Smart Room Heater Market Size

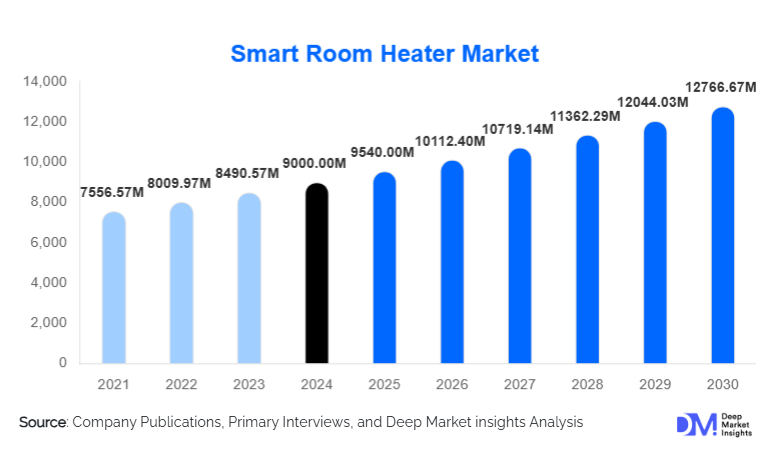

According to Deep Market Insights, the global smart room heater market size was valued at USD 9,000.00 million in 2024 and is projected to grow from USD 9,540.00 million in 2025 to reach USD 12,766.67 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The growth of the smart room heater market is driven by rising smart-home adoption, increased demand for energy-efficient personal heating solutions, and expanding integration of AI, IoT, and app-based controls into home appliances.

Key Market Insights

- Smart room heaters with Wi-Fi connectivity and AI-driven heating optimization are becoming mainstream, driven by consumer demand for intelligent, adaptive heating solutions.

- Residential users dominate global demand, supported by rising winter intensity and smart-home penetration across urban households.

- North America and Europe collectively account for over 60% of global market share, propelled by stringent energy-efficiency regulations and high technology adoption.

- Asia-Pacific is the fastest-growing regional market, with expanding middle-class populations in China and India driving the adoption of affordable smart heaters.

- IoT-enabled heaters with app and voice control are witnessing strong demand in commercial spaces such as co-working centers, retail stores, and hospitality environments.

- Technological advancements, including occupancy sensors, thermal analytics, and cloud-based energy management dashboards, are reshaping user experience and reducing energy costs.

What are the latest trends in the smart room heater market?

AI-Optimized and Predictive Heating Systems

Smart room heater manufacturers are rapidly integrating AI-based algorithms that automatically adjust heat output based on occupancy detection, user behavior, ambient temperature variations, and real-time electricity prices. Predictive heating systems are emerging as a core differentiator, enabling energy savings of 15–30% compared to conventional heaters. These solutions also support multi-device interoperability through Matter, Zigbee, and Wi-Fi 6 connectivity standards, making AI-driven heaters central to modern smart-home ecosystems. As sustainability becomes a priority for consumers and businesses, AI-enabled eco-modes and adaptive learning systems are expected to dominate next-generation heating appliances.

IoT, App-Controlled, and Voice-Assisted Heating Experiences

Technology-enhanced heating experiences are reshaping customer expectations in this market. Smart heaters now offer app-based control, remote scheduling, geofencing, child-lock safety monitoring, and integration with Alexa, Google Assistant, and Siri. Commercial users, including retail chains, cafés, and office spaces, are adopting IoT-enabled heaters with centralized dashboards for fleet management. These systems allow for automated power regulation, real-time energy tracking, and multi-zone heating control. Cloud analytics and remote diagnostics further enhance device reliability and reduce maintenance costs, appealing to both residential and commercial buyers.

What are the key drivers in the smart room heater market?

Rising Smart Home and Connected Appliance Adoption

The global surge in smart home ecosystems is a major growth driver. Over 50% of urban households in North America and Europe now own at least one smart device, making smart heaters a natural extension of connected living. Integration with home automation routines, such as bedtime heating schedules or occupancy-driven energy saving, has significantly boosted adoption.

Increasing Energy-Efficiency Regulations

Governments across the EU, U.S., Japan, and Australia are pushing strict efficiency standards, encouraging consumers and businesses to adopt low-consumption, digitally optimized heating appliances. Smart heaters offer measurable energy savings and consumption transparency, aligning with global decarbonization goals and cost-saving initiatives.

Climate Volatility and Extended Winter Durations

Erratic winters and record cold waves across Europe, North America, and Asia have elevated the need for portable, efficient, and room-specific heating. Consumers increasingly prefer targeted heating systems that minimize electricity usage compared to central HVAC systems. Smart heaters, with fast warm-up times and room-specific control, naturally benefit from this trend.

What are the restraints for the global market?

High Upfront Cost of Smart Heaters

Smart room heaters cost 30–60% more than traditional models due to embedded sensors, connectivity modules, and advanced safety systems. This price premium limits market penetration in price-sensitive regions, slowing volume adoption despite strong interest.

Connectivity Limitations and Data Security Concerns

Smart heaters rely heavily on stable Wi-Fi or Bluetooth connections. In regions with unreliable networks, performance issues can arise. Additionally, data privacy concerns, such as cloud storage of heating usage patterns, discourage some consumers from adopting connected appliances.

What are the key opportunities in the smart room heater industry?

AI and IoT-Integrated Heating Ecosystems

Manufacturers can tap into a growing opportunity by developing AI-powered heating optimization platforms that learn user behavior and coordinate with broader smart-home systems. Predictive diagnostics, energy analytics, remote control features, and smart grid compatibility present strong value propositions for both residential and commercial users. This opportunity is particularly promising as global energy prices rise and governments incentivize high-efficiency appliances.

Untapped Demand in Emerging Cold-Climate Regions

Countries in Eastern Europe, Central Asia, Northern India, and Latin America’s southern cone represent large, underpenetrated markets. Rising urbanization, increasing disposable incomes, and stricter winter conditions are motivating consumers to shift from conventional heaters to safer, eco-efficient smart models. Local manufacturing partnerships and region-specific product designs can accelerate growth in these emerging markets.

Product Type Insights

Fan-based smart heaters dominate the product landscape, accounting for the largest global market share due to their rapid heating capability, affordability, and compact form factor. Their integration with ceramic or PTC heating elements makes them both energy-efficient and safe for long-duration operation. Infrared heaters appeal to consumers seeking silent, directional warmth, while oil-filled smart radiators remain popular in larger rooms requiring steady, long-lasting heat. Panel heaters are gaining traction in minimalist households and modern offices due to their sleek design and wall-mounting convenience.

Application Insights

The residential segment represents the majority of global demand, driven by personal comfort needs and the rise of remote work lifestyles. Households increasingly prefer app-controlled and voice-integrated heating systems that provide flexible scheduling and energy insights. Commercial applications, including small offices, retail environments, and hospitality venues, are growing rapidly as businesses seek energy-efficient, zone-based heating solutions. Institutions such as schools, clinics, and coworking spaces are adopting smart heaters to reduce HVAC loads while improving room-level comfort and safety.

Distribution Channel Insights

Online platforms dominate smart heater sales, driven by consumer preference for product comparison, reviews, and seasonal discounts. E-commerce giants and D2C brand stores offer detailed specifications, user guides, and installation videos, enhancing consumer confidence. Offline specialty appliance stores remain relevant for premium purchases, where customers seek hands-on demonstrations and expert recommendations. Hybrid omni-channel strategies, including click-and-collect and virtual product demos, are becoming increasingly common among leading brands.

| By Product Type | By Connectivity & Control | By Power Rating | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 31% of global market share, led by the U.S. Demand is fueled by extreme winter temperatures, high adoption of connected appliances, and strong consumer preference for energy-saving products. Canada represents the fastest-growing submarket in the region, driven by harsh winters and urban modernization.

Europe

Europe holds roughly 29% of the global market, with Germany, the U.K., France, and Nordic countries leading consumption. The region’s stringent regulations on energy efficiency and carbon reduction strongly support the adoption of smart heaters. Eastern European nations are emerging growth hubs due to increasingly volatile winter conditions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding around 24% of the global market. China and Japan exhibit high demand for compact, efficient heating solutions, while India’s northern states are experiencing a surge in adoption due to intensified winters and rising disposable incomes. Increasing urbanization and improving digital infrastructure further accelerate APAC market growth.

Latin America

Latin America’s demand is concentrated in Chile, Argentina, and southern Brazil. Although the market share is relatively small, the region is experiencing stable growth as consumers shift from traditional heating methods toward safer, energy-efficient smart alternatives.

Middle East & Africa

While warmer climates limit overall demand, colder regions such as Turkey, Iran, and parts of South Africa exhibit steady adoption. Growing urban infrastructure and rising middle-class affluence contribute to increasing uptake of smart home appliances, including smart heaters.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Room Heater Market

- Dyson

- De’Longhi

- Honeywell

- Lasko

- Vornado

- Xiaomi

- Havells

- Philips

- Stiebel Eltron

- Klarstein

- Black+Decker

- Usha International

- Rowenta (Groupe SEB)

- Kogan

- Delmar

Recent Developments

- In May 2025, Dyson launched a next-generation AI-enabled smart heater with adaptive learning algorithms and enhanced air filtration features.

- In April 2025, Xiaomi introduced a budget-friendly IoT-integrated smart heater targeting emerging markets in Asia and Eastern Europe.

- In February 2025, De’Longhi expanded its production capacity in Europe to meet rising demand for energy-efficient ceramic smart heaters.