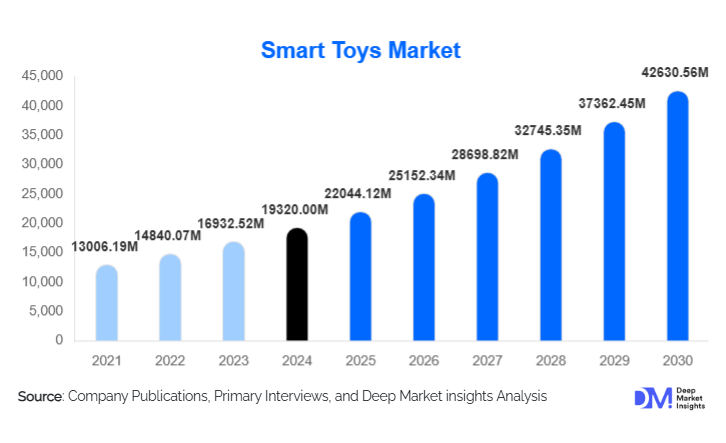

According to Deep Market Insights, the global smart toys market size was valued at USD 19,320 million in 2024 and is projected to grow from USD 22,044.12 million in 2025 to reach USD 42,630.56 million by 2030, expanding at a CAGR of 14.1% during the forecast period (2025–2030). The market growth is primarily driven by the increasing demand for interactive and educational play experiences, rising integration of AI and connectivity technologies in toys, and expanding e-commerce and global distribution channels that make smart toys more accessible worldwide.

Key Market Insights

- Interactive and educational play is shaping consumer preference, with parents increasingly seeking toys that combine entertainment with STEM/learning outcomes.

- Technological integration is expanding rapidly, with AI, AR/VR, IoT, and app-enabled platforms transforming traditional play into interactive experiences.

- North America dominates the market, with the U.S. and Canada accounting for roughly 25–30% of global revenue, supported by high disposable income and advanced retail infrastructure.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class populations in China, India, and Southeast Asia, along with increasing digital adoption and local manufacturing initiatives.

- Europe maintains a significant market share, led by Germany, the U.K., and France, with consumers emphasizing safety, regulation, and educational value in smart toys.

- Online and e-commerce channels are increasingly preferred, enabling direct access to tech-driven and niche products while supporting global expansion.

Latest Market Trends

AI and App-Enabled Learning

Smart toys are increasingly incorporating AI and companion applications to deliver personalized learning and play experiences. Educational robots, coding kits, and adaptive games allow children to progress based on skill levels, creating engaging and measurable learning outcomes. Companies are leveraging mobile apps to provide interactive content, parental monitoring, and gamification features that enhance user engagement. These innovations are attracting tech-savvy parents and schools, expanding demand beyond traditional gift markets.

Augmented Reality and Robotics Integration

AR-enabled toys and robotics-based play systems are transforming physical play into immersive digital experiences. Augmented reality games allow children to interact with the real world while engaging with virtual elements, enhancing creativity and problem-solving skills. Robotic toys with sensors, AI, and connectivity provide responsive and interactive feedback, creating lifelike play experiences. The convergence of robotics, AR, and app-enabled content is emerging as a core growth driver.

Smart Toys Market Drivers

Parental Demand for Educational Play

Parents increasingly prefer toys that provide cognitive and developmental benefits, supporting STEM learning, problem-solving, and creativity. School-age children (6–12 years) represent the leading consumer segment, accounting for approximately 35% of the market in 2024. This shift has pushed manufacturers to innovate with adaptive learning features and interactive content, driving revenue growth.

Technological Advancement and Connectivity

The declining cost of sensors, Bluetooth/Wi-Fi modules, and AI integration allows manufacturers to develop smart toys that are both interactive and affordable. Toys embedded with motion sensors, voice recognition, and cloud connectivity are enhancing engagement, appealing to children across multiple age groups while enabling recurring digital services such as app subscriptions and educational content updates.

E-commerce and Global Distribution Expansion

Online sales channels are becoming the fastest-growing distribution mode, accounting for nearly 45% of global sales in 2024. E-commerce enables manufacturers to reach remote or underserved markets, expand international presence, and offer a wide variety of tech-enabled toys. Omnichannel strategies combining online and offline sales are further accelerating market adoption.

Market Restraints

High Price Points

Smart toys are typically priced higher than traditional toys due to embedded electronics, software licensing, and connectivity features. This restricts affordability in emerging markets and among price-sensitive consumers. Premium AI or AR-based toys may cost US$60–150 or more, limiting mass adoption.

Data Privacy and Safety Concerns

Connected toys face scrutiny regarding child data security and compliance with international safety regulations. Concerns about privacy, software obsolescence, and compatibility may hinder adoption, requiring manufacturers to invest in secure, standards-compliant products.

Smart Toys Market Opportunities

Expansion into Emerging Markets

Regions such as India, Southeast Asia, Latin America, and the Middle East present large untapped potential. Rising disposable incomes, digital adoption, and government STEM initiatives provide an opportunity for manufacturers to introduce localized and affordable smart toys, increasing market penetration and global revenue.

Advanced Technology Integration

Integration of AI, AR/VR, IoT, and subscription-based digital content is opening new revenue streams. Manufacturers can differentiate via adaptive learning, immersive experiences, and cloud-based content, driving recurring sales and premium pricing opportunities.

Educational Partnerships

Collaboration with schools, after-school programs, and ed-tech providers enables smart toys to be positioned as learning tools. Aligning toys with curricula, cognitive development standards, or STEM frameworks boosts adoption while expanding non-traditional end-use markets.

Product Type Insights

Interactive games dominate the smart toys market, capturing approximately 70% of global revenue in 2024 (USD 12.3 billion). This segment’s leadership is primarily driven by the rising adoption of app-enabled, gamified, and robotically enhanced toys, which successfully combine entertainment with cognitive and skill-building elements. Parents and educators are increasingly prioritizing toys that deliver educational outcomes while maintaining high engagement, making interactive games the preferred choice. Emerging subsegments such as educational robots, coding kits, and AR-based toys are experiencing rapid growth, fueled by technological advancements and the increasing affordability of connected toys. The adoption of AI-enabled personalization in these products further enhances learning experiences, providing adaptive challenges and feedback that strengthen problem-solving, creativity, and STEM skills among children.

Application Insights

Educational and entertainment applications remain the core drivers of demand for smart toys. School-age children, pre-schoolers, and after-school programs constitute the primary end-users, reflecting the market’s focus on early learning and skill development. The leading driver for this segment is the growing emphasis on STEM education and interactive learning methodologies, which encourage hands-on engagement through toys that teach coding, mathematics, and science principles. Additionally, niche applications such as health-focused and wellness tracking toys are emerging, responding to parental demand for holistic child development solutions. Innovative classroom learning kits, therapy-assisted play, and hybrid educational-entertainment models are expanding opportunities for market players to differentiate products and target institutional buyers, including schools and educational centers, further boosting adoption.

Distribution Channel Insights

Online and e-commerce channels lead the global smart toys market, accounting for approximately 45% of sales in 2024. These channels enable manufacturers to reach a broad audience, including niche and premium segments, while offering convenient access to product comparisons, reviews, and interactive content. Offline channels, such as specialty toy stores and mass retail outlets, remain significant, particularly for younger children’s products where hands-on experience is valued. Emerging distribution strategies include D2C platforms, subscription-based sales models, and influencer-led marketing campaigns, which are increasingly shaping consumer purchasing behavior. Omnichannel strategies that integrate online and offline touchpoints are helping companies maximize reach, enhance brand engagement, and drive repeat purchases.

Age Group Insights

School-going children (6–12 years) represent the largest consumer segment, accounting for approximately 35% of the global market in 2024. This group’s strong preference for educational and interactive content underpins the dominance of interactive games and AI-enabled learning products. Pre-schoolers (3–5 years) and teenagers (13–18 years) follow as secondary segments, with demand for early learning kits and app-driven, gamified products increasing steadily. Additionally, older “kidult” and adult collector niches are emerging, particularly for sophisticated robotic kits, AR-enhanced toys, and STEM-based hobbyist products. This diversification of age groups encourages product innovation across complexity levels, functionality, and pricing tiers, further expanding the market potential.

| By Product Type | By Application | By Distribution Channel | By Age Group |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest regional market for smart toys, with the U.S. and Canada contributing 25–30% of global revenue (USD 4.4–5.2 billion in 2024). Growth in this region is driven by high disposable incomes, a strong culture of early childhood education, and significant parental focus on STEM and skill-building toys. The widespread penetration of e-commerce platforms, combined with robust offline retail infrastructure, supports broad product accessibility. Technological adoption is high, with AI, app-enabled, and interactive gaming toys leading demand. Additionally, partnerships with educational institutions and after-school programs encourage the adoption of smart toys as learning tools, further boosting regional growth.

Europe

Europe accounts for 20–23% of the global market (USD 3.5–4.0 billion in 2024), with Germany, the U.K., and France leading demand. Key growth drivers include strict safety regulations, parental emphasis on educational outcomes, and the rising popularity of eco-friendly and certified smart toys. Consumers in this region increasingly value high-quality, durable, and compliant toys, which pushes manufacturers to innovate while maintaining safety standards. Digital adoption, particularly through e-commerce platforms, supports the purchase of app-enabled and AR-integrated toys. Educational initiatives, such as STEM-focused school programs, also provide a strong growth catalyst for smart toys that combine learning and play.

Asia-Pacific

Asia-Pacific holds 25% of the market (USD 4.4 billion in 2024) and is the fastest-growing region. China leads the market, followed by India, Japan, and South Korea. Growth is driven by rising middle-class populations, increasing disposable incomes, expanding urbanization, and a growing emphasis on STEM education. The rapid adoption of smartphones, tablets, and IoT devices facilitates the integration of app-enabled and AI-based toys. India is the fastest-growing country, reflecting government initiatives promoting digital literacy and educational programs, along with a strong consumer interest in mid- and premium smart toy segments. Increasing e-commerce penetration and digital marketing campaigns further amplify growth potential in APAC.

Latin America

Latin America represents 8–10% of global revenue (USD 1.4–1.8 billion), with Brazil and Mexico as the largest markets. Growth drivers include rising consumer awareness, increasing disposable income among the urban middle class, and the expansion of e-commerce platforms. Parents are increasingly seeking educational and interactive toys that support skill development. The region is witnessing a gradual shift from traditional toys to smart, app-enabled, and gamified options, driven by digital literacy initiatives and the rising popularity of STEM-based learning in schools.

Middle East & Africa

MEA contributes 5% (USD 0.9 billion) of global smart toy revenue, with the UAE, Saudi Arabia, and South Africa as key markets. Growth is fueled by high-income consumer segments, premium product adoption, and rising awareness of educational benefits associated with smart toys. Expanding retail networks, luxury e-commerce platforms, and exposure to international brands drive regional demand. Additionally, government-backed initiatives promoting STEM education and digital learning in select countries are encouraging the adoption of educational and interactive toys, supporting sustained market growth despite smaller overall volumes.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Smart Toys Market

- LEGO Group

- Mattel

- Hasbro

- Spin Master

- VTech Holdings

- Sphero

- WowWee

- UBTECH Robotics

- K’NEX Industries

- Playmobil

- Sony

- Bandai Namco

- LeapFrog Enterprises

- Smartivity

- TOSY Robotics

Recent Developments

- In March 2025, LEGO Group launched an AI-enabled educational robotics kit for school-aged children, integrating adaptive learning algorithms and app-based content.

- In April 2025, Mattel expanded its interactive STEM toy portfolio in Asia-Pacific, focusing on affordable smart toys for pre-schoolers and school-going children.

- In May 2025, Spin Master introduced an AR-enabled companion app for its flagship robotic toys, enhancing immersive play and subscription-based digital content.